Digital Alchemy: A Post-Mortem Analysis of the Cryptocurrency Crash

TechFlow Selected TechFlow Selected

Digital Alchemy: A Post-Mortem Analysis of the Cryptocurrency Crash

This is a post-mortem analysis of the failed Terra ecosystem, which was once worth billions of dollars.

By Lyn Alden

Translated by TechFlow Intern

Throughout history, people have tried to create something out of nothing.

On one hand, there is genuine scientific innovation—new developments that allow us to harness denser energy and increase productivity, improving the quality of life for most people.

They created something from nothing. They made accessing resources faster and easier, extracting more, better organizing matter, information, and human activity. In other words, if you showed a smartphone to a caveman, he would think it was magic.

On the other hand, there are attempts at alchemy and perpetual motion machines—methods that misdirect science. Even brilliant minds like Isaac Newton spent significant time studying alchemy. It's an easy trap to fall into.

Much of the cryptocurrency market is essentially modern-day alchemy. While the field includes real innovations such as Bitcoin, fiat-collateralized stablecoins, and numerous technical experiments, it also contains massive speculation, pump-and-dump schemes, and technological claims that obscure project trade-offs and risk management.

This article is a post-mortem analysis of the failed Terra ecosystem, a multi-billion dollar cryptocurrency network based on algorithmic stablecoins.

Navigating Bitcoin

Local payments have historically been private and physical processes. I give you physical cash; you give me goods. This type of transaction is difficult to monitor or block.

But for many years, if people needed to send payments over long distances, they had to rely on large central intermediaries (commercial banks and central banks).

If I wanted to send money to a friend in Chicago or Tokyo, or buy something from merchants in those cities, I needed to go through a major bank. I'd instruct the bank in various ways and transfer funds, potentially involving our national central bank if crossing borders.

As an American, sending remote payments to these destinations wasn't a big issue because these entities wouldn't block my payments—but the problem was that it was expensive and slow.

However, for the majority of the world’s population living under restrictive monetary systems and persistent high inflation (more than half the world lives under authoritarianism and/or recurring double-digit inflation), the lack of alternatives has been a constraint. Journalists, scholars, and analysts from developed markets may not realize this, as many of them don’t experience this form of privilege.

The invention of Bitcoin changed this reliance on centralized intermediaries by introducing the first credible self-sovereign peer-to-peer money. Anyone with internet access can send liquid value to another internet user anywhere in the world without relying on commercial or central banks. No one holds their money for them, nor do they need permission from any centralized entity to send that value to someone else.

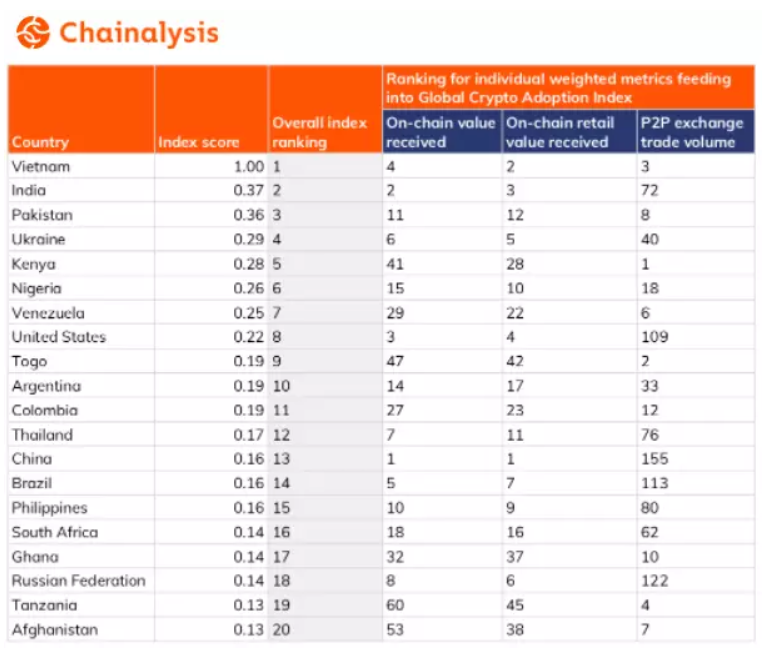

Unsurprisingly, 19 out of the 20 leading countries in Chainalysis’ Global Crypto Adoption Index are developing nations. Overall, people in these countries face lower levels of property rights, financial freedom, and higher currency inflation compared to most readers of this article:

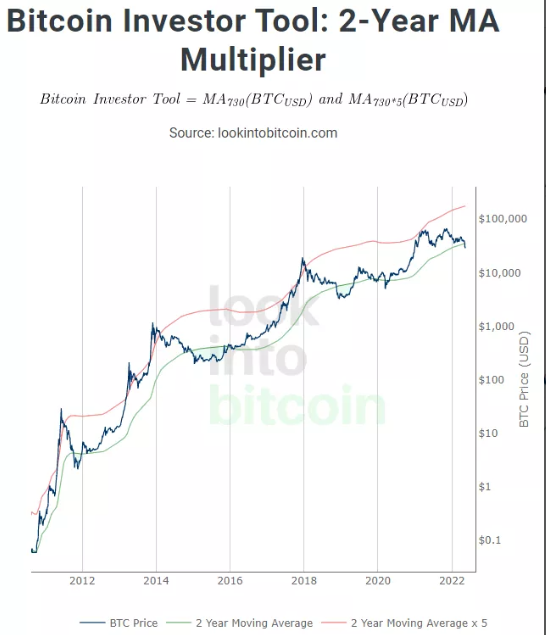

Bitcoin became the fastest asset in history to reach a $1 trillion market cap and has recovered from three crashes of over 80% and several drops above 50%, consistently reaching new highs:

Bitcoin holders must endure volatility, technical risks, and similar challenges, but technically speaking, what it offers is genuinely innovative. The protocol uses energy and open-source code to establish a publicly auditable global consensus ledger, rather than relying on human decision-making for consensus.

But after Bitcoin came twenty thousand imitators.

Some increased node requirements, sacrificing decentralization for higher transaction throughput (thus undermining the purpose of blockchain).

Some abandoned proof-of-work in favor of proof-of-stake consensus mechanisms, again reducing decentralization.

Others added extra complexity to enable more code functionality, which also increased node demands and reduced decentralization.

There's a consistent theme here: With each new "innovation" from competing projects, decentralization keeps getting thrown aside.

Satoshi deliberately sacrificed most metrics in Bitcoin's design to achieve an automated, decentralized, and auditable global transfer agent and registrar—and nothing more. He combined existing technologies like Merkle trees and proof-of-work algorithms, then added difficulty adjustment to the mix—that combination was his innovation.

Since then, developers have updated Bitcoin multiple times via soft forks (backward-compatible upgrades), but the core design remains unchanged. Since inception, it has maintained 99.98% uptime, and 100% uptime since March 2013.

During that same period, even the Federal Reserve’s interbank settlement system, Fedwire, did not maintain 100% uptime.

Most other cryptocurrency designs sacrifice some degree of decentralization, reliability, and security to add more features, then market those as innovations to investors.

There are indeed some innovations. For example, federated databases and computation layers could be useful. But in most cases, the space is filled with misunderstandings about what Satoshi created and why.

These trade-offs are rarely disclosed to investors; instead, they're marketed as pure technological improvements. This advertising attracts many, especially when combined with VC-funded temporary economic incentives.

Unlike the Bitcoin network, which has no central organization marketing it, most of these projects have central foundations or individuals who play key roles in online promotion and ongoing operations.

People working in the Bitcoin ecosystem are often critical of these other protocols. From the outside, the entire "crypto" ecosystem may appear homogeneous, but within the industry, it's not. Those involved in so-called "altcoins" naturally want to associate themselves with Bitcoin to better market their tokens, while Bitcoin supporters naturally feel compelled to point out all the risks and trade-offs of these so-called innovative projects.

Satoshi launched open-source software, updated it for a few years, never pre-mined Bitcoin for himself, never spent any mined coins, and then disappeared, leaving others to continue his project.

Since then, the network has relied on a fluid group of open-source developers, with no leader. No one can push network updates to users. No one intervenes when prices drop. Bitcoin never raised funds, hasn't passed the Howey test for securities, and thus isn't classified as a security—most often categorized as a digital commodity.

In contrast, many other protocol developers enriched themselves by leaving large pre-mined token allocations and continue operating their networks centrally while marketing them as decentralized. Many of these tokens/organizations raised capital, passed the Howey test, and thus exhibit many characteristics of securities.

If protocol developers were fully honest about their designs, we could analyze them like startups. But in practice, many operate in global gray areas as unregistered securities until regulators figure things out, all while branding themselves as decentralized networks.

This isn't to say all crypto projects are bad or lack technical contributions—rather, the industry is flooded with scams, frauds, well-intentioned but ultimately doomed projects, which collectively make up nearly all created projects. Bitcoin left a massive trail in its development path, and sharks are eager to fill that wake and figure out how to make quick money.

In most cases, Bitcoin is like the iPhone of this industry, followed by thousands of cheap counterfeit phones sold with Apple logos. Investors speculating across various crypto projects need to be extremely cautious.

Several exchanges in the industry also fueled the bubble for fast profits. For instance, meme coins like DOGE or SHIB, which have little actual future utility, are promoted to users, potentially attracting retail investors to buy at the top of the bubble. Additionally, many influencers on YouTube and TikTok sell small amounts of tokens, leveraging their audience to help exit their positions.

Terra – The “Nonexistent Central Bank”

Terra was a cryptocurrency network based on an algorithmic stablecoin called UST, using its native token LUNA as equity capital. The creation/destruction mechanism between the two aimed to maintain a stable peg.

It branded itself as decentralized, but in reality, it wasn't:

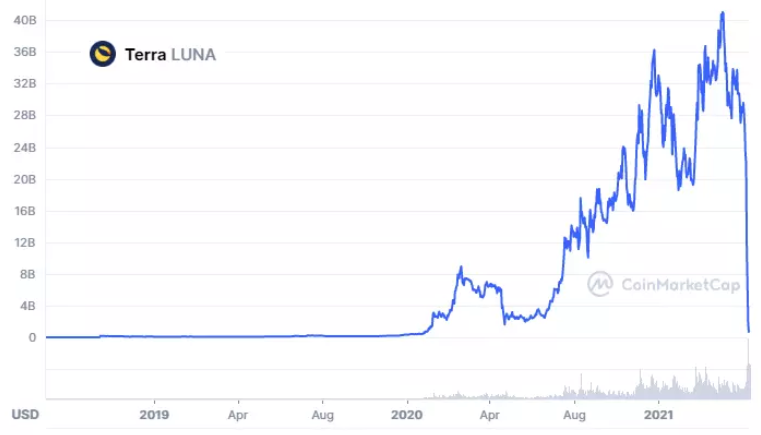

At its peak, Luna had a $40 billion market cap, while UST approached $20 billion. It attracted massive investment from crypto VCs and retail investors. Now most of it is dead—UST has de-pegged, and LUNA has gone to zero. This happened between May 7 and May 12, and is still unfolding.

When the Terra ecosystem was still small, I ignored it. I follow various crypto projects, and once they enter the top ~20 by market cap, I investigate what they’re doing—but I can only track so many things.

By mid-March 2022, the Luna Foundation Guard (LFG) was formed to support the Terra ecosystem, and LFG began buying Bitcoin as a secondary backstop for its token equity. That’s when I started digging deeper into Terra to analyze the risks.

For months, many in the Bitcoin ecosystem had been warning about Terra. Industry professionals including Brad Mills, Nic Carter of Castle Island Ventures, Cory Klippsten of Swan Bitcoin, and many others I haven’t mentioned, were publicly criticizing it. Cory Klippsten, in particular, loudly and repeatedly warned people.

I analyzed the situation, read criticisms of the project, then read counterarguments from Luna bulls claiming these risks were unfounded. My view was that the risks were very clear—not technical risks, but economic risks stemming from unstable economic design and unsustainable financial incentives.

Rather than rewriting my full analysis, I’ll share what I wrote to my research subscribers on April 3, 2022:

“Luna Defense Guard Bitcoin Accumulation”

Recent Bitcoin price strength may be due to the Luna Foundation Guard purchasing over $1.3 billion worth of Bitcoin, with plans to buy $3 billion as reserves and eventually grow that reserve beyond $10 billion.

Terra is a proof-of-stake smart contract cryptocurrency built around an algorithmic stablecoin, specifically the dollar-pegged UST. Unlike USDT or USDC, which are custodial stablecoins (centralized entities hold fiat dollars as assets and issue redeemable stablecoin tokens representing those assets), UST is an algorithmic stablecoin. This means it approximates the value of the dollar but doesn’t actually hold dollars.

Its mechanism works by using LUNA as volatility offset for UST. If UST goes above $1, arbitrageurs burn LUNA to mint more UST. If UST falls below $1, arbitrageurs mint LUNA and burn UST. UST should stay around $1, while LUNA is allowed to fluctuate. Over time, higher demand for UST should increase the market caps of both UST and LUNA. It’s like a central bank trying to incentivize market participants to conduct open market operations.

But if LUNA’s price doesn’t keep pace with UST’s market cap expansion, over time UST becomes less and less “backed” by LUNA. This has been the general trend since late 2021 when UST demand began taking off. Currently, it still has over 200% backing, but that ratio is declining rapidly.

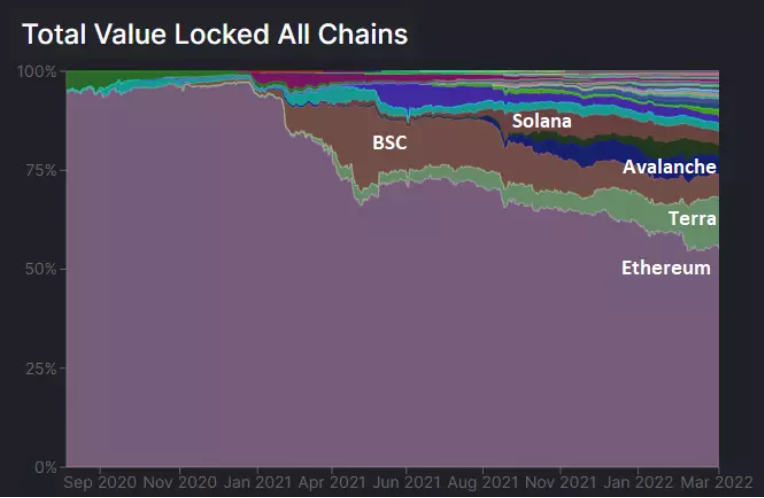

By total value locked, Terra is now the second-largest DeFi ecosystem:

The massive demand for UST is almost entirely driven by unsustainable high-yield APY opportunities, just like other DeFi ecosystems. Due to various arbitrage opportunities, investors have been able to earn nearly 20% UST yields on Terra’s Anchor protocol—and it’s already starting to dry up. If VC-subsidized high-yield opportunities vanish, UST demand could decline. If UST demand shrinks, it could trigger a negative feedback loop and liquidity issues between UST and LUNA—the so-called “death spiral”—with massive capital fleeing the Terra ecosystem, causing LUNA’s price to crash and ultimately breaking the UST peg. This scenario functionally resembles an emerging market currency crisis.

Unlike Bitcoin, which has no centralized foundation, most smart contract blockchains have specific for-profit or non-profit organizations acting as promotional and development hubs. Terra has Terraform Labs, Solana has the Solana Foundation, Ethereum has the Ethereum Foundation, Avalanche has Ava Labs. These are typically founder/VC-backed entities with dedicated leadership and staff promoting and growing the ecosystem, often using pre-mined tokens as launch funding.

Terraform Labs and others raised funds to establish the Luna Foundation Guard, intended as a second layer of defense for the UST/USD peg, not relying solely on LUNA.

One way to view it is as analogous to a national sovereign reserve. In times of economic prosperity, emerging markets can use accumulated trade surpluses or currency sales to build foreign exchange reserves such as gold, dollars, or euros. Then, if the country later faces recession and currency crisis, it can defend its currency’s value by selling some of those stored reserves and using the proceeds.

“On one hand, initially, Terra’s large-scale Bitcoin purchase signals bullish sentiment toward Bitcoin. LFG could have bought USDC or USDT as reserves, ETH as reserves, or a basket of these assets. Instead, they chose BTC as reserves, believing it to be the best—decentralized, primitive collateral that can be held long-term with minimal trading risk. This further validates the argument that Bitcoin is the best digital reserve asset. However, the larger the Terra ecosystem grows, the greater the expected BTC reserve demand. As the project expands to other platforms, LFG intends to gradually add small amounts of other tokens as reserves. For example, if expanding UST usage to the Solana ecosystem, they might buy some SOL as reserves.

On the other hand, this creates future downside risk for Bitcoin’s price. If Terra runs into trouble and is forced to sell large amounts of Bitcoin to defend the UST peg, that would hurt BTC prices—just as their current buying supports prices. The unsustainable Anchor protocol on Terra (offering 20% yield) drove massive UST demand, and with Terra’s new reserve practice, UST demand indirectly drives BTC demand. This could be seen as an indirect, artificial, or unsustainable source of BTC demand, bound to eventually dry up. Active Bitcoin traders should closely monitor LUNA and BTC reserves relative to UST’s market cap, because if the system starts collapsing and needs to defend the UST peg, we might see rapid selling pressure of tens of thousands of BTC.”

Then I continued monitoring Terra, raising my risk assessment level over time. In my May 1 report, I wrote:

“Luna Note”

Looking back at the premium report from April 3, I discussed concerns about the “UST” design.

In this month-later update, UST’s market cap increased while LUNA’s decreased, so collateralization weakened further:

This differs from DAI’s model. LUNA is an algorithmic stablecoin, not crypto-collateralized. Regardless, LUNA’s market cap is a critical variable for UST’s long-term integrity.

BTC and AVAX held by LFG add less than 10% to total collateral, so even accounting for these reserve assets, the ratio is weakening.

Meanwhile, Anchor’s reserves—artificially providing high yields for UST—declined by 40% in April. This drawdown represents many stakers withdrawing high yields. Ultimately, founders will either need to inject more capital or let yields settle at market rates, which could reduce UST demand.

We’re now at a stage where Terra’s UST peg deserves close attention over the coming months. As LUNA’s value declines, the amount of collateral LUNA provides to algorithmically support the UST peg has diminished. This could be temporarily rescued by a broad crypto market rebound, but either way, I’ll be watching it closely. Meanwhile, LFG’s reserve holdings continue to decrease.

The worst case is UST begins de-pegging, forcing LFG to sell part or all of its $1.6 billion Bitcoin stash into an already weak market to defend the UST peg. I expect it would work by allowing UST holders to redeem for Bitcoin, prompting many to cash out. At that point, the Terra network would suffer severe damage, and Bitcoin’s price could take a significant hit.

In that scenario, I’d be a buyer of Bitcoin, though it might get messy. It could even mark the bottom of this cycle, triggering widespread forced liquidations, similar to Q4 2018 or Q1 2020. I’m not saying this cycle will definitely unfold, but I observe that the risk pattern is manifesting.

Overall, the only investable asset I see across the digital asset ecosystem is Bitcoin, but even Bitcoin is best balanced with some cash in this challenging macro environment to rebalance and reduce volatility. Whenever I assess whether crypto is a Ponzi scheme, I categorize everything else in the industry as speculation, depending on the specific asset in question.

Despite growing concern, I didn’t expect Terra to collapse within a week of my second report. With deep-pocketed backers like Terra, such things can last a long time, so I didn’t know exactly when or how it would fail.

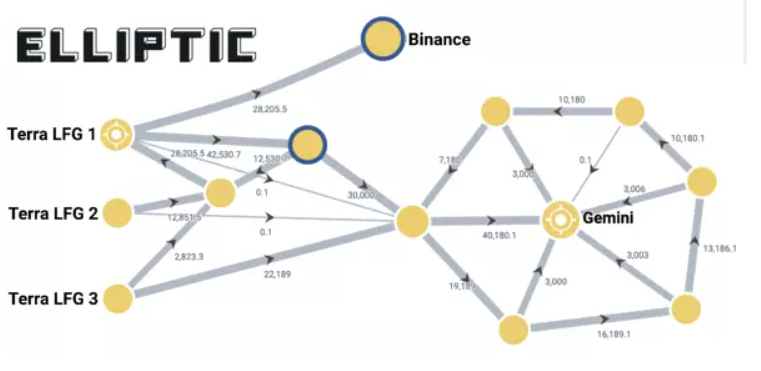

LFG didn’t even have time to set up an automated Bitcoin redemption mechanism, so LFG manually and centrally lent its Bitcoin reserves to market makers in a failed attempt to defend the UST peg.

LFG’s Bitcoin multisig address was drained, with large inflows going to exchanges. The full custody trail of its Bitcoin remains unclear, but blockchain analytics firm Elliptic tracked flows to Binance and Gemini:

Evidence suggests a well-funded attack influenced the timing of Luna’s collapse. A major entity shorted Bitcoin and triggered UST de-pegging, similar to how the protocol could have been attacked in 2021, as previously described. For macro investors, it’s akin to Soros shorting the Bank of England.

Blaming attackers misses the point—if something in the market can be successfully attacked, it eventually will be. This is by far the biggest failure of algorithmic stablecoins to date. Since much of their adjustment mechanism is public, attackers easily knew how to exploit it.

The fallout from Terra’s collapse is spreading across the digital asset ecosystem. Many VCs were exposed to Luna tokens. Thousands of altcoins began bleeding, various pools got spooked—it’s a period of re-evaluation across the ecosystem. People are separating wheat from chaff and finding mostly chaff.

Bitcoin itself continues running, suffering no permanent damage beyond price impact, while the Terra ecosystem took a severe hit. From regulatory, reputational, and liquidity perspectives, the broader crypto industry suffered some damage.

Final Thoughts

Structurally, I remain bullish on Bitcoin as part of a portfolio, especially using its volatility over time to accumulate steadily.

Despite the risks, I believe 2022 will be viewed as a good accumulation window for 3–5 year investors, similar to 2020, 2018, and 2015.

While there are other streamlined blockchains, personally I don’t see anything offering a compelling risk/reward profile. Investors should be cautious when speculating on any crypto tokens beyond Bitcoin. Even with Bitcoin, investors must assess volatility and network risks to maintain appropriate position sizing.

I view Bitcoin’s ongoing monetization similarly to a bodybuilder’s bulking and cutting cycles. Bodybuilders focus on cycles of gaining muscle and losing fat, so after multiple cycles, they accumulate significant muscle while avoiding fat buildup.

During bull markets, Bitcoin’s price rises, but faces dilution from thousands of new projects. When liquidity is abundant, anyone with an idea can raise funds and attract investors with promising narratives. External capital flows into Bitcoin, but then gets distracted by these shiny new things and begins diffusing into them.

Then during bear markets, liquidity exits. Bitcoin’s price takes a hit, and thousands of altcoins take even bigger hits. Over-leveraged positions blow up, pegs fail, Ponzi schemes get exposed, fragile networks collapse. Muscle growth halts or even shrinks, but crucially, large amounts of non-productive hidden fat get burned off, so the next growth cycle can begin anew.

With each new cycle, Bitcoin’s network effects and investment thesis remain historically intact, while most other projects stagnate and get abandoned by developers and investors. Bitcoin continues making higher highs across four major independent cycles, each with higher adoption and development, while most altcoins survive only one or two cycles.

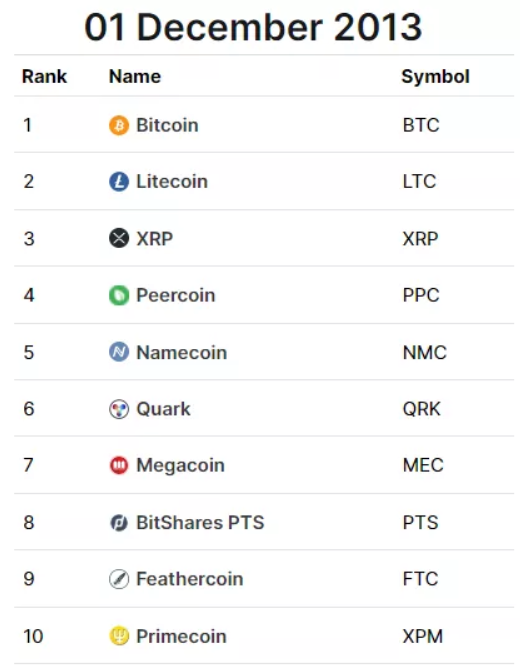

Many prominent tokens eventually stagnate. Of the top 10 tokens at the end of the 2017 bull run, each went on to underperform Bitcoin in subsequent bear and bull markets. Compared to 2017, ETH, BCH, XRP, LTC, ADA, MIOTA, DASH, NEM, and XMR all reached lower BTC-denominated peaks during the 2021 bull run.

The same generally holds true looking back at the 2013 bull run. Most people today haven’t even heard of most of these top ten coins. On that list, only XRP reached a higher BTC-denominated peak in 2017 compared to 2013, but failed to do so in the 2021 cycle—no one experienced a larger BTC-denominated gain cycle.

I believe this pattern will likely continue—most crypto darlings of the 2021 bull run have already seen their all-time highs in BTC terms. Perhaps one or two will reach new heights at some point, but most won’t.

This doesn’t mean Bitcoin is without risk, but it has by far the best track record in the space and was designed for a specific purpose. Block by block, it continues functioning as intended over time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News