Opinion: Utility tokens from real-world companies will drive Web3's next major surge

TechFlow Selected TechFlow Selected

Opinion: Utility tokens from real-world companies will drive Web3's next major surge

Tokenization is a major breakthrough of Web 3. It creates tremendous possibilities for innovation, but also opens Pandora's box.

Written by: TaschaLabs

Translated by: TechFlow intern

Tokenization is Web3’s big breakthrough. It unlocks massive potential for innovation, but also opens Pandora’s box.

Anyone can create a token to represent anything of value and trade it against other assets on an open network under common standards—an unthinkable scenario before public blockchains existed. Tokenization has also given many Web3 “products” short-term appeal, even when they are inherently unsustainable.

Ponzi schemes eventually collapse, but that doesn’t negate the fact—that when applied in the right context, tokenization is a powerful economic tool capable of accelerating business growth.

Real-world businesses are only beginning to realize the power of tokenization. The demise of speculation during the bear market creates breathing room for genuine innovation in tokenization. Companies with viable products that integrate utility tokens early into their existing business models will reap substantial rewards—and accelerate crypto adoption in the process.

By "utility token," I mean a token with a clear use case within a product's lifecycle—not a "security token" designed for profit-sharing, which resembles equity and may face regulatory hurdles down the road. So how can traditional businesses benefit from utility tokens? Here are three ways:

1. User Retention / Loyalty

The simplest use case for a utility token is as a rewards program—users earn more tokens the more they use the product, which can then be redeemed for future access or services.

Loyalty programs aren’t new—think frequent flyer miles, Starbucks rewards, credit card points—but the game-changer is allowing earned “points” to become liquid on secondary markets via public blockchains.

This fundamentally disrupts traditional loyalty economics.

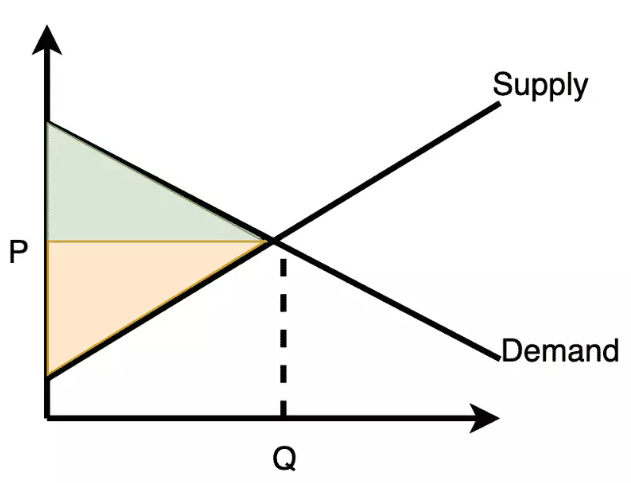

Traditional user rewards are essentially price discrimination. Charging different prices based on usage levels allows companies to capture higher profits—or in economic terms, greater producer surplus.

Example: In the chart below, the orange area represents producer surplus when all customers are charged the same price (P):

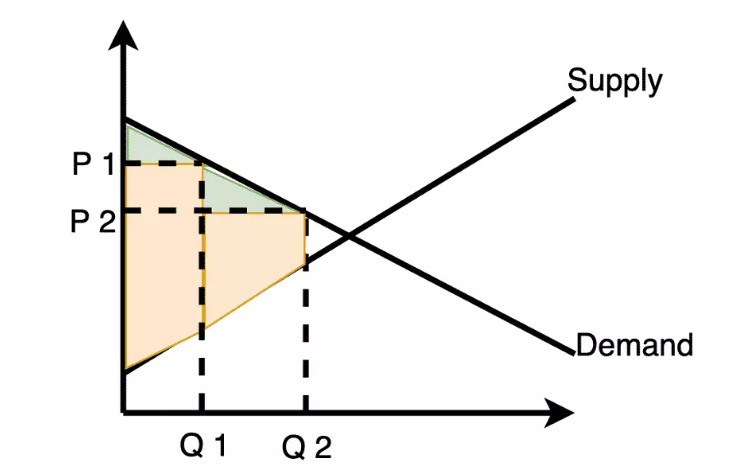

If the producer introduces tiered pricing based on quantity purchased, the orange area becomes larger:

The finer the price discrimination, the greater the producer surplus—as long as the company ensures high-tier customers cannot cheat by accessing lower-tier prices.

This is why airlines don't allow you to sell frequent flyer miles—if these “bulk discounts” were transferable, the business model would collapse.

But if you tokenize loyalty points—making them fungible tokens tradable on secondary markets—then everyone effectively gets the same discount: = token price × number of products per token.

So why would any company want to tokenize loyalty?

Because while tokens make differentiated pricing possible, they give users stronger incentives to earn rewards, since monetary benefits can be immediately realized on liquid secondary markets. This liquidity makes tokenized rewards far more attractive than siloed loyalty points tied to a single product.

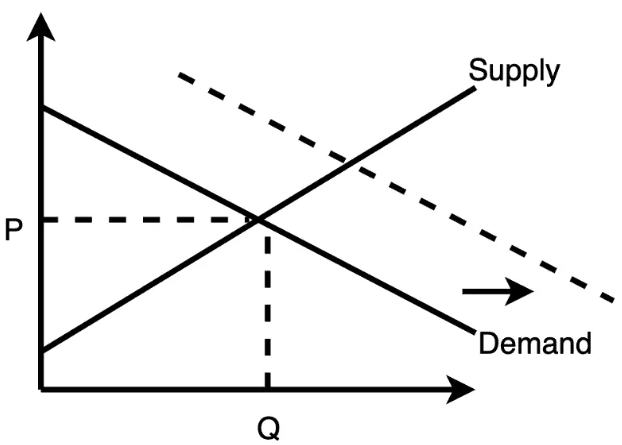

Economically, this extra incentive shifts the demand curve upward by an amount equal to the effective discount, resulting in increased user acquisition and higher engagement from existing users. The resulting equilibrium price, quantity, and producer surplus are all higher than in the baseline scenario.

2. Fund Growth Marketing Without Impacting Current Cash Flow

In 2000, PayPal awarded tens of millions of dollars in sign-up bonuses to bootstrap user adoption. It was a great incentive—but paid out in real cash from company coffers.

Unless you’re a well-funded VC-backed startup, most companies can’t afford such marketing tactics.

But if sign-up rewards are issued as tokens, they don’t impact current cash flow. Instead, the company recoups the cost when users redeem tokens for products or services in the future.

With secondary market liquidity, you're using future (unrealized) revenue to fund today’s growth—a far more flexible marketing budget model accessible to more companies.

Additionally, you can adjust redemption rates—X tokens for Y units of product—to dynamically change your dollar-denominated discount over time based on product pricing and secondary market conditions.

This “monetary policy” serves as an additional marketing lever (and helps establish a price floor and support stability for your token). Another advantage over traditional rewards: tokens expand both direct and indirect stakeholder bases.

3. Expand Your Stakeholder Base

Many so-called Web3 “communities” are merely chat rooms for speculators hoping token prices rise. Communities built on speculation may thrive in bull markets, but are fragile—and potentially destructive—in the long run. Not to mention, if the sole purpose of holding a token is price appreciation, you risk running into regulatory trouble.

Instead, a good token should aim for relative price stability to build long-term user trust. Users should be incentivized to earn more tokens through usage—not just wait for price increases.

Even without speculative worshippers, the mere fact that your token trades on secondary markets means more people interact with it than just your actual users. And a stable-value asset can be integrated into other financial instruments, further amplifying your reach.

So which types of companies are best suited for such tokens? A few basic criteria:

A. You Have Strong Product-Market Fit

Issuing a token on day one for an unproven product is unwise. The reflexivity of token prices and speculative “users” will distort your product development. When the tide goes out (and it will), you’ll be left exposed.

Having a token won’t solve high churn if your product fails to retain users. Ensure your product has sufficient stickiness and focus on retaining the users you attract.

B. Marginal Cost

Remember, issuing token rewards comes at the expense of your future revenue. If your marginal cost decreases as user numbers grow, that’s fine.

In such cases, acquiring more users makes sense—it offsets your reward costs—and tokenization helps you achieve that goal. But if your marginal cost remains flat or increases, tokenization may not be economically viable.

C. Winner-Takes-All Market

This complements point B, as winner-takes-all dynamics often occur in industries with declining marginal costs.

But the key is that the market must be large enough for meaningful demand curve shifts. If you run a small-town restaurant serving 2,000 locals, tokens probably aren’t the right marketing tool.

D. Your Business Model Allows Clear Token Utility

Example: Your product costs $X/month, and users can pay with tokens up to Y%.

If product usage and revenue come from different groups—for example, ad-supported content platforms—tokens can still work. Users earn tokens by consuming content → sell tokens on secondary markets → advertisers buy tokens and pay you.

Tokenization is again a powerful economic model for driving business growth—but only when integrated with viable, value-added products and services. Otherwise, it has no foundation. I hope to see much innovation in this space emerge from the bear market and become the next frontier of crypto adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News