Top-tier AscendEX: Forging a Path for Stable NFT Development with Financial Intelligence

TechFlow Selected TechFlow Selected

Top-tier AscendEX: Forging a Path for Stable NFT Development with Financial Intelligence

NFTs possess an extraordinary ability to bridge and integrate the physical world with the virtual digital realm, transforming diverse physical assets into corresponding cryptographic assets. Fueled by their non-fungible (unique) characteristics, the future potential of NFTs is truly不可小觑.

Recently, a research report released by Jefferies, a well-known Wall Street investment bank, indicated that the global NFT market could surpass $80 billion in value by 2025. The report also projected that this figure would exceed $35 billion in 2022 alone, with double-digit growth expected over the next five years.

Unstoppable Momentum! NFTs Sweep Across the Crypto Market

NFTs possess an extraordinary ability to bridge the physical and digital worlds, transforming diverse real-world assets into corresponding cryptographic assets. Fueled by their non-fungible (unique) characteristics, the future potential of NFTs is truly formidable.

According to industry reports, the NFT market developed relatively slowly since its inception in 2017, only beginning to show signs of growth in 2020. However, in 2021, the total transaction value of the global NFT market surged past $25 billion—nearly a 200-fold increase compared to previous years.

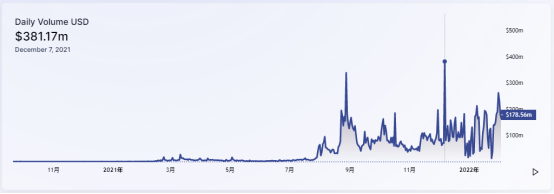

Data Source: DefiLlama - 0209

Data from DefiLlama shows that the global NFT market entered a period of "explosive growth" in 2021, reaching a record high daily trading volume of nearly $400 million on December 7. Another peak occurred on August 28, with a daily volume of $338 million. While 2022 has not yet seen any single day surpassing the previous year’s highs, the average daily trading volume has remained around $100 million.

Data Source: DefiLlama – 0209

In terms of total NFT trading volume, the project currently dominating the top spot is CryptoPunks, developed by U.S.-based game studio Larva Labs. As one of the earliest Ethereum-based crypto projects, CryptoPunks features over ten thousand unique, collectible pixel-art punk avatars. To date, it has generated nearly $2 billion in trading volume.

According to DappRadar, the highest recorded sale was CryptoPunk #4156—a monkey punk wearing a blue bandana—which sold for 2,500 ETH (approximately $10.26 million at the time). Incomplete statistics suggest that each individual CryptoPunk avatar now trades for no less than $500,000.

Following closely behind is the Bored Ape Yacht Club (BAYC), the ape-themed collection famously embraced by NBA star Stephen Curry. With a total of 10,000 uniquely designed apes differing in attire, hairstyle, and color schemes, BAYC has surpassed $1 billion in total trading volume, with the current floor price approaching $300,000 per piece.

Interestingly, the third-ranked Mutant Ape Yacht Club emerged as a surprising force. Triggered by Yuga Labs’ “mystery serum,” Bored Apes transformed into Mutant Apes. These boldly styled, eccentric apes reignited enthusiasm within the “ape” NFT ecosystem shortly after launch.

Since their release in August of last year, the 20,000 Mutant Apes swept through the NFT market, achieving daily trading volumes nearing 5,000 ETH (peaking at approximately $21.71 million) in November and December of last year, as well as January this year. To date, the Mutant Ape collection has exceeded $420 million in total trading volume, with the current floor price surpassing $60,000.

Among the “Top 5,” CLONE X launched in November 2021 as a collaborative NFT project with renowned Japanese artist Takashi Murakami. Featuring innovative, vividly colored 3D designs and classic anime-inspired aesthetics, CLONE X achieved remarkable success upon release, recording a single-day sales volume of 15,475 ETH (worth about $63.91 million at the time) on December 13 of the previous year.

Additionally, Loot, which debuted in August of last year with nothing more than a black background and a few words, gained astonishing popularity. This minimalist NFT allows users to mint by paying gas fees. Its open-ended concept attracted many early adopters eager to explore new NFT paradigms. On September 2 alone, Loot achieved an impressive trading volume of 16,095 ETH (approximately $61.61 million at the time).

Ethereum Holds Steady, Solana Emerges Strong

As NFT projects proliferate rapidly, the blockchain networks supporting them are also expanding in scale and diversity. While Ethereum still maintains dominance, the rise of emerging blockchain platforms is creating a vibrant, diversified landscape that complements the evolution of NFTs.

In fact, veteran investment bank JPMorgan recently highlighted this trend in a report, noting that Ethereum's leading position in the NFT ecosystem is gradually eroding due to issues like network congestion and high gas fees. The report further emphasized that Solana, as one of Ethereum’s main competitors, is steadily capturing market share in the NFT space.

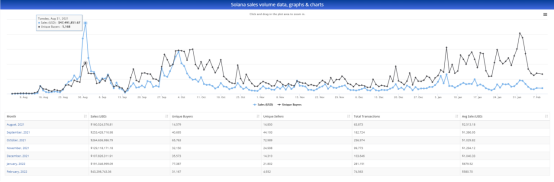

Data Source: CryptoSlam – 0209

Looking at the composition of NFT projects on the Solana blockchain, its ecosystem is already taking shape, encompassing NFT-based gaming, social, and trading platforms. In terms of value creation, data from CryptoSlam shows that since their emergence in August of last year, Solana-based NFT projects have achieved an average monthly trading volume of around $180 million, accumulating over $1.1 billion in total trading volume by January this year.

Notably, in October 2021, Solana set a record high for monthly NFT trading volume at $264 million. Although this pales in comparison to Ethereum’s $1.89 billion during the same period, such achievement within just two months marks Solana as a rising force to be reckoned with in the blockchain arena.

AscendEX: Capturing the Essence of the NFT Market with Professional Financial Insight

Drawing on years of experience in traditional finance, AscendEX (asdx.plus) continues to seek out new opportunities for value creation in the burgeoning "blue ocean" of the crypto market. Solana, having emerged as a shining star—particularly during the DeFi boom—is one such opportunity.

In August 2020, AscendEX became one of the first platforms to fully support the development of the Solana ecosystem. Through innovative initial auction offerings, several standout "dark horse" projects were selected and delivered exceptional market performance, achieving remarkable listing gains including SRM (+4,682.35%), OXY (+4,060%), FIDA (+1,900%), and AKT (+1,669.23%).

In response to the explosive rise of NFTs, AscendEX remains actively engaged while promoting sustainable development. The platform carefully evaluates the continuity and value stability of the NFT market, while leveraging the advantages of centralized exchanges to develop innovative product solutions tailored for NFTs.

Technically speaking, NFTs differ significantly from uniform cryptocurrencies like BTC and ETH. Beyond the inherent value of digital art, much of an NFT’s market appreciation stems from community recognition and consensus among holders and enthusiasts. As such, the NFT market inevitably harbors various instabilities and uncertainties.

However, as a key vehicle for value transfer within the metaverse and GameFi ecosystems, NFTs are becoming essential components in virtual worlds and gaming environments. Whether viewed as digital goods or value instruments, NFTs are poised to shine steadily within smart contract-driven digital economies.

As a centralized crypto-financial platform, AscendEX leverages core NFT attributes—generatability, verifiability, tradability, accessibility, transparent circulation, and immutability—to create broad and diverse innovation opportunities across minting, purchasing, trading, and collecting processes. Furthermore, based on the distinct characteristics of different NFT categories, specialized business modules can be developed for art, collectibles, in-game items, and virtual assets.

Thanks to the operational agility, efficient cost management, and user-centric design of centralized platforms, participants can acquire and trade NFTs at lower costs, with continuous improvements being made to refine functionality, trading experiences, and information display through iterative updates.

Moreover, beyond existing partnerships, centralized platforms can foster diversified and interconnected NFT business models using platform tokens and major cryptocurrencies. Refined operations will also include NFT education, user guides, and targeted promotional campaigns—all aimed at lowering barriers to entry.

Additionally, thanks to robust technical infrastructure and integrated multi-chain networks, platforms can offer high-concurrency trading environments and fast network transmission. Through innovative mechanisms, users may access valuable opportunities at low participation costs, while NFT projects gain favorable collaboration prospects by integrating with the platform.

More importantly, NFT projects vetted and selected by centralized platforms are unlikely to include obscure issuers, technically unsound or underfunded "fake projects," or marginal categories lacking appreciation potential. As more traditional institutions and enterprises enter the NFT space, broader platform collaborations could help bridge emerging concepts like the metaverse and GameFi, jointly advancing a highly creative and expansive NFT ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News