Kyoko Finance: Unlocking the D2D Lending Market and Cross-Chain NFT Lending Opportunities

TechFlow Selected TechFlow Selected

Kyoko Finance: Unlocking the D2D Lending Market and Cross-Chain NFT Lending Opportunities

DAO to DAO, a new narrative.

Author: Ping

DAOs and NFTs have become mainstream narratives in Web3, but something still seems to be missing.

Applying Masayoshi Son’s "Time Machine" theory, we observe a blank space around credit markets for DAOs and NFTs—enter Kyoko Finance.

Kyoko Finance is a composite liquidity solution for crypto assets, providing DeFi services to DAOs, institutions, and individual users. Its business revolves around two core pillars:

-

Acting as an intermediary for institutional credit, offering high-value, unsecured or crypto-collateralized D2D (DAO-to-DAO) loans, enabling the rapidly growing ecosystem of DAOs to access greater liquidity and even leverage debt to accelerate growth;

-

Providing NFT lending and staking services, allowing high-consensus NFT assets to serve as collateral in credit facilities or generate stable staking yields, thereby expanding NFT asset liquidity.

D2D (DAO to DAO) Lending Service

The first pillar of Kyoko Finance is inter-DAO credit lending.

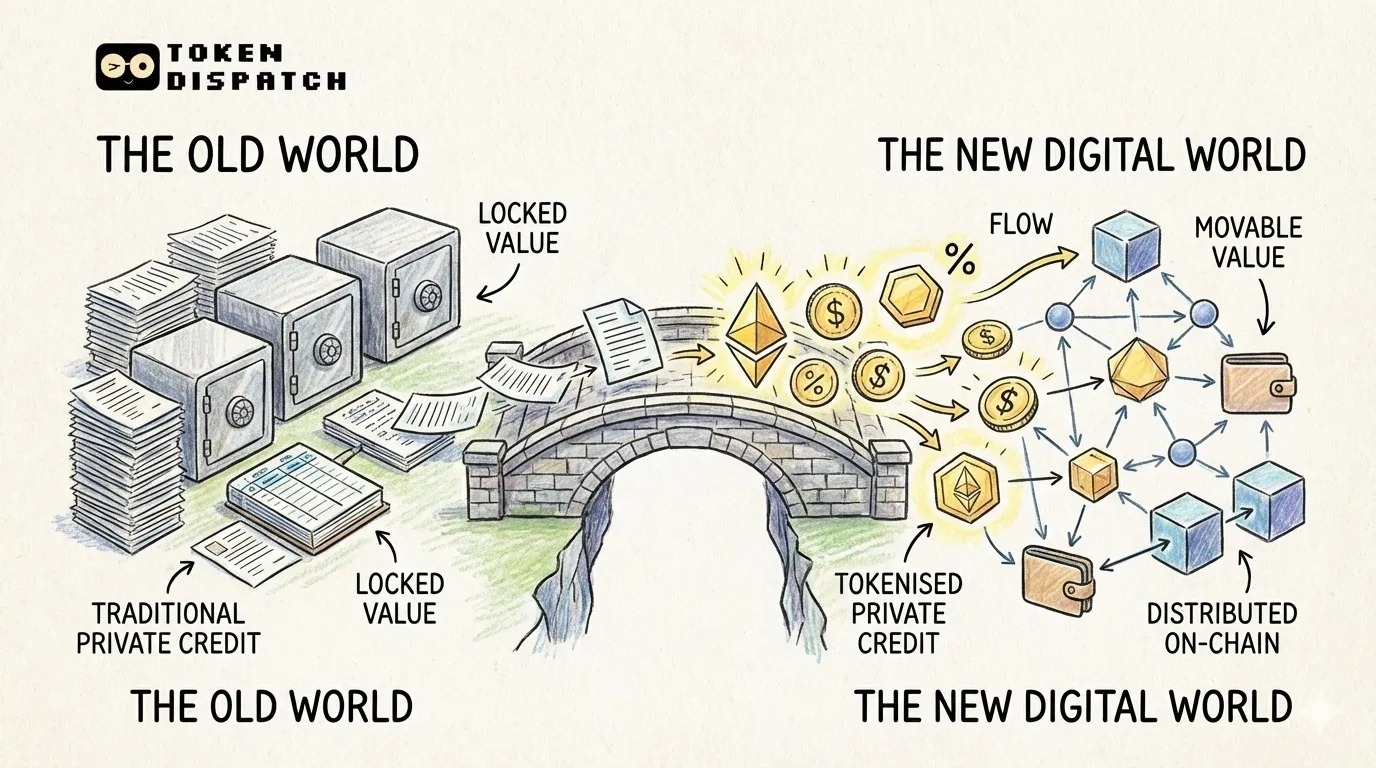

In traditional corporate governance, inter-company lending, bond issuance, and cross-shareholding are standard practices in asset management, with a global corporate bond market valued at $8.5 trillion. However, most DAOs’ operational models and their managed crypto assets struggle to gain recognition from traditional financial lenders.

Currently, there is no intermediary platform dedicated to DAO credit lending. Unsecured lending protocols like C.R.E.A.M. Finance’s Iron Bank require existing holdings as collateral—the “deposit-first” model does not align with the typical corporate bond-style credit needs of most DAOs.

While DAO governance is still in its infancy and difficult to directly compare with traditional companies in terms of asset scale, according to DeepDAO data, over 4,000 DAOs collectively hold nearly $900 million in treasury value (excluding NFT assets). There is a significant disparity in AUM (Assets Under Management) across DAOs—most have less than $100 million in AUM, with only 16 DAOs exceeding $100 million. This divergence creates strong supply and demand dynamics between borrowers and lenders within the DAO ecosystem.

There are clear success stories in DAO lending. Last year, PleasrDAO, shortly after founding, secured a $3.5 million collateralized loan via C.R.E.A.M. Finance’s Iron Bank to expand operations. By early this year, PleasrDAO’s valuation approached $1 billion—demonstrating the potential of D2D credit.

The Kyoko Finance DAO will, through proposals, reviews, and voting, offer unsecured or crypto-collateralized loans to various DAOs in need of capital—providing bond-like financing and filling a critical gap in the current DAO financial ecosystem.

Currently, Kyoko Finance DAO has established close partnerships with numerous DAOs, including YGG SEA and Animoca Brands (with large GameFi assets), Taipei-based NFT collector group SweeperDAO, Southeast Asia’s BreederDAO, and several emerging small NFT clubs. These networks are expected to form a solid foundation for Kyoko Finance’s D2D operations.

Current Practical Applications of D2D Services

Unsecured Loans: The beta version of D2D service currently available on the official website allows users to stake stablecoins as lenders and provide simple, unsecured stablecoin loans to whitelisted DAOs certified by Kyoko Finance DAO. Lenders earn a share of the interest paid by borrowers, similar to the operation of DeFi pioneer Aave V2, with the key difference being the dedicated DAO-focused lending functionality.

Collateralized Loans: As the name suggests, this offers collateralized lending to DAOs. Some DAO treasuries contain diverse assets—including Bitcoin, Ethereum, stablecoins, platform tokens, and even the DAO’s own token. When a DAO needs liquidity, selling these assets may not be feasible due to community voting requirements or lock-up/staking conditions.

D2D collateralized lending opens up access to long-tail assets. Through centralized review, DAOs are granted specific collateral limits to meet liquidity needs.

Potential Investment Opportunities: DAOs that receive early credit support from Kyoko D2D may offer future rewards back to Kyoko, investors, and vault providers. These rewards could take two forms:

1. Early investment opportunities—such as seed or private rounds—may be opened to Kyoko or other investors. In this sense, Kyoko can act as a DAO incubator and data-driven “investment firm” capable of identifying high-potential opportunities;

2. Future airdrops to holders of Kyoko tokens, serving as a special bonus.

Integrated NFT and DeFi Solutions

The current DeFi market’s total locked value (TLV) exceeds $200 billion, while the NFT market is valued near $10 billion. Yet, DeFi applications combining NFTs and lending have received limited attention. The most active NFT lending platform, “NFTfi,” has only around $60 million in outstanding loans. Moreover, its returns rely solely on peer-to-peer (P2P) user lending, lacking core DeFi mechanisms such as staking, liquidity mining, and yield rewards via pooled funds. Clearly, NFTfi’s path in NFT DeFi still holds vast untapped potential.

Previous P2P protocols often suffer from poor liquidity and long matching times, largely limiting usage to top-tier blue-chip NFTs. Most users face difficulties in finding matches. Pool-based lending, meanwhile, lacks clear timeframes and liquidation mechanisms, posing higher systemic risks and vulnerability to malicious manipulation. Furthermore, heterogeneous NFTs cannot easily replicate DeFi’s oracle mechanisms and require more complex valuation systems.

To address these challenges, Kyoko Finance has launched three NFTfi services:

-

NFT Staking Vault (officially launched Q1 2022)

Users can currently stake NFTs in Kyoko Finance’s Staking Vault, currently in a “blind staking” phase where specific yields are not disclosed. The project team explains that future Staking Pool returns will be determined by DAO community votes, setting yield coefficients based on NFT value tiers and distributing a portion of DAO revenue to NFT stakers accordingly.

The NFT Staking Vault is also expected to include NFT collateral pledged by other DAOs borrowing via Kyoko Finance DAO, serving as infrastructure for D2D services.

We can understand Kyoko Finance’s Staking Vault as a centralized platform operated by a decentralized entity—not purely smart contract-driven, but requiring DAO participants to individually assess and allocate value. This approach acknowledges the non-fungible nature of NFTs, whose values cannot be reduced to simple formulas or oracles, necessitating ongoing human consensus and revaluation.

-

P2P NFT Lending (Beta launched Q1 2022)

NFT lending follows a P2P model. Users borrowing against NFTs set their own terms—loan amount, interest rate, repayment period—with no restrictions from the platform.

Lenders set personalized lending terms and pay ERC20 funds plus a 1% platform fee. Borrowers and lenders can negotiate terms via Kyoko’s private chat system. A loan is only created upon mutual agreement. Unlike prior models, no upfront deposit or collateral is required. Liquidation is confined to the NFT itself—if repayment isn’t completed by the deadline, the NFT is automatically transferred to the lender’s wallet. Kyoko’s P2P model offers an alternative solution to persistent issues like NFT valuation difficulty, lack of NFT oracles, and poor trade matching.

-

CCAL – Cross-Chain Asset Lending (Q3 2022)

CCAL stands for Cross-Chain Asset Lending, designed primarily for multi-chain GameFi NFT assets. It operates via pooled funds to promote a shared economy in GameFi, significantly lowering entry barriers and risk for gold farmers and players, while providing idle GameFi NFT assets held by play-to-earn guilds or individuals with additional yield and liquidity.

Similar to P2P NFT lending, CCAL uses a Peer-to-Peer model, allowing users to set flexible borrowing periods for game assets. The key difference is that CCAL supports deposit-based clearing: lenders can pre-set a deposit amount, which is automatically returned to the original NFT holder in case of liquidation.

CCAL is planned to run on EVM-compatible chains like BSC, Polygon, and Avalanche, avoiding Ethereum’s high gas fees. Player-oriented users can borrow NFTs by paying ERC20 tokens, use them directly in GameFi to earn returns, then repay interest and return the NFT to reclaim their deposited tokens. Investor-oriented NFT holders, especially large-scale guilds, can earn steady interest income. (Lenders pay a 5% platform fee per transaction.)

Kyoko plans to expand CCAL by offering game data analytics—for example, comparing asset prices, lending rates, and earnings across different GameFi games—to help users make informed decisions.

Overall, Kyoko Finance’s composite NFT lending solutions stand out in the NFT DeFi space by combining the strengths of both P2P and pooled models. By replacing high-risk oracles with community participation, and leveraging P2P and DAO mechanics, Kyoko gradually delivers differentiated, tailored services for users with varying risk appetites.

Development Team and Funding Background

The four founding members—Henry, Jack, Helson, and Matt—have extensive backgrounds in blockchain and software development, with years of experience in tech and startups. The team is still expanding and plans to onboard more operational staff for D2D credit evaluation. For now, the team remains semi-anonymous, so their credentials cannot be independently verified.

Two prominent advisors are Mr. Block and Brian Lu, well-known figures in Taipei’s blockchain venture capital scene. Mr. Block is a core member of DeFi protocol Curve and PleasrDAO, while Brian Lu is a partner at renowned private equity firm Headline and leads its crypto arm, IVC.

In February, Kyoko Finance raised $3.5 million in seed and private rounds, led by renowned blockchain gaming company Animoca Brands, with participation from YGG SEA, Infinity Ventures Crypto (IVC), Honglou Capital, Axia8 Ventures, NGC Ventures, Momentum 6, Morningstar Ventures, Kliff Capital, BlockchainSpace, BreederDAO, and SweeperDAO.

In March, Kyoko Finance secured $3.6 million in strategic funding, led by ATEN Infinity Ventures, with participation from Morningstar Ventures, Kliff Capital, Cherubic Ventures, Kosmos Ventures, Vespertine Ventures, Tess Ventures, and Cryptobuddy.

Seed round investors like YGG SEA, IVC, and Blockchain Space were all projects led by Animoca Brands during their private rounds. Kliff Capital has prior experience operating corporate credit services in Thailand. Overall, investors are predominantly of Chinese heritage, with rich experience in NFTs, blockchain gaming, and guild investments—mainly active Asian investors and VCs. Notably, SweeperDAO—a well-known NFT collector group in Taiwan—and its lead Mr. Block, along with IVC’s Brian Lu, also serve as project advisors.

Yat Siu, CEO and founder of Animoca Brands, emphasized his strong belief in Kyoko Finance’s crypto-centric credit model and its ability to improve liquidity for NFTs and other digital assets. Notably, Kyoko Finance is the fourth NFT lending project Animoca has privately invested in, following Vera ($3M in August last year), Pawnfi ($3M in November), and NFTfi ($5M)—indicating that Kyoko still possesses unique narrative advantages and growth potential beyond existing players.

Economic Model

$KYOKO is the native token of Kyoko Finance, serving four primary functions:

-

Staking

$KYOKO uses a VeToken model: longer staking duration equals greater voting power. Staking periods range from one week to four years. VeKYOKO grants eligibility for DAO voting and additional $KYOKO rewards (including retroactive airdrops and revenue sharing from platform operations).

Stake for 4 years: 1 $KYOKO = 1 VeKYOKO

Stake for 3 years: 1 $KYOKO = 0.75 VeKYOKO

Stake for 2 years: 1 $KYOKO = 0.5 VeKYOKO

Stake for 1 year: 1 $KYOKO = 0.25 VeKYOKO

-

DAO Governance Participation

Many major decisions within the Kyoko Finance protocol require DAO community voting, such as proposing and reviewing unsecured loan whitelists and determining NFT staking valuations and yields.

Snapshots are taken before each vote. Future D2D activities may bring substantial retroactive airdrops to VeToken holders.

-

Liquidity Mining

Staking ETH/KYOKO LP tokens yields additional $KYOKO mining rewards.

-

Platform Revenue Sharing

Holders who stake $KYOKO receive dividends from platform operating revenues.

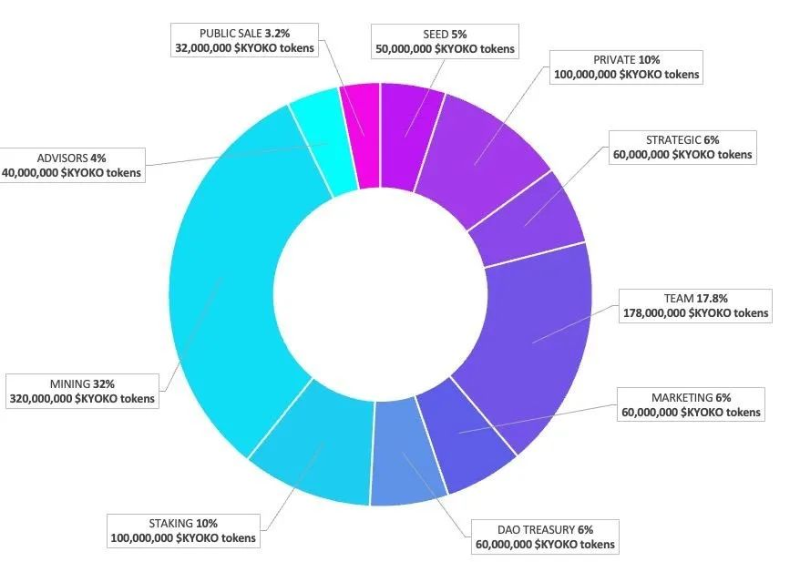

Token allocation is shown below:

IDO

Kyoko Finance DAO token $KYOKO was scheduled for an initial public offering (IDO) from March 22 to March 30, 2022, using a multi-track approach: Launchpad IDO, IVO on SOLV, and INO via Kyoko’s own platform. Details are as follows:

1. IVO: SOLV

$KYOKO IVO price: $0.10

Conducting the IVO on SOLV enables Kyoko to distribute (or sell) tokens using Vesting Vouchers and build a scalable user network. Sale price: $0.10

2. Launchpad IDO: Polkastarter/MoonEdge

$KYOKO IDO price: $0.10

Both Polkastarter and MoonEdge are whitelist-based launchpads offering a lower sale price ($0.10), but participation requires meeting platform qualifications. Together, they plan to sell 31 million $KYOKO tokens.

3. INO: Kyoko Pawn

Kyoko Pawn INO price: 20,000 USDT per NFT

Kyoko Pawn is a limited-edition NFT issued by the Kyoko platform, with a total supply of 1,000. On March 22, 633 units were publicly sold at 20,000 USDT each (the first 367 were gifted to early investors and advisors).

The main utility of Kyoko Pawn is participation in decentralized investments. Due to the nature of D2D services, many early-stage investment opportunities may arise—holders of Kyoko Pawn will receive guaranteed allocation rights. Proceeds from Kyoko Pawn sales do not go into Kyoko’s vault but are directly deposited into the D2D liquidity pool.

Notably, this INO follows a “borrow first, repay later” model, repeatable on an annual cycle.

One year after minting, each Kyoko Pawn can redeem 20,000 USDT. During this year, the NFTs remain freely tradable. Over the course of the year, the 633 Kyoko Pawns will collectively receive 2 million $KYOKO in rewards, distributed to the NFT holder’s address at redemption.

Risks and Conclusion

Overall, Kyoko Finance targets underdeveloped yet promising sectors—credit and collateralized lending between DAOs and NFT-backed lending. With strong resource backing and mature product design, Kyoko Finance shows great potential. However, risks remain, particularly regarding market adoption, which is yet to be proven. Additionally, the growth of Kyoko Finance is inherently tied to the broader cycles of DAO and NFT market development.

For long-term investors bullish on the DAO and NFT ecosystems, Kyoko Finance warrants attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News