Unsecured stablecoin credit

TechFlow Selected TechFlow Selected

Unsecured stablecoin credit

When unsecured consumer credit shifts toward the stablecoin赛道, its operating mechanism will change, and new participants will have the opportunity to get a piece of the pie.

Author: haonan

Translated by: Block unicorn

Introduction

Users in the global unsecured consumer credit market are like modern finance's sheep—slow-moving, judgment-impaired, and mathematically challenged.

When unsecured consumer credit shifts to the stablecoin赛道, its operating mechanisms will change, creating opportunities for new participants to get a piece of the pie.

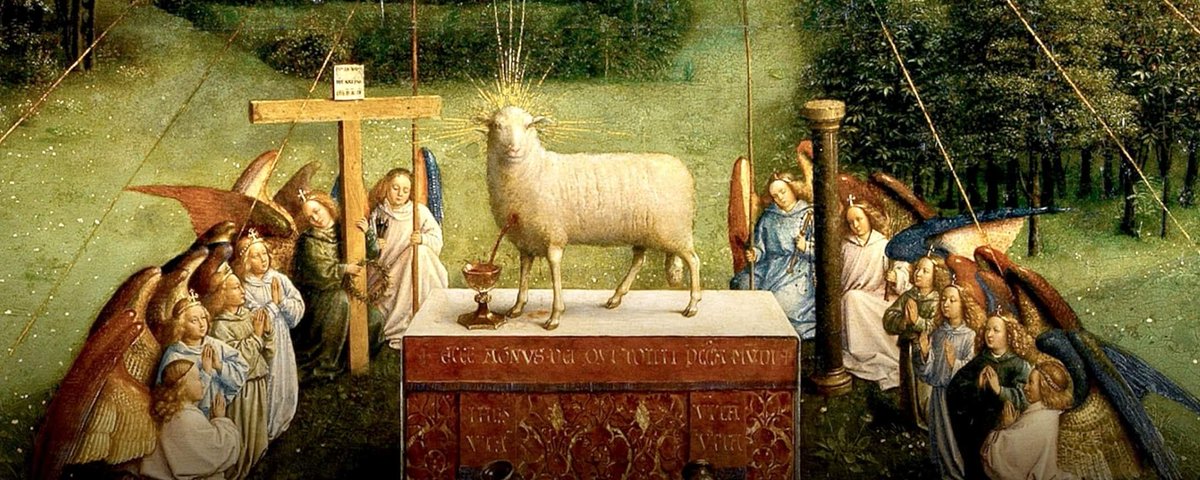

Huge Market

In the United States, the primary form of unsecured lending is the credit card: this ubiquitous, liquid, and instantly available credit tool allows consumers to borrow without providing collateral when shopping. Credit card debt continues to grow and has now reached approximately $1.21 trillion.

Outdated Technology

The last major innovation in credit card lending occurred in the 1990s when Capital One introduced risk-based pricing—a breakthrough that reshaped the landscape of consumer credit. Since then, despite the emergence of countless neobanks and fintech companies, the structure of the credit card industry has remained largely unchanged.

However, the arrival of stablecoins and on-chain credit protocols brings a new foundation: programmable money, transparent markets, and real-time funding. These have the potential to finally break the cycle and redefine how credit is originated, funded, and repaid within a digital, borderless economy.

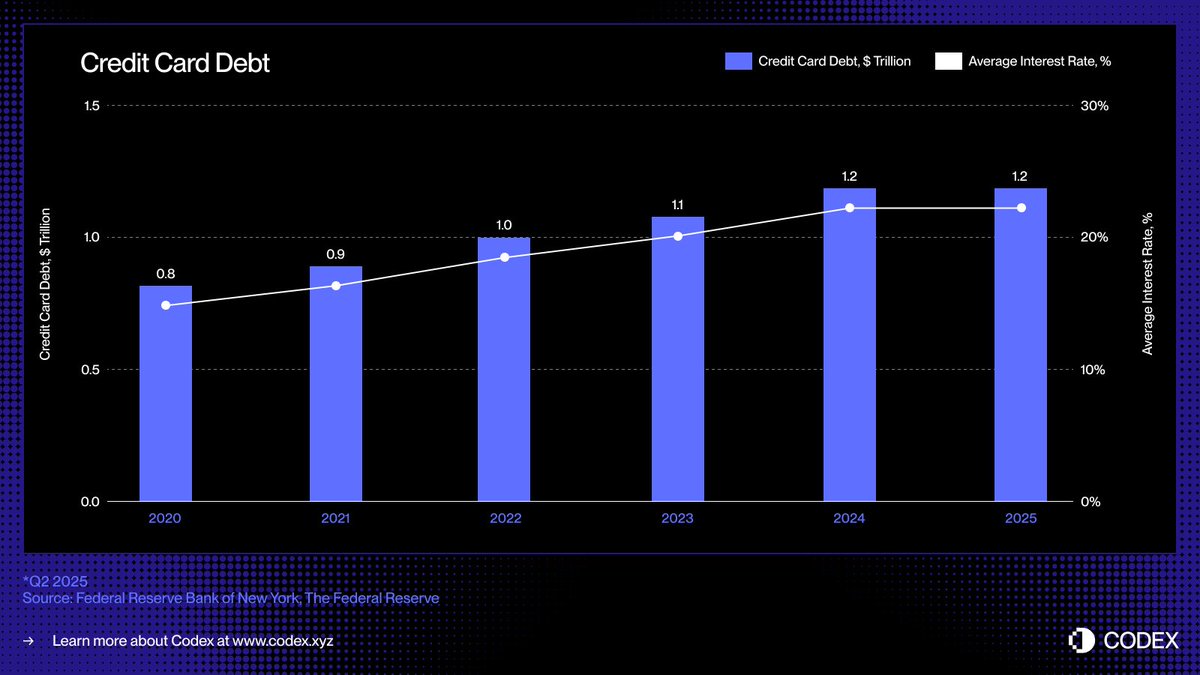

In today’s card payment systems, there is a time lag between authorization (the transaction being approved) and settlement (the issuer transferring funds to the merchant via the card network). By moving the funding process on-chain, these receivables can be tokenized and funded in real time.

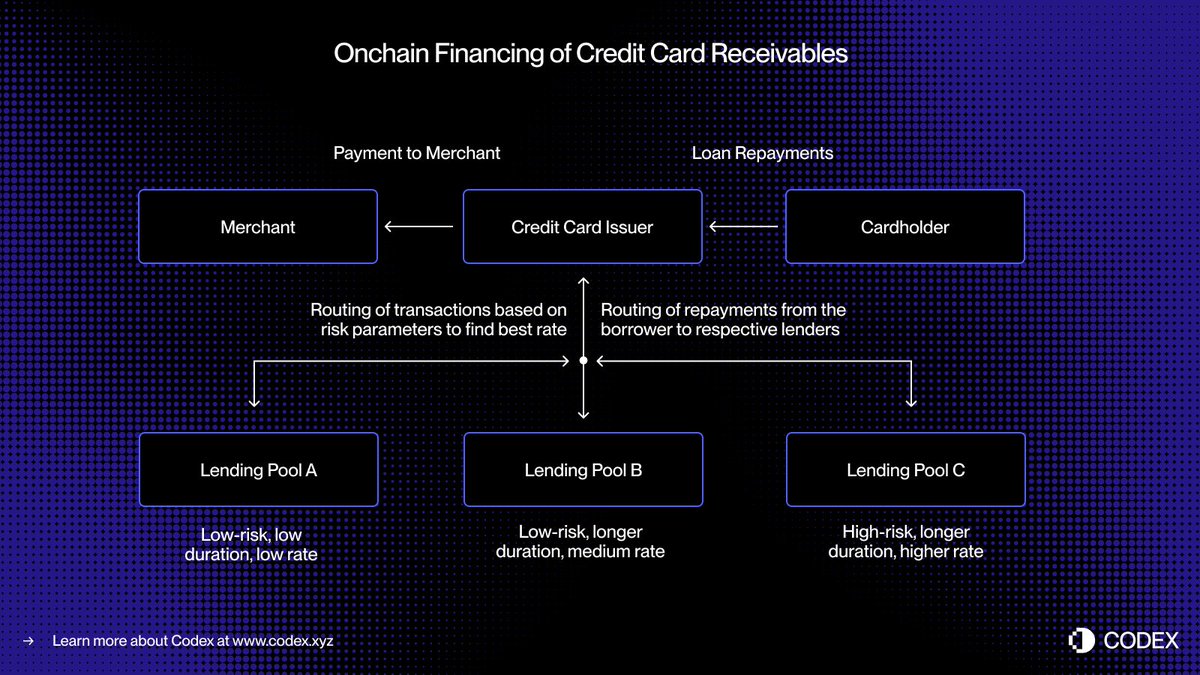

Imagine a consumer purchases $5,000 worth of goods. The transaction is immediately authorized. Before settling with Visa or Mastercard, the issuer tokenizes the receivable on-chain and receives $5,000 in USDC from a decentralized credit pool. Once settlement is complete, the issuer sends the funds to the merchant.

Later, when the borrower makes repayments, those payments are automatically returned to the on-chain lenders via smart contracts. Again, the entire process happens in real time.

This approach enables real-time liquidity, transparent funding sources, and automated repayment, reducing counterparty risk and eliminating many manual processes that still exist in today’s consumer credit system.

From Securitization to Pools

For decades, the consumer credit market has relied on deposits and securitization to scale lending. Banks and credit card issuers bundle thousands of receivables into asset-backed securities (ABS), which are then sold to institutional investors. This structure provides ample liquidity but also introduces complexity and opacity.

"Buy Now, Pay Later" (BNPL) lenders like Affirm and Afterpay have already demonstrated the evolution of credit underwriting. Instead of offering universal credit lines, they evaluate each transaction at the point of sale, differentiating between a $10,000 sofa and a $200 pair of sneakers.

This transaction-level risk management produces standardized, divisible receivables—each with a clear borrower, term, and risk profile—making them ideal for real-time matching through on-chain lending pools.

On-chain lending can extend this concept further by creating specialized credit pools tailored to specific borrower segments or purchase categories. For example, one pool could fund small transactions for prime borrowers, while another could focus exclusively on travel installment loans for subprime consumers.

Over time, these pools may evolve into targeted credit markets with dynamic pricing and transparent performance metrics for all participants.

This programmability opens the door to more efficient capital allocation, better interest rates for consumers, and the creation of an open, transparent, and instantly auditable global unsecured consumer credit market.

The Emerging On-Chain Credit Stack

Reimagining unsecured lending for the on-chain era isn’t just about porting credit products onto blockchains—it requires rebuilding the entire credit infrastructure from the ground up. Beyond issuers and processors, traditional lending ecosystems rely on a complex network of intermediaries:

We need new credit scoring methods. Traditional credit scoring systems like FICO and VantageScore might be portable to blockchains, but decentralized identity and reputation systems could play a larger role.

Lenders will also need ratings, equivalent to those from S&P, Moody’s, or Fitch, to assess underwriting quality and repayment performance.

Finally, the less glamorous but critically important aspects of loan collections require improvement. Stablecoin-denominated debt still needs enforcement mechanisms and recovery processes that combine on-chain automation with off-chain legal frameworks.

Stablecoin cards have already bridged the gap between fiat and on-chain spending. Lending protocols and tokenized money market funds have redefined savings and yield. Bringing unsecured credit on-chain completes this triangle, enabling consumers to borrow seamlessly and investors to fund credit transparently—all powered by open financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News