Six Key Factors Driving Mass Adoption of Ethereum and Its Layer 2 Scaling Solutions

TechFlow Selected TechFlow Selected

Six Key Factors Driving Mass Adoption of Ethereum and Its Layer 2 Scaling Solutions

Ethereum will need more innovation and breakthroughs to achieve mass adoption, and 2023 will be a critical turning point.

Written by: The DeFi Investor

Compiled by: TechFlow

In today's cryptocurrency market, the Ethereum ecosystem has consistently been one of the most active and popular projects. However, achieving mass adoption will require further innovation and breakthroughs. 2023 will be a pivotal turning point, with six key factors pushing Ethereum and its Layer 2 scaling solutions closer to widespread adoption. Let’s explore what these factors are.

1. Eigenlayer Mainnet Launch

Eigenlayer is one of the most innovative projects I’ve come across recently. It can be seen as a re-staking solution for $ETH. With Eigenlayer, Ethereum validators will be able to simultaneously secure multiple networks or protocols.

A good way to measure the security of a PoS chain is by looking at the total value of tokens locked by validators—the higher this value, the greater the cost of an attack.

Precisely because of this, Ethereum is among the most secure L1s, so other protocols may want to rent its security. In short, Eigenlayer is building a marketplace where ETH node operators can opt into offering services in exchange for additional fees. They could even validate networks such as sidechains or even non-EVM networks. Misbehavior would result in slashing of their staked ETH.

Any project—from L1s and L2s to oracles and bridges—can leverage Eigenlayer’s technology. Mantle, an upcoming modular Ethereum L2 design project, will be one of those utilizing EigenLayer’s data availability solution.

The Eigenlayer mainnet is expected to launch in Q3.

2. Ethereum Shanghai Upgrade

The upcoming Ethereum upgrade has sparked significant interest in liquid staking derivatives. Shanghai will enable $ETH staking withdrawals along with several minor improvements. However, this may not trigger a massive sell-off of $ETH as many might expect.

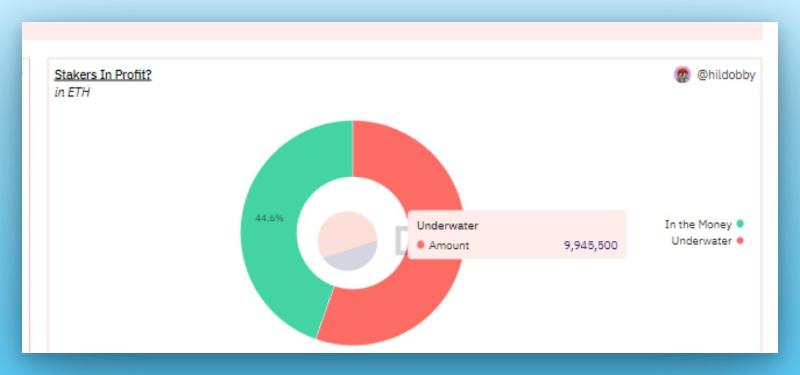

The upgrade will implement a withdrawal queue, preventing everyone from withdrawing their staked ETH all at once. Additionally, it appears that less than 50% of $ETH stakers are currently in profit, making a large-scale $ETH sell-off unlikely.

The Shanghai upgrade is expected in April 2023.

3. Optimism Bedrock Upgrade

The Arbitrum Nitro upgrade significantly reduced gas fees on Arbitrum and helped it gain more attention. Now it’s Optimism’s turn.

Optimism Bedrock was introduced in May 2022. It is described as the cheapest and fastest rollup architecture. Once live, users should expect lower average transaction fees on Optimism, alongside faster deposits. Moreover, it will allow Optimism to integrate ZK proofs, enhancing its security.

Launch timeline: Q2 2023.

4. Arbitrum Stylus Upgrade

Do you think the Arbitrum team is just resting after launching $ARB this year? Think again—the next major Arbitrum upgrade is called Stylus. Stylus will allow deployment of programs written in the most popular programming languages.

Yes, Arbitrum will become the first L2 to support multiple programming languages like Rust and C++. In addition, it will also make Arbitrum more scalable.

Launch timeline: 2023.

5. zkEVMs

The official mainnet launch of the first zkEVMs is finally becoming a reality. zkEVMs are Ethereum scaling solutions that are EVM-compatible or EVM-equivalent, using ZK proofs to verify transactions. Developers can directly deploy Ethereum smart contracts on these scaling solutions.

ZK Rollups are considered more secure and efficient than Optimistic Rollups. zksync and Polygon have already launched their first zkEVM mainnets, but this is just the beginning.

Consensys and Taiko are also expected to launch their zkEVM mainnets later this year.

6. Proto-danksharding

Proto-danksharding is another major Ethereum upgrade expected to be ready later this year. It will introduce a new type of transaction to Ethereum, drastically reducing transaction fees on L2s.

This will make Ethereum L2s more scalable and more accessible to retail investors. Initially, this upgrade was planned for the same day as the Shanghai upgrade. However, since staking withdrawals were the top priority, it has been postponed to autumn.

Personally, I’m most excited about the Proto-danksharding upgrade. A $0.30 transaction fee for using L2s is still too high. To make Ethereum L2s accessible to everyone, fees must drop below $0.05.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News