EigenLayer and Ether.fi Both Pivot as Restaking Sector Faces Challenges?

TechFlow Selected TechFlow Selected

EigenLayer and Ether.fi Both Pivot as Restaking Sector Faces Challenges?

Do the strategic adjustments of the two leading players indicate that this赛道 is becoming ineffective?

Text: Fairy, ChainCatcher

Editor: TB, ChainCatcher

In the first half of 2024, the concept of secondary yield ignited market excitement, and "restaking" became a dominant theme across the crypto ecosystem. EigenLayer rose to prominence, followed by projects like Ether.fi and Renzo, while liquid restaking tokens (LRTs) proliferated.

Yet today, both leading projects in the sector have chosen to pivot:

Ether.fi announced its transformation into a crypto neobank, planning to launch debit cards and staking services for U.S. users;

Eigen Labs announced a roughly 25% workforce reduction, reallocating resources to focus entirely on its new product, EigenCloud.

The once red-hot narrative of "restaking" has now reached a turning point. Do these strategic shifts by the two industry leaders signal that this track is losing relevance?

Emergence, Hype, and Cleansing

Over the past few years, the restaking sector has evolved from conceptual experimentation to a phase of intense capital inflow.

According to RootData, over 70 projects have emerged in the restaking space to date. Ethereum-based EigenLayer was the first to bring the restaking model to market, triggering a surge of liquid restaking protocols such as Ether.fi, Renzo, and Kelp DAO. Later, new architectural players like Symbiotic and Karak entered the scene.

In 2024, funding events surged to 27, raising nearly $230 million for the year—making it one of the most sought-after sectors in the crypto market. By 2025, however, fundraising momentum began to slow, and overall sector热度 gradually cooled.

Meanwhile, sector consolidation accelerated. Eleven projects—including Moebius Finance, goTAO, and FortLayer—have already ceased operations, clearing out early-stage bubbles.

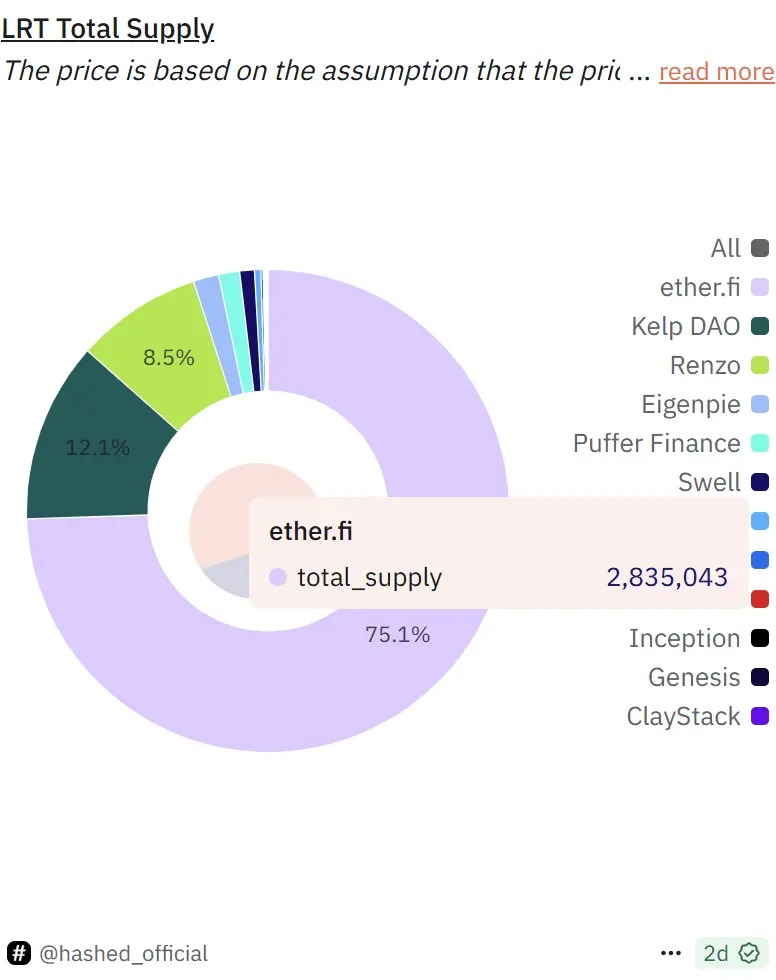

Currently, EigenLayer remains the dominant player, with a TVL of approximately $14.2 billion, capturing over 63% of the market share. Within its ecosystem, Ether.fi holds about 75%, followed by Kelp DAO at 12% and Renzo at 8.5%.

Narrative Weightlessness: Cooling Signals Behind the Data

As of now, the total TVL across restaking protocols stands at around $22.4 billion, down 22.7% from its peak of ~$29 billion in December 2024. While lock-up volumes remain substantial, growth momentum in restaking has clearly slowed.

Image source: Defillama

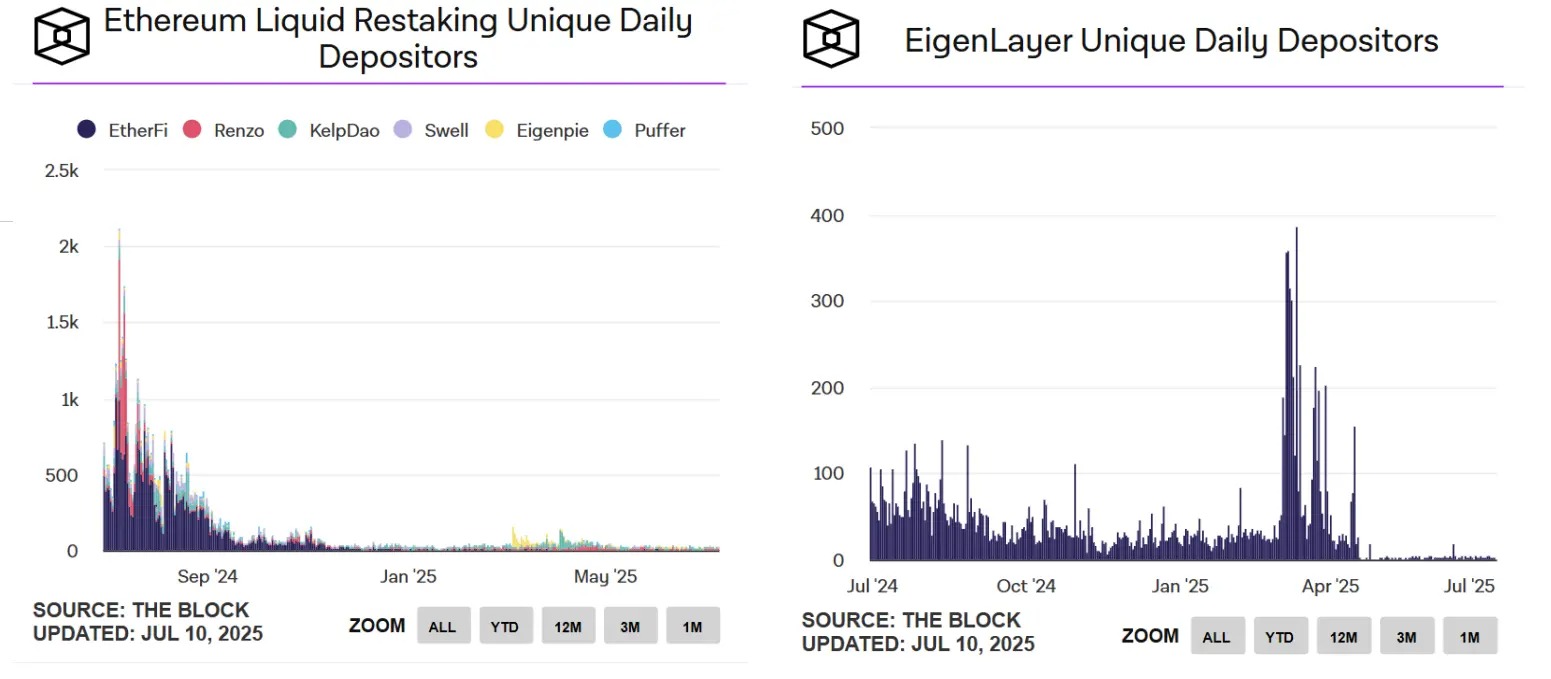

A decline in user activity is even more pronounced. According to The Block, daily active depositors in Ethereum’s liquid restaking protocols have plummeted from over a thousand at their July 2024 peak to just over thirty today. Meanwhile, EigenLayer’s number of daily unique deposit addresses has fallen into single digits.

Image source: The Block

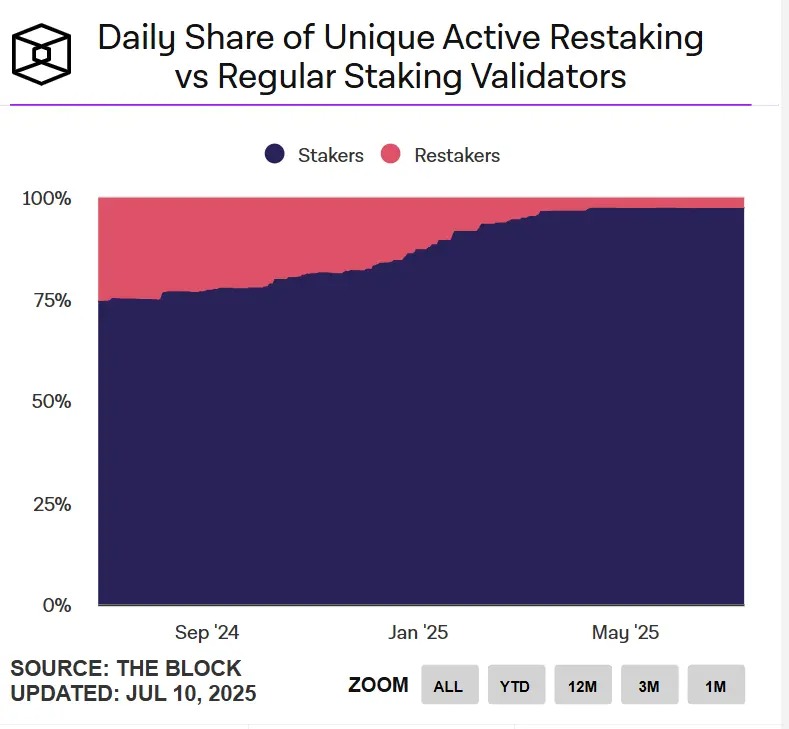

From the validator perspective, restaking's appeal is also fading. Currently, daily active restaking validators make up less than 3% compared to regular staking validators on Ethereum.

Moreover, token prices for Ether.fi, EigenLayer, and Puffer have all dropped over 70% from their highs. Overall, while the restaking sector still maintains scale, user engagement and enthusiasm have significantly declined—the ecosystem is entering a state of "weightlessness." As narrative-driven momentum weakens, the sector’s growth has hit a bottleneck.

Top Projects Pivot: Is the Restaking Business No Longer Viable?

As the "airdrop-era红利" fades and sector热度 cools, expected return curves flatten. Restaking projects now face a pressing question: how can platforms achieve sustainable long-term growth?

Take Ether.fi as an example. It generated over $3.5 million in revenue for two consecutive months at the end of 2024, but by April 2025, revenue had dropped to $2.4 million. With growth slowing, a singular restaking offering may no longer suffice to sustain a full-fledged business model.

It was precisely in April that Ether.fi began expanding its product scope, repositioning itself as a "crypto neobank." By integrating real-world use cases such as bill payments, salary disbursements, savings, and spending, it aims to build a closed-loop financial system. The dual-track strategy of "debit card + restaking" has become its new engine for boosting user stickiness and retention.

Unlike Ether.fi’s application-layer breakout strategy, EigenLayer has opted for a restructuring focused on infrastructure-level strategy.

On July 9, Eigen Labs announced a ~25% staff reduction, redirecting resources toward its new developer platform, EigenCloud—which recently secured a fresh $70 million investment from a16z. EigenCloud integrates EigenDA, EigenVerify, and EigenCompute, aiming to provide universal trust infrastructure for both on-chain and off-chain applications.

While Ether.fi and EigenLayer have taken different paths, they reflect two variations of the same underlying logic: transforming "restaking" from an end goal into a starting module, shifting from being the purpose itself to becoming a tool for building more complex application systems.

Restaking is not dead—but its "single-threaded growth model" may no longer be sustainable. Only when embedded within larger-scale application narratives can it continue attracting users and capital.

The mechanism of "secondary yield" that once sparked market frenzy is now seeking new footholds and renewed vitality within a more complex application landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News