Analyst Note: Is the Fat Protocol Thesis Obsolete?

TechFlow Selected TechFlow Selected

Analyst Note: Is the Fat Protocol Thesis Obsolete?

Fat protocol: The value of blockchain will be generated at the base protocol layer, not at the application layer.

Author: Messari

Translation: TechFlow Intern

In August 2016, Joel Monegro from Union Square Ventures proposed what is arguably the most famous crypto thesis outside of the Bitcoin whitepaper: the Fat Protocol Thesis (FPT).

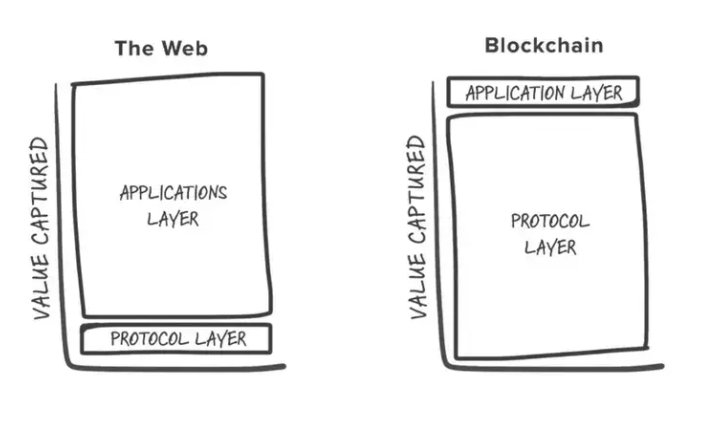

The fat protocol thesis argues that value in blockchain will accrue at the base protocol layer rather than at the application layer. This stands in contrast to what happened with the internet—where companies like Google and Facebook became trillion-dollar giants while protocols such as TCP/IP remained nearly valueless.

Investors who embraced Monegro’s theory later achieved returns once thought reserved for deities. Ethereum, Solana, Avalanche, Cosmos—these smart contract platforms have become some of the top-performing assets in crypto, delivering extraordinary gains to early investors.

Challenging the Fat Protocol Thesis

Chia Jeng Yang of Saison Capital recently published an article explaining why he believes the fat protocol thesis is outdated and where cracks in the theory have emerged. Yang cites the following reasons driving the decline of this thesis:

1. Reduced Monopolization: Multi-chain applications

2. Overstated Network Effects: Prolonged protocol competition leads to lower fees

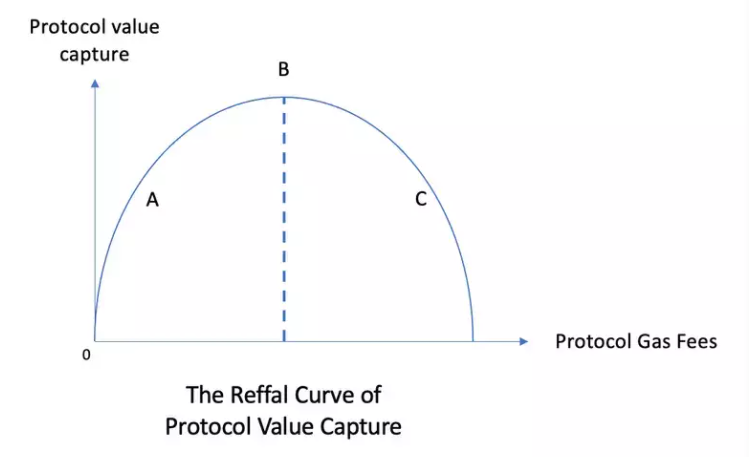

3. Reffal Curve: Rollups reduce total demand

4. New Framework for L1 Value Capture: Money as a nation

5. Fat Protocols Gained Value Due to Lack of Alternatives: The surge in applications now gives investors options

We find three of Yang's points particularly relevant to the discussion.

Overstated Network Effects

Sami: As Yang points out, the fat protocol thesis was written at a time when a multi-chain world didn't exist and competition within each crypto domain was limited. Now in 2022, there are numerous smart contract platforms—such as Avalanche and Solana—all vying to take market share from Ethereum. Moreover, mainstream adoption of crypto will bring in participants unfamiliar with blockchains who are simply looking for the simplest and cheapest applications.

Kel: These mainstream users may never need to directly purchase protocol tokens. Applications like cross-chain bridges (e.g., Synapse) already provide users with enough native tokens to cover gas fees, setting a precedent for more apps to be designed this way.

Sami: If users don’t need to hoard tokens, they may not exhibit the almost religious behavior we’ve seen over the past six years. This weakens protocol-level network effects, as college friends won’t call each other up anymore touting the technical merits of their favorite blockchain.

Rollups and the Reffal Curve

Kel: Scalability solutions that tie scalability to token demand can offer a counterargument to the Reffal Curve. For example, Avalanche’s subnet design requires staking 2,000 AVAX per subnet to join the network.

In cases like Avalanche, demand for scalability correlates positively with demand for the protocol token, mitigating the decline in value capture seen in part C of the Reffal Curve.

This assumes that within-ecosystem demand for scaling is strong enough to incentivize applications to pay 2,000 AVAX instead of opting for cross-ecosystem scaling. Cosmos and Polkadot are two ecosystems among others exhibiting similar correlations between scalability and token demand.

Lack of Alternatives to Fat Protocols

Kel: I don’t believe traditional institutional investors—infamous for their risk aversion in crypto—will plunge into Pool 2 or dive headfirst into the abyss of crypto applications.

Even though there are more legitimate applications in 2022 than when FPT was written in 2016, I expect large institutions will still be drawn to the slightly less complex yields offered by protocols, especially given the sustained inflation rates not seen in 50 years. Early sentiment around the Ethereum merge suggests this may already be true.

Sami: While I partially agree with Kel, I do believe we’ve already seen traditional investors shift attention from the protocol layer to the applications being built on top, especially as protocol valuations skyrocket. For instance, the Arweave network distributes dividends to L2 token holders when users interact with applications built on the protocol. This kind of value-capture dynamic may prove stronger—and more attractive to investors—than holding protocol-layer tokens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News