Next-Door Neighbors with a Chain: A Deep Dive into the Terra Ecosystem

TechFlow Selected TechFlow Selected

Next-Door Neighbors with a Chain: A Deep Dive into the Terra Ecosystem

This article will provide a detailed explanation of the token economics of Terra, Mirror, and Anchor, highlighting their considerable complexity.

Author: Florian Strauf

Translation: TechFlow

In simple terms, Terra provides a decentralized algorithmic stablecoin.

To ensure its stablecoin has real-world utility, Terra has built an entire ecosystem around it.

This ecosystem currently includes a payment application (Chai), a savings protocol (Anchor), and a synthetic stock market (Mirror), with an insurance protocol (Ozone) soon to be launched—all using Terra's stablecoins and thereby increasing their demand.

Chai is a mobile wallet app in South Korea that allows users to make payments in Korean Won at local stores. Transactions are processed in the background via the Terra blockchain, and transaction fees go to the Terra network instead of Visa or Mastercard. Compared to traditional bank accounts, Chai offers much faster settlement times from merchants to users’ wallets and significantly lower transaction fees.

Chai currently has 2.5 million users, with approximately 60,000 daily active users, and processed around $42 million in transaction volume in June 2021. While its real-world usage still lags far behind giants like Visa and Mastercard, it already surpasses most other cryptocurrency projects by a wide margin.

This article will detail the tokenomics of Terra, Mirror, and Anchor, highlighting their considerable complexity.

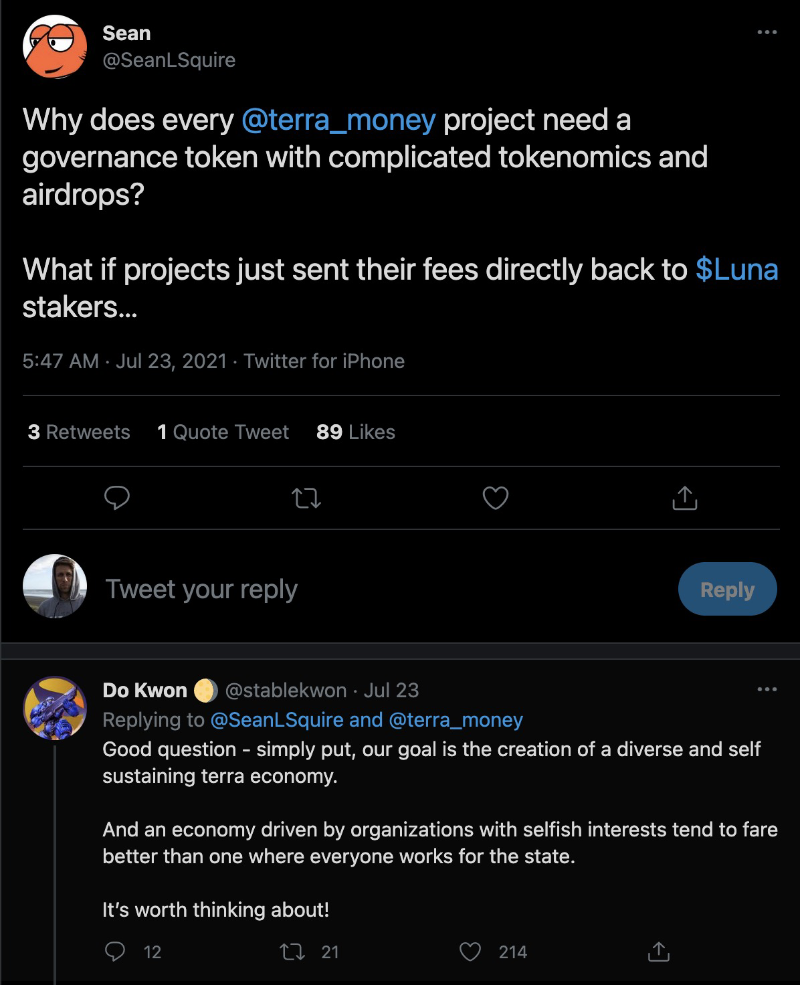

One might ask: why use multiple tokens and protocols?

Compared to an all-in-one solution, this approach clearly increases design complexity.

Do Kwon, one of Terra’s co-founders, offered a clear explanation: Our goal is to create a diverse and self-sustaining Terra economy.

“An economy composed of individuals pursuing their own interests often performs better than one where everyone works for the state.”

Terra / Luna

Terra refers to the stablecoin, while Luna is the reserve or governance token used to peg Terra. It forms the core of the Terra ecosystem, designed to grow beyond its native chain by enabling multiple stablecoins across other ecosystems (such as Solana)—a mechanism more complex than those of Ethereum or Bitcoin.

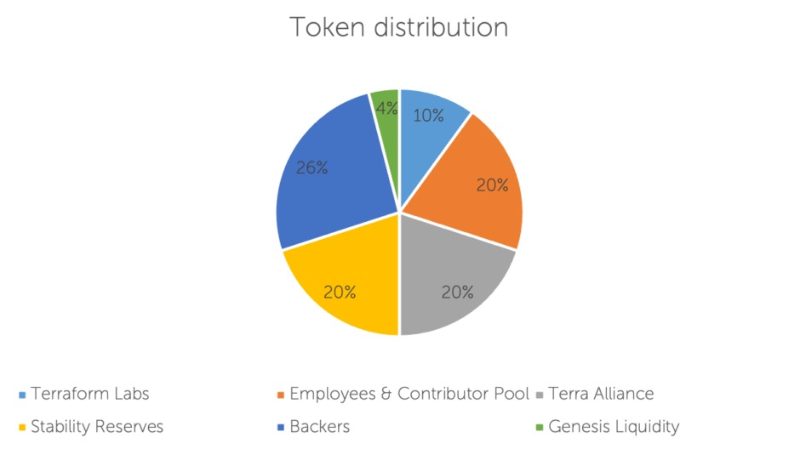

Luna had an initial supply of 1 billion, allocated as follows:

The stable reserve tokens are intended to manage early network stability and allow intervention by injecting Luna when necessary. For example, if demand rises sharply, the Terra team can burn Luna from reserves to mint additional Terra (explained in more detail below).

Terra can be pegged to multiple fiat currencies and has already achieved pegs with major global currencies. The USD-pegged UST holds the largest market cap and trading volume, while the KRW-pegged KWT is used within the Chai payment app. This article explains the mechanism using UST as an example, though the same logic applies to other Terra stablecoins.

Whenever there is strong demand for UST, protocol market makers create arbitrage opportunities through Terra mining. High demand causes UST’s market price to rise above its $1 peg. Arbitrageurs can then use Luna to mint UST at a 1:1 rate and sell the newly minted UST at a premium on the open market. A portion of the used Luna is burned, while the remainder goes into the treasury or foreign exchange reserve.

This process continues until sufficient supply brings UST back to its peg.

The contraction mechanism works in reverse. When UST trades below $1, arbitrageurs can buy discounted UST on the market and redeem it for Luna at a 1:1 rate. The redeemed UST is burned, reducing supply until the price returns to the peg.

Contraction may introduce large amounts of Luna into circulation, potentially driving down its price. The Terra protocol aims for growth driven by real-world economic usage. Holders who believe in this vision must endure short-term volatility in exchange for long-term ecosystem development, wider UST adoption, and increasing scarcity and value of Luna.

Seigniorage is used to pay validators acting as exchange rate oracles, maintain ecosystem stability, and fund fiscal stimulus. In the upcoming Columbus-5 upgrade, seigniorage will be burned.

Validators vote on the exchange rates between Terra and its pegged fiat currencies. Accurate votes are rewarded; inaccurate ones are penalized.

Transaction fees consist of miner fees and taxes. Miner fees are set by validators to prevent spam. Taxes are determined by the protocol and can be adjusted via voting, up to a maximum of 1%.

Validators run full nodes and sign transactions into blocks. They earn transaction fees as rewards. Inflationary mining rewards are not used for staking rewards. Only the top 130 validators with the highest stake and meeting activity requirements receive fee rewards. Those violating security or activity rules may face slashing penalties.

Luna holders can delegate their tokens to validators to earn rewards (approximately 10% annually), contributing to total staked amount without running a node themselves. Delegated validators take a commission from rewards before passing the rest to delegators.

The treasury collects Luna from seigniorage and can distribute it as fiscal stimulus to support applications within the Terra ecosystem. Treasury fund allocation requires proposals and approval by validator voting. The idea is to stimulate economic growth by supporting ecosystem applications.

Mirror

The Mirror protocol brings synthetic assets to the Terra ecosystem—digital replicas of real-world stocks. It enables investors outside the U.S. to gain exposure to American equities. Built around UST usage, Mirror also has its own governance token, MIR.

mAssets track the prices of real-world stocks listed on Nasdaq and are backed by collateral. Users wishing to list an mAsset for mining must provide over-collateralization at a specified ratio above the asset’s current value.

Qualified users can hold or trade mAssets on Terraswap. Trading and holding occur even outside regular market hours. If an mAsset’s price deviates significantly from its underlying asset, arbitrage incentives help restore price alignment.

Collateral is deposited into a Collateralized Debt Position (CDP), which monitors the collateral ratio. If the asset price rises too high without additional collateral, the position is liquidated. MIR, UST, mAssets, ANC, and LUNA are all accepted as collateral.

Mirror includes built-in oracles that are incentivized or penalized based on the accuracy of reported asset prices.

Mirror has a governance system responsible for deciding which mAssets are whitelisted for mining.

Stakers with locked positions are eligible to participate in governance. They can vote and earn staking rewards in MIR (APR).

MIR staking is funded by a 1.5% protocol fee. This fee is charged each time funds are withdrawn from a CDP.

Contract collectors receive the 1.5% fee in UST and sell it on Terraswap to buy MIR, creating demand to balance supply against staking rewards.

A second form of staking involves liquidity provider (LP) tokens earned from swap mining. LPs receive tokens representing their share of a liquidity pool. By staking these LP tokens, they earn MIR rewards—a stronger incentive than standard trading fees (i.e., yield farming).

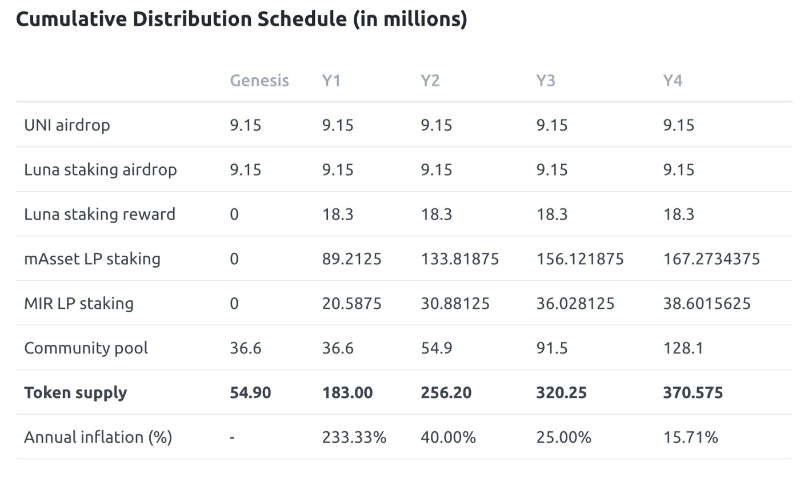

These liquidity staking rewards are funded by the initial token supply, distributed among multiple parties and fully paid out over four years.

Like real stock markets, Mirror allows users to short assets. The CDP structure itself functions as a short position. If the price of an mAsset backed by 200% collateral rises, users must deposit more collateral to maintain the 200% ratio—just like covering a short in traditional finance. Failure to maintain the ratio triggers liquidation and auction of the position.

Anchor

If Mirror is the stock market, Anchor is the fixed-income counterpart. It offers a fixed annual return of 19% on deposits of UST or other Terra stablecoins—an unusually high guaranteed yield compared to other protocols. This yield comes from:

Depositing Terra stablecoins such as UST or KRT earns a fixed 19% annual interest. Stablecoin deposits are pooled together, and depositors receive Terra-based tokens representing their share of the pool along with claim rights to interest earnings.

Anchor aims to maintain a deposit rate around 19%, achieved by drawing subsidies from a yield reserve and incentivizing borrowers to deposit more assets when needed.

Borrowers receive ANC, Anchor’s governance token, as a reward for borrowing—often offsetting loan interest costs. This is possible because the project initially issued ANC tokens to bootstrap the ecosystem. In later stages, such rewards will be funded by the yield reserve when necessary.

The yield reserve accumulates excess returns in Terra stablecoins and converts them into ANC tokens via Terraswap. This creates demand and balances the supply generated by rewarding stakers, liquidity providers, and borrowers. The yield reserve only supplies tokens when needed. During periods of high supply, surplus yields are collected and redistributed as incentives.

Borrowers can take out loans in Terra stablecoins by paying interest and posting collateral. Collateral is deposited in the form of bAssets—tokens representing staked assets in proof-of-stake protocols. Currently, only Luna is supported, but integration of other staked assets is planned.

bAssets require over-collateralization to ensure liquidity. As staked assets, bAssets generate staking rewards. These rewards are captured by the Anchor protocol and either directed to the yield reserve or distributed as staking rewards. This constitutes a major revenue stream for Anchor. Although loans are capped at a fraction of the collateral value, Anchor earns staking rewards exceeding 200% of the loan amount.

Liquidators monitor collateral ratios. If borrowers fail to maintain required ratios by adding more collateral, their positions are partially or fully liquidated. In such cases, 1% of the collateral is transferred to the yield reserve.

The yield reserve also funds staking rewards for ANC holders (currently at 5.8% APR) and enables token holders to participate in protocol governance.

Like Mirror, Anchor relies on ANC liquidity on Terraswap. Liquidity providers for the ANC:UST pair currently earn around 38% APR, partially subsidized by the initial token supply.

The initial total supply of 1 billion ANC is spread over the first four years, with most of it allocated to incentivize borrowers and oracle feeders to keep bAsset prices updated and maintain accurate collateral ratios.

*TechFlow is a research and investment insights platform under TechFlow. The views expressed herein do not constitute financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News