Nansen: On-chain Review of 2021 - L1, DeFi, DAO, and NFT

TechFlow Selected TechFlow Selected

Nansen: On-chain Review of 2021 - L1, DeFi, DAO, and NFT

In 2022, we expect supply to catch up with demand, and the best projects will emerge as clear winners.

Author: Nansen

Translation: BlockBeats

Year in Review

2021 was a pivotal year for crypto, dominated by strong projects and major trends.

Ethereum is no longer the only smart contract platform with significant user adoption, as "multi-chain" became the dominant trend of 2021.

DeFi continued to bring capital into the crypto space, while NFTs injected fresh energy. Austrian economics failed to serve as a compelling theoretical foundation for Bitcoin investment, whereas people discovered that cartoon JPEGs might actually be a better investment strategy.

In 2022, we expect all these key themes in crypto to continue their rapid growth. Multi-chain ecosystems, DeFi, and NFTs will persist. In particular, NFTs showed strong momentum this year, yet we have only scratched the surface of their potential in gaming, art, and social networks.

Layer 1 & Layer 2 Blockchains

Speed, security, and decentralization—these are the three core elements of blockchains. Known as the blockchain trilemma, achieving all three simultaneously has traditionally been considered impossible, requiring trade-offs among them.

In recent years, rising demand from users and applications has driven existing blockchains to urgently seek scalability solutions.

Numerous Layer 1 and Layer 2 solutions have introduced innovative approaches to overcome limitations of traditional consensus mechanisms, competing fiercely for market dominance. The rise of these solutions can be observed through increases in on-chain contract deployments, users, and transaction volumes. Meanwhile, Ethereum's mainnet has fallen behind, averaging around 20,000 daily contract deployments—sometimes even lower between August and December 2021.

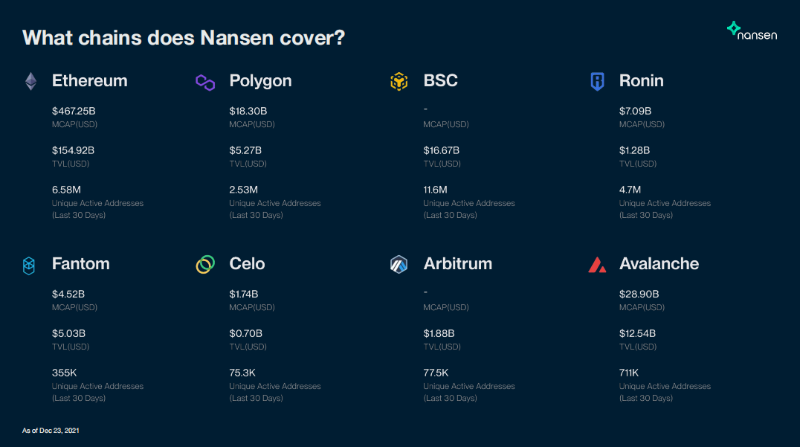

Nansen provides on-chain data across multiple blockchains to enhance transparency and keep users informed about network activity.

Networks Covered by Nansen

(Data source: Nansen; Date: December 23, 2021)

Ethereum

Benefiting from first-mover advantage, Ethereum remains the leading blockchain in total value locked (TVL) and market capitalization.

However, since the DeFi summer of 2020, high gas prices due to base-layer congestion have become commonplace. This urgent need for scaling created opportunities for Layer 1 and Layer 2 expansion solutions. With the emergence of high-performance, low-cost alternative chains, contract deployment activity on Ethereum has remained relatively low recently. Some projects easily migrated due to EVM compatibility.

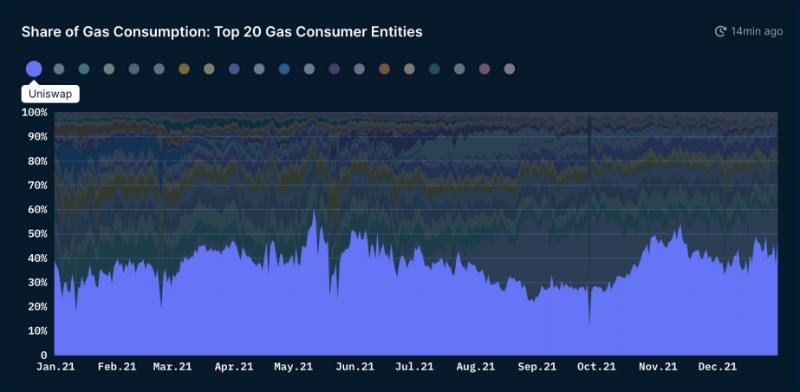

Uniswap was the dominant application on Ethereum in 2021, accounting for over 30% of gas consumption among the top 20 apps.

(Data source: Nansen; Date: December 31, 2021)

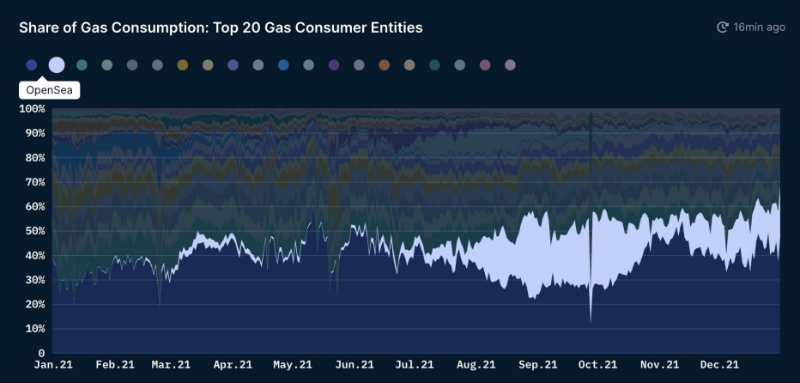

OpenSea, the NFT marketplace, saw explosive growth in usage during 2021, becoming the only project occasionally surpassing Uniswap in activity (in September and October).

(Data source: Nansen; Date: December 31, 2021)

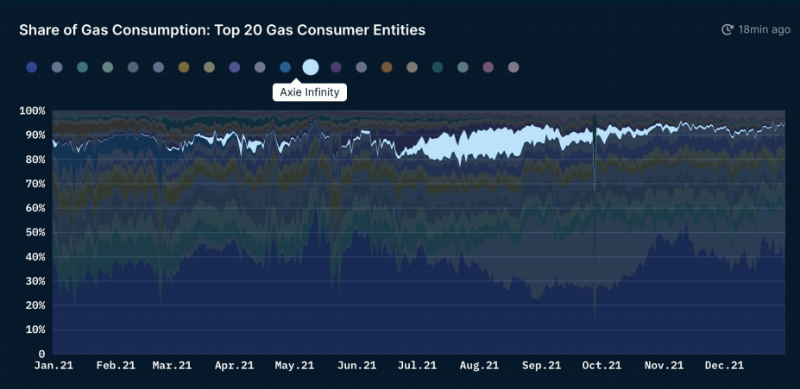

Between July and September, Axie Infinity was the largest gas-consuming application on Ethereum before migrating to its own sidechain, Ronin.

(Data source: Nansen; Date: December 31, 2021)

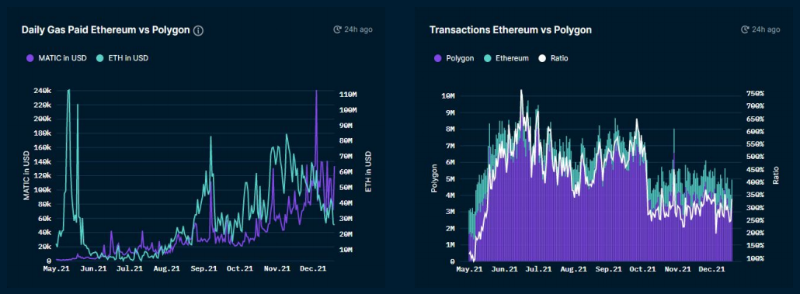

Polygon

Polygon’s transaction volume exceeds Ethereum’s by 300%, yet its daily gas expenditure in dollar terms is typically less than 0.5% of Ethereum’s.

(Data source: Nansen; Date: December 21, 2021)

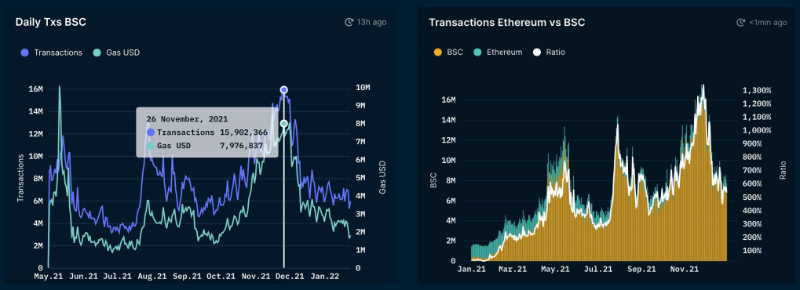

Binance Smart Chain

BSC has the highest number of daily active addresses among all Layer 1 chains. At its peak in late November 2021, BSC’s daily transaction volume reached 1,345% of Ethereum’s.

(Data source: Nansen; Date: December 21, 2021)

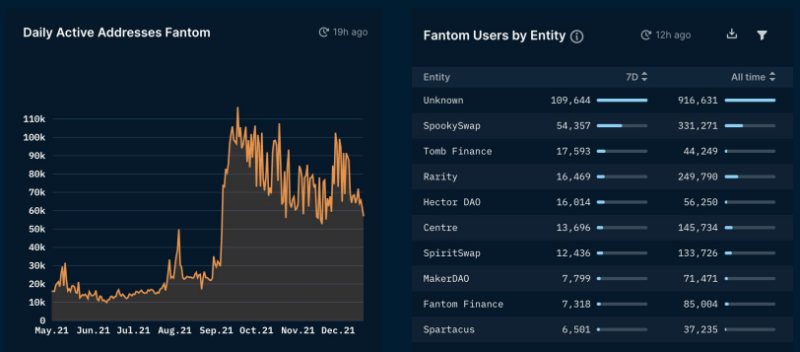

Fantom

In September 2021, the Fantom Foundation announced a $370 million FTM rewards program, driving a 440% increase in daily active addresses and growing TVL from approximately $1 billion to over $6 billion by November.

(Data source: Nansen; Date: December 21, 2021)

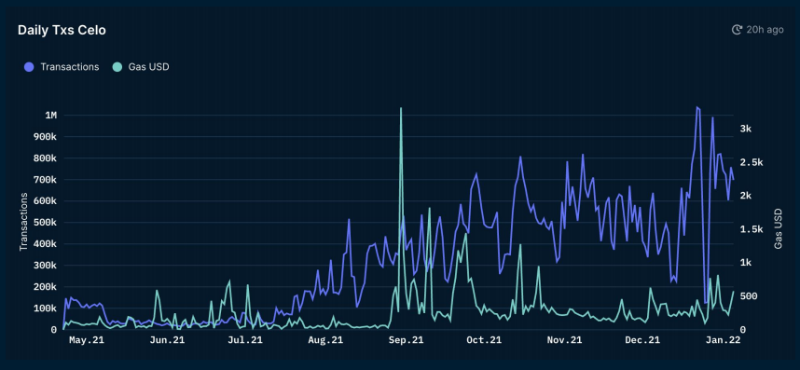

Celo

Since June, transaction volume on Celo has grown more than fourfold; its TVL peaked at $1.07 billion in late October.

(Data source: Nansen; Date: December 21, 2021)

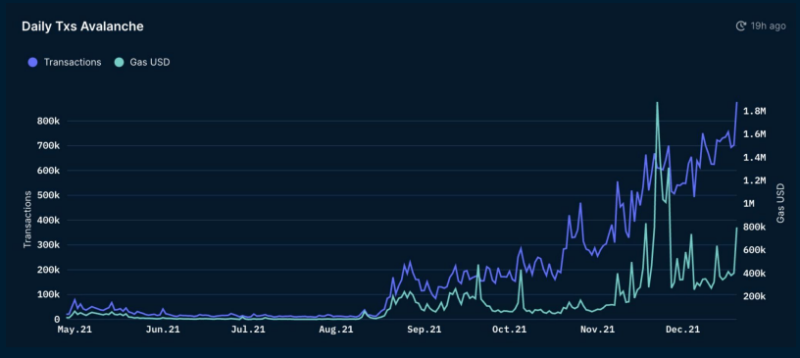

Avalanche

An $180 million incentive program in August, $230 million in funding from prominent VCs, and the launch of several high-quality dApps drove a surge in Avalanche’s transaction volume and price.

(Data source: Nansen; Date: December 21, 2021)

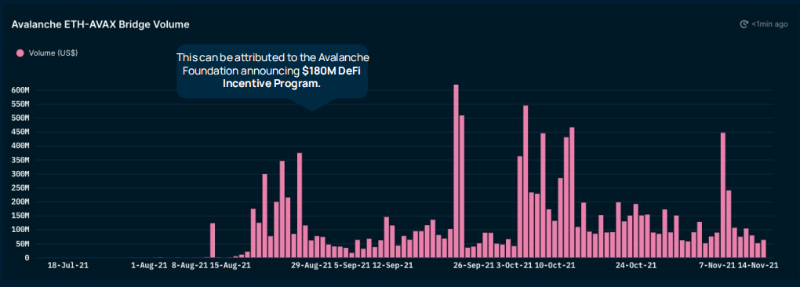

Cross-chain transaction volume from Ethereum to Avalanche reached $600 million in September.

(Data source: Nansen; Date: December 21, 2021)

The total value of tokens transferred to Avalanche via bridges exceeded $15.5 billion.

(Data source: Nansen; Date: December 21, 2021)

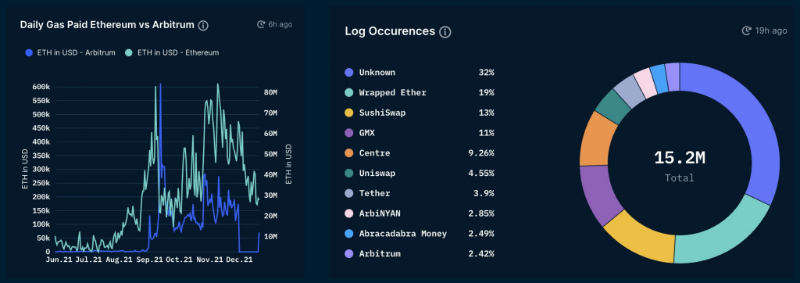

Arbitrum

Gas usage on Arbitrum spiked significantly on September 12 due to the launch of ArbiNYAN yield farming. Major DeFi protocols such as Curve, SushiSwap, Uniswap, and Balancer have also launched on Arbitrum’s mainnet.

(Data source: Nansen; Date: December 21, 2021)

DeFi

Following its breakout in 2020, decentralized finance (DeFi) maintained strong momentum in 2021. Notably, DeFi’s TVL grew approximately 1120% year-on-year. Stablecoins matured further, and reliable, sticky DeFi dApps emerged—including Uniswap, Aave, and Lido.

Uniswap

Interaction volume on Uniswap initially doubled following the launch of V3 but declined noticeably as more forks and variants entered the market.

Daily address count and transaction volume for Uniswap contracts:

(Data source: Nansen; Date: November 24, 2021)

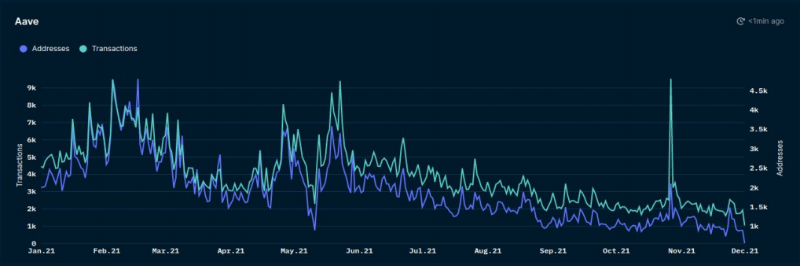

Aave

Aave reached a daily transaction peak above 9K, with active addresses hitting 4,500 in March.

Daily address count and transaction volume for Aave contracts:

(Data source: Nansen; Date: November 21, 2021)

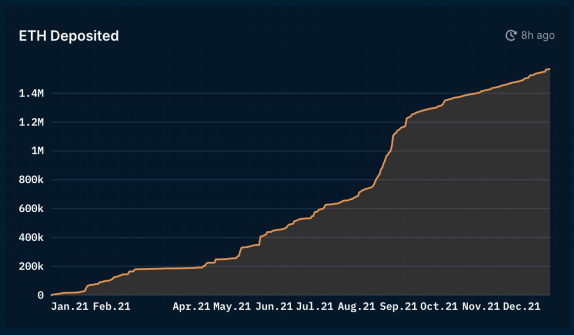

Lido

Lido’s total value locked steadily increased to 1.57 million ETH (approximately $6.3 billion), half of which was staked by just 37 depositors.

ETH staking over time (Data source: Nansen; Date: December 22, 2021)

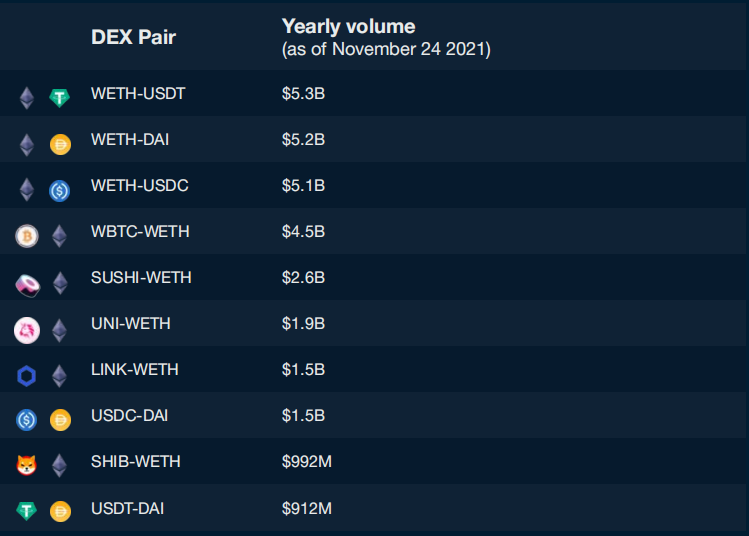

Smart Money

Overall, Smart Money traded WETH-Stable pairs most frequently on DEXs in 2021, followed by WBTC-WETH pairs.

Top 10 DEX markets traded by Smart Money in 2021 (by volume):

(Data source: Nansen; Date: December 24, 2021)

Smart Money also frequently visited blue-chip DeFi projects (SUSHI, UNI, LINK) on DEXs. Interestingly, meme coin SHIB ranked 9th in Smart Money trading volume.

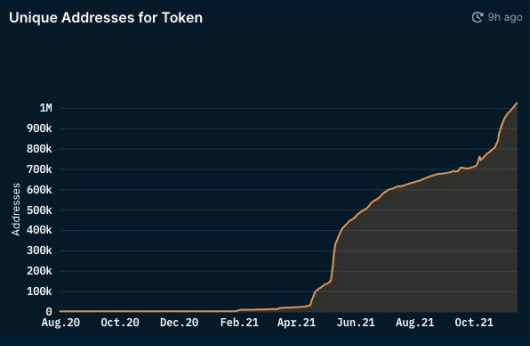

Shiba Inu (SHIB)

Given Shiba Inu’s (SHIB) sharp rise over recent months, some addresses achieved extraordinary returns.

Number of unique SHIB holders:

(Data source: Nansen; Date: December 24, 2021)

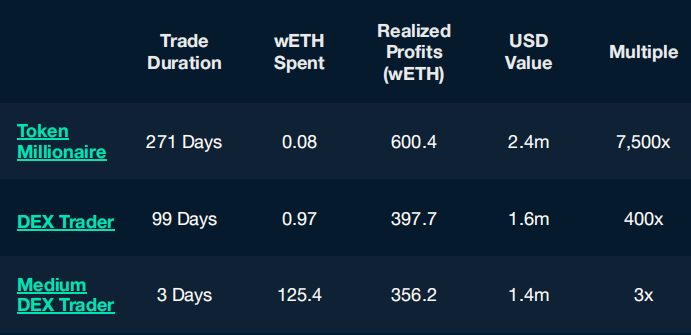

Significant SHIB Gainers

Nansen shows one address purchased SHIB for 0.08 ETH and saw assets grow 7,500x to 600.4 ETH after 271 days.

(Data source: Nansen; Date: December 24, 2021)

Stablecoin

USDT retained its dominance in 2021, but USDC emerged as the preferred stablecoin for decentralized trading.

(Data source: Nansen; Date: December 2021)

Ethereum maintained a high share (~70%) of the DeFi market, and USDT preserved its leading position among stablecoins in 2021.

However, increased regulatory scrutiny on USDT weakened its dominance. USDC found its niche this year, becoming the go-to stablecoin for decentralized trading, ranking second in market cap in 2021 and briefly surpassing USDT in early 2022.

As of 2021, whale wallets holding over $1 million accounted for more than 50% of stablecoin value and have been steadily increasing. A potential trend is that USDT’s market concentration may decline further in the coming years.

(Data source: Nansen; Date: November 2021)

(Data source: Nansen; Date: November 2021)

NFT

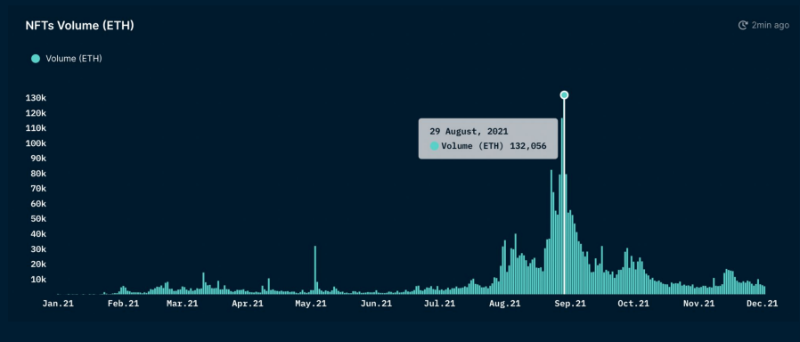

Trading volume peaked twice—late May and late August—driven by user interest in specific trending projects: Meebits for CryptoPunks (May) and Mutant Ape Yacht Club for Bored Ape Yacht Club (August).

NFT trading peaked on August 29, reaching an unprecedented daily sales volume of 130,000 ETH (approximately $422,080,100 USD).

On August 29, multiple projects recorded daily trading volumes exceeding 1,000 ETH ($2.7 million). By year-end, total NFT sales surpassed 4.6 million ETH ($17 billion USD).

On August 29, NFT trading volume hit an all-time high, captured in Nansen’s 24-hour data overview.

This year on Ethereum, over 1.2 million wallets minted NFTs across 18,000 projects, generating 187,000 ETH ($7.2 million) in transaction fees.

The Mint Master dashboard tracks recent minting activity of NFT projects on Ethereum.

The top 10 NFT traders this year collectively earned 46,221 ETH in net profit ($185 million), with influential figures like "Pranksy" reinvesting profits into new projects.

Nansen’s profit leaderboard closely tracks the next moves of top-performing NFT investors.

Play-to-Earn

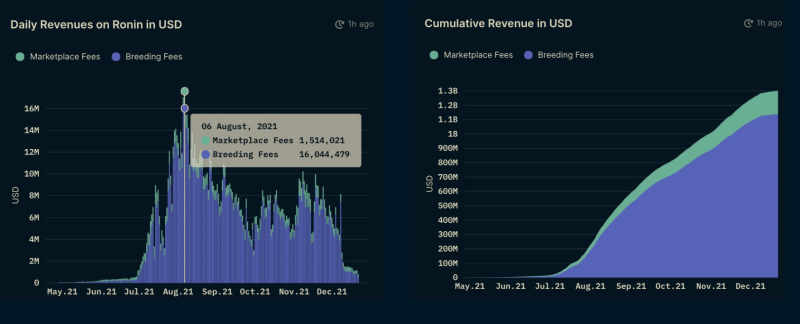

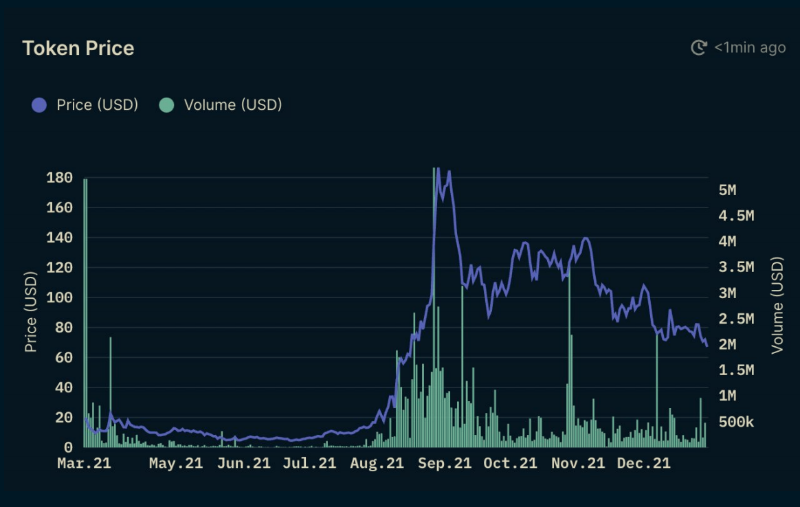

The most popular play-to-earn game, Axie Infinity, generated annual revenue of $1.3 billion, with a record daily revenue of $17.5 million on August 6.

On November 19, Ronin chain reached a peak of 1.1 million daily active addresses. Its total on-chain market cap (including SLP, AXS, and WETH) peaked at $9.65 billion on November 8.

(Data source: Nansen; Date: December 30, 2021)

With the launch of DEX Katana in early November, Ronin’s daily active addresses surged by 362% within a month.

DAO

DAO stands for Decentralized Autonomous Organization, ranging from purely social platforms like Friends With Benefits—a Discord server gated by token ownership—to fully investment-driven platforms like MetaCartel.

PleasrDAO is another interesting example, combining social engagement with art collecting.

ConstitutionDAO was founded in November 2021 to bid on an original copy of the U.S. Constitution, attracting over 17,000 contributors and raising $47 million in ETH.

We can analyze the price evolution of native DAO tokens over time using the volume-price chart of Friends With Benefits Pro (FWB).

Value Drivers of DAOs:

1) Effective incentive mechanisms;

2) High voting participation;

3) Consistent project launches.

Outlook for 2022

As crypto gains broader adoption in 2022, Layer 1 and multiple Layer 2 chains will continue to perform well due to their scalability. Winners will be determined by the quality and quantity of dApps, as well as seamless bridging with minimal withdrawal delays and fees—aligning with a multi-chain future.

Experiments with stablecoins increased in 2021, and adoption of non-USDT stablecoins on smaller chains improved. This suggests a continued decline in USDT’s market share in the coming year. A promising stablecoin that stood out in 2021 is TerraUSD (UST), whose market cap has surpassed $10 billion.

Demand for crypto assets from clients is likely to outpace regulatory developments. The biggest risk lies in wealth management, where clients can easily purchase crypto. Concerns about inflation and Federal Reserve actions are expected to weigh on the real economy in 2022, making crypto relatively more attractive.

As more institutions explore crypto markets, crypto lending and options are poised for institutional adoption. While few companies will hold BTC directly on balance sheets like Tesla or MicroStrategy, opportunities for using crypto as payment may eventually bring it into the mainstream. Additionally, we expect institutional holdings of crypto to flourish in 2022, potentially surpassing retail investors.

NFTs achieved mainstream breakthrough in 2021. Despite surging volumes, sustained interest from first-time buyers indicates a new market is forming. In 2022, we expect supply to catch up with demand, allowing the best projects to emerge as clear winners. Early signals show increasing investment in metaverse and gaming applications. However, the reality is that the NFT market thrives on innovation that is both exciting and unpredictable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News