The on-chain evolution of private credit: from ledger to investable products

TechFlow Selected TechFlow Selected

The on-chain evolution of private credit: from ledger to investable products

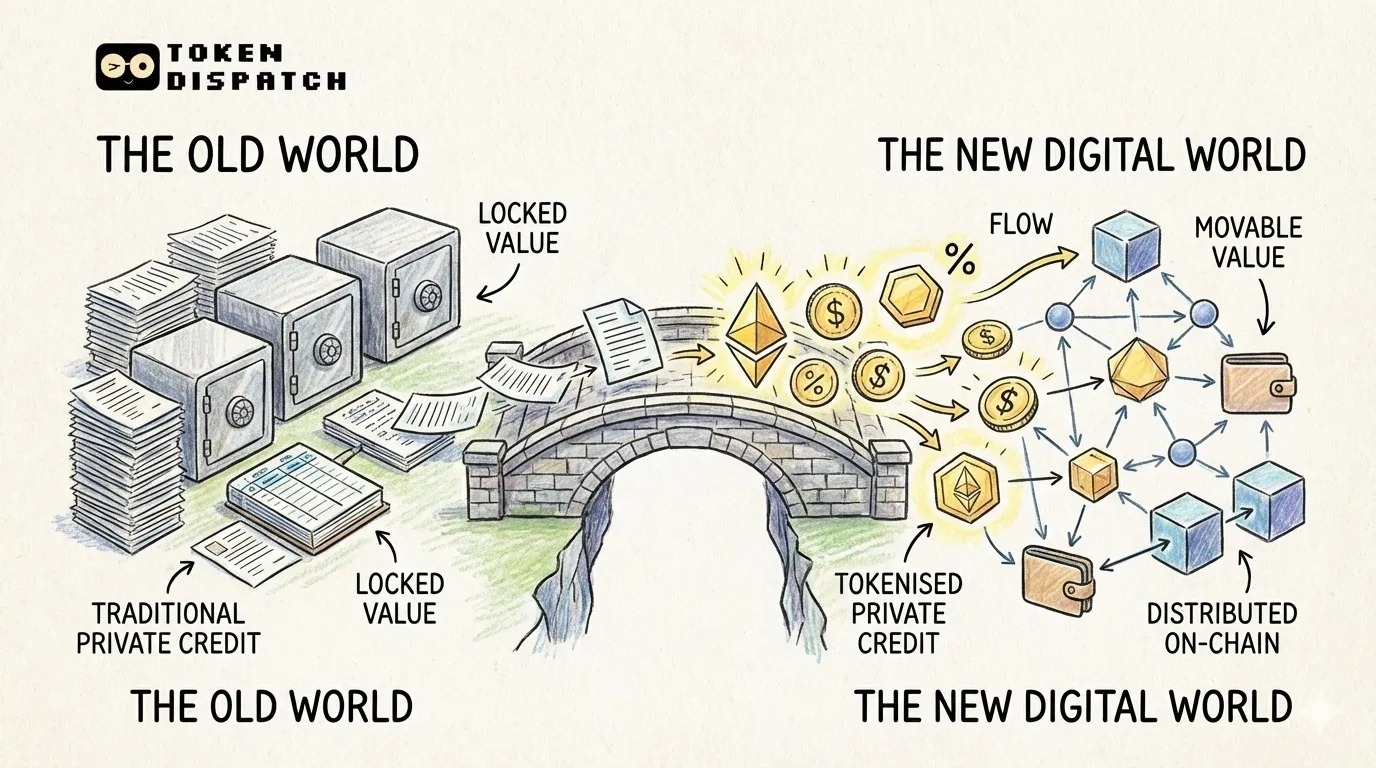

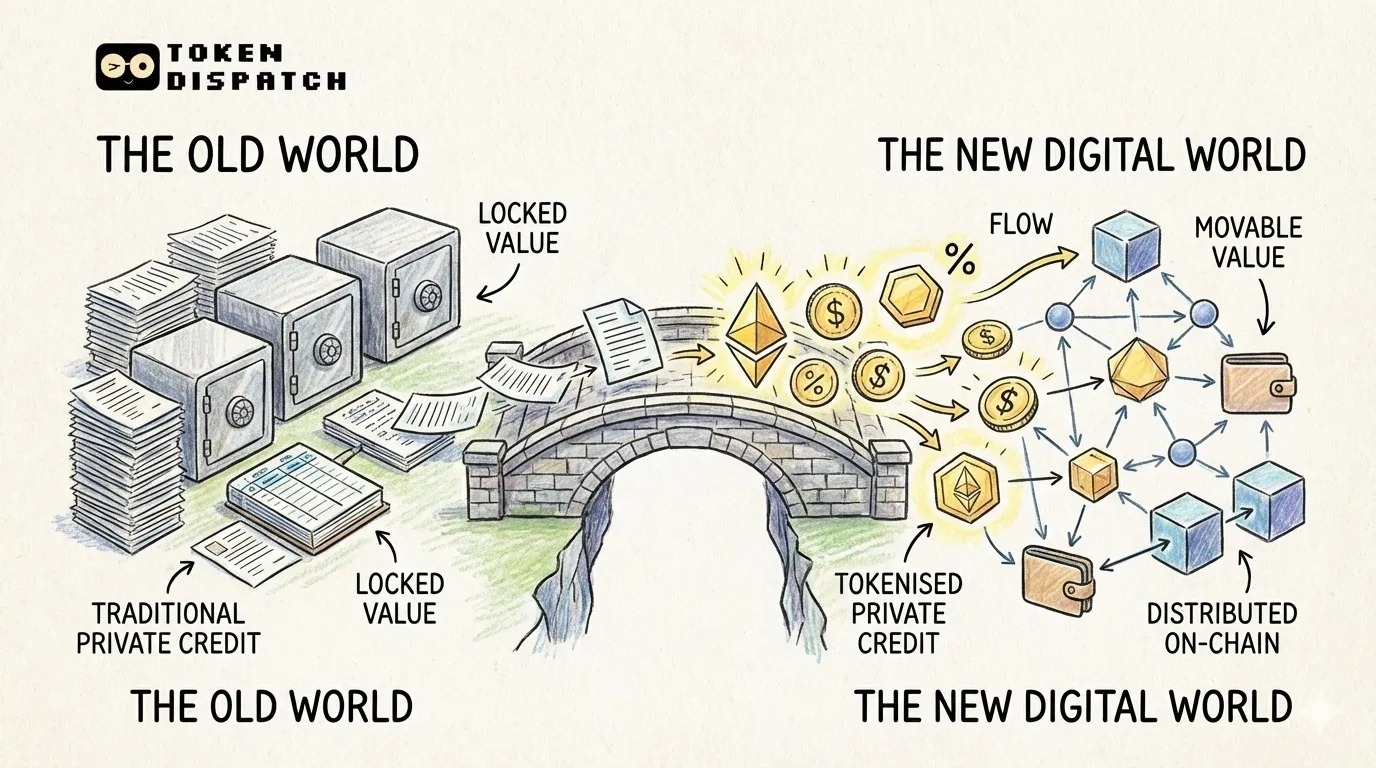

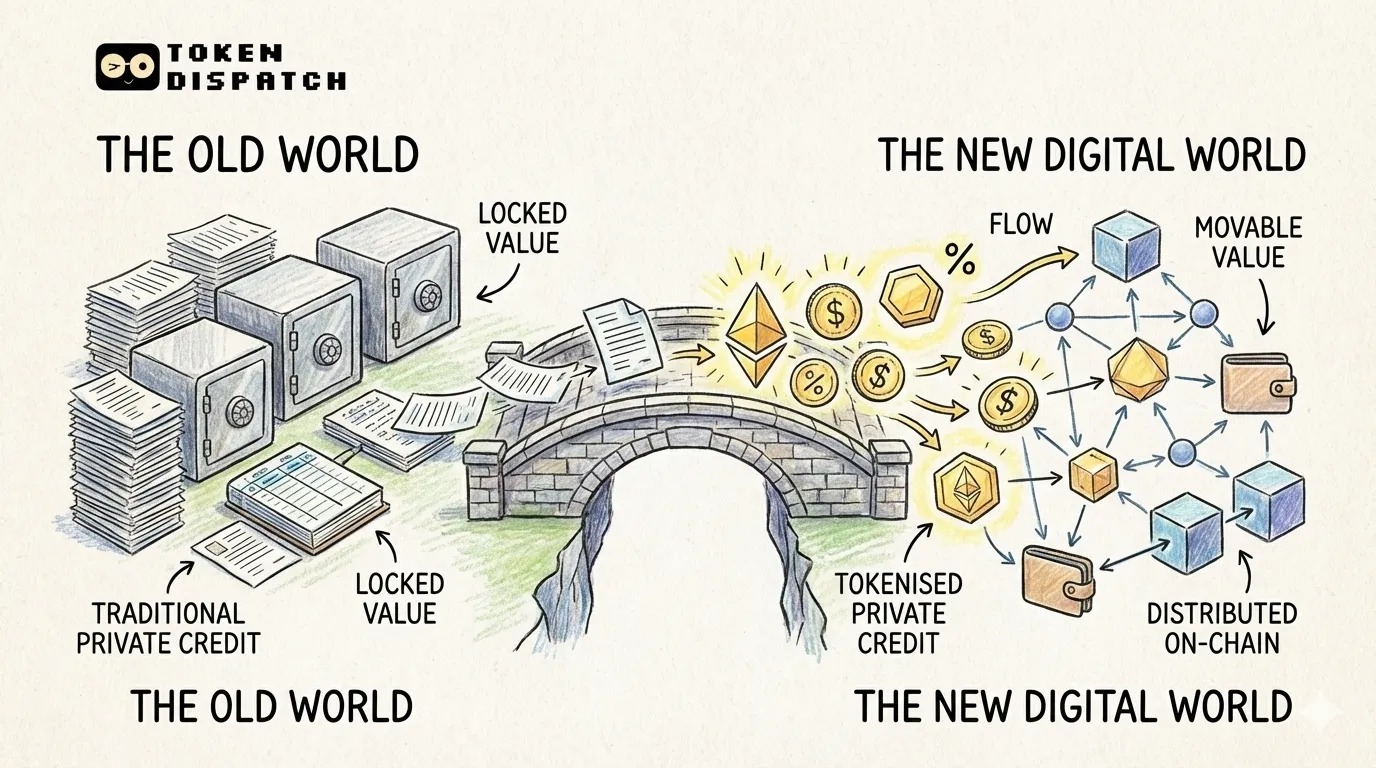

"Portability" is a prerequisite for achieving large-scale standardized distribution of private credit, which has historically been lacking in private credit.

Author: Prathik Desai

Translation: Block unicorn

Introduction

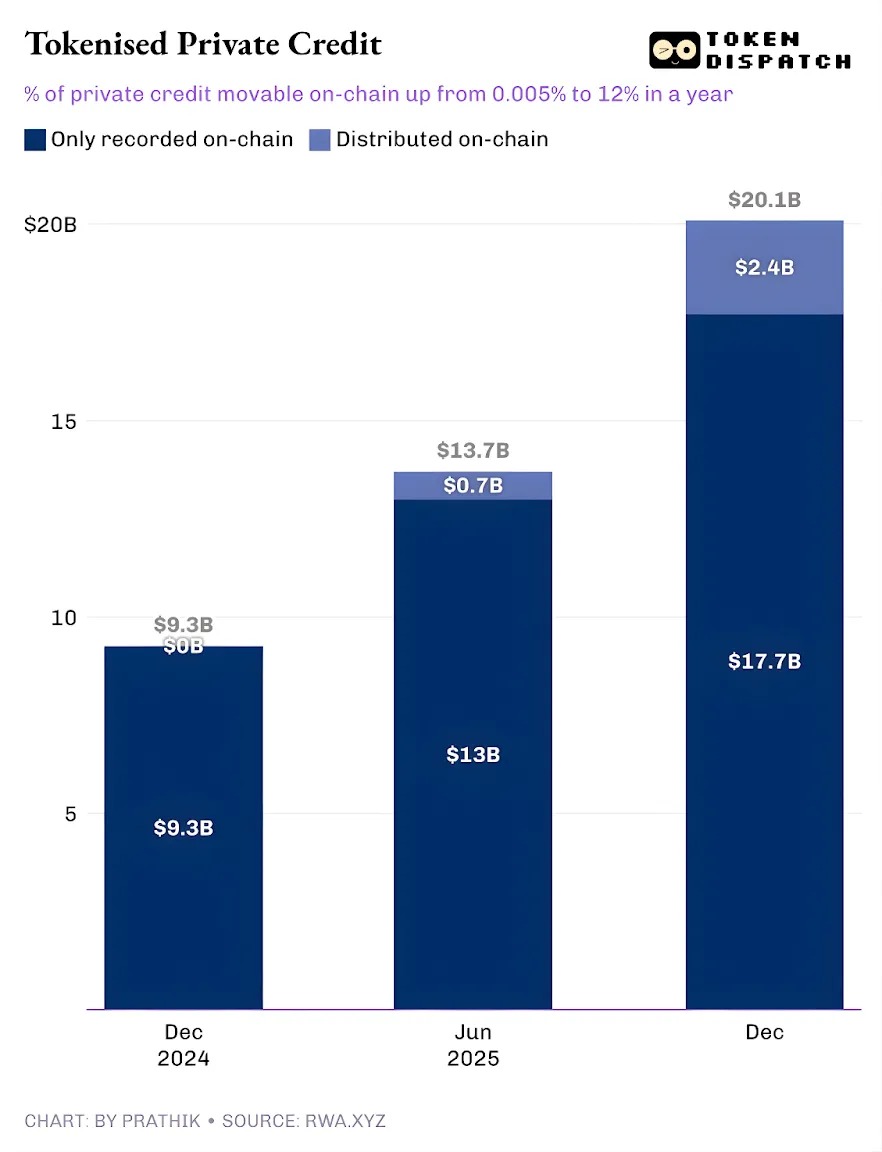

Private credit is at a tipping point on tokenized real-world asset (RWA) platforms. Over the past year, tokenized private credit has been the fastest-growing category, expanding from less than $50,000 to approximately $2.4 billion in size.

If we exclude stablecoins—whose payment rails cover all on-chain activity—tokenized private credit ranks just behind on-chain commodities. Top tokenized commodities include gold-backed tokens from Tether and Paxos, as well as commodity-backed tokens for cotton, soybean oil, and corn from Justoken. This appears to be a serious category with real borrowers, cash flows, underwriting mechanisms, and yields, and one that is less dependent on market cycles compared to commodities.

But the story only becomes complex upon deeper inspection.

The $2.4 billion in outstanding tokenized private credit represents only a small fraction of the total outstanding loans. This indicates that only a portion of these assets can actually be held and transferred on-chain via tokens.

In today’s article, I will examine the reality behind the numbers in tokenized private credit and what these figures mean for the future of this category.

Let’s dive right in.

The Dual Nature of Tokenized Private Credit

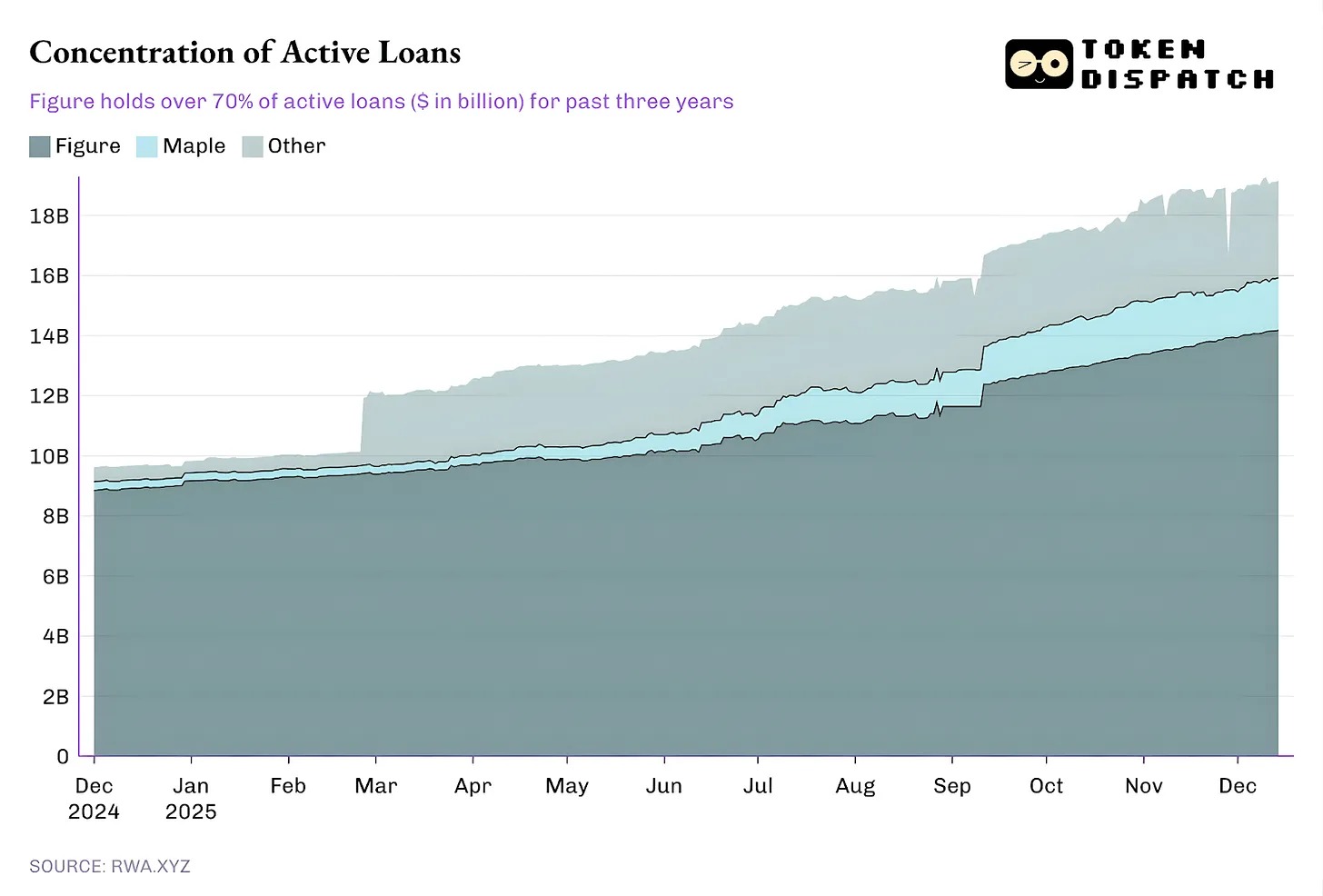

The total value of active loans on RWA.xyz exceeds $19.3 billion. However, only about 12% of these assets can be held and transferred in tokenized form. This reflects the dual nature of tokenized private credit.

One side is "representational" tokenized private credit, where blockchain provides only operational upgrades by recording loans originated from traditional private credit markets onto an on-chain ledger of outstanding loans. The other side involves distributive upgrades, where blockchain-driven markets coexist alongside traditional (or off-chain) private credit markets.

The former is used solely for record-keeping and reconciliation, logged on a public ledger. In contrast, distributed assets can be transferred into wallets for transferability.

Once you understand this classification system, you’ll stop asking whether private credit is on-chain. Instead, you’ll ask a sharper question: How much private credit originates from blockchain? The answer may offer some insight.

The trajectory of tokenized private credit is encouraging.

Until last year, nearly all tokenized private credit involved only operational-level upgrades. Loans already existed, borrowers repaid on time, platforms functioned normally, and blockchain merely recorded these activities. All tokenized private credit was simply recorded on-chain but could not be transferred as tokens. Within a year, the share of transferable on-chain assets has risen to 12% of the total trackable private credit volume.

This demonstrates the growth of tokenized private credit as a distributable on-chain product, enabling investors to hold fund shares, pool tokens, notes, or structured investment exposures in token form.

If this distributive model continues to expand, private credit will no longer resemble loan ledgers but instead become a truly investable on-chain asset class. This shift would change the benefits lenders derive from transactions. Beyond yield, lenders would gain tools with greater operational transparency, faster settlement, and more flexible custody. Borrowers would access funding not reliant on a single distribution channel—a significant advantage in risk-off environments.

But who will drive the growth of the distributable private credit market?

The Figure Effect

Currently, the majority of outstanding loans come from a single platform, while the rest of the ecosystem forms a long tail.

Since October 2022, Figure has dominated the tokenized private credit market, though its market share has declined from over 90% in February to 73% today.

But more interesting is Figure’s private credit model.

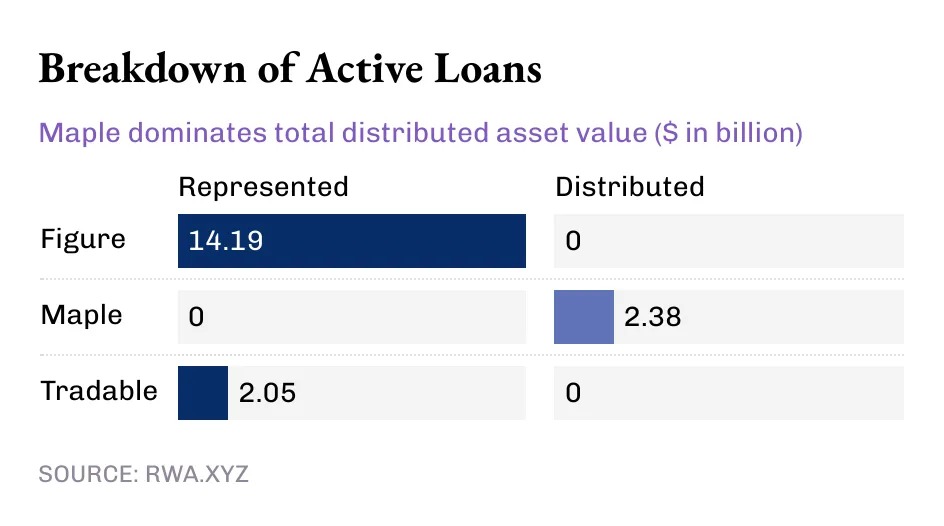

Despite the industry now exceeding $14 billion in tokenized private credit, this market leader's entire value lies in "representational" assets, with zero distributed value. This suggests Figure’s model functions as an operational pipeline, recording loan origination and ownership tracking on the Provenance blockchain.

Meanwhile, smaller players are driving the distribution of tokenized private credit.

Figure and Tradable hold all their tokenized private credit as representational value, whereas Maple distributes its value entirely through blockchain.

From a macro perspective, the vast majority of the current $19 billion in active on-chain loans are merely recorded on blockchain. But the trend over recent months is undeniable: an increasing amount of private credit is being distributed via blockchain. Given the immense growth potential of tokenized private credit, this trend is likely to accelerate further.

Even at $19 billion, RWAs currently represent less than 2% of the $1.6 trillion private credit market.

But why does "movable, not just recorded" private credit matter?

Movable private credit offers more than just liquidity. Gaining exposure to private credit via tokens outside a platform provides portability, standardization, and faster distribution.

Assets obtained through traditional private credit channels trap holders within a specific platform’s ecosystem. Such ecosystems have limited transfer windows and cumbersome secondary market processes. Additionally, secondary market negotiations proceed slowly and are largely dominated by professionals, giving existing market infrastructure far more power than asset holders.

Distributable tokens can reduce these frictions by enabling faster settlement, clearer ownership transfers, and simpler custody.

More importantly, "movability" is a prerequisite for large-scale standardized distribution of private credit—a feature historically missing in private credit. In traditional models, private credit appears in forms such as funds, business development companies (BDCs), and collateralized loan obligations (CLOs), each layer adding intermediaries and opaque fees.

On-chain distribution offers a different path: programmable wrappers enforce compliance (whitelisting), cash flow rules, and disclosure requirements at the instrument level, rather than through manual processes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News