BitMEX founder: Inflation becomes the new global norm, cautiously bullish on crypto market

TechFlow Selected TechFlow Selected

BitMEX founder: Inflation becomes the new global norm, cautiously bullish on crypto market

No one can escape the impact of war; all you can do is protect your assets.

Original title: annihilation

Author: Arthur Hayes, Co-founder of BitMEX

Translation: Moni, translator at Odaily Planet Daily

From a macro-humanistic perspective, war is always destructive and consumes vast amounts of energy.

Human civilization transforms solar and terrestrial potential energy into food, shelter, and entertainment, while war represents the act of consuming energy to destroy the fruits of human civilization. Although one side may "win" and achieve some resource-driven objective by defeating its enemy, humanity as a whole loses.

In this article, we will examine the crypto capital markets, but we must view humanity as a whole—money and assets exist for the benefit of everyone, not merely for a specific imagined structure. Every life and structure requires energy to sustain and build, meaning the more we waste, the greater the negative impact on humanity as a whole.

Today, perhaps our greatest waste lies in money itself, with inflation being its most apparent consequence. We must prepare ourselves to protect the value of our financial assets.

Looking Behind the Truth

Currently, monetary policies across countries are among the most accommodative in history, occurring alongside alarming geopolitical conflicts. I know that central banks everywhere claim to be tackling inflation and promise to resolve it properly, yet nearly all continue printing money. By comparing policy interest rates with official inflation indicators, we see that so-called "official" inflation figures fail to fully reflect the price pressures ordinary citizens face. I believe these statistics have been manipulated and beautified—the reality is that consumer price inflation has severely worsened, even according to their own flawed data.

Federal Funds Rate – U.S. CPI = U.S. Real Interest Rate (currently -7%)

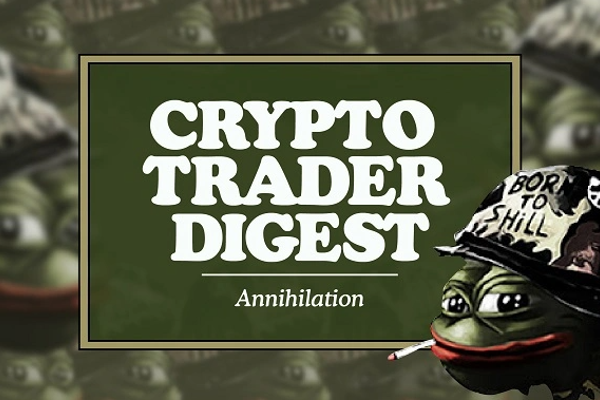

Eurozone Deposit Rate – Eurozone CPI = Eurozone Real Interest Rate (currently -5%)

UK Bank Rate – UK CPI = UK Real Interest Rate (currently -5%)

The three charts above show [policy rate minus officially reported consumer price inflation]. As you can see, real interest rates have plunged deeply negative since the outbreak of the pandemic. Imagine having $1—or €1 or £1—in your wallet today, only to find its value eroded by 5% to 7% next year. If workers' wages rose accordingly, this wouldn't be an issue. But for most salaried employees or hourly workers, their pay does not increase in line with the depreciation of physical or digital currency in their wallets.

As you’ve likely felt firsthand, people are increasingly frustrated that their wages cannot keep up with rising prices for food, energy, and transportation. Politicians respond by tasking their “independent” central banks with controlling inflation. There's no debate about whether central banks should raise policy rates—it's how much and how fast they do so that remains contentious.

If the Fed hikes six times this year, the entire financial world would surely react as if facing apocalypse. In fact, the federal funds futures market has already priced in such hikes, assuming 0.25 percentage point increases per meeting, pushing the so-called "policy rate" up to 1.5%. We know U.S. CPI inflation has surged beyond 7%. Even if inflation halves to 3.5% by end-2022, the dollar’s real interest rate would still sit at -2%.

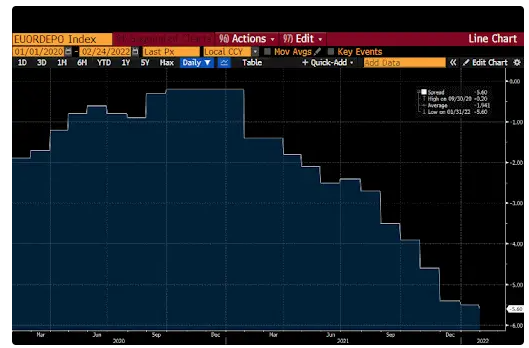

The chart above shows the term structure of Eurodollar futures contracts. To calculate the yield on U.S. dollar deposits held outside the U.S., subtract the futures price from 100. For example, if the Eurodollar futures price is 98.00, the yield is 2%.

I could say much about the importance of the Eurodollar market, but boil it down to this: it is the world’s most critical interest rate market, deeply influenced by Fed policy.

Looking at the curve, Eurodollar futures peak near 2.5% in September next year, reflecting market expectations of higher short-term rates. These futures reflect three-month dollar deposit rates. At 2.5%, however, rates remain utterly insufficient to combat current inflation levels—not accounting for medium or large-scale wars over the next year that will significantly affect global energy usage.

Despite political calls in the U.S. to “fix inflation,” execution falls short. Why? Because the policy rate level capable of triggering financial crisis keeps getting lower with each economic downturn.

The chart above shows the lower bound of the federal funds rate since 1990. Each major global financial crisis has stemmed from leverage and debt accumulation in certain corners of financial markets. When the Fed raises rates, bubbles burst because speculative financing becomes too costly.

After the first Gulf War with Iraq ended, the Fed exited its low-rate era, hiking rates to around 5–6% by late 1994. This triggered the Mexican peso crisis, eventually resolved when the U.S. Treasury intervened and the Fed slightly cut rates. A few years later, when rates neared 6% again, the Asian financial crisis erupted. With rising U.S. dollar funding costs, the “Asian Tigers” sought emergency aid from the IMF and World Bank.

We all know what happened in the tech sector in 2000. The chart clearly shows the Fed modestly cutting rates after Asia’s crisis, then hiking again. Rising capital costs ended the dreams of technological utopia, followed by an unexpected stock market crash.

Then came the 9/11 attacks in 2001. The Fed began cutting rates and fueled a housing bubble. After rates rose by roughly 5%, the U.S. real estate market bubbled by 2006. By 2008, the subprime mortgage crisis shook the entire global financial system, unleashing a worldwide financial tsunami! After seven years of zero interest rates, the Fed raised rates slightly above 2% by late 2018/early 2019. Following the hikes, recession spread widely by late 2019, compounded by the global coronavirus pandemic, leading to the worst contraction in economic activity in history.

6%, then 5%, then 2%—nearly every decade, nominal interest rates fall within financial markets. Given explosive growth in systemic debt and leverage post-pandemic due to low or negative rates and yield-seeking behavior, I believe even a 2% nominal dollar rate globally would be unaffordable. Looking at the chart above, even at a 2% policy rate, real rates remain negative. Unless workers receive substantially larger raises, they’ll continue suffering under inflation month after month. So now let’s discuss—

The Inflation Narrative

Each asset class carries an evolving narrative, but a key metric in assessing asset value is whether it serves as an effective hedge against inflation. Many instinctively believe Bitcoin and other cryptocurrencies, as scarce assets, should be strong inflation hedges. For many years, this may have held true, but recently Bitcoin appears more “risky” than “safe,” failing to appreciate as expected during market downturns.

Frankly, Bitcoin’s sharp rise was largely driven by massive money printing by central banks during the pandemic. That means Bitcoin needs time to absorb this sudden surge. Once liquidity tightens, its performance may disappoint.

But let’s set aside negative rates for a moment and look historically at how macroeconomic conditions affected Bitcoin. In March 2020, Bitcoin traded around $4,500. By November 2021, it had soared to nearly $70,000. Then central banks shifted course—starting to take proper steps to curb inflation—and markets reacted swiftly, stalling the crypto bull run.

The chart above compares Bitcoin (yellow line) and U.S. 2-year Treasury yields (white line) since September 2021. In my view, the primary reason the Bitcoin bull market stalled is tightening global liquidity. As markets anticipated rate hikes by major central banks like the Fed, fiat credit was repriced, sending 2-year Treasury yields up eightfold—while Bitcoin entered sideways consolidation and began drifting lower.

At this point, gold finally started recovering from its lows. With U.S. dollar rates persistently negative, gold climbed toward $2,000. Moreover, despite rising nominal short-term rates, gold kept rising because real rates remained negative. Ultimately, in a context of fiat currency depreciation, gold’s store-of-value properties reasserted themselves and regained investor attention. I expect Bitcoin will eventually undergo a similar narrative shift, with investors rediscovering its value. But for now, patience is paramount—restrain your itchy fingers from clicking buy buttons until the right moment arrives to re-enter or rebalance financial assets.

What might happen if the current situation in Eastern Europe escalates into a medium or large-scale global conflict? Let’s first analyze the prevailing market environment:

1. Due to environmental concerns, many nations have reduced investments in hydrocarbon production and exploration, forcing societies to replace cheap hydrocarbons with relatively expensive wind and solar energy (measured by energy output versus required investment). As a result, everything costs more because human survival within current social structures demands energy. Some argue hydrocarbon prices don’t fully reflect their negative environmental externalities—but when a family must pay over 50% more to heat their home during harsh winters, problems become undeniable.

2. Over the past 50 years, governments have printed more money than ever before in human history. Meanwhile, aging populations across all major economies mean declining capacity to repay debts. To keep the game going, central banks must keep printing new money to pay off old debts. The U.S. government, for instance, won’t voluntarily default on its currency—even widespread inflation is preferable.

3. Post-pandemic, inflation rates have risen globally, and labor has become scarcer. In this “post-pandemic era,” global costs keep climbing because fewer workers remain on production lines, demanding higher wages and benefits. Robots aren’t ready yet, so businesses still need humans.

4. As the central bank of the world’s most advanced economy, the Fed needs to sharply raise rates to achieve positive real interest rates. Yet nominal dollar rates are at historic lows—raising them risks collapse in parts of the financial and real economy.

Back to money: When politicians waving flags demand the Fed control inflation, what will central bankers actually do? I see three possibilities:

Scenario 1: Containing Inflation

To properly contain inflation, central banks must bring real interest rates to at least 0%, requiring policy rates above 6%—seemingly unlikely given current financial market fragility, yet this is the minimum necessary rate to suppress inflation and correct imbalances accumulated over the past 50 years.

Note that much of the recent surge in energy prices (oil) isn’t primarily monetary—central banks may be powerless here. They may hike, hike, and hike again, yet energy prices won’t fall. Only when a global economic collapse slashes per capita energy demand—due to drastically reduced consumption—might energy prices suddenly plummet.

If dollar rates rise to 5% or 6%, some global economic damage would occur, but compared to the 2008 global financial crisis, the impact would be minor. Economic turmoil would eliminate weaker firms, ultimately steering humanity toward more sustainable growth. However, such rebalancing disrupts social stability. If real rates stabilize then spike high enough to crush the world economy and reduce energy use, volatility hedging (like investing in crypto) may be your only salvation.

But I think this scenario is unlikely.

Scenario 2: Misleading the Market

For much of 2022, we may easily be misled by markets.

On many financial media outlets, you’ll see central bank governors appear and tell politicians they’re serious about fighting inflation. Bankers raise policy rates into the 1–2% range—because futures markets tell them to—and stop there. But even then, real dollar rates remain negative—a crucial factor during war or near-war periods, because governments need to spend heavily on warfare or preparation.

By keeping real rates negative and ensuring nominal government bond yields stay below nominal GDP growth, the U.S. government can finance itself affordably and reduce its debt-to-GDP ratio. Negative real rates amount to a stealth wealth transfer from savers to the state. While such nominal policy rates may trigger recession, they won’t drastically alter social structures—the U.S. government can still afford war spending.

The problem here is the Fed cannot control energy costs, which may keep rising. And since monetary policy remains loose toward government spending, the U.S. government continues crowding out private-sector energy use, pushing energy costs higher. Eventually, lacking genuine anti-inflation credibility could spark social unrest.

Dollar interest rates are closely tied to our portfolios—but first, patience is essential.

If the Fed and other central banks hike rates, asset prices will be suppressed. In such a "bloodbath," Bitcoin and cryptocurrencies will be the first to flee—and rebound—because crypto markets are the only truly free-trading venues, accessible to anyone with internet access. Compared to traditional financial markets, crypto will fall first, then rise first. Remember, our analysis assumes real rates will remain negative. Once sustained negative real rates erode fiat purchasing power, scarce assets will undoubtedly benefit.

The U.S. government doesn’t want to restructure society by raising rates to genuinely suppress consumer demand and government spending—after all, once elections pass, political pressure to fight inflation fades.

Again, for crypto traders: patience is key.

If you already hold base crypto assets (my base is Bitcoin and Ethereum), don’t sell recklessly or go short. Instead, open a bottle of wine, read a book (not TikTok), and calm down. If you're a dedicated trader actively buying and selling crypto daily, remember: market dips may be temporary relative to the inflation-hedge narrative—so don’t get greedy. Get in, get out, focus on the long term.

(Note: This article was drafted last weekend, when the Russia-Ukraine conflict seemed brief and Western reactions appeared calm. Yet the war persists, and the West seems prepared to endure economic pain to decouple from Russia. But note: Russia is a major supplier of food and energy. Losing these supplies globally would cause severe inflation. Moreover, we cannot truly predict the consequences of a full Western-Russia decoupling. You never know where hidden problems lie on financial institution balance sheets until volatility strikes. Thus, a reasonable assumption is that Western-Russia decoupling could push major financial institutions into distress, potentially escalating into a global financial crisis.)

However, the West’s political response to Russia gives central banks an excuse to abandon their anti-inflation commitments. I’m not sure they’ll actually do it, so I remain cautiously bullish on Bitcoin. I’m exploring long call options on Bitcoin and Ethereum.

Federal funds futures suggest the market expects a 0.25% Fed hike in March. But watch closely what major investment banks and the Fed mouthpiece *Wall Street Journal* say—the Fed’s stance may shift. Depending on market and geopolitical developments, they might conclude continuing zero rates is acceptable.

Make no mistake: oil prices will keep rising. I’m not ready to deploy more into crypto. Given shifting market dynamics, extreme caution is needed when buying any asset. If the Fed deviates from expectations and hikes 0.25% to 0.50% in mid-March, financial leverage could trigger another crypto downturn.

Scenario 3: Accelerating the Dollar Printing Press

An intense global conflict would change the rules entirely—perhaps accelerating the dollar printing press.

Price controls, rationing, and inflation would become the new normal across nations, as all available resources must be directed to military needs. Gold, Bitcoin, and other cryptos would be increasingly hoarded—this is where Gresham’s Law begins to operate.

(Planet Note: Gresham’s Law is an economic principle also known as the "bad money drives out good" law. It states that under a bimetallic monetary system, when two forms of currency circulate simultaneously and one depreciates, the "good money"—whose intrinsic value exceeds its face value—gets hoarded and gradually disappears from circulation, while the "bad money"—whose intrinsic value is lower than face value—floods the market.)

Under such conditions, accessing gold and crypto markets will become harder, as capital controls emerge preventing ordinary citizens from protecting their assets—leaving them vulnerable to inflationary "looting."

Most financial assets denominated in fiat currencies will lose increasing value—perhaps becoming worthless, like toilet paper. Yes, nominally your stock portfolio might rise, but prices of milk, butter, eggs, sugar, etc., will rise faster than your free index-tracking ETFs.

I truly hope this doesn’t happen. Unfortunately, human history is a history of conflict.

If you believe dire scenarios are likely, position yourself early—prepare ahead of time.

That means allocating some idle financial assets into globally recognized stores of value—such as real estate, stocks, gold, Bitcoin, and select cryptocurrencies.

Perhaps someday the global conflict ends, and hopefully your assets won’t have depreciated. No one escapes the effects of war—you can only protect your wealth. If you doubt it, rewatch *Downton Abbey*.

Conclusion

Today, everyone carries a smartphone—an instant mass communication tool for sharing knowledge. While we may remain idealists hoping information diffusion changes humanity’s inclination toward war, we must prepare to protect our wealth from inflation’s ravages.

Of course, this doesn’t mean ignoring short-term price movements, but overall, adopt a longer-term view and time your entries and exits wisely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News