Sino Global COO: Where is crypto credit headed after deleveraging?

TechFlow Selected TechFlow Selected

Sino Global COO: Where is crypto credit headed after deleveraging?

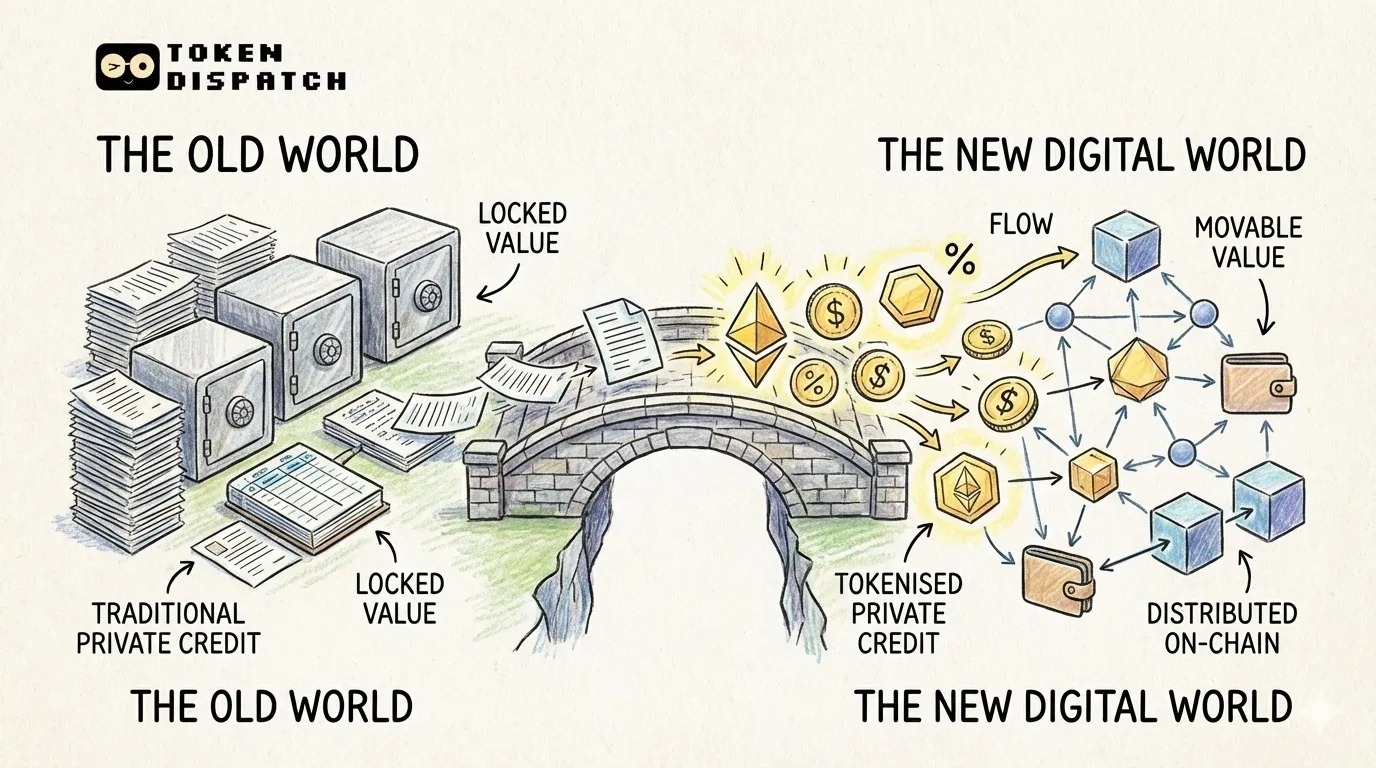

Given the importance of lending in the crypto market, new business models are likely to emerge (or have already emerged).

Author: iWitty, COO of Sino Global

Translation: TechFlow intern

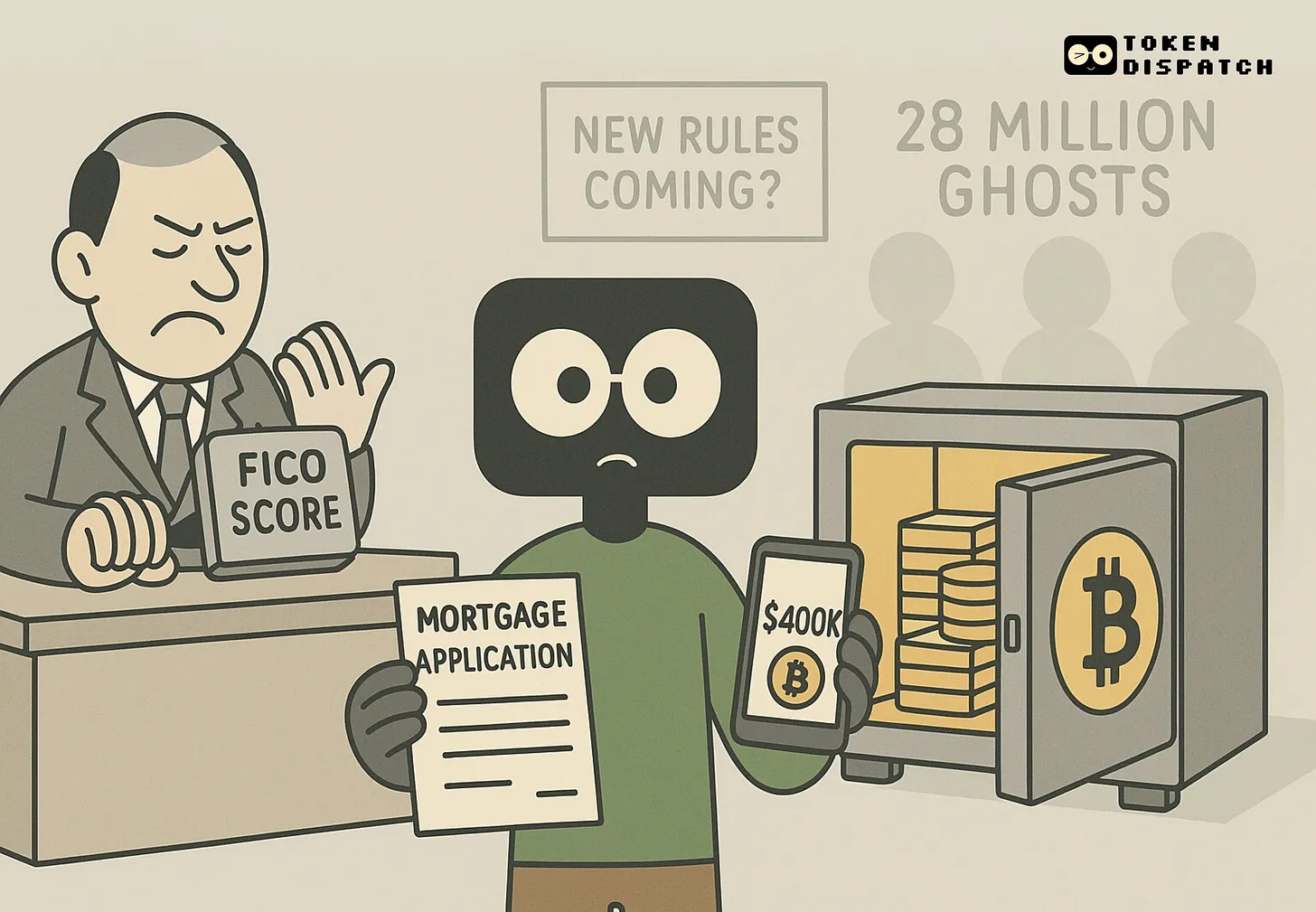

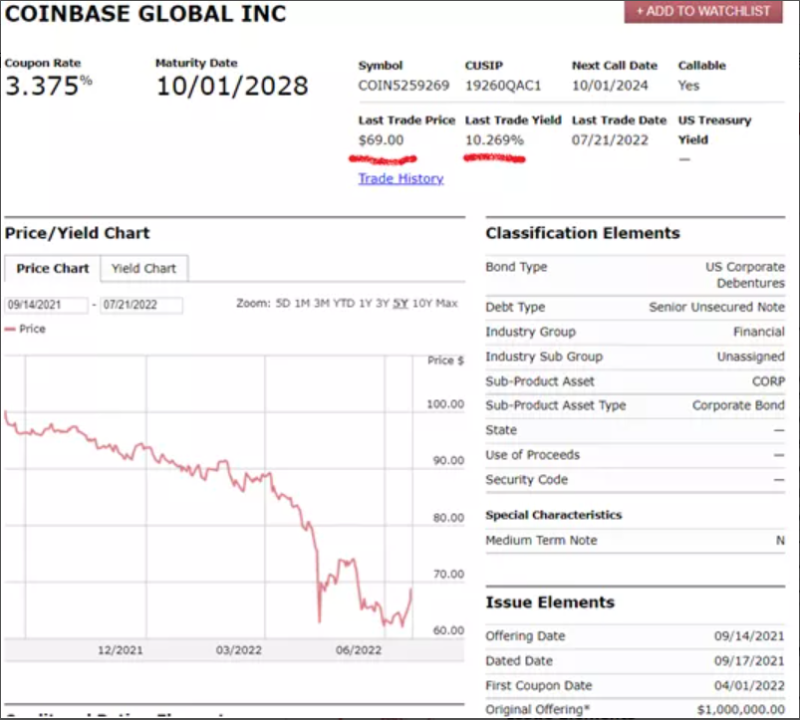

Recent large-scale deleveraging has occurred due to the failures of many centralized lenders. Celsius Network's outstanding loans stand at $98 million, Coinbase bonds are trading at a yield of around 10%, and trading limits for leading market makers (MMs) have been reduced.

The ultimate result is:

Reduced loan supply → Less trading capital for market makers → Lower trading volume → Wider spreads and reduced market depth.

Some large participants can no longer enter or exit positions as needed. As more loans are called in, even some top trading pairs are beginning to be affected.

Who Needs Credit? Loans = Leverage

Crypto trading requires loans as trading capital. Most credit flows to market-neutral market makers who use it to place orders on their books so they can execute trades efficiently.

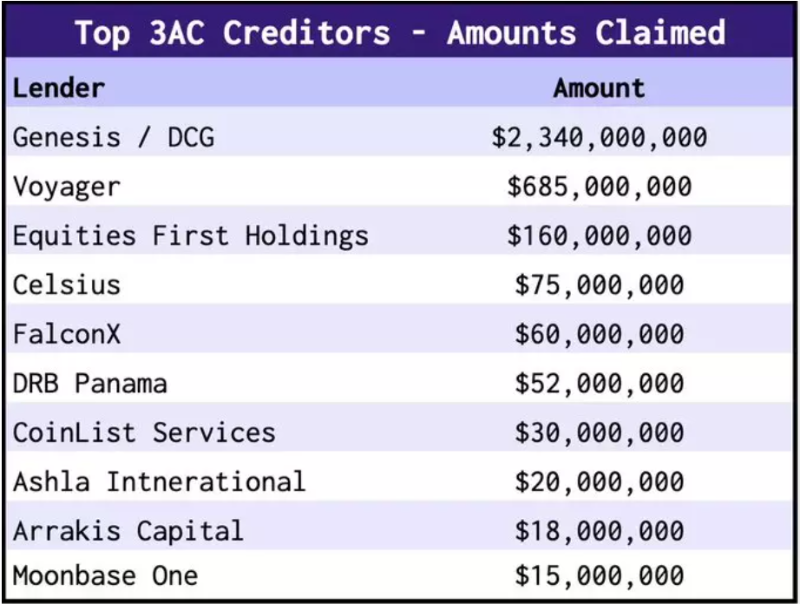

Some loans also go to directional traders such as ZhuSu from 3AC and Kyle Davies, whose borrowing was much larger than you might imagine. These loans carry high risk, which should be reflected in interest rates—but this isn't always the case.

How Important Are Market Makers?

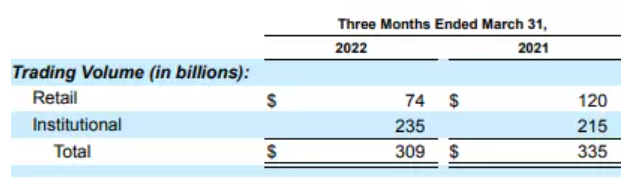

Coinbase’s Q1 quarterly report stated: “While institutional market makers are relatively few... they account for a significant portion of trading volume and net revenue on our platform.” In Q1 2022, institutions (including high-frequency trading) accounted for 76% of trading volume.

The largest loan originators:

-

Centralized lenders such as Celsius Network, BlockFi, Genesis Trading;

-

Decentralized lending platforms like Clearpool, Maple Finance;

-

Exchange credit lines;

Most loans were originated by centralized lenders, but most of them have largely failed and created a massive agency problem—ultimately leading to misaligned incentives in risk management. Consumers earned capped returns of X%, while underwriters only profited if they took on additional risk beyond X%. So, can you guess whether they were incentivized to take risks beyond X%?

How Much Credit Has Disappeared?

At its peak, centralized lenders issued tens of billions in loans each month. Today, without them, the market faces:

-

Loan recalls = mass deleveraging, shrinking from billions down to $98 million at Celsius Network.

-

Stricter lending terms (higher APRs, more collateral, etc.).

Many past loans were severely undercollateralized—lending desks would issue unsecured loans en masse. This means we won’t see those kinds of loans again…

Global Macro Shocks

-

Traditional finance (TradFi) has been de-risking;

-

Crypto and crypto lending have become steeper on the risk curve;

This affects all crypto lending—currently, Coinbase bonds trade at just 10% yield (down from nearly 15% last week).

When most crypto loans disappear, the industry faces severe liquidity issues:

-

Trading volume stagnates;

-

Large and widening bid-ask spreads for altcoins;

-

Increased slippage;

Although liquidity remains adequate for major currency pairs, current conditions continue to frustrate institutional investors. Until new sources of credit emerge, this will remain our reality. Given the importance of lending in the crypto market, we believe new business models will (or already have) emerged.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News