Ethereum's $1.9 billion unstaking wave: Profit-taking or a new beginning for the ecosystem?

TechFlow Selected TechFlow Selected

Ethereum's $1.9 billion unstaking wave: Profit-taking or a new beginning for the ecosystem?

Releasing the pledge does not necessarily mean a sale will occur.

Written by: TechFlow

Whenever the market rallies, FUD follows.

Today, a piece of news has once again sparked concerns about ETH's price:

Ethereum network validators are queuing up to unstake their ETH.

As a representative of the PoS consensus mechanism, staking ETH technically secures the entire Ethereum network and economically generates additional yield, locking ETH liquidity within staking pools.

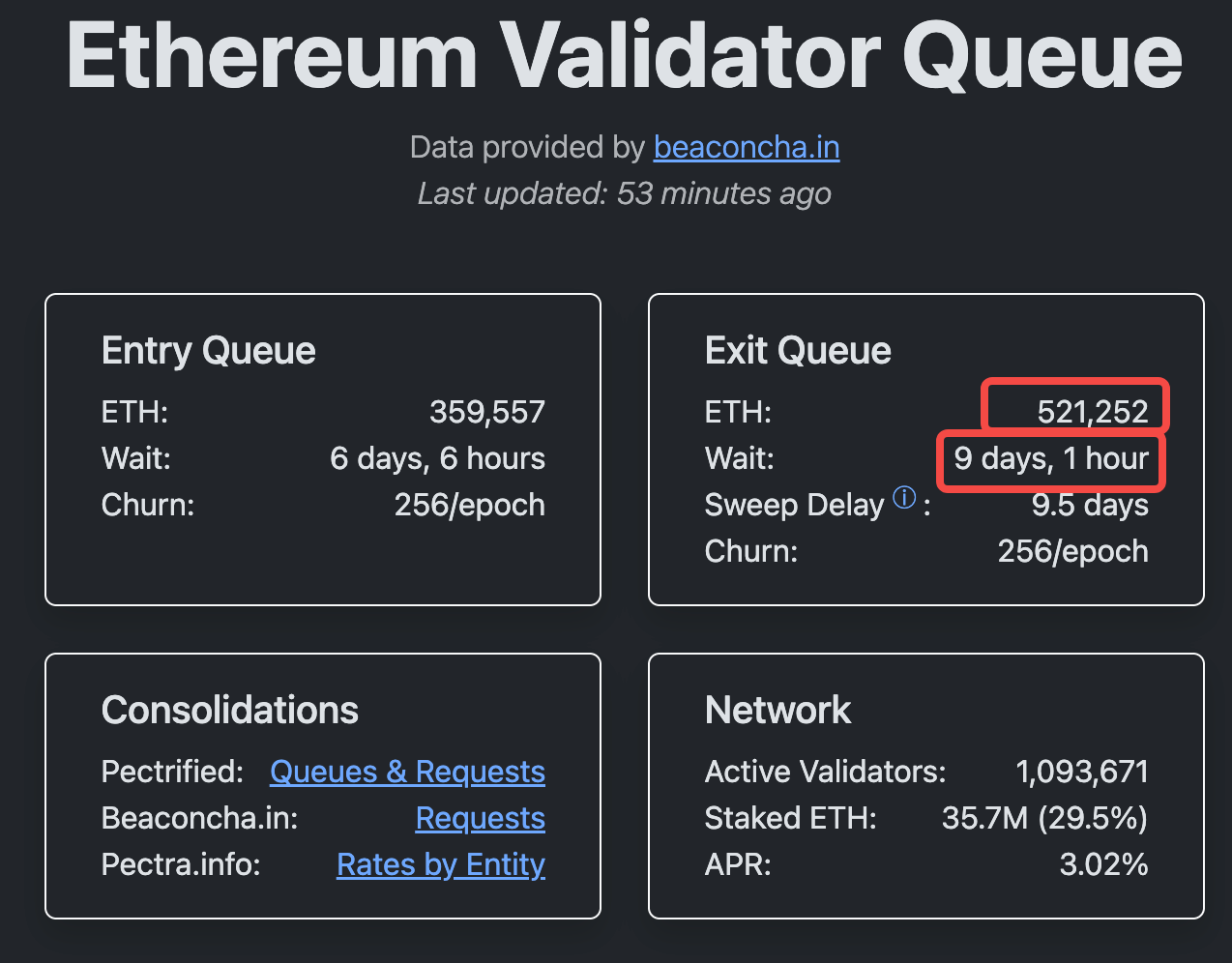

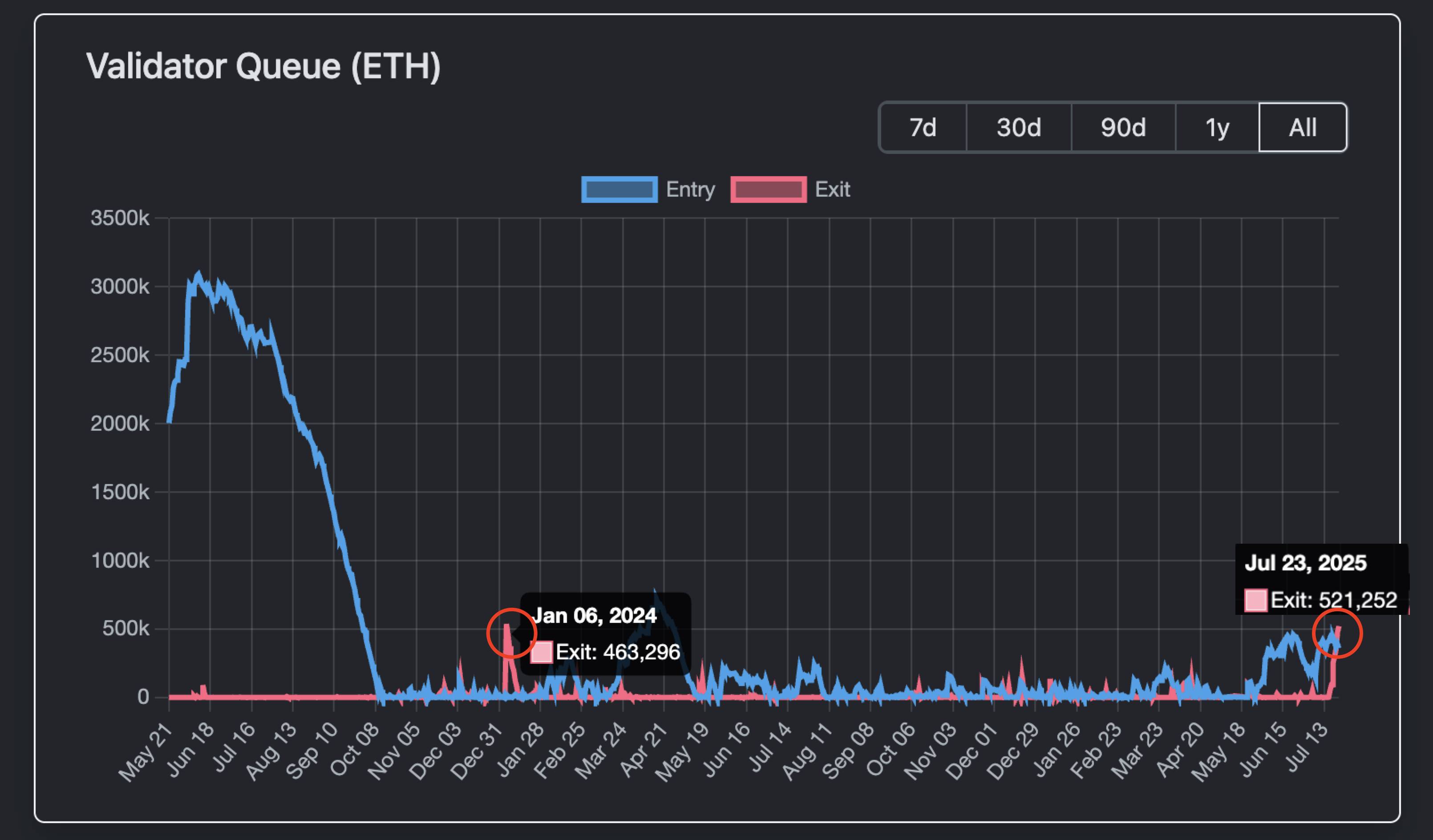

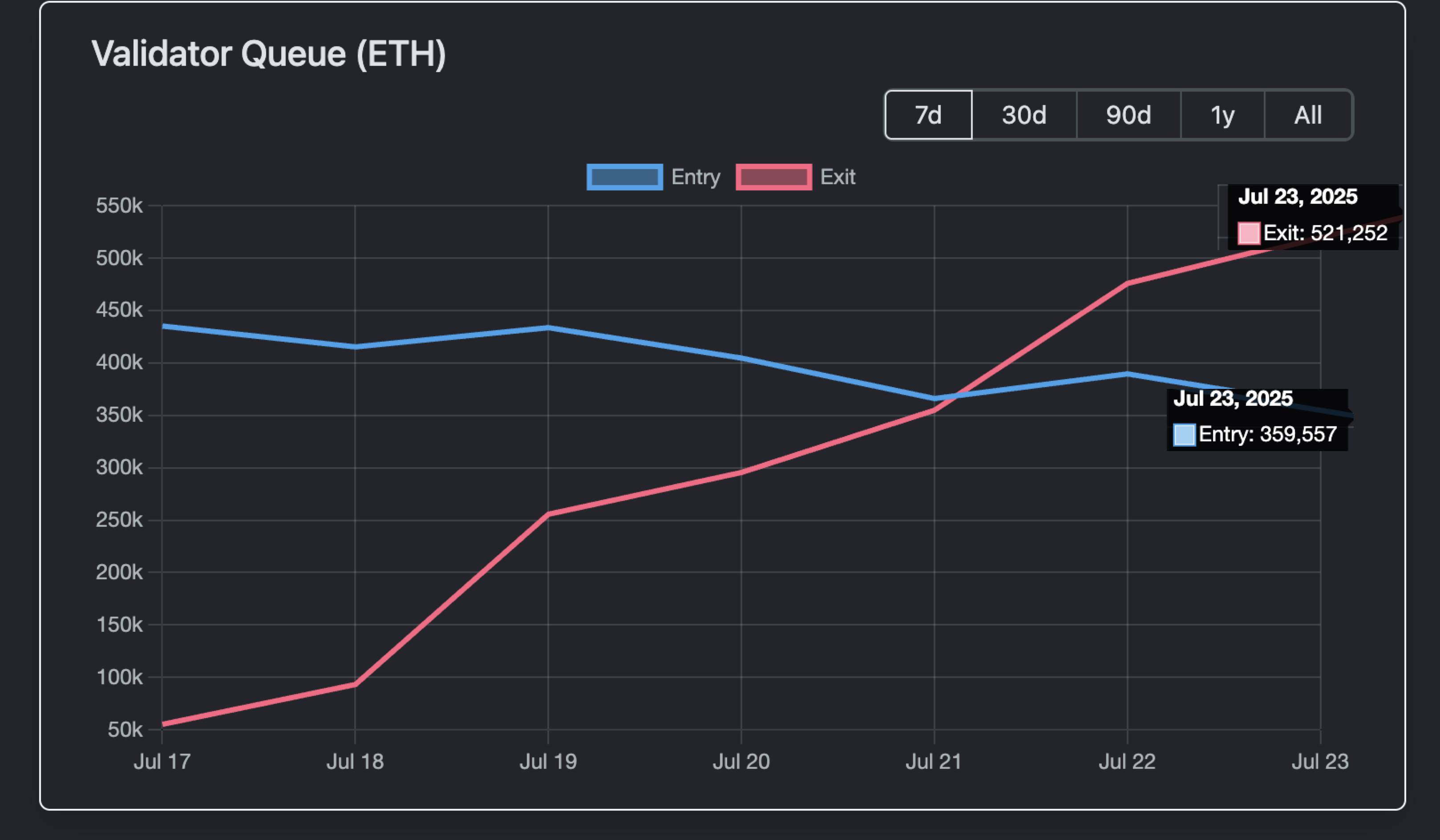

However, according to data from Validator Queue showing, as of July 23, approximately 521,252 ETH were in the exit queue undergoing unstaking, valued at around $1.93 billion, with an estimated waiting time exceeding 9 days and 1 hour.

This is the longest queue validators have faced when exiting over the past year.

Since each validator typically stakes 32 ETH, this theoretically equates to more than 16,000 validators seeking to exit. Such large-scale queuing for unstaking raises some red flags.

Profit Taking?

Are whales and institutions selling ETH to lock in profits?

The surge in Ethereum unstaking may be partially linked to the recent price increase.

Starting from the lows in early April 2025 (around the $1,500–$2,000 range), ETH has seen a strong rebound, accumulating a gain of 160% so far. Specifically, on July 21, ETH reached a high of $3,812, marking its peak in the past seven months.

Such rapid appreciation often prompts some investors to take profits, especially early stakers who may decide to secure gains rather than continue holding.

Historically, this pattern isn't new.

From January to February 2024, when the ETH/BTC ratio rose 25% within a week, a similar wave of unstaking occurred, leading to a short-term price drop of 10%-15%. Around that same period, Celsius' bankruptcy liquidation led to 460,000 ETH being unstaked en masse, causing congestion in Ethereum’s validator exit queue for about a week.

Not Necessarily Selling Pressure

Different from before, although the current unstaking queue is long and the amount substantial, it doesn’t necessarily mean immediate selling pressure.

First, looking again at Validator Queue data, while 520,000 ETH were queued for unstaking on July 23, another 360,000 ETH entered the staking queue on the same day.

After netting these out, the actual net outflow of ETH from the network would be significantly reduced.

Second, institutional activity also acts as a buffer.

Data from July 22 showed that publicly traded ETH spot ETFs collectively recorded inflows totaling $3.1 billion—significantly surpassing the value of the 520,000 ETH queued for unstaking ($1.9 billion) on that day.

And this was just one day’s ETF net inflow, not accounting for the fact that validator exits face a 9-day queue delay.

Moreover, unstaking does not automatically imply selling.

In the context of this current ETH rally, concentrated unstaking could very well stem from institutions adjusting custody services or shifting toward crypto treasury strategies—in simpler terms, switching custodians to seek higher returns, not selling ETH outright.

On-chain, some of the unstaked ETH is more likely to be used in DeFi and NFT-related activities—for example, providing collateral for liquidity, or yesterday when a whale swept the floor of Crypto Punks.

In addition, LST tokens frequently experience de-pegging, creating arbitrage opportunities for ETH—such as recently when the stETH-to-ETH ratio dropped to 0.996 (a 0.04% discount), with weETH showing similar fluctuations. Arbitrageurs profit by buying discounted LSTs and waiting for them to re-anchor at 1:1, thereby increasing demand for ETH.

Overall, unstaking appears more like internal adjustment within the Ethereum ecosystem rather than a direct sell signal.

Nonetheless, various speculations circulate on social media. While concentrated unstaking doesn’t indicate selling pressure, it may point to a phenomenon known as "changing the house".

Some argue that BlackRock, which has been driving crypto adoption into mainstream finance, has effectively become the dominant "house" for ETH. As of July data, BlackRock has accumulated over 2 million ETH (worth approximately $6.9–8.9 billion), representing about 1.5%-2% of ETH’s total supply (roughly 120 million ETH).

This isn’t secret—it’s public ETF asset management. So it’s more like an institutional-grade "open house"—accumulating ETH transparently via ETFs to promote institutional adoption, rather than manipulating the market.

The logic of "changing the house" suggests that as Ethereum transitions from an in-crypto value consensus to broader financial instrument recognition, Wall Street taking over and preparing major moves is an increasingly evident trend.

This speculation holds merit—staking and unstaking might also reflect shifts in ownership structure.

Regardless, Ethereum's growth potential will continue to support its leadership in the crypto space. This unstaking wave might simply mark the beginning of a new cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News