Economics PhD: Outlook for the next 6 months in crypto, high volatility, Bitcoin dominance continues to decline

TechFlow Selected TechFlow Selected

Economics PhD: Outlook for the next 6 months in crypto, high volatility, Bitcoin dominance continues to decline

At the end of the previous cryptocurrency cycle, existing liquidity flowed from large-cap stocks into smaller "altcoins," causing these altcoins' liquidity to exceed fundamentals, resulting in a sharp decline in Bitcoin's dominance that marked the end of the prior cycle.

Author: Tascha

Translation: TechFlow

The entire crypto market has seen no growth over the past six months, and will face more resistance in the next six.

But if you know where to look, opportunities still exist.

Below is my outlook for the coming market.

First, from a speculative flow perspective, price appreciation in large-cap assets like BTC and ETH depends almost entirely on new capital entering the cryptocurrency space. They are the gateway for new participants, and their gains subsequently flow into other tokens.

BTC and ETH account for 60% of the total crypto market cap. Their weak price performance over the past six months indicates minimal inflow of new capital.

This assessment is further supported by the lackluster growth in open interest for BTC derivatives during the same period.

When I say “small,” I don’t mean zero. Given the growing socioeconomic impact of cryptocurrencies, there will clearly always be some new capital flowing in. And institutional players do exist.

But the beast itself has grown much larger. In early 2021, the crypto market was valued at $800 billion; it now exceeds $2 trillion. To achieve similar growth rates, this beast now requires significantly more "food" than it did a year ago.

In other words, unless capital inflows accelerate, BTC and ETH are unlikely to reach new highs.

Why Isn't Capital Inflow Accelerating?

1) We’ve been in a crypto bull market for three years. The capital willing and able to go long on this market in the short term has already done so. Remaining inflows are steady and incremental.

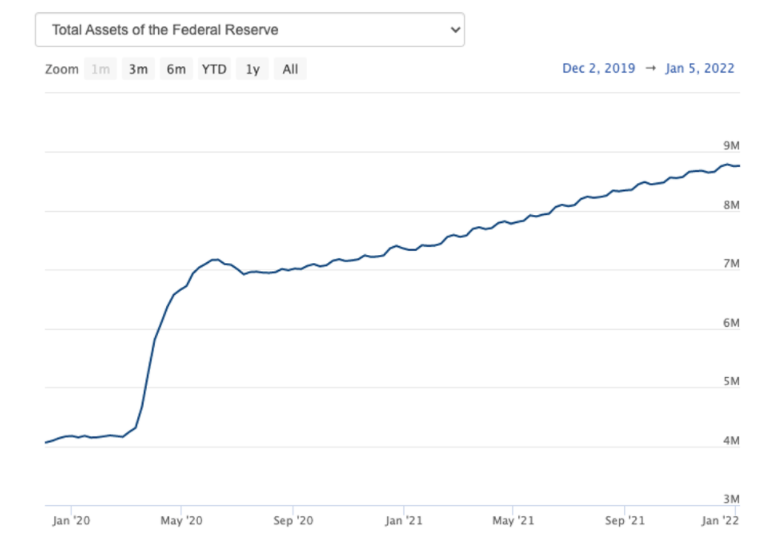

2) Looking deeper—the Fed's liquidity supply isn’t accelerating. If anything, the expansion of the Fed’s balance sheet has slowed.

Will we see accelerated capital inflows in the next six months? The answer is almost certainly no.

With strong U.S. economic conditions, the Fed is tightening monetary policy. Tightening has already begun, with at least three rate hikes expected in 2022–23. Central banks across Asia (except China) may follow suit. (Some countries, such as South Korea, have already raised rates.)

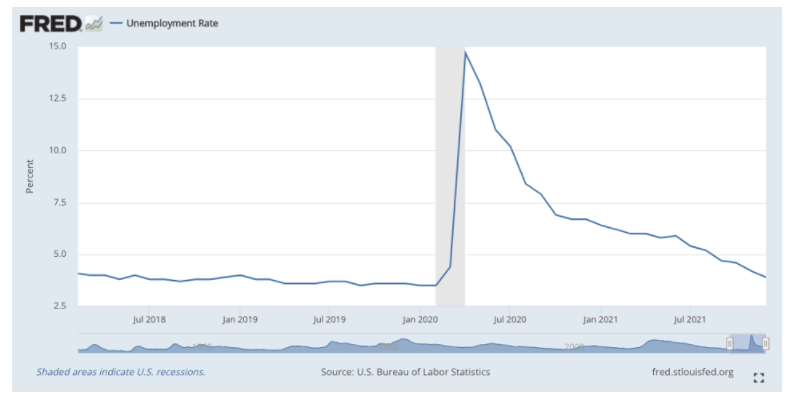

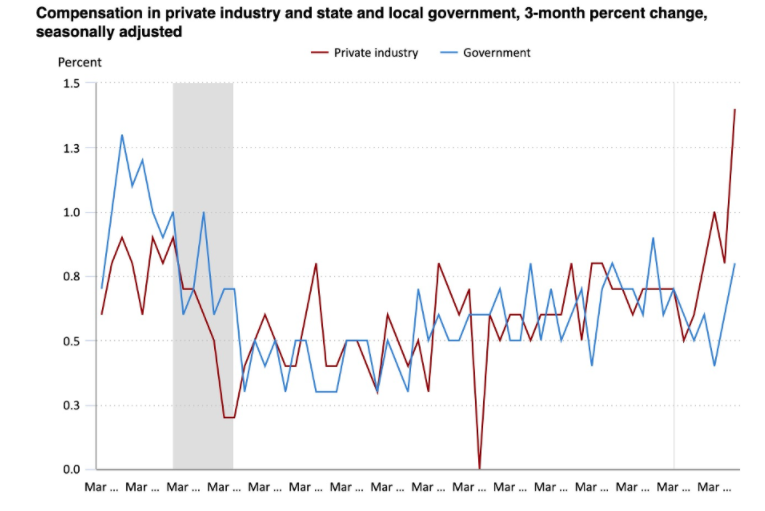

Inflation and economic pressures in the U.S. and elsewhere are primarily driven by pandemic-related supply bottlenecks. But unlike many other nations, demand in the U.S. is also heating up—partly due to government stimulus during the pandemic.

U.S. unemployment has fallen rapidly and is now close to pre-pandemic levels.

Wage growth is at its highest level since the 2008 financial crisis.

From an inflation and business cycle standpoint, monetary tightening is fully justified, and the Fed is expected to maintain this policy over the next six months.

Since BTC and ETH performance relies heavily on accelerated inflows of new capital—and no such acceleration is visible on the horizon—the best we can expect from these two is sideways movement. (As I mentioned earlier, ETH faces additional bearish factors.)

Moreover, until the pace of Fed tightening becomes clearer, markets will remain tense. Sudden sell-offs of 15–30% should not be surprising.

However, if you believe that a deteriorating macro backdrop only means long investors cannot profit over the next six months, you need to think again.

Despite the lack of momentum in large caps, we’ve already seen the rise of a new generation of alt L1s and other projects. If you held Sol, Avax, and Luna in 2021, your portfolio is likely still near all-time highs.

(Though once SoLunAvax becomes a meme, you’ll know the market is ready to rotate elsewhere. Are you adapting?)

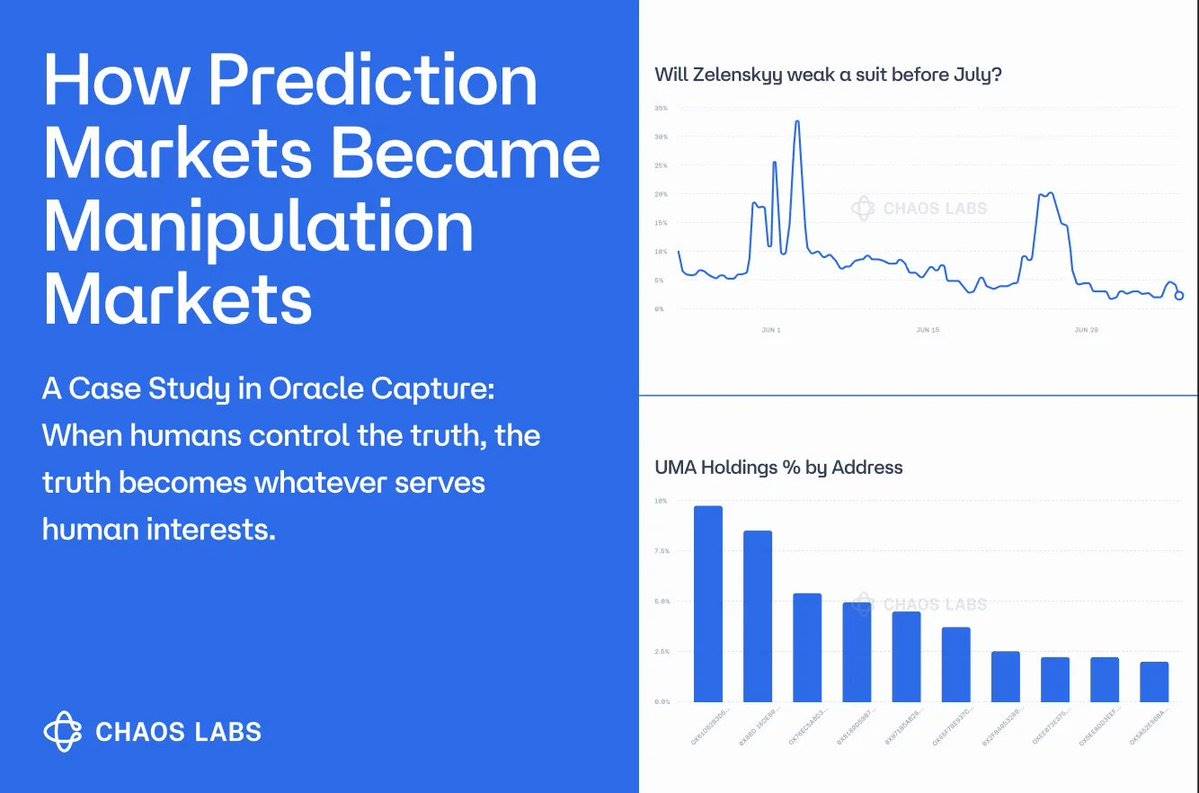

At the end of previous crypto cycles, existing liquidity flowed from large caps to smaller "altcoins," driving those altcoins’ valuations far beyond fundamentals—leading to sharp declines in Bitcoin dominance.

Yet over the past six months, Bitcoin’s dominance has barely declined—sharply contrasting with previous cycles—even as assets like SoLunAvax soared. Why?

(By the way, has it always been this way? I write personal insights on investing, macro, and human potential. Subscribe to my newsletter for updates.)

Part of the reason lies in the poor performance of ETH—the largest non-Bitcoin token. High gas fees have hindered Ethereum’s usage growth, a situation unlikely to change soon (refer again to my ETH article).

Although alt L1s have surged by countless percentages, they started from near-zero and remain small. Meanwhile, older-generation altcoins, despite once having significant market caps, are suffering heavy losses due to falling behind.

Thus, despite substantial development in web3 in 2021, with developers and users flocking to new chains and projects, Bitcoin’s dominance has changed little. Do you find this fair? Neither do I.

I believe we’re still miles away from the end of this "cycle," when we’ll finally see a sharp drop in Bitcoin’s dominance. The crypto market still has ample liquidity to make this happen.

All it needs is continued circulation of existing capital within crypto—then re-circulation. For promising new projects, given their small size, this won’t take long.

Take second-tier alt L1s like Cosmos, Algorand, Near, Fantom, Elrond, and Harmony. Though they’ve grown substantially, their combined market cap is only $43 billion. If BTC prices remain flat, each would need to grow another 350% for Bitcoin’s dominance to fall from 40% to 20%.

Note: I’m not suggesting only these will grow. This is merely to illustrate what kind of price increases in tier-2 and tier-3 alts would imply a major drop in Bitcoin dominance.

Therefore, I am positioning myself in promising projects where existing liquidity might flow over the next six months. What are these projects? As I wrote before: 1) crypto gaming, 2) interoperability/multi-chain solutions, 3) alt L1s/L2s.

For point 3), if you're focused on short-term gains, you may want to look beyond SoLunAvax at Layer 2 plays. But if you're holding for over a year, you might not need to worry about timing.

Still, since BTC and ETH are essentially funding sources for other tokens, if the gates fall, everything downstream suffers. And we’re in a macro environment where sharp downside volatility is increasingly common.

Nevertheless, adoption of crypto technology hasn’t stopped. Even if capital inflows don’t accelerate in the short term, I still expect sufficient inflows to support BTC and ETH prices—just not push them to new highs.

In summary:

1. Expect higher volatility and more sudden crashes over the next six months

2. Bitcoin and ETH are unlikely to reach new highs

3. Rotation into high-risk/high-reward projects is underway

4. Growth in gaming / alt L1s & L2s / interoperability projects will continue to reduce Bitcoin dominance

TechFlow is a community-driven platform dedicated to delivering valuable information and thoughtful perspectives.

Community:

WeChat Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: TechFlowPost

To join our WeChat group, add assistant WeChat: TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News