EigenLayer slashing is about to go live—how should AVS, node operators, and restakers respond?

TechFlow Selected TechFlow Selected

EigenLayer slashing is about to go live—how should AVS, node operators, and restakers respond?

Why is EigenLayer's slashing mechanism so important? How does it enable a programmable trust model?

Author: KarenZ, Foresight News

Despite underwhelming price performance of the EigenLayer token, the technological innovation driven by EigenLayer is reshaping Ethereum's economic security landscape. On April 17, EigenLayer will launch its slashing mechanism on mainnet—a milestone marking a critical step toward maturity for the restaking ecosystem.

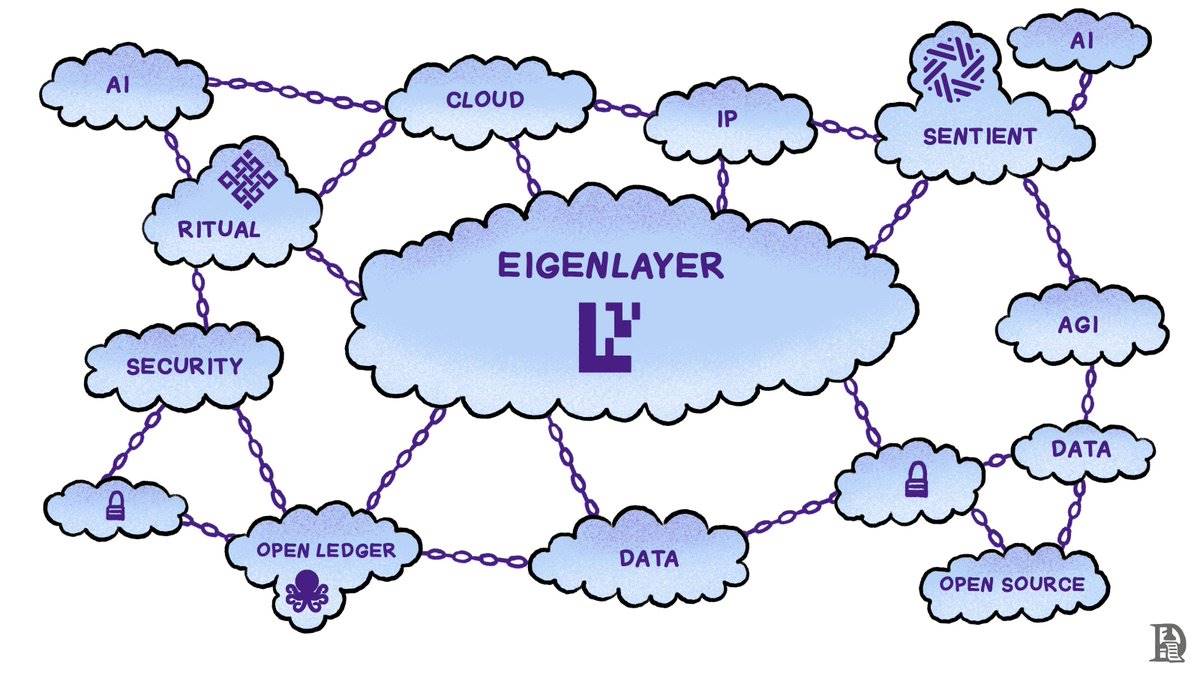

As an innovative middleware protocol within the Ethereum ecosystem, EigenLayer creates a value network for Actively Validated Services (AVSs), Operators, and restakers through its restaking model. The introduction of slashing will bring key changes to these three core participant groups, not only strengthening ecosystem security and trust mechanisms but also introducing new opportunities and challenges. This article provides an in-depth analysis of EigenLayer’s slashing mechanism and its specific impacts on AVSs, Operators, and restakers.

EigenLayer Slashing Mechanism: Why It Matters

EigenLayer’s restaking model allows Ethereum stakers to re-stake their ETH or liquid staking tokens to AVSs, providing validation services for third-party protocols and earning additional yield. However, this open model introduces potential risks—malicious behavior or negligence by Operators could undermine ecosystem trust.

The introduction of slashing fundamentally reshapes the rules of the EigenLayer ecosystem: economic constraints ensure Operator compliance, while offering AVSs a programmable framework for trust enforcement. This mechanism not only enhances security but also provides flexible options for participants with different risk preferences through its unique “risk isolation” design.

With slashing going live on mainnet, the entire ecosystem will gain greater credibility and economic security. This shift will directly impact the operational models and strategies of AVSs, Operators, and restakers.

Core Features of the Slashing Mechanism

As noted, the slashing mechanism aims to deter potential malicious acts or negligence by Operators, ensuring that AVS trust models remain aligned with Ethereum mainnet security, while preserving flexibility in reward structures and incentives for specific activities.

Before analyzing how each participant group is affected, it's essential to understand the core design and functionality of the slashing mechanism.

1. Unique Stake Allocation: Operators can allocate a specific portion of their stake to a particular AVS, and only that AVS may slash this allocated stake. This design isolates risk between different AVSs, protecting other assets held by Operators and restakers from cross-contamination.

2. Operator Sets: Provides AVSs with tools to organize Operators into distinct groups. AVSs can define slashing conditions within these groups, assign tasks, and precisely manage slashable security. Operators must carefully choose which groups to join based on their own risk tolerance, capabilities, and the AVS’s design and incentive structure.

Other Key Rules:

-

Voluntary Participation: Initially, Operators and restakers can opt in or out of the slashing mechanism, providing a transition buffer period for the ecosystem.

-

14-Day Withdrawal Delay: All withdrawals require a 14-day queue before completion. During this period, AVSs can initiate slashing for misconduct, preventing malicious actors from quickly withdrawing funds to evade penalties.

-

Programmable Slashing Rules: AVSs can set custom slashing conditions based on their needs—such as penalties for failed tasks or malicious behavior—enhancing flexibility.

-

Rewards and Penalties: Honest Operators are rewarded, while rule-breakers face loss of staked assets, creating a free-market incentive system.

AVSs: Customizable Slashing Rules

-

Programmable Trust Model: AVSs will use the "Operator Set" feature to manage Operators, defining conditions and registration requirements for each set. The slashing mechanism empowers AVSs to create customized reward and penalty rules, enabling optimization of security strategies across various use cases—such as data availability, cross-chain bridges, or decentralized sequencers. Slashing rules are bound to specific Operator Sets.

-

Targeted Stake Slashing: Due to the Unique Stake Allocation rule, an AVS can only slash the portion of an Operator’s stake specifically delegated to that AVS.

-

Enhanced Economic Security: Will attract more developers to build complex trustless services.

-

Accelerated Ecosystem Growth: After mainnet launch, AVSs are expected to gradually adopt slashing. This mechanism will push AVSs to improve service quality to attract Operators and restakers.

The slashing mechanism gives AVSs a tool for differentiated competition. By designing balanced slashing and reward rules, high-quality AVSs can attract more staked capital and strengthen market competitiveness. However, AVSs must balance the strictness of their rules with attractiveness—overly harsh rules may deter Operators and restakers, while overly lenient ones may compromise security.

Operators: Careful AVS Selection to Balance Rewards and Risks

-

Increased Risk Management Needs: Operators must closely monitor and understand the slashing rules of different AVSs, allocating unique stakes per AVS to ensure only that AVS can slash the designated stake. For example, when serving multiple AVSs simultaneously, Operators must ensure proper resource allocation to avoid being slashed due to failure in one task.

-

Selective Participation: Initial opt-in participation offers Operators decision-making flexibility. However, long-term, Operators who do not join slashing may lose competitiveness due to lower perceived trustworthiness.

-

Higher Reward Potential: Operators who successfully complete tasks will earn higher rewards, especially in high-value AVSs, incentivizing high-quality service delivery.

The slashing mechanism establishes a transparent risk-reward framework for Operators. High-performing Operators can win more delegations from restakers and expand market share. However, they must carefully select AVSs to balance rewards against slashing risks. Additionally, smaller Operators may struggle with the complexity of managing multiple slashing rules due to limited resources, potentially leading to increased market concentration among larger Operators.

Restakers: Optimizing Delegation Decisions

-

Slashing rules only affect Operators and their delegators when Operators explicitly opt into a slashable Operator Set created by an AVS.

-

Greater Transparency: The slashing mechanism enables restakers to better assess Operator performance and AVS risk levels, improving delegation decisions.

-

Increased Potential Risk: If a delegated Operator is slashed, the restaker’s staked assets may suffer partial losses—especially when participating in high-risk AVSs.

-

Diversified Staking Portfolios: As the AVS ecosystem expands, restakers will have more options to diversify their staking portfolios and balance risk and return.

The launch of slashing will help high-quality Operators and AVSs stand out, allowing restakers to achieve higher long-term returns. However, restakers must invest more time researching slashing policies of Operators and AVSs, increasing decision complexity. Inexperienced users may face risks from information asymmetry.

Conclusion

The mainnet launch of the slashing mechanism will significantly enhance the security and scalability of the EigenLayer ecosystem, injecting greater safety and flexibility into the restaking economy. For AVSs, it presents an opportunity to build diverse trust-based services; for Operators, it offers a path to differentiate themselves through high-quality performance, though slashing risk management remains crucial; for restakers, it opens a window to optimize risk-return trade-offs. Nevertheless, the EigenLayer ecosystem still faces challenges, including balancing incentives and penalties and lowering barriers to entry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News