Fat protocols are "dead"—long live fat applications

TechFlow Selected TechFlow Selected

Fat protocols are "dead"—long live fat applications

The market value of protocols always grows faster than the aggregate value of applications built on top of them, and success at the application layer further fuels speculation at the protocol layer.

Written by: Westie

Compiled by: TechFlow

The "fat protocol" thesis was first introduced by Joel Monegro in 2016 to highlight what he saw as a fundamental difference in value accumulation between the internet and blockchain-based applications.

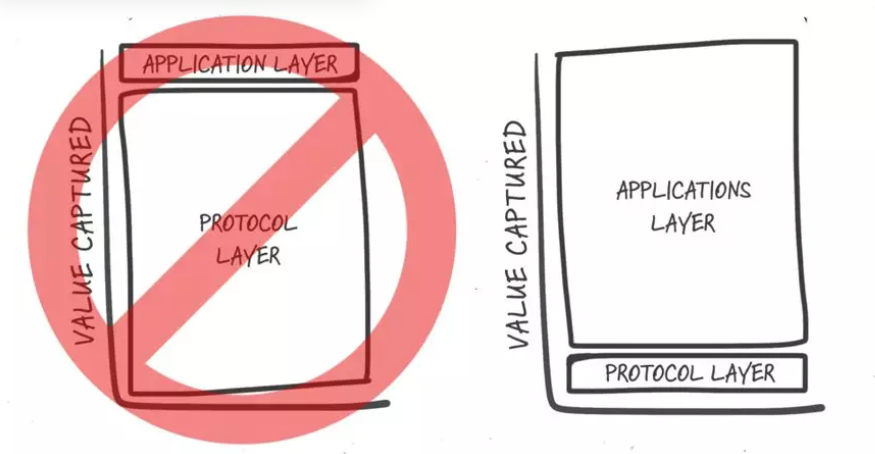

He argued that while traditional internet infrastructure allows applications built on top of base protocols to capture most of the value, blockchains instead concentrate nearly all value within the base layer protocols themselves—hence the term "fat protocols."

His first argument centered around a shared data layer.

The open and permissionless nature of blockchains intensifies competition, lowers barriers to entry, drives fees toward zero, and forces deep optimization of user experience.

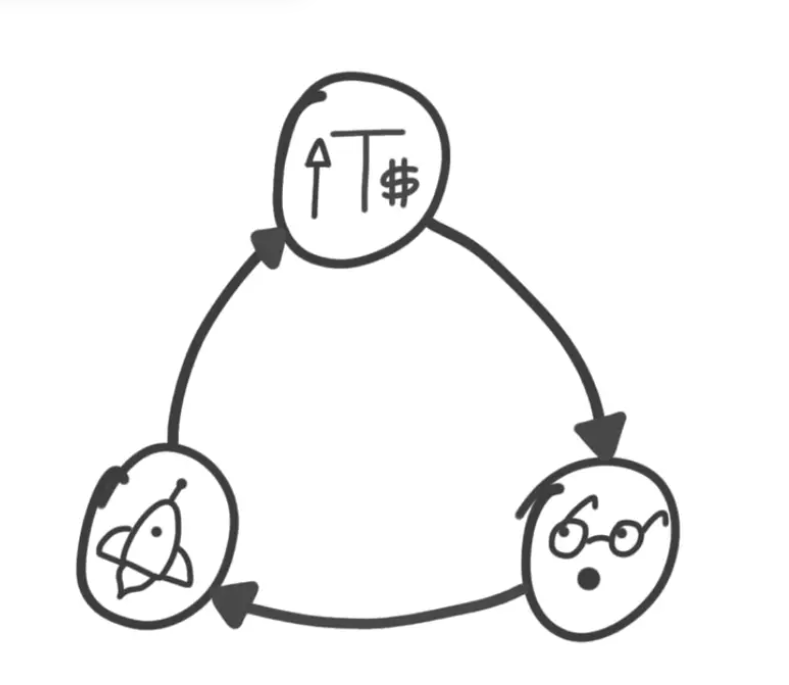

The second argument involves the existence of protocol tokens.

This creates a flywheel effect: rising token prices attract more network users; as more people adopt and build on the network, token value increases further, reinforcing the cycle.

Therefore, he believed:

"...the market cap of the protocol will always grow faster than the combined value of applications built on top, with application-layer success further fueling speculation at the protocol layer."

While this has largely held true so far—$ETH and $BTC remain the largest crypto assets, and other base-layer tokens like $AVAX, $SOL, and $MATIC have delivered astonishing performance in past cycles—this pattern is now changing rapidly.

Until now, the base layer has accumulated virtually all the value. Although people recognized the huge potential of applications like DeFi and NFTs, no single application had achieved sufficient product-market fit to rival Web2 apps or fintech products.

As a result, these base-layer tokens ($ETH, $SOL, $AVAX) became proxies for betting on the future growth of an entire ecosystem economy, without clarity on which individual applications would ultimately emerge as winners.

Today, we’ve finally reached an inflection point—applications are starting to deliver.

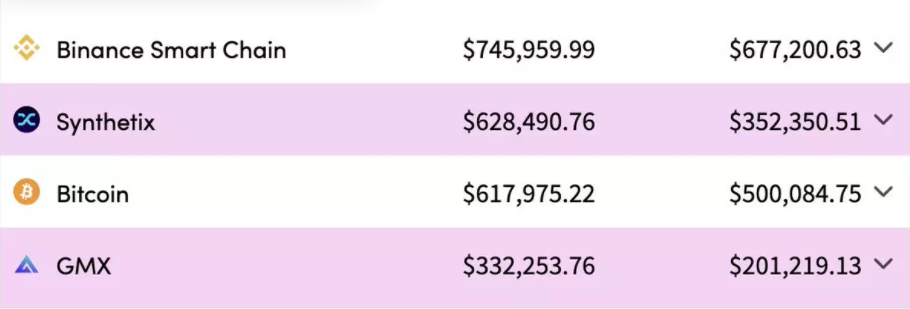

Uniswap now rivals Coinbase in trading volume, OpenSea has become a household name, and Synthetix and GMX generate more daily fees than the entire Bitcoin network.

We’re also witnessing a shift toward a cash-flow-driven world.

Fees and revenue generation have become the new scoreboard, replacing TVL (Total Value Locked), which can be heavily manipulated—as seen with Ian Macalinao’s actions on Solana.

Cash flow also provides a more accurate measure of value accrual during transactions.

For example: when a user trades $100,000 on an L2 DEX, paying $0.5 in network fees but $300 in exchange fees, it's clear which layer captures more value.

Beyond direct cash flows, much of the base protocol’s value accumulation comes from MEV (Maximal Extractable Value). However, applications are now designing ways to mitigate or capture this MEV value themselves.

Strong examples today include CowSwap’s CoW and Manifold Finance’s OpenMEV.

While open and permissionless networks do enable greater competition and better UX, that doesn’t mean applications can’t build moats in liquidity and user retention. Do you really think anyone could fork Uniswap or Aave today and directly compete with them on Ethereum?

These applications don’t need to drive their fees to zero, because users are willing to pay for the unique value they provide. This isn’t to say that networks won’t continue to derive value as more apps are built on them—rather, individual applications can now accumulate even more value, especially in L2 environments or on L1s with extremely low network fees.

As applications continue expanding their user bases, building defensible moats, increasing revenue, and achieving true product-market fit, we’ll see a world where individual apps generate more value than the networks themselves.

Thus, the era of the "fat app" begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News