Market Outlook: Halving Narrative Resurfaces, Analysts Uniformly Bullish on Bitcoin's Future

TechFlow Selected TechFlow Selected

Market Outlook: Halving Narrative Resurfaces, Analysts Uniformly Bullish on Bitcoin's Future

Views on the current secondary market from various well-known traders or cryptocurrency research institutions, shared solely for informational purposes and not intended as investment advice.

*This article is a TechFlow curation of views on the current secondary market from various well-known traders or crypto research institutions, intended solely for informational purposes and does not constitute any investment advice.

Loma: Bitcoin will break above the $28,000 resistance level

Loma, a cryptocurrency analyst with over 280,000 followers, said he believes Bitcoin will eventually break through the resistance zone around $28,800.

However, it's important to note that the breakout may take time, and BTC could test the patience of long-position holders.

"Ideally, if this consolidation continues upward, we won’t get another chance to buy spot at levels around $25,500–$26,500.

The most likely scenario is being squeezed between daily highs and lows before moving higher.

• If you haven't entered, build positions via range trading.

• If you're already in, this should be a test of patience, nothing more."

Loma’s chart suggests he expects Bitcoin to break out before the end of April, leading to a strong rebound toward his target of $38,000. At the time of writing, BTC was trading at $28,487.

As for Litecoin, he believes LTC is poised to rally toward the key psychological resistance level of $100. According to Loma, Litecoin’s reaction at the $100 price level will determine whether LTC can rise further to his target of $140.

"Very curious about the reaction at the psychological + technical resistance near $100. In my view, any strength above this would quickly push prices to $130–$140. The Binance-CFTC [Commodity Futures Trading Commission] low provides a good benchmark for defining risk." At the time of writing, LTC was valued at $87.54.

A prominent cryptocurrency analysis platform says that amid a surge of large whale transactions involving the king of crypto, one indicator could signal Bitcoin’s (BTC) next major rally.

Santiment: Stablecoin metric suggests potential for BTC surge

Cryptocurrency data firm Santiment says traders should closely monitor the market capitalization of stablecoins such as Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Pax Dollar (USDP), and Dai (DAI).

Santiment notes that the combined purchasing power of the top five stablecoins stands at $126.31 billion—more than double their value in March 2021—and sustained upward momentum in Bitcoin may depend on continued growth among the top five stablecoins by market cap.

"With a great first quarter ending and a recovering crypto market, the combined purchasing power of USDT, USDC, BUSD, DAI, and USDP totals $126.3 billion. This week’s dip has been gradually narrowing. An upward move would significantly increase the probability of a Bitcoin rally."

However, Santiment also issued a cautionary note to Bitcoin holders, stating that the five largest Bitcoin transactions in 2023 all occurred in March, suggesting that large BTC holders might be starting to take profits.

"Given the very large transactions that took place in March, along with the continued decline (in percentage terms) and gradual reduction (in total number of addresses) within the 10–10,000 BTC address tier, if you’re hoping to see Bitcoin surge to $35,000 or beyond, there do appear to be some warning signs worth noting…"

Alex Krüger: Bitcoin plays a new role

Alex Krüger, a renowned economist and crypto analyst with 150,000 followers, says Bitcoin (BTC) now serves a different role in investors’ portfolios compared to the past—BTC will no longer make anyone rich overnight as it did ten years ago, but it is now becoming an effective way to preserve wealth and store value.

"People shouldn’t expect to get rich by buying Bitcoin anymore. That ship has sailed. Bitcoin is now used for wealth preservation, attractive risk-adjusted returns, trading, and hedging against fiat systems."

Nevertheless, the trader added that there’s still potential for Bitcoin to rise tenfold from its lows, meaning a price near $150,000 at the peak of the next bull market.

Krüger recently listed eight reasons why the current BTC market structure could lead to a bullish reversal:

- Prolonged months-long consolidation

- Momentum indicators turning upward

- Highest historical volume at the bottom

- Higher lows on very high volume

- Engulfing candles forming on increasing volume

- Rebound from the 200-day moving average (DMA)

- Range top aligns with the 200-week moving average (WMA)

- Bearish volume pockets above.

At the time of writing, Bitcoin was trading at $28,307.

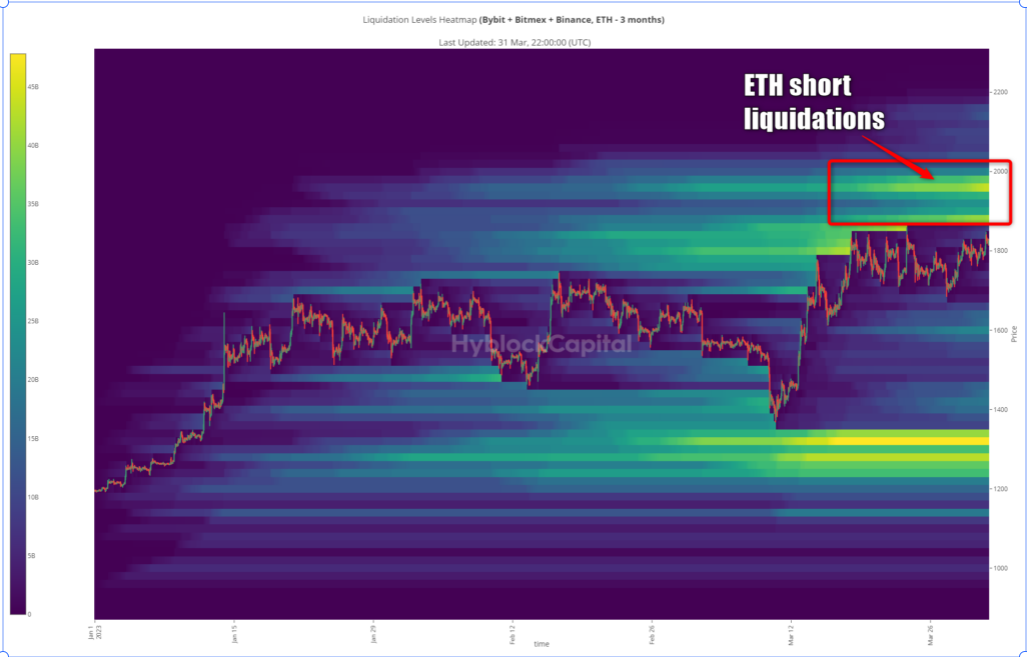

Justin Bennet: Ethereum breaks $2,000, strong short squeeze

Justin Bennet, a well-known trader with 100,000 followers, says Ethereum ( ETH ) may be preparing for a rally to liquidate bearish traders.

He said Friday’s rebound in the S&P 500 Index (SPX) could signal a short-term uptick in the crypto market. Cryptocurrencies often follow equities, though there appears to be a lag between the two asset classes. Bennett added that if crypto takes cues from stocks, he expects Ethereum to face resistance at $1,840.

Bennett said an Ethereum breakout could trigger a short squeeze, with “significant” short liquidations stacked above the $2,000 price level for ETH. A short squeeze occurs when traders who have heavily shorted an asset decide to cut losses amid an unexpected price rise, which then triggers additional upward momentum.

"That could be quite telling, as crypto tends to target these areas, and $2,030 was the high point in August 2022. There are more long liquidations below the current level, but distance matters, so short liquidations up to $2,000 could impact ETH in the near term."

However, Bennett warned that time is running out for both cryptocurrency and Ethereum. According to the trader, an Ethereum short squeeze is certain to happen in the coming days—or else, he said, the rally may not materialize at all.

"But I hope to see crypto 'catch up' with equities soon, if this is going to happen. If we don’t see ETH clearing out these shorts in the next few days, then this scenario becomes much less likely."

At the time of writing, Ethereum was trading at $1,818.

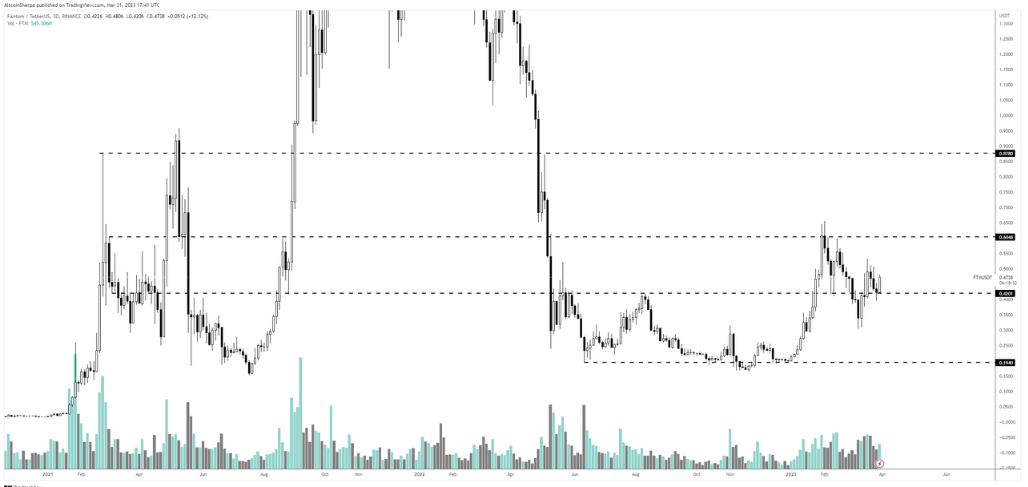

Altcoin Sherpa: Watch two altcoins

Altcoin Sherpa, a well-known trader with 190,000 followers, said Bitcoin may retrace, and the $25,000 level might not hold, but buyers should wait for dips when BTC falls below $24,000. At the time of writing, Bitcoin was trading sideways at $28,571 this week.

In addition, Altcoin Sherpa is focusing on two altcoins: AVAX and FTM.

Altcoin Sherpa said AVAX may be ready to break above the $22 resistance into a new trading range, potentially reaching $30.

"AVAX: The compression here looks strong—I think it’ll have another leg up soon. The 200-day EMA initially acting as resistance (as usual), but I believe it will strongly break above $22 shortly."

At the time of writing, AVAX was valued at $17.22.

Altcoin Sherpa is also watching Fantom (FTM), which has risen 135% since the beginning of the year.

The analyst said FTM may be preparing for another upward move.

"FTM: Overall still looks quite solid. I think it’s forming some kind of bottom and will rise again."

Charts show FTM’s next resistance appears around $0.60. At the time of writing, FTM was trading at $0.43.

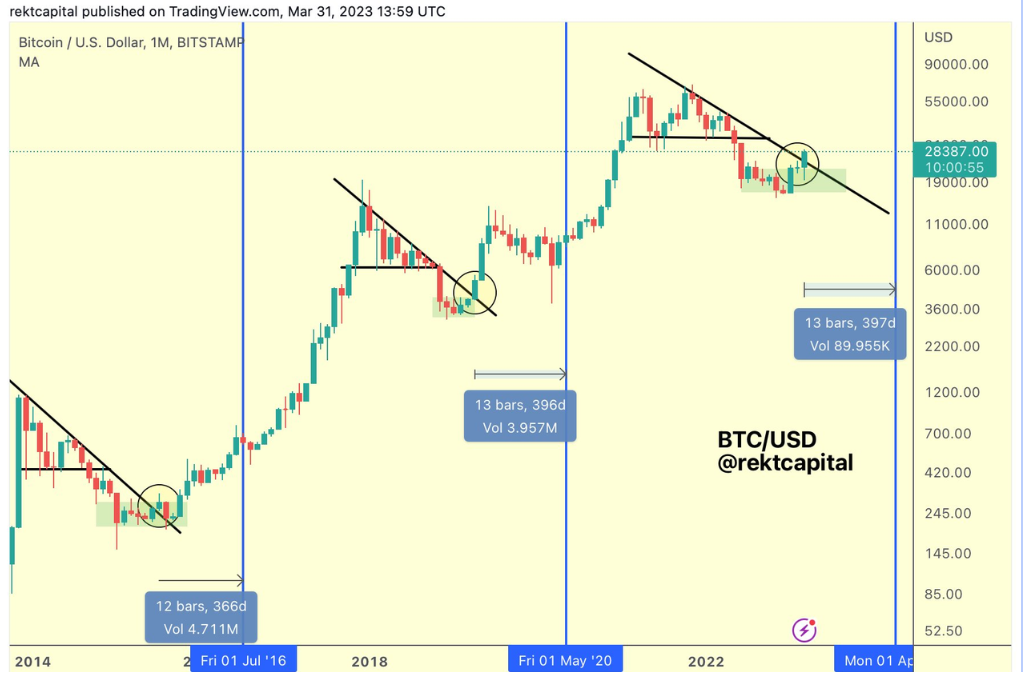

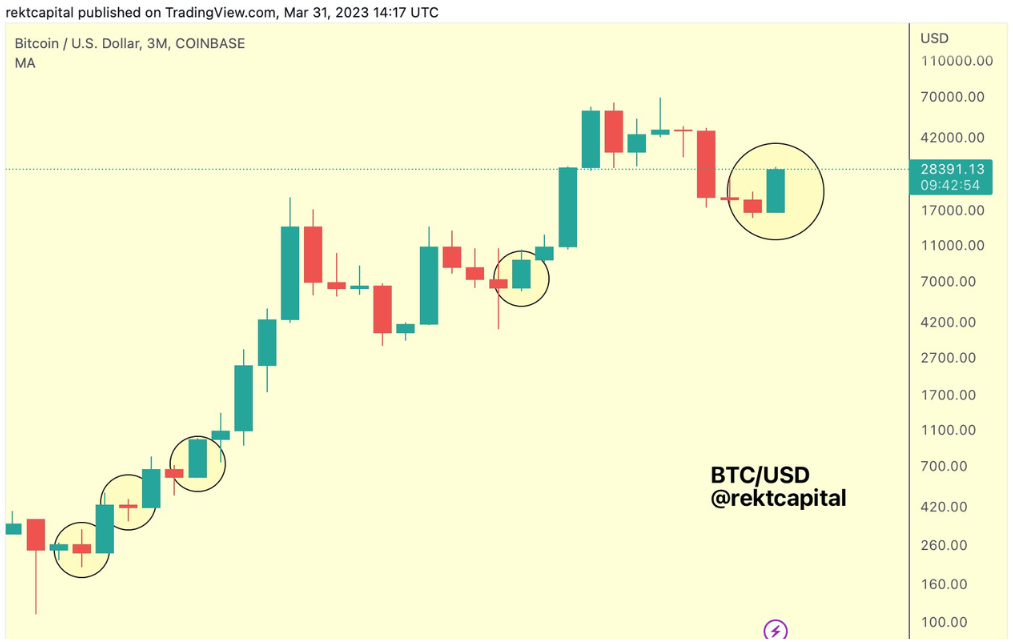

Rekt Capital: Bitcoin on verge of history-making key breakout

Rekt Capital, a well-known trader with 340,000 followers, pointed out that BTC is moving above a critical macro downtrend resistance entering April—a trendline that has kept Bitcoin bearish since its all-time high in November 2022.

"Tomorrow, BTC’s monthly candle will close above the macro downtrend, confirming a new bull market. BTC is at a pivotal moment to make history."

Rekt also noted that BTC’s breakout comes exactly 396 days before the upcoming Bitcoin halving, scheduled for April next year. He added that in 2019, Bitcoin also surged exactly 396 days before the 2020 halving.

"BTC tends to break its macro downtrend about a year ahead of an upcoming halving—and this time is no exception"

He said another bullish factor for Bitcoin is that a quarterly bullish engulfing candle has just closed for BTC. A bullish engulfing candle occurs when a green candle fully overlaps the previous red candle in both open and close price.

"BTC is on the verge of confirming its first quarterly bullish engulfing candle since early 2020. Historically, each quarterly bullish engulfing candle has preceded multiple quarters of gains."

At the time of writing, Bitcoin was trading at $28,409.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News