AscendEX: 2021 Annual Review of the Cryptocurrency Industry

TechFlow Selected TechFlow Selected

AscendEX: 2021 Annual Review of the Cryptocurrency Industry

Over the past year, the cryptocurrency market has achieved "leapfrog" development.

By AscendEX

As we enter 2022, AscendEX looks back with you at the remarkable developments in the cryptocurrency industry over the past year and its global applications and evolution. As a crypto trading platform bridging CeFi & DeFi, AscendEX has become a solid link among users, institutional investors, and DeFi protocols. Leveraging this position, we aim to review key data and insights from the crypto industry over the past year through the lens of AscendEX’s milestones. We also share our unique perspectives on market trends and the future of the crypto market.

Market Highlights

Over the past year, the cryptocurrency market has seen "leapfrog" development. Although its supporters are still largely innovators and early adopters within the crypto space, it has gained significant mainstream attention in areas such as NFTs and payments. There is strong confidence that "this is the future," and this emerging asset class will continue to grow.

With rapidly increasing institutional participation, maturing new Layer-1 blockchain networks, and broad integration between DApps and virtual reality, participants in the crypto market firmly believe the crypto industry will shape a new world order in the future.

Institutional Participation

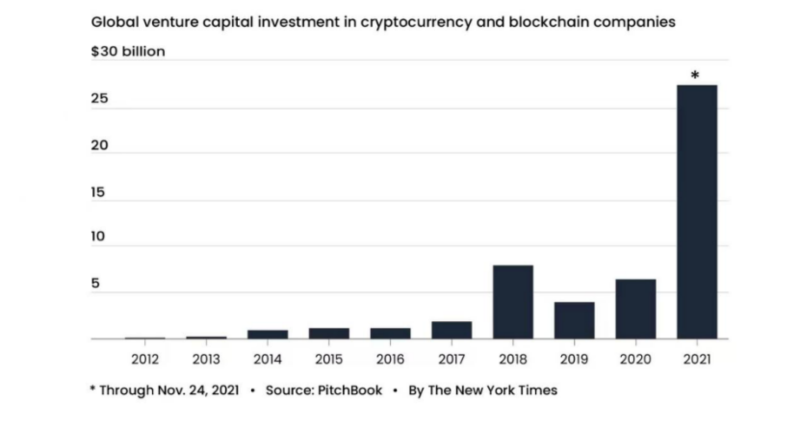

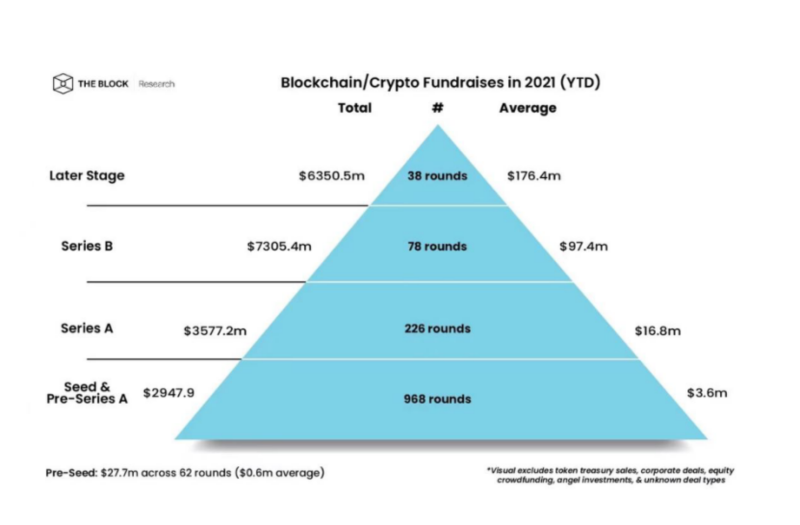

As awareness of cryptocurrencies grows, a wave of large-scale institutional involvement in blockchain development has emerged. One sign is traditional capital market players actively purchasing crypto blue-chip stocks, which have clearly become part of their macro and tech investment portfolios. Meanwhile, public crypto investment vehicles including ETPs and listed companies are gradually adding Bitcoin to their balance sheets. In the private market, venture capitalists have raised massive funds for deployment in the crypto space. Today, investment flowing into the crypto sector has reached record highs.

In Q3 2021 alone, venture investors deployed approximately $8.5 billion into cryptocurrency startups—the largest quarterly investment amount in crypto history. Many venture firms now manage billions of dollars in crypto assets. This investment trend accelerated further in Q4. Additionally, the number of crypto unicorns surged to over 60 in 2021, spanning exchanges, infrastructure firms, gaming companies, and more. Venture capital always invests around talent development, and similarly, talent gravitates toward capital. This creates a reflexive loop and broad convergence of talent, gradually driving overall industry advancement.

Entering a Multi-Chain World

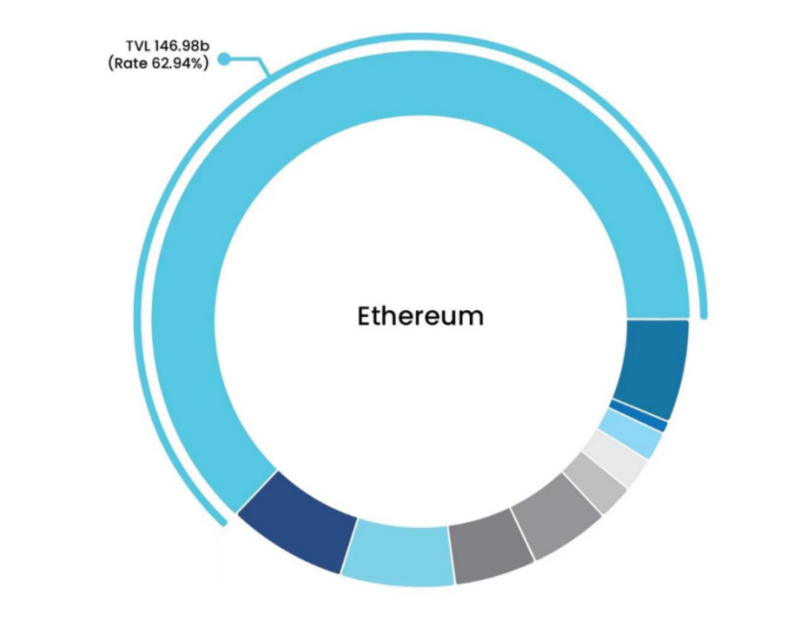

Following the "2020 DeFi Summer," attention and innovation around DeFi exploded—primarily on Ethereum. Just one year ago, Ethereum accounted for over 97% of total value locked (TVL) across all crypto projects. Over the past year, however, emerging blockchains and DeFi protocols have matured rapidly, leading to today's landscape of multiple interoperable blockchains coexisting.

Today, Ethereum’s TVL share stands at about 65%. While Ethereum remains dominant, the crypto market landscape is vastly different from 2020. Overall on-chain liquidity is increasingly fragmented, with many alternative EVM and non-EVM compatible blockchains capturing spillover value from Ethereum. High gas fees due to insufficient block space on Ethereum, along with rising demand for block space, have driven massive appreciation in L1 alternative ecosystems. As a result, investors, users, and developers are increasingly recognizing multi-chain parallelism as the future trend. Nevertheless, multi-chain development still lacks sufficient infrastructure and interoperability solutions. Thus, the multi-chain landscape requires more time to mature, and we must remain vigilant against ecosystem fragmentation.

As a cross-chain platform, AscendEX will continue supporting the diversification of L1 ecosystems and applications as the multi-chain world evolves.

(Link to graphic — https://defillama.com/chains, labels/keys can be found dynamically on the website)

Liquidity Wars

While interoperability helps tightly integrate the multi-chain world, it also intensifies competition among various L1s and decentralized apps for liquidity. Liquidity stems from developer and investor attention and assets. As competition between L1s and L2s intensifies, liquidity becomes the hottest commodity among protocols, each offering more and more unique incentives to attract it.

However, given the profit-driven nature of DeFi liquidity providers, TVL is actually a poor benchmark for protocol performance.

For example, major drivers behind changes in TVL across different L1s include dozens (or more) “ecosystem funds” launched by developer foundations such as Polygon, BSC, Avalanche, Harmony, and Fantom. Throughout 2021, TVL shifts repeatedly followed this pattern: an L1 or L2 network launches an “ecosystem fund” to bootstrap capital, funding developers to build apps on their chain and rewarding users who provide liquidity to native protocols. Most ecosystem funds were created to solve the classic “chicken-and-egg” problem—providing funds for builders and rewards for users. Protocols using liquidity mining to bootstrap soon realized financial incentives alone couldn’t bridge the gap between speculators and genuine users. After liquidity mining programs ended, profit-taking withdrawals (outflows in total value locked) spurred innovation in liquidity attraction methods—including protocol-controlled liquidity, discussed next in the “DeFi 2.0” section.

Although TVL has become a popular metric for measuring a DeFi protocol’s success relative to the broader ecosystem, this method has flaws and limitations. TVL simply reflects the total dollar value of collateral deposited into a given network (Ethereum, BSC, etc.) or application (UniSwap, AAVE, etc.). Since collateral assets dynamically move from one protocol to another, DeFi-native money markets often double-count liquidity.

Consider the scenario described by CoinMetrics:

1) A user deposits $1,500 worth of Wrapped Ether (WETH) into Maker and receives a $1,000 DAI loan (150% collateral ratio).

2) The user then deposits this newly minted DAI token plus another $1,000 worth of USDC into the Uniswap V2 USDC-DAI pool. In return, they receive LP tokens representing a $2,000 share of the pool’s liquidity.

3) The user then deposits these LP tokens back into Maker to obtain another $1,960 DAI loan (102% collateral ratio).

- Source: https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-0c0

In short, the flexibility of most DeFi applications allows assets to be easily re-collateralized and TVL repeatedly counted across multiple protocols. Although TVL is used as a benchmark for comparing protocols at specific points in time, the ease of redeeming leased liquidity—and the rapid shifts in TVL when yields decline—demonstrate that TVL does not fully reflect a protocol’s true liquidity picture.

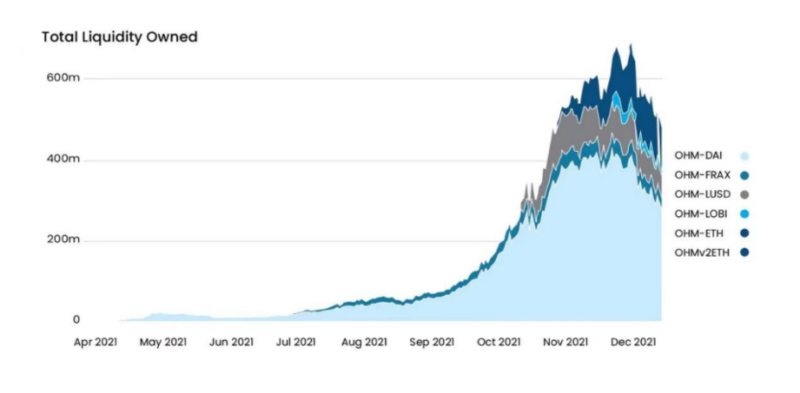

DeFi 2.0

In the final quarter of 2021, we observed stagnant TVL growth among DeFi 1.0 blue-chip decentralized apps like MakerDAO, Curve, AAVE, and Compound. While they won’t disappear anytime soon, we believe the next wave of DeFi growth will come from newer, more innovative protocols that emerged over the past year—so-called “DeFi 2.0.” Leading this new wave are innovations in protocol-controlled liquidity. Protocol-Controlled Value (PCV), pioneered by the Fei protocol, enables a protocol to own the assets locked within it, rather than individual liquidity providers. Instead of lending out collateralized assets or renting them for yield, PCV allows users to sell assets directly to the protocol. Over the past year, Olympus DAO has led this innovation by incentivizing users to bond their assets with the protocol in exchange for OHM—a non-pegged, backed reserve currency. Undoubtedly, OHM has become the most forked DeFi protocol to date, and we are closely monitoring this space. More importantly, we are optimistic about the potential of bonding-based liquidity in both emerging and existing crypto projects, as it may mitigate the negative impacts of profit-driven liquidity.

(Link: https://dune.xyz/queries/153224/303068)

Other Developments

Beyond the headline events of 2021, AscendEX has also been closely watching other significant developments. Everyone should form their own deep understanding of market dynamics; here we briefly highlight key future trends.

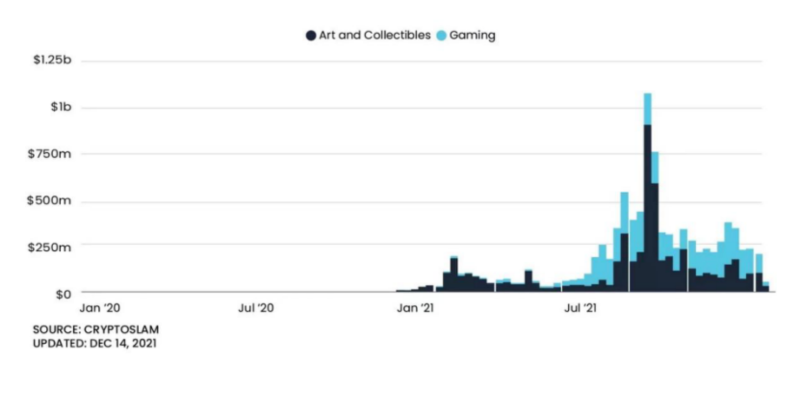

NFT — Although the first NFT token standard ERC-721 was created in 2018, over the past year NFTs have widely been seen as a major disruptor in digital ownership. Starting with JPEGs and profile pictures, the NFT market has rapidly evolved to cover a wide range of applications. Despite still being in early stages of infrastructure development, NFTs have successfully penetrated mainstream culture. This rapid pace suggests they will continue growing in 2022 and beyond, becoming a major contributor to value creation in the crypto economy.

Play-to-Earn & Metaverse — Play-to-Earn games like Axie Infinity achieved exceptional product-market fit, accumulating millions of users who can earn while playing. This trend gave rise to gaming guilds like Yield Guild Games, which gather talent and share revenue. Crypto-native Play-to-Earn games are innovating economic incentives—potentially starting a new trend that could push non-crypto-native game companies to build and integrate crypto elements into their games.

Web3.0 — Over the past year, the crypto industry underwent its greatest rebranding, gradually becoming part of the larger Web3.0 vision. Web3.0 is the next generation of the internet—the future of the web. Everything in Web3.0 is built upon decentralized, permissionless concepts where users and builders own the network, connected by tokens.

Major Protocol Upgrades

This year, both Bitcoin and Ethereum underwent two major upgrades—Taproot and the London Hard Fork—landmark milestones in their respective histories.

Taproot is Bitcoin’s latest network upgrade and its most important in four years. It enables complex multi-signature transactions and makes transaction verification faster and easier. The upgrade also blends single-signature and multi-signature transactions together, making it harder to identify inputs in Bitcoin network transactions.

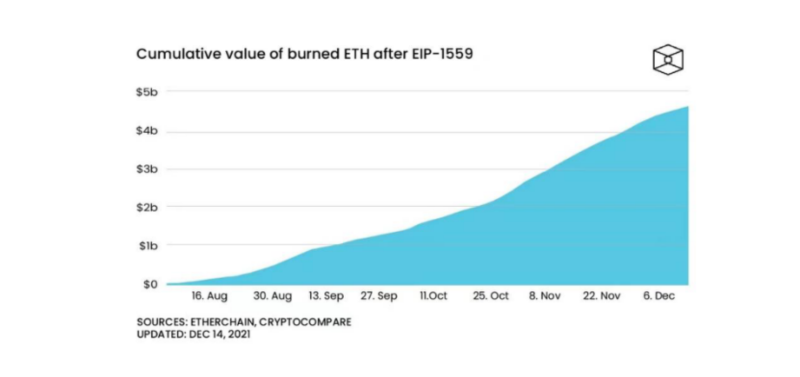

The London Hard Fork upgraded the Ethereum blockchain, incorporating five Ethereum Improvement Proposals (EIPs), including EIP-1559. EIP-1559 redesigned Ethereum’s fee market using a hybrid system of algorithmically determined base fees and optional tips. Previously, Ethereum used a first-price auction model where higher bids won. EIP-1559 aims to eliminate this uncertainty by pre-calculating block base fees based on congestion levels. Another notable improvement in EIP-1559 is the introduction of variable block sizes. Additionally, under EIP-1559, part of every transaction fee on Ethereum is burned, introducing a deflationary mechanism into Ethereum’s tokenomics.

Despite the high scale, value, and degree of decentralization of Bitcoin and Ethereum networks, they have proven resilient and capable of continuous improvement and upgrades amid rapid innovation across the broader ecosystem.

Scaling Solutions

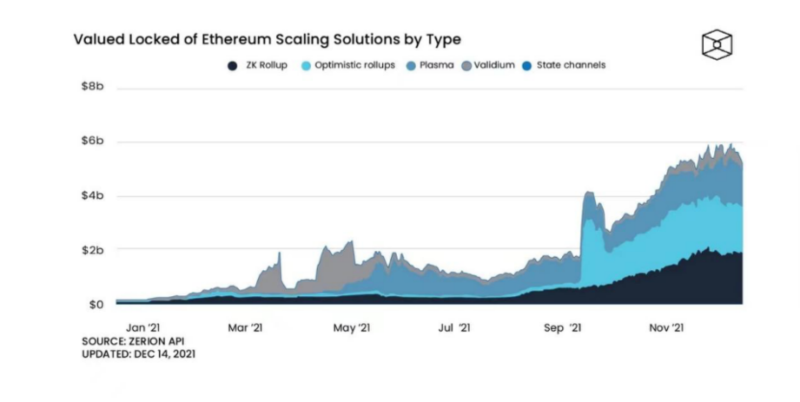

Beyond these protocol upgrades, scalable solutions designed to alleviate on-chain transaction drawbacks became a key theme in 2021.

The Lightning Network, one of the leading Bitcoin scaling solutions, enables off-chain transactions via state channels and began exponential growth in 2021. Although its mainnet launched in 2018, 2021 marked a breakthrough year for adoption, channel count, and capacity.

On Ethereum, numerous scaling solutions have gone live, including those using Optimistic Rollups, ZK Rollups, Validium, and Plasma technologies, fueling growth in Ethereum’s Layer-2 networks and successfully aggregating tens of billions in TVL. While Arbitrum, based on L2 Optimistic Rollup technology, maintained its lead with over $2.5 billion in TVL and 41% market share, ZK Rollup scaling solutions are gaining increasing traction. Currently, among the top 10 scaling solutions by TVL, four use ZK Rollups, four use Optimistic Rollups, and two use Validium. As various scaling solutions mature, we expect more centralized and decentralized participants in the crypto ecosystem to begin adopting them. Even as Ethereum’s merge and ETH 2.0 sharding transition approach, continued growth of alternative L1s and development of L2 solutions will keep pressuring Ethereum’s dominance. We anticipate Ethereum’s L1 dominance will decline in the future.

DAO (Decentralized Autonomous Organizations)

While there is still debate over the exact role DAOs will play, it is clear they will continue evolving and gradually build a future of distributed collaboration. Most DAO tools remain primitive, non-integrated, and often off-chain, with issues like extreme voter apathy. AscendEX continues to closely monitor how DAO user interaction and participation experiences will improve in the future, especially in innovative D2D (DAO-to-DAO) business models.

Established Incumbents

In a short time, we’ve seen mainstream institutions and enterprises that once ignored crypto gradually embrace a new paradigm. To facilitate the Web3.0 shift, incumbents in tech, finance, gaming, music, and other fields have begun strategic moves. Facebook rebranded to Meta; fintech and traditional financial firms accelerated integration into the crypto space; gaming companies recognized the importance of Play-to-Earn. These moves indicate corporations are speeding up their race for market dominance. As these companies begin disrupting business models in their respective sectors, each faces its own innovation dilemma. Who will successfully transition to the crypto economy, and who will lose to native crypto upstarts? That question remains unanswered.

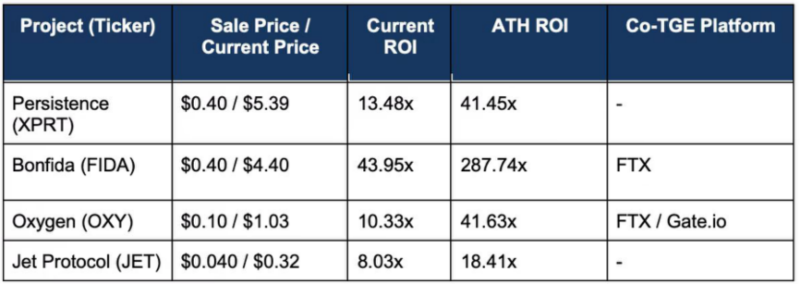

Year-End Review: AscendEX Highlights

AscendEX is renowned for its excellence in IEOs. We are committed to fulfilling our mission as a trading platform by providing users early access to outstanding ecosystem projects. Key auctions and listings include Persistence, Bonfida, O2, Jet Protocol, and others. Through AscendEX IEOs, these projects gain ample liquidity and achieve strong price performance, further solidifying AscendEX’s track record of curating high-quality projects. Based on historical data from all IEO projects, AscendEX’s current return on investment stands at 832%, with an average ATH (all-time high) ROI of 4,714%.

(Note: Current ROI calculated based on market cap as of December 17, 2021)

AscendEX Earn

Integrating projects directly into a centralized exchange’s underlying infrastructure (staking, lending, etc.) is one of AscendEX’s most powerful offerings. In summer 2021, AscendEX launched a comprehensive earning portal to help users efficiently and securely access high-yield DeFi opportunities. With AscendEX Earn, users can benefit from DeFi yields without directly interacting with Web3.0 protocols. AscendEX Earn abstracts away DeFi complexity, enabling users accustomed to centralized exchanges to seamlessly benefit from sophisticated DeFi innovations. With the rise of decentralized exchanges, AscendEX is pleased to achieve seamless integration with DeFi infrastructure, providing users a unified entry point to easily access and participate in the broader DeFi ecosystem.

AscendEX Milestones

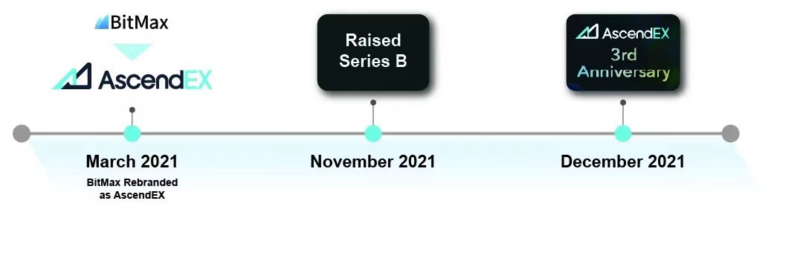

Beyond exciting IEOs, listings, and product launches, AscendEX achieved several key milestones over the past year. We’ve consistently focused on scaling and maturing the platform. In March 2021, the BitMax brand officially rebranded to AscendEX, reflecting our ambition to build a globally leading digital asset trading platform connecting CeFi & DeFi and Eastern and Western crypto markets. In November 2021, AscendEX announced a $50 million Series B funding round led by Polychain Capital and Hack VC, with participation from Jump Capital and Alameda Research. Shortly after, AscendEX celebrated its third anniversary.

As AscendEX has grown into a comprehensive financial services provider, we strive to support diverse innovations. We’re excited that this vision is gradually becoming reality through our initiatives, including Polkadot parachain auctions, Layer-2 integrations, and more IEOs!

Regarding AscendEX’s Recent Security Incident:

Following the security breach of AscendEX’s hot wallet (click for details), we have worked tirelessly to make the right decisions for our customers, minimize losses, and restore normal operations as quickly as possible. We have made full reimbursement of customer losses our top priority. Trading, staking, and mining activities remained unaffected throughout the incident until we could safely reopen deposits and withdrawals.

Cryptocurrency has its ups and downs, but we believe difficult times are crucial tests of an institution’s capabilities. We sincerely thank our partners and customers for their full support and immediate assistance. We see this incident as an opportunity to uphold our core values of transparency, resilience, and integrity. In 2022, as a global platform, we will continue striving for the next stage of growth and look forward to a brighter future with enhanced user trust.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News