Can Karak, the new player in restaking, challenge EigenLayer's dominant position?

TechFlow Selected TechFlow Selected

Can Karak, the new player in restaking, challenge EigenLayer's dominant position?

Is Karak's data growth, as an emerging restaking project, the result of false prosperity or long-term ecosystem development?

Author: shaofaye123, Foresight News

Karak, an emerging player in the restaking sector, has been controversial since its launch. Despite boasting elite funding backing, the project team has faced public relations crises; it carries a $1 billion valuation yet shows lackluster total value locked (TVL); and although labeled with multiple trending concepts—modular architecture, AI, and restaking—its actual product innovation appears underwhelming.

Is Karak a rising star in restaking or just another bubble destined for obscurity? Can it compete with EigenLayer? This article dives deep into Karak Network.

Introduction to Karak

What is Karak?

Karak Network is a restaking network similar to EigenLayer and other restaking projects. It adopts a points-based model to incentivize users to restake assets and earn multiple rewards. Karak enables users to reuse their staked assets, supporting a wider range of assets including ETH, LSTs, LRTs, PTs, and more. Beyond Ethereum’s mainnet, it also supports multiple chains such as Arbitrum, Mantle, BSC, and K2. Stakers can allocate their assets to Distributed Security Services (DSS) on the Karak Network and agree to grant additional execution rights over their staked assets.

How Does Karak Work?

Karak's operational mechanism doesn't differ significantly from EigenLayer, acting as a bridge between developers and validators. At the execution layer, however, Karak differs by developing its own Layer 2 (K2) for sandbox testing, allowing DSS developers to build and test before launching on Layer 1.

Karak is currently at Version 2. In V1, technologically, it provided a Turnkey-like SDK plus the K2 sandbox to simplify development processes. On July 23, Karak Network launched Phase One of its V2 Keystone testnet, introducing a contract-based slashing mechanism and enabling developers to deploy Distributed Security Services (DSS) and custom restaking mechanisms. Operators can also configure validators and native staking modules within this testnet.

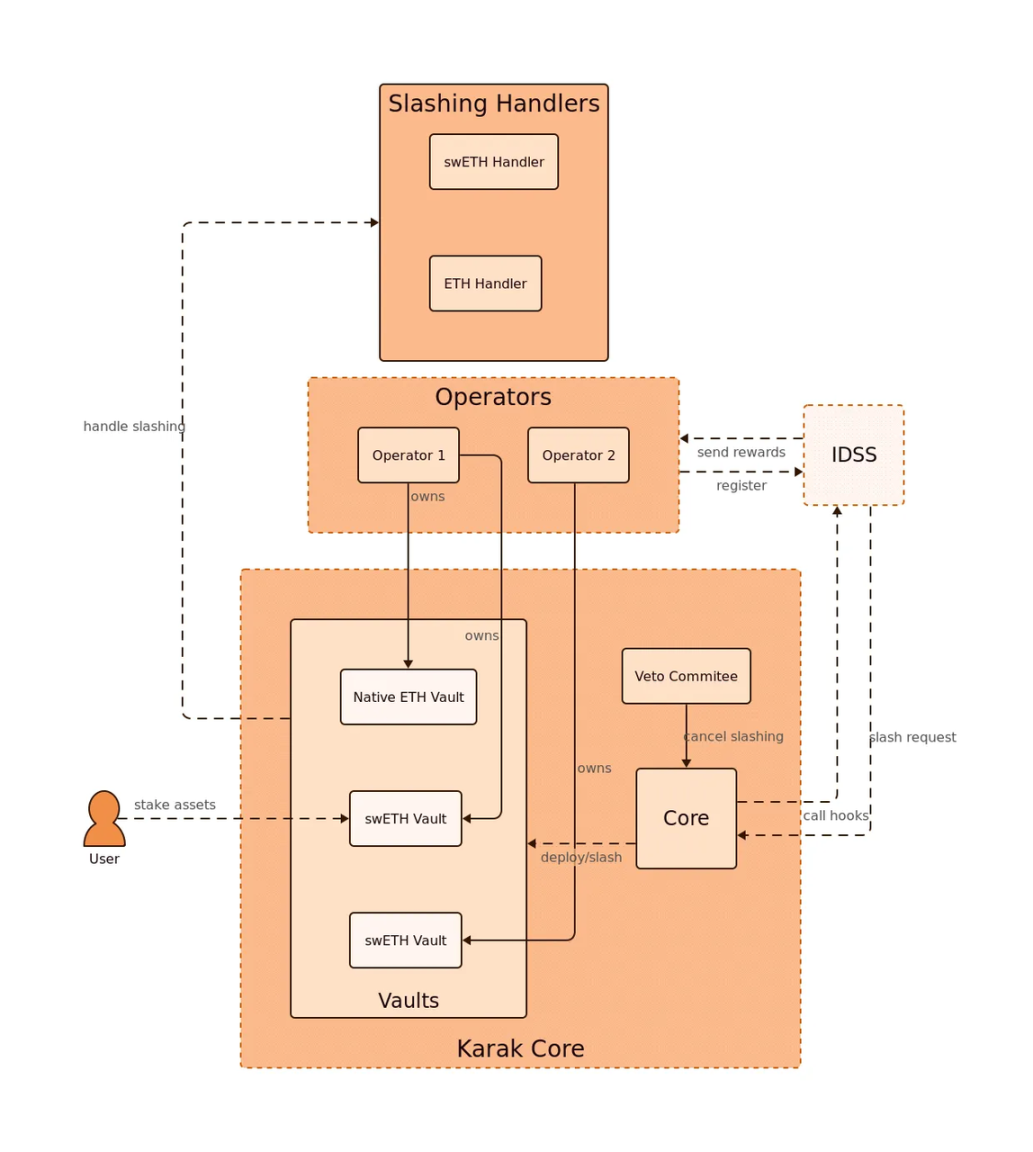

The design of Karak Keystone utilizes four deployed contracts: Core, Vault, SlashingHandler, and DSS. The Vault contract manages deposits and withdrawals and complies with slashing requests. The SlashingHandler contract defines how specific assets should be slashed—whether they are to be burned, sent to a zero address, or undergo custom operations. The DSS contract, written by external teams, contains tasks for operators to execute and slashing conditions to penalize those who fail. The Core contract governs the other contracts, adjudicates slashing requests, and adds new assets and vaults. With the Keystone testnet, developers can begin building and deploying Distributed Security Services (DSS) and customized liquid restaking strategy vaults. Operators can participate by registering as operators in the testnet contracts, running sample DSS instances, and configuring their testnet validators to use the native restaking module.

Can Karak Compete with EigenLayer?

Whether considering asset diversification risk or multi-chain staking demand, the restaking space won’t have just one winner. Other prominent projects like Puffer, Swell, and Kelp already exist in this space—so why is Karak drawing so much attention?

Elite Funding Backing and Team PR Controversy

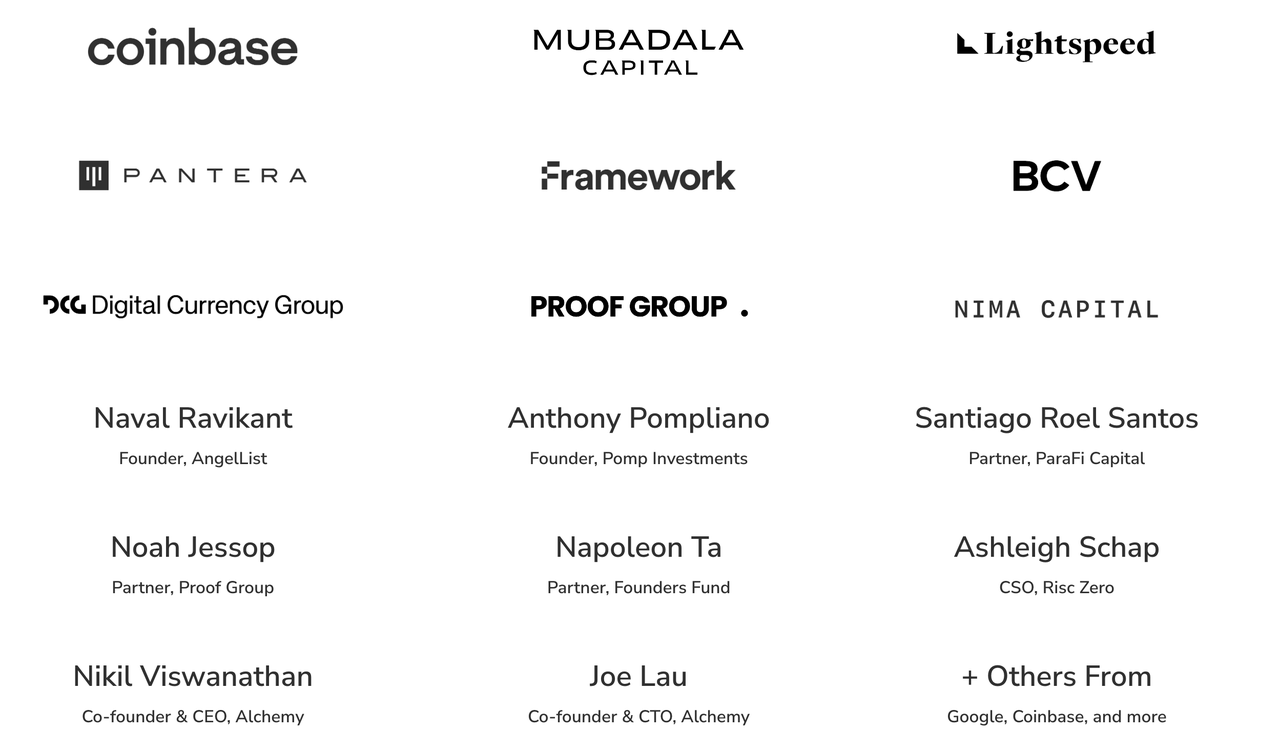

Since December 2023, when Karak announced a $48 million Series A round, its prestigious investor lineup has attracted significant market attention. Led by Lightspeed Venture Partners and joined by Mubadala Capital (Abu Dhabi’s second-largest fund), Coinbase, and others, Karak achieved a valuation exceeding $1 billion. This strong investment consortium not only brought visibility but also substantial capital support for competition in the restaking arena.

However, after launching in February, Karak’s TVL performance was disappointing until growth began in April. The project team has also faced scrutiny on two fronts:

-

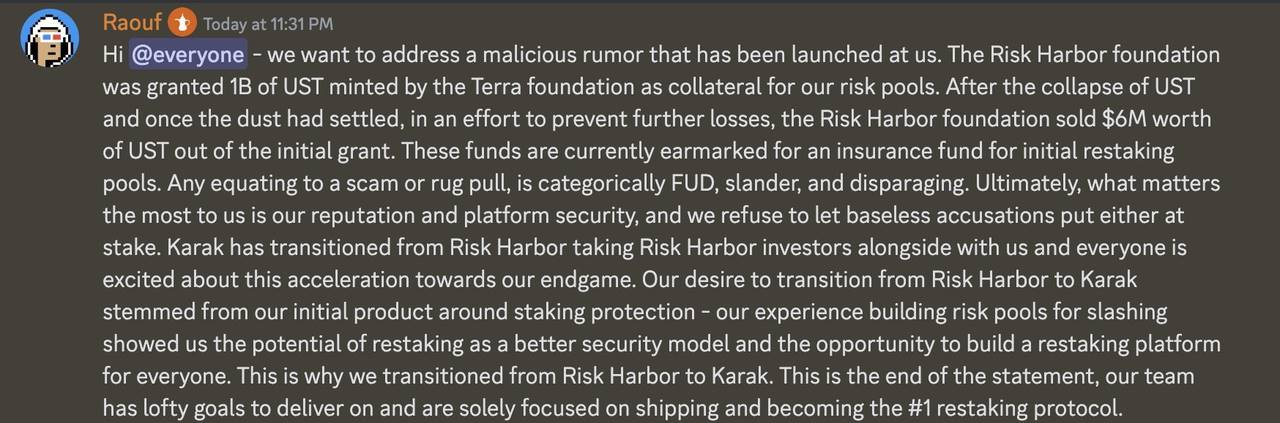

First, controversy surrounds the team members’ backgrounds. They are believed to originate from Risk Harbor in the Terra ecosystem, which during the LUNA crash sold off approximately $6 million worth of UST from its insurance pool without community voting. Market FUD claims this was a rug pull, while supporters argue it was a necessary move to salvage funds amid crisis rather than let them go to zero.

-

Second, concerns about opaque technical progress. After securing funding at the end of 2023, the team “rushed” to release the product in February. As a restaking project, discussions around its technology remain limited, with marketing tactics like “points campaigns” dominating instead. Meanwhile, details regarding concrete progress, technical development, and ecosystem building remain insufficiently disclosed, undermining community confidence in transparency and long-term viability.

Technological Innovation or Hype-Chasing?

Karak’s website references nearly every hot narrative today—modular architecture, Layer 2, AI, etc. Karak claims to be “the first modular Ethereum L2,” offering secure scalability needed for various applications, committed to building open infrastructure prioritizing censorship resistance, privacy, and verifiability. It further states that AI models can be seamlessly integrated into various apps via Karak, enabling any developer to leverage cryptography for model inference.

Yet the market isn’t short of innovative L2s, plug-and-play modularity, or high-yield restaking. These so-called innovations remain largely homogenized—more about chasing trends than delivering breakthroughs. While Karak’s technical path resembles EigenLayer’s, notable differences give it a competitive edge.

Multi-Asset Restaking: Karak introduces multi-asset restaking, allowing users to restake various assets—including Ethereum, liquid staking tokens, stablecoins—and earn rewards, greatly enhancing asset diversity.

Optimized Restaking Process: Similar to EigenLayer, Karak has its own version of AVS called Distributed Secure Services (DSS). It internalizes a “restake anywhere” philosophy, making restaked security infrastructure accessible to anyone on any chain.

That said, technological innovation remains relatively modest. While DSS can attract capital across more chains, this advantage stems more from market strategy and competitive positioning than technical superiority. Compared to Ethereum, other assets carry lower opportunity costs, giving DSS potentially more sustainable yields.

Short-Term Illusion or Long-Term Ecosystem?

Karak’s market strategy has yielded impressive short-term gains. Since the launch of Karak V1 Private Access in April, key metrics have surged across the board:

-

Restaked TVL exceeded $1 billion within six weeks;

-

Over 155,000 unique users joined;

-

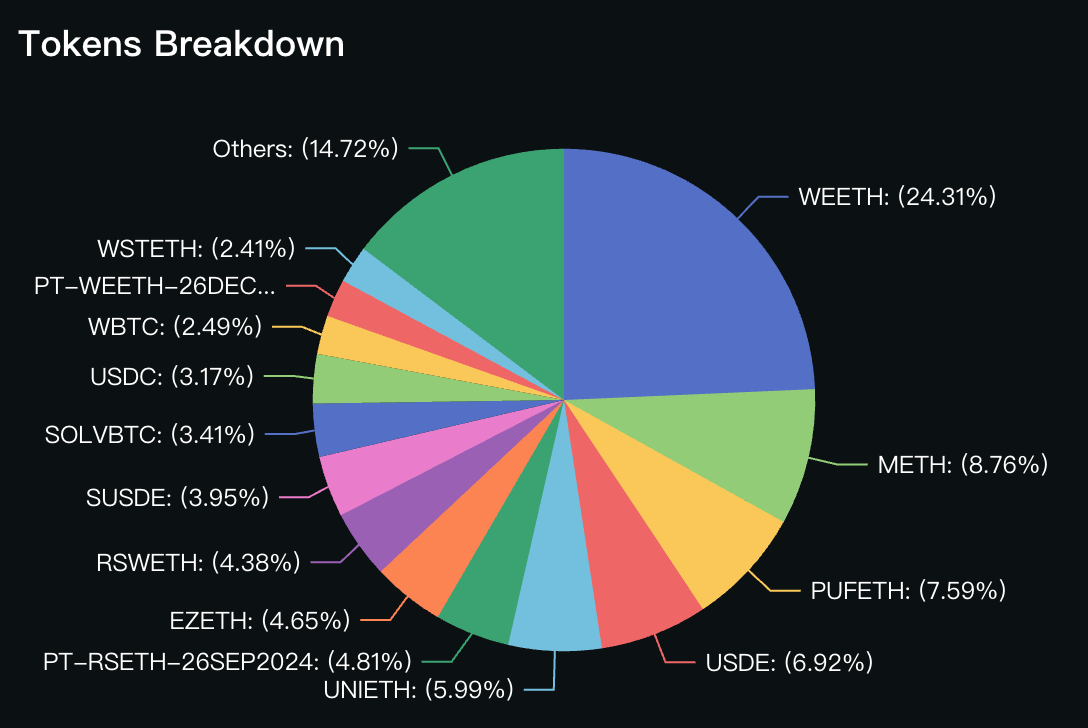

Integration of 45+ assets, including stablecoins, liquid staking tokens, and liquid restaking tokens;

-

Integration across 5+ chains including Ethereum mainnet and Arbitrum;

-

Development of over 10 Distributed Security Services and 20+ DSS applications.

Despite showing strong competitiveness in both technology and market strategy, Karak still faces risks. EigenLayer’s restaking mechanism and security have been validated by the market, and its massive TVL and broad recognition firmly establish its leadership in the restaking space. Karak’s layered structure may allow short-term data growth and apparent ecosystem vitality, but hidden risks behind rapid TVL increases cannot be ignored. How many networks or projects will actually adopt Karak’s restaked assets? Will its security withstand real-world scrutiny? Can non-Ethereum assets sustain the restaking narrative? And do users genuinely intend to continuously support ecosystem development? When the restaking hype fades, these questions will find their answers.

Conclusion

As a newcomer in the restaking space, Karak demonstrates strong market competitiveness through its multi-chain, multi-asset restaking capabilities. To challenge established players like EigenLayer, Karak must not only maintain momentum in user trust, security, and marketing—but more importantly, ensure its ecosystem truly meets real market needs. Will AVS providers seeking robust security choose to build on EigenLayer instead? Beyond users solely chasing diversified yield, who else will opt for Karak? That is what deserves closer attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News