Ukraine's Crypto Battle in the Course of History

TechFlow Selected TechFlow Selected

Ukraine's Crypto Battle in the Course of History

The Ukraine conflict will to some extent rewrite or accelerate the course of crypto history.

By: TechFlow Intern

“The first crypto war in history”—this is how The Washington Post described the Russia-Ukraine conflict.

I have an unrefined hunch: the war in Ukraine may to some extent rewrite or accelerate the historical trajectory of crypto.

One thing most people overlooked: prior to the war with Russia, Ukraine announced the legalization of cryptocurrency.

On February 17, Ukraine’s government website announced that parliament had passed, by a large majority, amendments to the Virtual Assets Law proposed by the president. This bill recognizes the legality of virtual assets in Ukraine.

The timing seems somewhat significant.

Later on Twitter, I raised a hypothesis: Ukrainian government and military forces had been receiving donations in Bitcoin and other cryptocurrencies from around the world to support their armed resistance against Russia.

For example, an organization called Come Back Alive, founded in 2014 to provide Ukrainian troops with military equipment, training, and medical supplies, began accepting cryptocurrency donations in 2018 and received a surge of such donations just before tensions escalated.

Soon after, the Ukrainian government itself stepped in, publishing donation wallet addresses on Twitter, and received over $22 million in donations within two days.

Almost the entire crypto industry overwhelmingly supported Ukraine.

FTX CEO Sam Bankman-Fried announced on Twitter that his company would give $25 to every Ukrainian account holder on its exchange.

Ethereum co-founder Vitalik Buterin called on social media for support to Ukrainians through UkraineDAO.

Tron founder Justin Sun announced a $200,000 donation for Ukraine.

Binance donated $10 million and launched the first crowdfunding campaign for Ukraine Emergency Relief Fund. Founder CZ said, “This is where blockchain shines—global fundraising.”

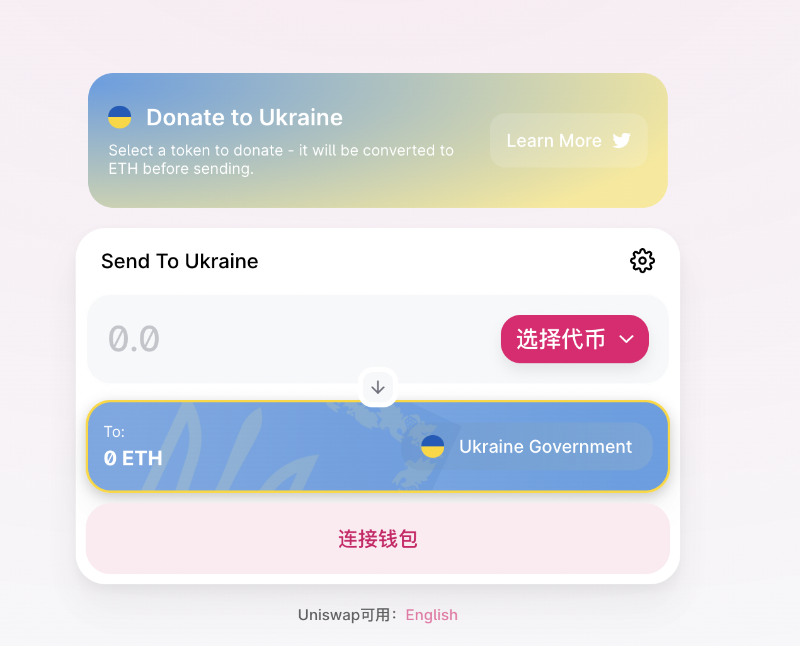

Uniswap even built a dedicated interface that allows users to convert any ERC-20 token into ETH and directly send it to the Ukrainian government in one transaction.

The overall ideology in the crypto industry leans pro-Western. As V God put it, Ethereum is neutral—but he himself is not.

Monetary Warfare

Crypto and war remind me of computers and the internet—both born out of war. The internet’s predecessor was ARPANET, developed by the U.S. Defense Advanced Research Projects Agency (DARPA), the world’s first operational packet-switching network and the ancestor of today’s global internet.

In 1974, Robert Kahn of ARPA and Vinton Cerf of Stanford University developed the TCP/IP protocol. On January 1, 1983, ARPANET switched its core protocol from Network Control Program to TCP/IP, which became the foundation of the modern internet.

The internet transmits information; blockchain transfers value. Information and value are the most critical intangible battlefields in modern warfare—and may be even more important than physical combat.

Before hot wars come cyberwarfare, security offensives and defenses, and information warfare.

Image: Director of 360 Cybersecurity Research Institute

War is a money-burning machine. For example, during the Iraq War in 2003, the U.S. spent between $28 billion and $30 billion in less than two months of offensive operations.

Thus, raising funds, maintaining domestic financial stability, and undermining foreign financial systems become invisible financial battlegrounds.

Crypto assets are emerging as a powerful new tool for war-related crowdfunding, concluded Elliptic, a crypto analytics firm.

When facing financial sanctions, permissionless crypto could also serve as a hedge to circumvent them.

Therefore, it's hard to say whether crypto benefits Ukraine or Russia—but Bitcoin has once again taken center stage.

SWIFT, Switzerland, and Bitcoin

Remember the Cyprus debt crisis in 2013? That was Bitcoin’s first breakout bull run, and many people first learned about Bitcoin because of that event.

That March, Cyprus—the so-called “tax haven”—faced a severe debt crisis, with three consecutive years of economic contraction and soaring unemployment.

To cope with the crisis, President Nicos Anastasiades announced on April 17 that, in exchange for €10 billion in emergency aid from the EU, the government would impose a deposit tax on bank accounts: 9.9% for deposits over €100,000 and 6.75% for those below.

People were furious and rushed to withdraw cash. At the same time, the Bitcoin network saw its first major influx since inception. Some Cypriots familiar with Bitcoin scrambled onto the network, converting part of their savings into BTC to hedge against policy risks. As a result, Bitcoin’s price surged from around $30 to $265 in just a few days—a nearly tenfold increase.

Born during the 2008 financial crisis, Bitcoin gradually entered the mainstream during the 2013 Cyprus crisis, the U.S. government shutdown, the 2015 Greek debt crisis, and the 2016 Brexit referendum.

This time, it’s a war crisis—Bitcoin has found its “perfect narrative.”

On February 26, the U.S., EU, UK, and Canada jointly announced they would ban Russia from using the SWIFT international payment system.

Exclusion from SWIFT is akin to being deplatformed on social media. Hence, SWIFT sanctions are often dubbed the “nuclear option” in finance—previously used only against countries like North Korea and Iran.

Even Switzerland—the traditional safe-haven for global billionaires—rarely abandoned its neutrality, choosing instead to follow EU sanctions and freeze Russian assets.

Meanwhile, Russia imposed capital controls, banning residents from transferring money to overseas bank accounts and restricting the export of large amounts of foreign currency.

...

Traditional financial transfer systems crippled, assets frozen by centralized institutions, capital controls imposed… this perfectly aligns with Bitcoin’s original narrative: a permissionless, decentralized value transfer network.

Technology is neutral, and so is Bitcoin. Yet Western governments worry about Russia using crypto to evade sanctions.

The U.S. Treasury issued new rules prohibiting Americans from providing any support—including transactions via digital currencies or assets—to Russian oligarchs and entities. It also requested Binance, FTX, and Coinbase to block sanctioned individuals and addresses.

Ukraine took a more aggressive stance, with its Ministry of Digital Transformation sending formal letters to eight exchanges—Coinbase, Binance, Huobi, KuCoin, Bybit, Gate.io, Whitebit, and Ukrainian platform Kuna—citing concerns that crypto might be used to bypass sanctions, demanding they cease services to Russian users.

Coinbase, Binance, and Kraken each voiced objections: “Exchanges cannot freeze Russian customers’ accounts without legal requirements.”

Bitcoin is decentralized, but exchanges are centralized—exchanges now face a clash between decentralization ideals and centralized authority.

Money Freedom

In 1791, freedoms of Speech, Religion, Press, Assembly, and Petition were enshrined in certain national constitutions.

But something seems missing? Money Freedom.

It wasn’t until 2008 that Money Freedom became technologically possible.

As Li Xiaolai put it, Bitcoin is the first time in human history that technology has made private property sacred and inviolable.

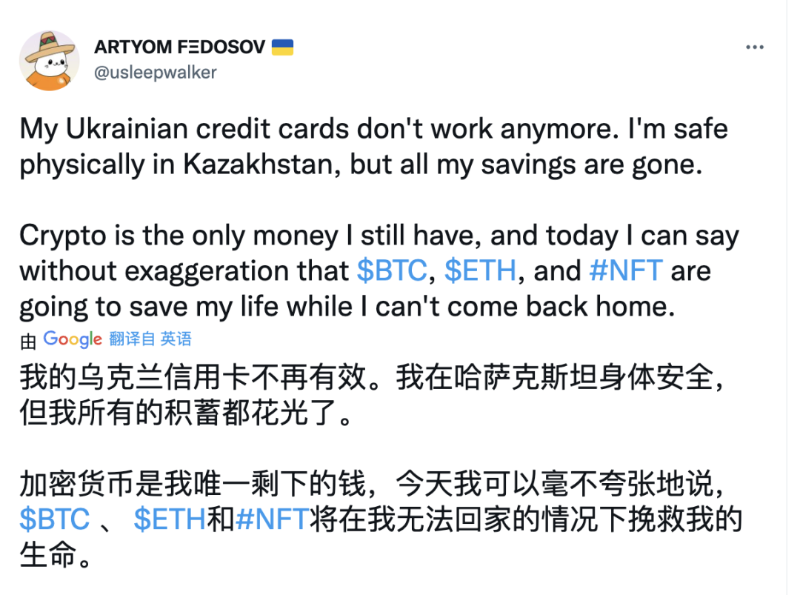

Especially in wartime, when sovereign states themselves are under threat, fiat currencies backed by sovereign credit become vulnerable. Supranational hard currencies become lifelines. Previously, only gold served this role; now there’s another option. Artyom Fedosov, a developer at Silicon Valley startup Portside, knows this all too well:

As a friend once said, holding Bitcoin isn’t about hoping it goes to the moon—it’s about having something that might one day save your life, and the lives of your entire family.

Finally, I hope the war ends soon.

In war, politicians provide ammunition,

the rich provide food,

and the poor provide their children…

After the war, politicians reclaim leftover ammunition,

the rich grow more crops,

but the poor can only search for their children’s graves.

MAKE LOVE, NOT WAR!

PEACE!

TechFlow is a community-driven deep content platform committed to delivering valuable information and thoughtful insights.

Community:

WeChat Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

To join our WeChat group, add assistant WeChat: TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News