7 Potential Impacts of the Ukraine Conflict on Cryptocurrencies: Risks, Hopes, and Countermeasures

TechFlow Selected TechFlow Selected

7 Potential Impacts of the Ukraine Conflict on Cryptocurrencies: Risks, Hopes, and Countermeasures

The war in Ukraine: bullish or bearish for cryptocurrency?

Written by: Tascha

Translated by: TechFlow Intern

Will the Ukraine war lead to a bullish or bearish crypto market? Here are seven potential impacts, arranged from short-term to long-term.

1. Collateral Damage from Liquidity Tightening

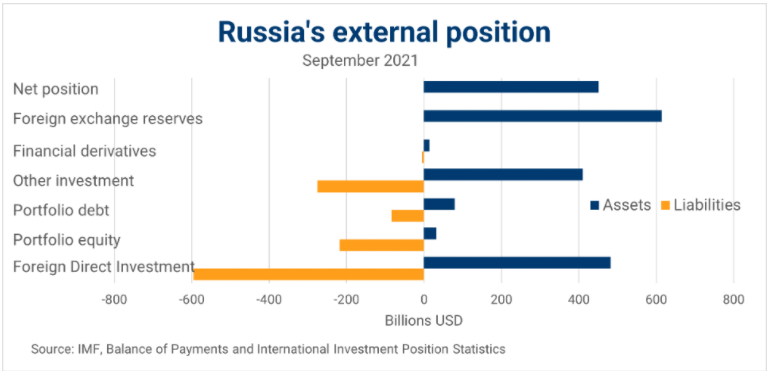

Financial sanctions mean that Russia’s $1.2 trillion in foreign liabilities—half of which are portfolio debt/equity—must be written off from foreign creditors’ and investors’ books, as well as receivables from Russia.

Russian-linked creditors/exporters/investors will need to raise additional liquidity from markets. Combined with increased risk aversion, this implies that financial conditions—already tighter than pre-pandemic levels—will continue to tighten further.

Similar factors also lead to a stronger U.S. dollar, which means falling cryptocurrency prices.

Of course, for risk assets including Web3, all of this is short-term.

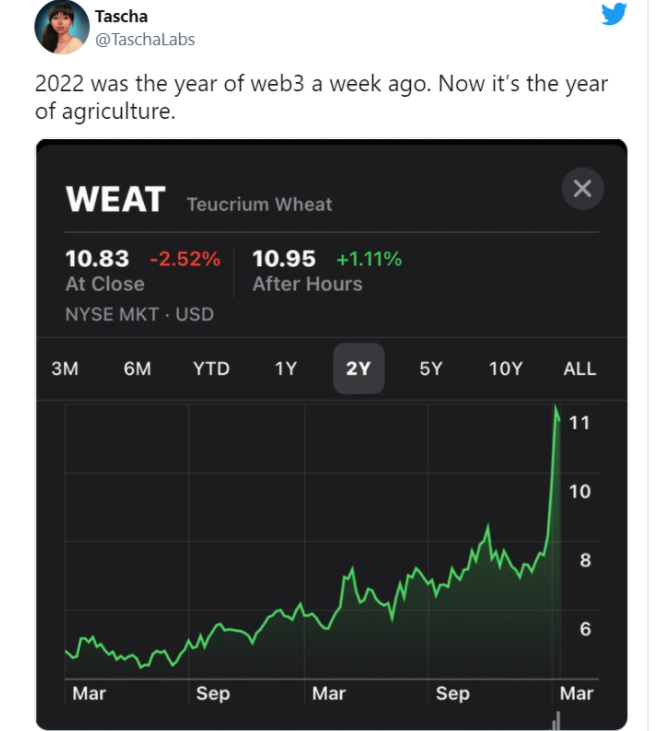

2. “Smart Money” Will Shift

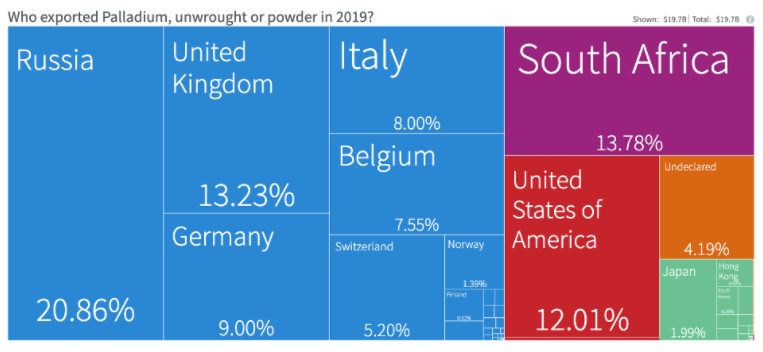

Russia is a major exporter of energy, grains, and metals. It's obvious to everyone that cutting Russia off from global markets creates massive opportunities in commodities.

For example, 20% of the world’s palladium supply will vanish.

Palladium futures have already surged 25% since last week.

Expect FinTwit to quickly pivot from blockchain experts to agriculture and metals specialists.

Investor capital will shift from tech stocks and cryptocurrencies into commodities. Although we’ve seen two days of strong BTC price surges over the past week, this may stem from short-term capital flight out of Russia and Ukraine—and I don’t expect it to last.

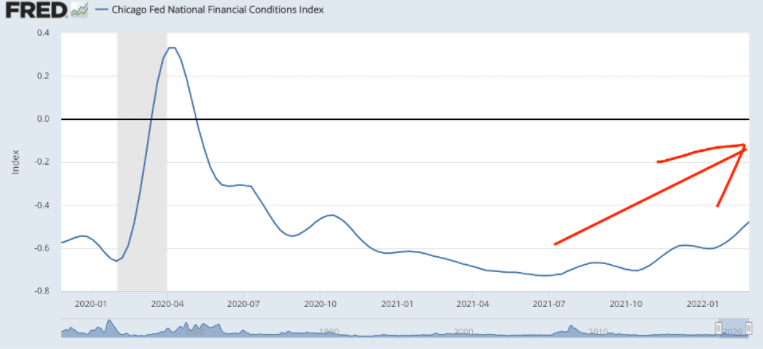

3. The Fed’s Response

The U.S. economy is still running hot, but rising commodity prices will add to inflation pain. If this triggers a global recession later this year through its impact on commodity-importing regions like Asia and Europe, it will eventually feed back into the U.S.

The Fed still has no reason not to hike rates, but if financial conditions keep tightening and recession risks grow, quantitative tightening (QT) may become increasingly difficult to sustain.

Rather than QT, we might see some form of price control directly targeting food and fuel costs. No QT this year would benefit cryptocurrencies and equities in the second half—but it’s too early to count on this.

4. Recession Ahead

If the war triggers a recession within 6–12 months, that could be bullish for cryptocurrencies and other exponential-growth assets—similar to the pandemic-induced recession—especially if it forces the Fed to reverse course and resume easing.

5. Free Marketing for Decentralization

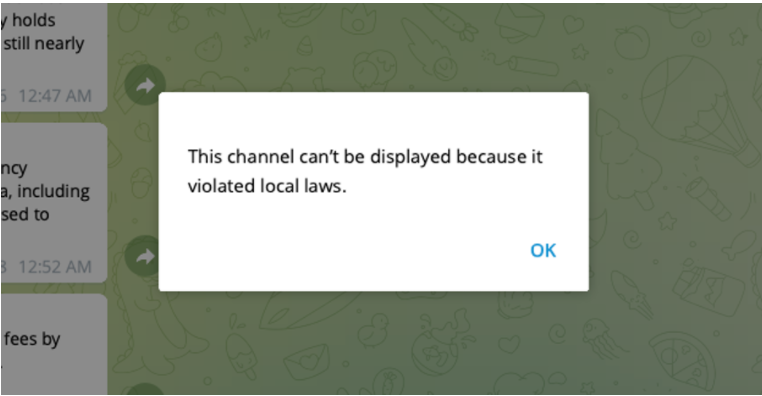

Media and financial sanctions against Russia have been swift and severe. I was surprised even Telegram banned a Russian news channel I followed.

Generally speaking, I don’t make value judgments about regulatory regimes or oppose them outright. Censorship is a complex issue, context-dependent. On this point, crypto-libertarian views often come across as naive.

But over the past week, centralized entities like Infura and Circle have revealed their sensitivity to regulatory pressure—undoubtedly strengthening public credibility for decentralized peer alternatives and highlighting the benefits of decentralization.

6. More Compliant and Mature Exchanges

Cryptocurrencies have long struggled to shed their reputation as financial tools for criminals and drug traffickers. Whether you think this perception is fair or not, the reality remains.

In the past, many exchanges actively avoided regulatory scrutiny. To gain mainstream acceptance, exchanges must grow up. They need to act like responsible financial industry participants and align with the sociopolitical agendas of their jurisdictions.

This war offers exchanges a crucial opportunity to prove that crypto is not an enemy of the state. Most major exchanges have made clear they comply with sanctions rules—an encouraging sign for the industry’s long-term development.

7. Seeds for the Next Bull Run

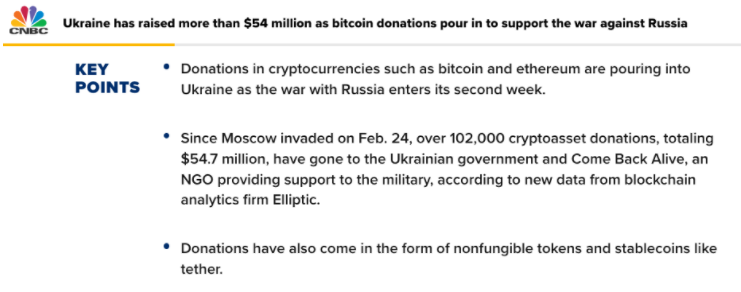

While less visible, Ukraine is using blockchain technology to fund its war effort. Compared to El Salvador adopting Bitcoin as legal tender, this is a far more favorable use case for cryptocurrencies.

El Salvador is a poorly managed predatory state; adopting an extremely volatile asset as official currency is at best a questionable policy move. Both actions only reinforce mainstream skepticism toward crypto.

In contrast, Ukraine is viewed by the West as a more legitimate regime, garnering widespread public sympathy. Its use of crypto for international fundraising helps demonstrate blockchain’s advantages over traditional money in fast settlement and resilient transaction processing.

Although the amount raised via crypto remains negligible compared to traditional financial channels, it puts blockchain on the map as a credible alternative to traditional banking rails. This impact on public awareness outweighs 100 Super Bowl ads—and it’s completely free.

Conclusion: The crypto market will remain volatile and may stay in a bear market for now. But in the long run, the Ukraine war will become a significant and purely positive catalyst for adoption and market growth.

Strategies to Respond

We may face more external shock events this year, shaking markets like what happened in the past 10 days. You need to closely monitor your portfolio and stay flexible. Here are some response options:

-

1) Hold long-term and stake

-

2) Trade around volatility with strict risk control

-

3) Temporarily allocate funds to commodity markets, then return to crypto after the sell-off.

Option 1) is least ideal in this environment but requires the least effort and carries the fewest mistakes. If you’re very familiar with the market, have excellent trading skills, and time to manage trades, go for 2) or 3) (or both). If you’re a pure speculator, use all three—and possibly more.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News