Dragonfly Capital Partner: Blockchain is more like a city

TechFlow Selected TechFlow Selected

Dragonfly Capital Partner: Blockchain is more like a city

The network is a flawed analogy for blockchain, as blockchains are constrained by physical limitations. Blockchains cannot scale to infinite block space because they require many independent small validators; if blocks were arbitrarily large, blockchains would cease to be decentralized. Smart contract chains are more like cities.

Author: Haseeb Qureshi, Dragonfly Capital

Translation: Block Unicorn

Will we live in a multi-chain world, or will there be “one chain to rule them all”? That depends on your mental model of blockchains.

People often describe L1 blockchains as networks—like the Ethereum network, Solana network. This implies that blockchains can scale infinitely, just like the internet, Telegram, or Facebook.

If blockchains are networks, then network effects will dominate, and one blockchain will win.

But networks are a flawed analogy for blockchains—they face physical constraints. Blockchains cannot scale to infinite block space because they require many independent small validators; if blocks grew arbitrarily large, blockchains would no longer be decentralized.

Smart contract chains are more like cities. If you accept this mental model, then the dynamics around L1 blockchains become far less mysterious.

Everyone loves to complain about Ethereum.

It's expensive. It's crowded, slow, built long ago, nothing works quite as it should, and improvements seem impossible. It’s so absurdly costly that only the wealthy can afford to transact there.

Ethereum is New York City.

New York

Of course, New York is where things happen! It has all the biggest banks, most billionaires, hottest brands and celebrities. Likewise, Ethereum hosts all the largest DeFi protocols, most TVL, hottest DAOs and NFTs.

But it's expensive—if you're an up-and-comer, you’re priced out. Maybe you could have gotten rich if you bought assets early. But today, prices will eat you alive, and there simply isn't enough room for everyone. Billionaires might be fine, but the next generation will have to go elsewhere.

So how do you scale New York?

Three ways to scale a city:

Path #1: Build Up.

Land may be limited, but you can always build vertically. By constructing taller buildings, you can accommodate more people on the same land.

But building up isn’t a complete solution—there’s a limit to skyscraper height, and even tall buildings don’t escape the congestion of the underlying city. If I live on a high floor in Manhattan and you live on another, and I want to visit you, I must descend to the ground floor, hail an expensive taxi, and battle Manhattan traffic—we haven’t escaped the fundamental constraint: Manhattan is crowded.

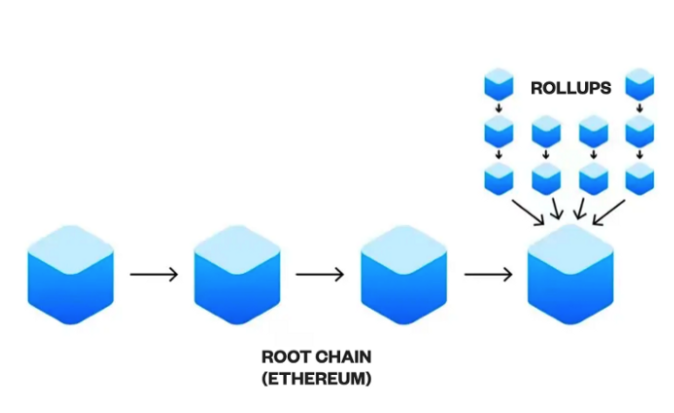

L2s and rollups are the blockchain equivalent of skyscrapers. Each rollup is like a vertical blockchain extending upward from the base L1. There’s plenty of space in rollups! But to access one rollup from another, you must exit back down to Ethereum and deal with its underlying traffic.

Building up helps—it lets more people into the city—but it’s not a full answer. If Ethereum is congested now, it will remain congested beneath the rollups (the billionaires can stay on L1 and pay fees). So how else can we scale blockchains?

Path #2: The "Interoperability Network".

Such as Polkadot or Cosmos. Polkadot and Cosmos provide SDKs for developers to launch application-specific blockchains—small chains dedicated to a single app. All these blockchains are connected via routing systems—the relay chain in Polkadot, the Cosmos Hub in Cosmos.

In the city analogy, this is like creating a network of small towns each doing one thing. Here’s a mining town, there’s a cluster of factories, an agricultural town, then a town just for direct retail. Each is connected along a massive highway system.

A factory town in Sin City

This works to some extent, and some places will be built this way. Factory and farming towns have their place, but they aren’t where most people live and do business. You need more than a few small towns to absorb a growing population.

Path #3: Build Another City

The last remaining way to scale a city: build another one. This is what Solana, Avalanche, and NEAR each did.

When you build a new city, you must first replicate massive infrastructure. It seems redundant. Every new city needs another road, police station, school, hospital. Similarly, every new L1 needs another block explorer, fiat on-ramp, native AMM, NFT marketplace. It’s redundant, but each L1 needs these basics to get started.

But the benefit of building a new city is that each can be built differently.

Take Solana—as LA. Compared to Manhattan, it’s big, wide, and cheap. You can be a struggling actor and still make it in LA! Ignore East Coast obsession with decentralization—move your app to Solana, launch your NFT, and get 10 minutes of fame.

Manhattan

Sure, Solana isn’t the most decentralized. But games and NFTs don’t need much decentralization at first. The weather is nice, fees are low, and nobody takes themselves too seriously.

What about Avalanche? I’d say Avalanche is Chicago—trying to be the next Wall Street, but newer, cheaper, and more aggressive. It’s cold there, but Avalanche’s expertise in finance and trading makes the city vibrant and confident—it’s hard not to bet on it rising.

Chicago

NEAR is San Francisco—built for web3 technologists. It’s an idealistic city full of people trying to realize the dream of Ethereum 3.0. In their view, sharding is the only sustainable long-term path forward.

San Francisco

The importance of these cities lies not just in their size and openness to commerce, but in the fact that each has a different vision for what a city should be and how it should be governed. They each embrace different trade-offs, uphold unique values, and attract distinct industries.

So will we live in a multi-chain world, or will there be “one chain to rule them all”? Reframe the question: Will we live in a multi-city world, or will one city rule them all?

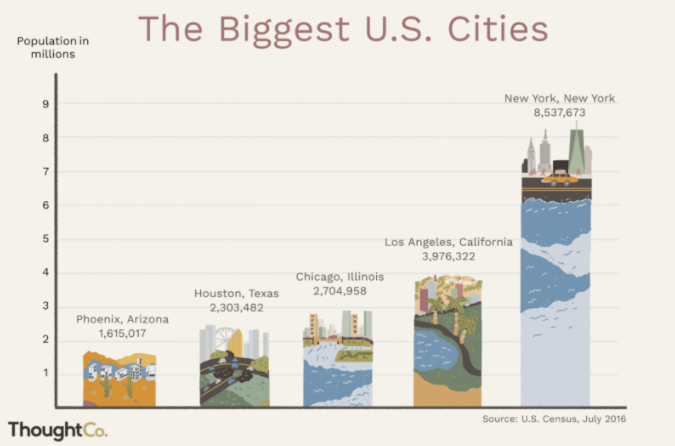

The answer is obvious—cities follow a power-law distribution (another interpretation: Matthew effect), but many cities matter. No analogy is perfect. Yet I find this mental model highly useful for predicting how L1s will evolve.

I’ll leave you with six predictions from this model:

1. The future will be multi-chain.

2. Ethereum will likely be the most valuable chain, because—as a famous bank robber once said—that’s where the money is.

3. Other L1s will also be valuable, but they will continue to diverge. New York, Los Angeles, Chicago, and Houston endure as great cities because their institutions and cultures differ.

4. L2s are important—skyscraper technology is essential for scaling any city—but they’re not the end of the story. L2s are “and,” not “or.”

5. Application-specific blockchains will remain niche.

6. In the real world, transportation accounts for nearly half of housing GDP. If we see something similar in crypto, cross-chain bridges will become extremely valuable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News