A Brief Analysis of EigenLayer's Restaking and Trust Marketplace, and Its Impact on the Ethereum Ecosystem

TechFlow Selected TechFlow Selected

A Brief Analysis of EigenLayer's Restaking and Trust Marketplace, and Its Impact on the Ethereum Ecosystem

What EigenLayer is building benefits not only the entire Ethereum ecosystem but also ecosystems beyond Ethereum.

Original authors: DX, Henry Ang, Mustafa Yilham, Allen Zhao, Jermaine Wong & Jinhao, BiXin Ventures

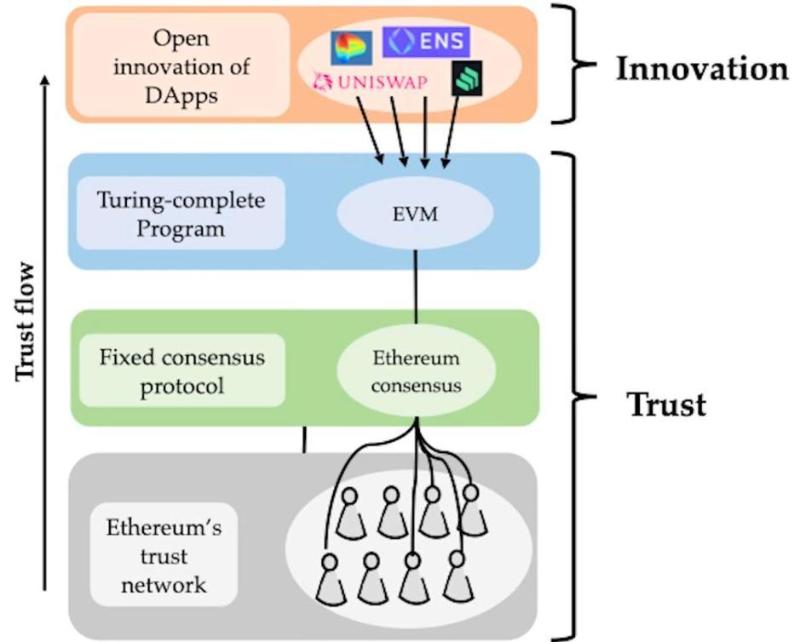

Blockchain is known as the "machine of trust," enabling users to build networks without requiring permission from centralized authorities.

Bitcoin was where it all began. Using the Proof-of-Work (PoW) consensus mechanism, miners reached agreement on value distribution, thereby creating a trust layer upon which all value transfers occur. However, one issue with Bitcoin is that it resembles a single-application blockchain focused solely on transfers. Other applications like Namecoin must create their own trust layers to operate, presenting significant barriers to innovation.

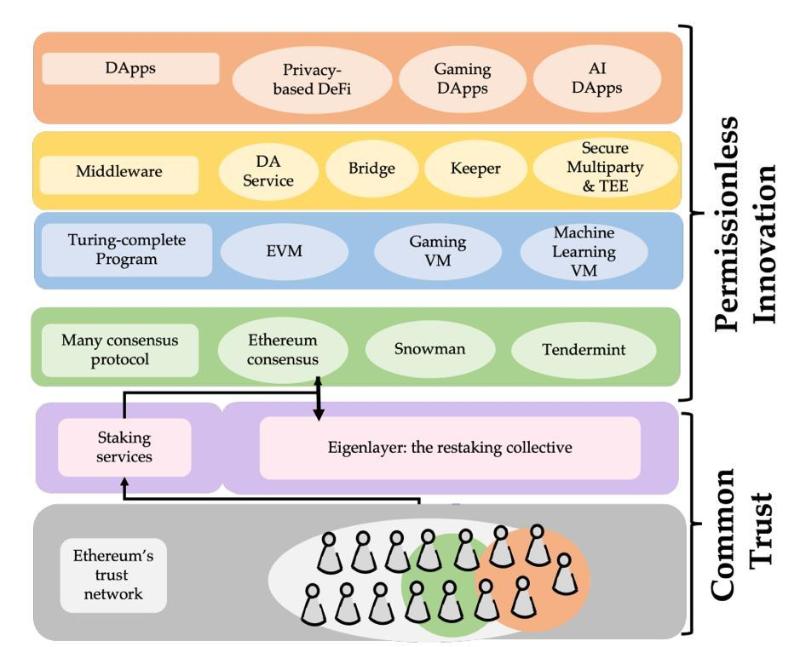

Ethereum’s breakthrough lies in adding a general-purpose, Turing-complete execution layer (i.e., the EVM) atop Bitcoin’s innovations. By decoupling the application layer from the trust layer, developers can deploy smart contracts directly on Ethereum and inherit its security guarantees without building a separate trust layer from scratch.

After The Merge, Ethereum transitioned from PoW to Proof-of-Stake (PoS) consensus. Unlike PoW, where miners compete using hardware and computational power, PoS requires validators to stake funds to vote on consensus. Honest participants receive network rewards, while rule violations result in penalties. This approach offers two key advantages:

First, the penalty mechanism increases the Cost of Corruption even when the Profit from Corruption remains unchanged, enhancing the economic security of the trust layer.

Second, it enables more granular governance over validator behavior, expanding protocol-level control and introducing multidimensional incentives. For example, Ethereum can dynamically adjust slashing penalties based on total amounts slashed during a period, increasing punishments for colluding malicious nodes. Additionally, under the inactivity leak mechanism—triggered when too many validators go offline, preventing finality across four epochs—Ethereum can slash inactive validators’ stakes to restore finality and maintain network liveness.

Thanks to this mechanism, Ethereum achieves a more balanced management of rights and responsibilities among trust-layer validators.

Limitations of Ethereum’s Trust Layer

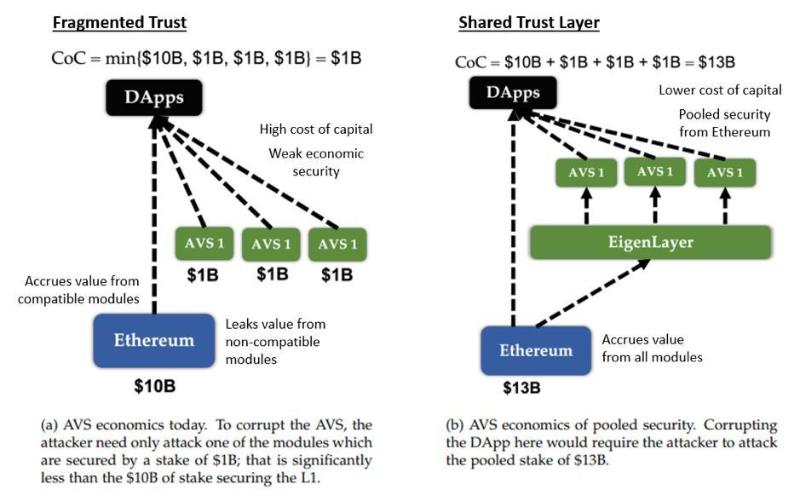

Ethereum manages its trust layer through an on-protocol slashing mechanism at the consensus level. When non-Ethereum applications wish to leverage Ethereum’s trust layer, they cannot slash validator funds for actions that violate application-specific rules but comply with Ethereum’s consensus rules. In other words, these external applications cannot directly utilize Ethereum’s trust layer as a foundation.

Protocols such as oracles or cross-chain bridges must therefore establish their own trust layers or actively validated services (AVS), raising the barrier to application-layer innovation and increasing economic burdens. Moreover, fragmented AVS implementations lead to liquidity fragmentation, weakening each individual AVS’s economic security.

EigenLayer’s Solution

Restaking

To overcome Ethereum’s trust layer limitations, EigenLayer uses restaking to extend Ethereum’s slashing mechanisms. By leveraging smart contracts to control validator withdrawal credentials, EigenLayer introduces a new, contract-level slashing mechanism.

When an Ethereum validator participates in validation via EigenLayer, its withdrawal address is set to an EigenLayer smart contract. If the validator violates application-layer rules, EigenLayer can slash its ETH through a dedicated slashing contract. This mechanism allows application layers to define validator rights and obligations via smart contracts, making it possible for other applications or middleware to securely reuse Ethereum’s trust layer.

An Open Trust Marketplace

Building on restaking, EigenLayer aims to create an open trust marketplace to monetize trust.

First, Ethereum validators act as suppliers, interacting with demand-side application protocols through free-market dynamics to determine transaction terms.

Second, validators choose whether to participate in validating specific applications based on their preferred risk-return profiles and slashing conditions, earning additional income. Application protocols can thus easily purchase “trust” at market prices, allowing them to focus on innovation and operations while achieving optimal trade-offs between security and performance.

Externalities of EigenLayer

Due to its innovative design combining restaking and a trust marketplace, EigenLayer exerts both positive and negative externalities on the broader Ethereum ecosystem.

Positive Externalities

1) Accelerating Application-Layer Innovation

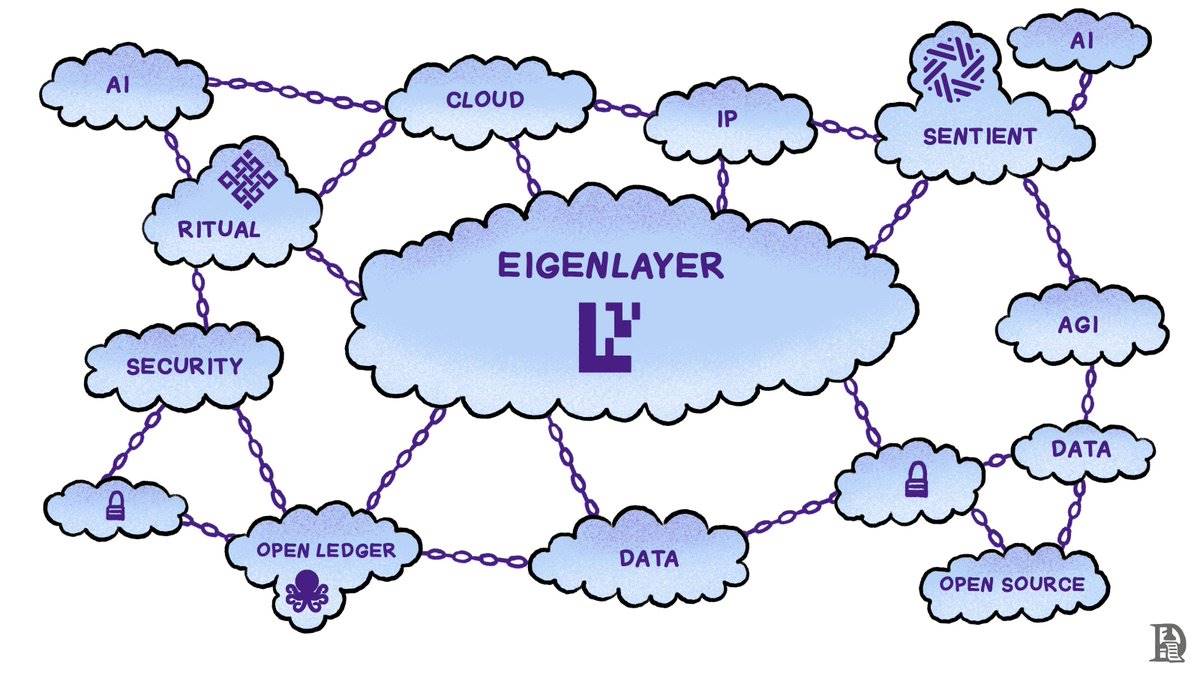

By establishing a trust marketplace, EigenLayer further modularizes Ethereum’s trust layer, separating it cleanly from the execution layer. Non-Ethereum applications can now conveniently access a modularized trust layer, significantly lowering capital requirements for achieving strong security. This greatly benefits economically secure applications and middleware such as oracles, data availability layers, decentralized sequencers, cross-chain bridges, and sidechains, enabling them to focus on protocol innovation and user experience. Similar to Web3 social protocols, when social data is abstracted into a dedicated data layer accessible by all protocols in a permissionless manner, application innovation and user experience improve rapidly.

2) Enabling Protocol-Layer Innovation

Since EigenLayer implements a slashing mechanism at the smart contract level equivalent in effect to consensus-layer mechanisms, it can introduce new optional rules for validators to follow—effectively creating quasi-consensus mechanisms without modifying existing consensus protocols.

For instance, to address single-slot finality: currently, Ethereum’s Gasper protocol only finalizes checkpoint blocks (the first block of each epoch), not every slot within an epoch. With EigenLayer, validators can commit to extending chains containing specific slot blocks, granting finality to each slot. Validators breaking this commitment face slashing.

Another example involves mitigating partial-block MEV-Boost centralization risks. Currently, block builders submit complete blocks via MEV-Boost, and proposers only see full block contents after signing the header—preventing proposer theft. EigenLayer enables builders to submit partial blocks, with proposers completing the remainder. If a proposer fails to include the builder’s transactions as agreed, their stake is slashed by EigenLayer. This allows more proposers to participate in block construction and share MEV revenue, reducing builder centralization. Furthermore, since highly centralized builders no longer control entire blocks, randomly selected proposers contribute to construction, improving censorship resistance on Ethereum.

3) Strengthening Ethereum’s Economic Security

EigenLayer allows validators to earn additional yield by taking on extra risk, increasing overall staking returns. This incentivizes more ETH to be staked, reinforcing Ethereum’s economic security and the level of security available to application protocols—a virtuous cycle.

4) Enhancing Decentralization of Ethereum’s Trust Layer

On one hand, higher yields from EigenLayer incentivize more individuals to run their own nodes. On the other hand, application protocols may require only individual operators as validators, enhancing both application-level and overall Ethereum trust-layer decentralization.

Negative Externalities

1) Harm from Abnormal Slashing to Ethereum’s Trust Layer

Beyond legitimate slashing due to rule violations, abnormal slashing may occur due to software bugs or malicious protocols, potentially penalizing honest validators. Widespread unjustified slashing could severely undermine the economic security of Ethereum’s trust layer.

To mitigate this risk, EigenLayer employs two countermeasures: rigorous audits to minimize vulnerabilities, and a veto mechanism allowing a governance council to use multi-sig to override slashing decisions, providing a safety net in extreme cases.

2) Trust Leverage from Restaking

In the open trust marketplace, trust-layer validators can restake their deposits across multiple protocols to earn additional yields. When validator capital provides validation services for high-value applications or middleware, excessive leverage may arise—potentially leading to situations where corruption profits exceed corruption costs, thereby weakening the trust layer’s economic security. Therefore, determining appropriate limits on restaking and balancing yield against security will require ongoing real-world experimentation.

Conclusion

In the future, blockchains will enhance performance through greater modularity and selective outsourcing of functions. What EigenLayer is building benefits not only the Ethereum ecosystem but also ecosystems beyond Ethereum.

Beyond the points discussed, EigenLayer aims to fundamentally transform current blockspace models by tapping into an underutilized pool of validator resources, serving as a new testing ground to break the trade-off between Ethereum’s decentralization and flexibility—unlocking possibilities for novel business models.

At the same time, EigenLayer is actively developing new products such as EigenDA—an ultra-scalable data availability layer for Ethereum designed to offer cheaper, more consistent fees and higher data bandwidth. EigenLayer also plans to collaborate with teams like Mantle Network to expand the technology’s applicability. We look forward to seeing how EigenLayer will shape the future evolution of Layer 2 solutions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News