THORChain Lending: Unveiling the Shadow of Terra LUNA

TechFlow Selected TechFlow Selected

THORChain Lending: Unveiling the Shadow of Terra LUNA

The lending protocol has implemented strict risk controls and risk isolation measures, resulting in relatively low overall risk that will not lead to systemic risks similar to Terra LUNA.

Author: Yilan, LD Capital

Introduction

By diving deep into Thorchain's newly launched lending module on August 22, we detect echoes of Terra LUNA. The similarity with LUNA primarily lies in the fact that user-provided collateral is converted into RUNE, and it is the fluctuation in the RUNE-collateral exchange rate that determines RUNE’s inflation or deflation—in other words, RUNE absorbs the volatility of the RUNE-collateral exchange rate through inflation/deflation, just as LUNA absorbed UST’s volatility. However, there are key differences in mechanism (RUNE participates in lending via minting and burning at loan opening and closing, whereas LUNA maintains stablecoin pegs via arbitrage-driven minting/burning when UST de-pegs) and risk scale (LUNA allowed uncapped minting, while RUNE has inflation/deflation limits, and only 50% of synthetic asset collateral is composed of RUNE). Moreover, the lending protocol implements strict risk controls and isolation measures, thus overall risk remains relatively small and will not generate systemic risks akin to Terra LUNA—even a negative spiral would not affect Thorchain’s other functions.

I. Understanding Thorchain’s Lending Mechanism

Thorchain’s lending is characterized by no interest, no liquidation risk, and no time limit (initially, minimum loan duration is 30 days). For users, this is effectively equivalent to shorting USD and going long BTC/ETH collateral; for the protocol, it’s shorting BTC/ETH and going long USD. Debt is denominated in TOR (Thorchain’s USD-equivalent), making the user analogous to purchasing an out-of-the-money call option under a gold standard, while the protocol/RUNE holders act as the counterparty.

Opening a new loan creates a deflationary effect on $RUNE, while closing a loan creates an inflationary effect. BTC collateral is first swapped into RUNE, then destroyed, and finally new RUNE is minted to redeem the required asset. In this process, the difference between collateral value and debt, minus fees, corresponds to the net RUNE value burned.

If the collateral appreciates at repayment time, more RUNE must be minted to acquire the required asset (assuming RUNE price remains constant), causing inflation. If RUNE price rises, fewer RUNE need to be minted—this is the ideal scenario. If RUNE price falls, inflation worsens. Conversely, if the collateral depreciates significantly at repayment, users may choose not to repay (avoiding any minting).

If RUNE’s value relative to BTC remains unchanged between loan opening and closing, $RUNE experiences no net inflation (the amount burned equals the amount minted minus swap fees). However, if the collateral’s value increases relative to RUNE during the loan period, $RUNE supply undergoes net inflation.

To address inflation risks, lending control mechanisms are in place—if minting pushes total supply beyond 5 million RUNE, a circuit breaker activates. In such cases, the reserve steps in to redeem loans (without further minting), and the entire lending system halts—but all other THORChain functionalities continue operating normally.

Thus, the lending process exerts significant but bounded effects on RUNE inflation/deflation. With a relatively low lending cap, both inflation and deflation are capped. In the case of unlimited appreciation in the RUNE-collateral exchange rate, maximum deflation equals the largest possible position size—currently 15 million × 0.33 (where 0.33 is the lending leverage factor, subject to change), i.e., 4.95 million (potentially expandable in the future). In the event of unlimited depreciation, inflation is capped at 5 million RUNE due to the circuit breaker.

Specifically, when users overcollateralize at 200% to borrow 50% of the desired asset, the remaining 50% is minted upon redemption based on the RUNE-collateral exchange rate. This step is conceptually similar to LUNA, but under Thorchain Lending, since only 50% is backed by RUNE and the product capacity is limited, overall risk is relatively low. Risk is well isolated, and even a negative spiral would not impact Thorchain’s other functions.

1. How to Understand That Lending Is Like a Deep Out-of-the-Money Call Option with Resettable Strike Price

When Alice deposits 1 BTC, she receives 50% cash (at 200% CR) plus the right to purchase 1 BTC at that initial BTC price.

If BTC appreciates at repayment (say, one month later), Alice repays the debt (equal to 50% of the BTC value one month prior) and effectively buys 1 BTC at the earlier price. If BTC crashes more than 50%, Alice may opt not to repay—the protocol avoids minting RUNE (and thus inflation), while Alice simply fails in her long bet.

2. Understanding the Absence of Borrowing Interest

The absence of interest can be viewed as users paying multiple swap fees instead. At its core, this is still a CDP-style product. Charging additional borrowing interest would reduce its appeal to users.

The full lending flow is as follows:

Users deposit native collateral assets (BTC, ETH, BNB, ATOM, AVAX, LTC, BCH, DOGE); initially, only BTC and ETH are supported. The maximum collateral each debt vault can accept is determined by a hard cap (15 million), lending leverage, and pool depth coefficient. Overcollateralization generates debt, with loan size determined by the collateral ratio (CR).

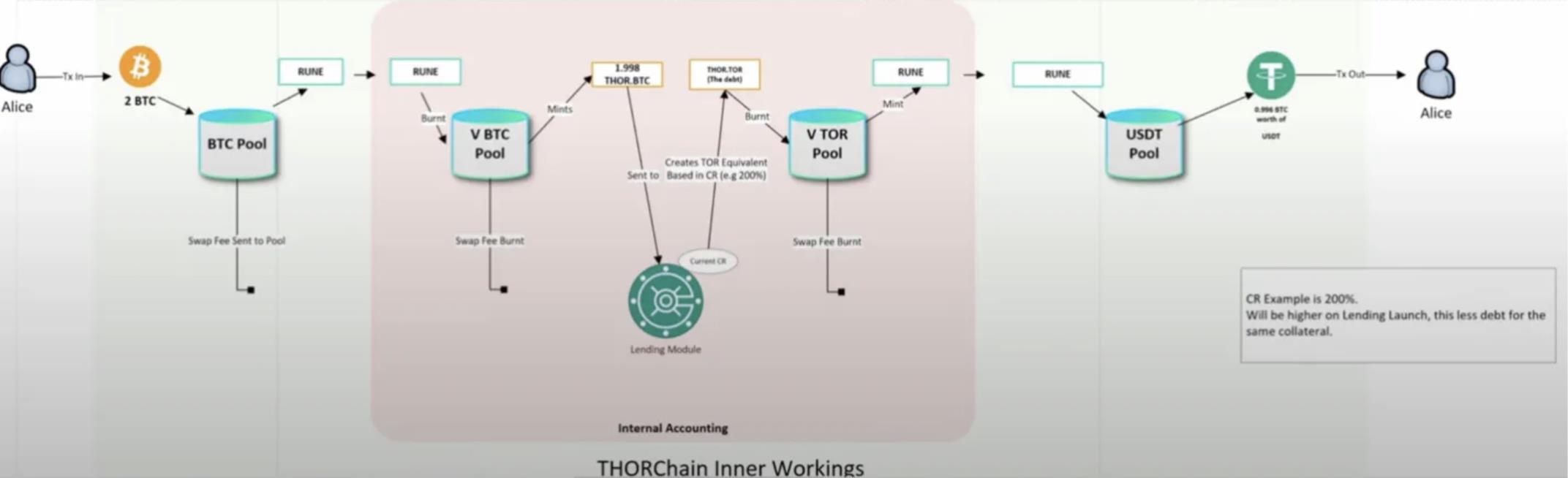

Borrowing: Alice deposits 1 BTC. This BTC is first swapped into RUNE via the BTC-RUNE swap pool. These RUNE enter a virtual BTC pool, where they are burned and converted into a synthetic asset, Thor.BTC. The synthetic asset’s collateral consists of constant-product liquidity, always 50% asset and 50% RUNE. Thor.BTC is then sent to an internal module, where a dynamic CR determines how much loan can be drawn, generating Thor.Tor (a USD-like token) as the accounting unit. These internal steps serve purely for bookkeeping. Subsequently, USDT loans are issued and delivered to Alice.

Repayment: When Alice repays, she sends USDT or other Thorchain-supported assets to the protocol, which converts them into RUNE. RUNE mints Tor, and the protocol verifies whether all Tor-denominated debt is fully repaid. If so, the collateral is released, converted back into derived collateral (Thor.BTC), which is then re-minted into RUNE and swapped back to L1 BTC. RUNE is thus minted in this process.

Note that each swap and conversion incurs fees (at least four swap fees per loan), meaning total repayment exceeds principal to cover these costs. While there is no interest, these layered fees effectively substitute for interest. Although costly to users, the RUNE portion of fees is burned—providing real deflationary pressure.

3. Understanding No Liquidation and No Repayment Deadline

Since debt denominated in TOR (stablecoin) is fixed, borrowers can repay with any supported asset, but all are ultimately converted into RUNE via the market. Liquidity providers and depositors do not directly lend their assets to borrowers. Pools merely act as intermediaries exchanging collateral for debt—this is why no liquidation occurs. The protocol requires sufficient RUNE to fully repay TOR debt before releasing collateral. If collateral value drops sharply, users may abandon repayment (avoiding RUNE minting, resulting in net deflation). In fact, the protocol prefers users not to repay—repayment during collateral appreciation and RUNE depreciation causes inflation.

4. Understanding RUNE’s Inflation/Deflation as a Transaction Medium

First, the total cap across all lending pools is determined by multiplying the "RUNE Burnt" portion (gray area in the chart below) by the lending leverage. The 15 million RUNE Burnt results from previously burned non-upgraded BEP2/ERC20 RUNE. Thus, the protocol currently has room for up to 15 million additional RUNE inflation before hitting the 500 million max supply.

As described earlier, RUNE plays a central role throughout the lending process (see mechanism section above). Opening a loan deflates RUNE supply; closing a loan inflates it.

If collateral appreciates at repayment and RUNE price stays flat, more RUNE must be minted to redeem assets—causing inflation. If RUNE price rises, less minting is needed—ideal. If RUNE price falls, inflation intensifies. If collateral depreciates and RUNE price holds, users may skip repayment (no minting occurs).

If RUNE’s value relative to BTC remains unchanged between loan open and close, there is no net inflation (burned quantity equals minted minus fees). However, if collateral value increases relative to RUNE during the loan, net inflation occurs in RUNE supply.

To manage inflation, controls are in place—if minting pushes supply beyond 5 million RUNE, a circuit breaker activates. Reserves then redeem loans (without further minting), and lending functionality halts—though all other THORChain operations continue unaffected.

Based on current parameters, the total capacity across all debt pools amounts to only 4.95 million RUNE—meaning collectively, they can accept up to 4.95 million RUNE worth of collateral.

Source:GrassRoots Crypto

The total RUNE Burnt in the Reserve acts as the buffer for all debt pools and the last resort against inflation. Currently, the total buffer of 4.95 million RUNE (Reserve Burnt × Lending Leverage) is allocated across pools based on depth—the deeper the pool, the larger its share. For example, if the BTC lending pool is twice as deep as the ETH pool, its maximum collateral capacity equals Reserve Burnt × Lending Leverage × depth coefficient. As RUNE price rises, the pool can support more collateral. Thus, both lending leverage and RUNE price jointly determine the collateral ceiling.

The THORChain protocol and all RUNE holders are counterparties to every loan. The RUNE burn/mint mechanism means RUNE is condensed or diluted (across all holders) when debts are opened or closed. RUNE-collateral depreciation causes inflation; appreciation causes deflation.

5. Is a CDP Protocol a Good On-Chain Capital Sink Model?

Thorchain’s Lending is precisely such a model—indirectly absorbing capital while making RUNE an essential medium in borrowing and repayment, thereby increasing burn and mint scenarios.

Is this capital sink model advantageous? Let’s compare with other models.

CEXs are the most obvious beneficiaries of capital absorption. As custodians, they can often generate additional yield from user funds (though this has diminished post-reserve transparency requirements). Ensuring custody security remains a key regulatory concern—regulators typically demand full reserves.

On-chain dynamics differ entirely.

DEXs must offer high incentives to LPs after absorbing capital. Their goal is to deepen liquidity—not directly monetize deposited “deposits”—but rather build a moat via large reserves.

Pure lending protocols like Aave or Compound must pay interest to attract deposits. The model mirrors traditional finance—requiring active loan management, repayment deadlines, etc.

In contrast, CDP-style capital absorption is healthier. Given high collateral volatility, most overcollateralized CDPs let users lock assets to draw stablecoins or other assets. In this process, the protocol effectively gains more “deposits” without paying interest.

Thorchain fits this CDP model. But where is the collateral held? In fact, collateral is swapped into RUNE via liquidity pools. No one “stores” the collateral. As long as THORChain pools remain healthy, any deposited collateral is exchanged into RUNE and rebalanced by arbitrageurs as usual. Effectively, collateral settles into Thorchain’s RUNE-paired trading pools. Because BTC and other collaterals enter circulation rather than being held in protocol custody, although debt is 100% collateralized, the gap between collateral value and debt is ultimately determined by RUNE’s value—casting a shadow reminiscent of Terra LUNA.

Capital sinking might be one of Thorchain Lending’s goals—using user collateral to deepen swap pool liquidity. As long as users don’t close loans and RUNE price doesn’t crash, the protocol retains assets, RUNE deflates, and a positive cycle forms. Of course, the reverse could trigger a negative spiral.

6. Risks

Because BTC and other collaterals enter circulation rather than being held in protocol custody, although debt is 100% collateralized, the value gap between collateral and debt is determined by RUNE’s price—giving the entire mechanism a Terra LUNA-like aura. Since RUNE burned at loan opening and minted at closing aren’t necessarily equal, both inflation and deflation can occur—equivalently, if RUNE price rises at repayment, deflation occurs; if it falls, inflation occurs. If RUNE price drops below 1/lending_leverage of the entry price, the circuit breaker triggers. RUNE price critically influences inflation/deflation—during price declines, widespread loan closures pose high inflation risk. However, strict risk controls and isolation measures keep overall risk low, preventing systemic collapse like Terra LUNA—even a negative spiral won’t impair Thorchain’s other functions.

Lending leverage, collateral ratio (CR), and the decision to enable different collateral types form the three pillars of Thorchain Lending’s risk management.

Additionally, Thorchain has a history of hacks and highly complex code—Thorchain Lending may contain vulnerabilities requiring pause or patching.

II. Conclusion

The launch of Thorchain Lending creates network synergies, boosts transaction volume, improves pool capital efficiency, generates real system revenue, increases Total Bonded, and enables Thorchain to potentially appreciate by reducing circulating supply (when RUNE-collateral rates rise).

Capital sinking (perhaps a key goal of Thorchain Lending) leverages user collateral to deepen swap pool liquidity. So long as users keep loans open and RUNE price doesn’t plummet, the protocol retains capital and RUNE deflates—forming a favorable positive loop.

Yet, adverse market trends could still trigger inflation and negative spirals. To mitigate risks, Thorchain Lending is capacity-constrained and conservatively scaled. Overall, given current caps, inflation/deflation impacts are bounded (max ~5 million RUNE) and unlikely to fundamentally alter RUNE’s price trajectory.

Moreover, from a user perspective, capital efficiency is low—CR ranges between 200%-500%, likely settling at 300%-400%. Purely as a leverage tool, it’s suboptimal. Despite zero borrowing fees, repeated internal swap fees impose significant friction on users.

Evaluating Lending alone does not reflect the full potential of Thorchain’s DeFi ecosystem. Further analysis on other Thorchain products will follow.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News