The Crossroads of Financial Future: How Cryptocurrencies Integrate into the Mainstream Credit System?

TechFlow Selected TechFlow Selected

The Crossroads of Financial Future: How Cryptocurrencies Integrate into the Mainstream Credit System?

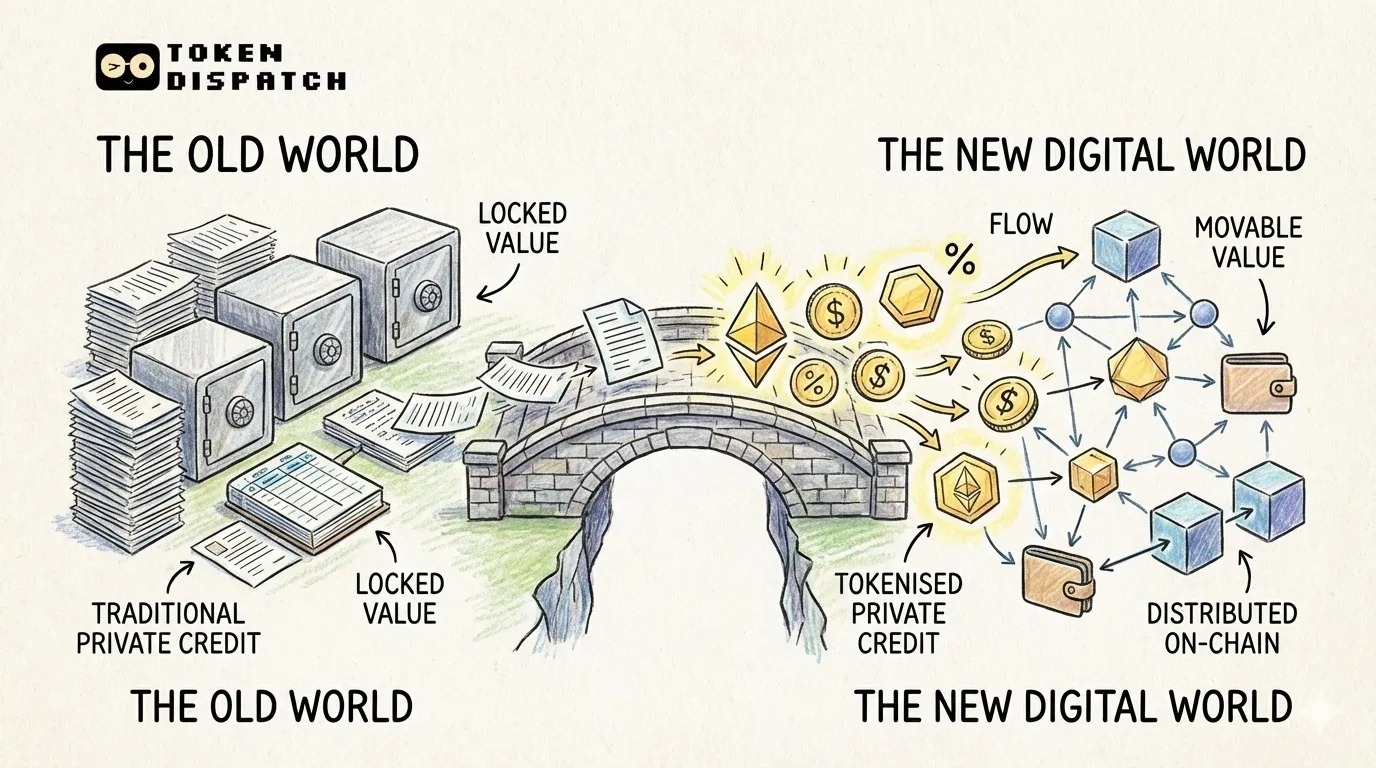

The credit system we know is rapidly evolving and gradually embracing cryptocurrency in new ways every day.

By: Prathik Desai

Translated by: Block unicorn

Preface

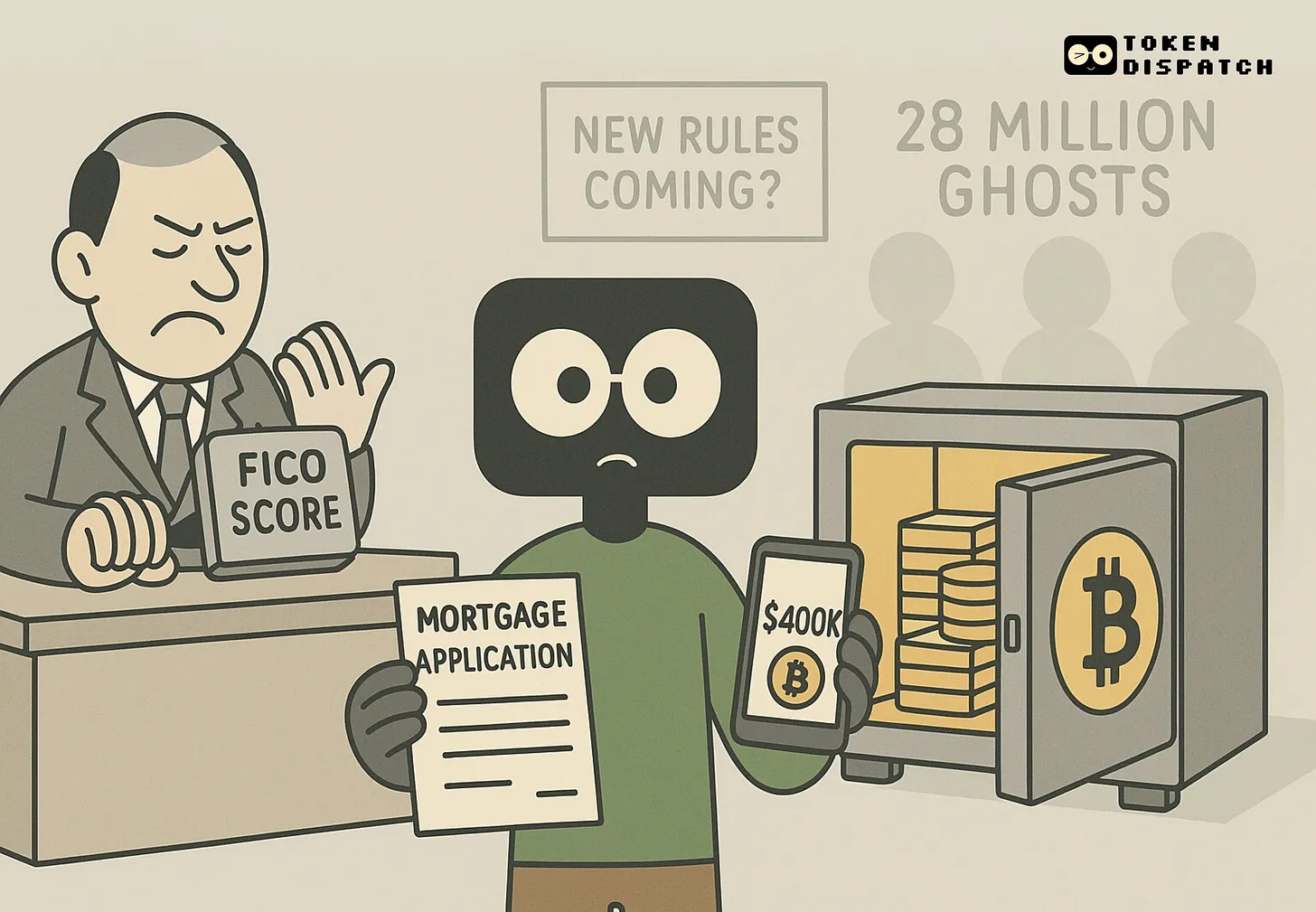

There's an irony in modern finance. You might hold $400,000 worth of Bitcoin yet struggle to get approved for a $300,000 mortgage. Your digital wealth may make you appear rich on paper, but when it comes time to buy something big—like a house—you're effectively invisible. This is especially true if you lack a traditional credit history.

This absurdity made me wonder: if the wealth is real, why isn't it recognized?

On Monday, that absurdity moved one step closer to resolution.

Bill Pulte, the newly appointed director of the Federal Housing Finance Agency (FHFA), posted a tweet.

Within hours, leaders across the crypto space responded.

Michael Saylor proposed his Bitcoin credit model. Jack Mallers of Strike volunteered to make Bitcoin-backed mortgages "a reality across America."

The signs are clear: the credit system as we know it is rapidly evolving, and crypto is being integrated in new ways every day.

The 28 Million "Financial Ghosts"

About 28 million adults in the U.S. are classified by regulators as "credit invisible." They exist in the economy—they work, earn, and spend—but to banks, they don't exist. They have no credit cards, student loans, or mortgage records. They are financial ghosts: financially sound but lacking a FICO score to prove it.

According to Tom O'Neill, senior advisor at Equifax, lenders have missed out on roughly 20% of potential U.S. credit demand growth simply because they haven’t adopted alternative data into traditional scoring models—a stark illustration of systemic exclusion.

Meanwhile, around 55 million Americans own cryptocurrency. Many within this group may be asset-rich in digital terms but credit-poor in the traditional system.

Consider immigrants who avoid debt, young professionals who’ve never needed a credit card, or global entrepreneurs paid in digital assets. Someone could hold enough Bitcoin to comfortably afford a home, yet be denied a mortgage because their wealth isn’t registered in the FICO system.

Ironically, traditional banks are already recognizing this issue.

In 2023, JPMorgan Chase, Wells Fargo, and Bank of America launched a pilot program challenging decades of credit card underwriting norms. These lenders began approving credit cards by analyzing consumer account activity—including checking and savings balances, overdraft history, and spending patterns—instead of requiring a traditional credit score.

Early results showed that many previously excluded consumers were actually creditworthy; they just lacked conventional financial footprints.

So what’s the logical next step? Using cryptocurrency holdings as another form of alternative data. After all, if your bank balance, stock, and bond portfolios can be used to assess creditworthiness, why not your Bitcoin balance?

The scale of this disconnect becomes clearer in the numbers. In 2023, the global lending market was one of the largest financial sectors, valued at $10.4 trillion, and is projected to reach $21 trillion by 2033.

On-chain lending accounts for only a tiny fraction—0.56%.

Focusing just on housing, agencies overseen by the FHFA provide over $8.5 trillion in funding to the U.S. mortgage market and financial institutions.

If crypto assets could be properly integrated into this mainstream ecosystem, a massive influx of recognized collateral and participants would follow.

Instead of forcing crypto holders to sell assets to qualify for a mortgage, lenders could treat digital assets as legitimate collateral or proof of wealth.

Under today’s rules, buying a $400,000 house means liquidating your crypto, triggering capital gains taxes, and forfeiting any future appreciation of an asset you wanted to hold. It’s like being punished for holding the “wrong” kind of money.

In a crypto-inclusive framework, you could use your Bitcoin as collateral without selling it, avoid tax events, and secure real estate while preserving your digital assets.

Some companies are already doing this in the private sector.

Milo Credit, a fintech based in Florida, has issued over $65 million in crypto-backed mortgages.

Other firms offer Bitcoin-backed mortgages too, but they operate independently. Some function outside the Fannie Mae/Freddie Mac system, meaning higher interest rates and limited scalability. Pulte’s statement could push this trend into the mainstream.

Modernization Is Imperative

Traditional credit scoring is outdated. Banks look backward at payment history but ignore forward-looking indicators of wealth.

Some decentralized finance (DeFi) protocols are already experimenting with on-chain credit scores.

Cred Protocol and Blockchain Bureau analyze wallet transaction histories, DeFi protocol interactions, and asset management behaviors to generate credit scores based on demonstrated financial responsibility.

A person with a stable on-chain transaction record and a healthy crypto portfolio may be more creditworthy than someone with maxed-out credit cards—yet the current system cannot recognize this. Progressive lenders are already testing alternative data such as rent payments, bank balance trends, and utility bills.

So what’s holding back crypto-backed mortgages? One major issue remains.

Crypto’s notorious volatility could turn mortgages into margin-call scenarios.

Bitcoin lost about two-thirds of its value between November 2021 and June 2022. What happens if your mortgage eligibility hinges on one Bitcoin worth $105,000 today, but tomorrow it drops to $95,000? A once-creditworthy borrower suddenly becomes a default risk—not due to their actions, but market swings.

Scale this across millions of loans, and you have the makings of a real crisis.

This feels familiar.

In 2022, European Central Bank official Fabio Panetta noted that the crypto market had surpassed the $1.3 trillion subprime mortgage market that triggered the 2008 crisis. He observed "similar dynamics" between traditional and crypto markets: rapid growth, speculative fervor, and opaque risks.

Digital wealth can appear—and vanish—at astonishing speed during bull runs. Aggressive lending based on inflated portfolio values could replay the boom-bust cycle that destroyed the housing market seventeen years ago.

Our Take

Even if the FHFA moves forward, Pulte hasn’t provided timelines or specifics. Practical hurdles remain daunting. How do you value volatile assets for lending purposes? Which cryptocurrencies qualify? Only Bitcoin and Ethereum? What about stablecoins? And how do you verify ownership without enabling fraud?

Then there’s foreclosure: if a borrower defaults, can banks truly seize crypto collateral? What if the borrower claims their private key was “lost in a boating accident”? Traditional repossession involves sending agents to reclaim physical property. Seizing crypto assets involves… well, just some alphanumeric keys.

Some challenges are being addressed by emerging undercollateralized loan protocols. Platforms like 3Jane have developed “credit slashing” mechanisms that bridge the gap between anonymous borrowing and real-world accountability. Their approach allows borrowers to remain private initially, but default triggers a process where collection agencies can access real-world identities and pursue recovery through traditional means—including credit reporting and legal action. Borrow anonymously, but bear consequences upon default.

For crypto holders, Pulte’s statement represents long-awaited recognition. Your digital assets may finally be seen as “real” wealth by mainstream finance. For the housing market, this could unlock a wave of buyers previously excluded by outdated qualification methods.

But execution will determine whether this becomes a bridge to financial inclusion—or a path to the next crisis. Integrating crypto into mortgage lending demands a level of careful risk management that the financial industry has not always excelled at.

The wall between crypto and traditional credit is beginning to crumble. Whether what emerges is a stronger, more inclusive financial system—or a more fragile house of cards—will depend on how carefully we build the bridge between these two worlds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News