The Madman's Trial: Can UST/LUNA Return?

TechFlow Selected TechFlow Selected

The Madman's Trial: Can UST/LUNA Return?

What exactly does the TFL team need to do to ensure such a bank run doesn't happen again?

Written by: Jack Melnick

Translated by: TechFlow intern

You may have noticed that market conditions recently have been extremely volatile. This chaos was driven by specific factors, with the bear market having set in for several months, and much of this turmoil stemming from risks inherent in the Terra model.

As UST's circulating supply grew, it created upward pressure on the price of LUNA. This worked well in a bullish market, where increasing use cases for UST drove demand, allowing LUNA holders to see their tokens directly generate value. However, in a risk-off market, the same mechanism can trigger problematic death spirals.

Let’s quickly review what happened to LUNA and UST, and consider what exactly the Terraform Labs (TFL) team needs to do to prevent such bank runs from happening again.

Background

1. Investors flock to safe-haven assets. Macro conditions have clearly deteriorated for some time, with global interest rate hikes and deflationary pressures persistently affecting both equities and cryptocurrencies. This led investors to shift from undercollateralized stablecoins (UST) toward fully cash or cash-equivalent-backed stablecoins (USDC, USDT).

2. UST has an asset-liability mismatch. Despite being uncollateralized, UST can always be redeemed 1:1 for $1 worth of LUNA—a feature that creates a direct linkage between the two tokens’ demands. In rising markets, this mismatch isn’t problematic. But in declining markets, balance sheet concerns become more pronounced, and algorithmic risk spikes dramatically.

What Happened?

1. LFG first announced the withdrawal of $150 million in UST liquidity from the 3CRV + UST pool, preparing for the launch of 4pool. At the same time, an anonymous address bridged and dumped $85 million worth of UST.

2. This sell-off unbalanced the Curve pool and put downward pressure on the UST price. To help correct the de-peg, LFG removed another $100 million in UST liquidity from Curve.

3. Still, this wasn't enough to re-anchor UST, and panic began spreading among users.

4. Due to the protocol design, LUNA’s price is inherently tied to UST’s circulating supply. However, during a massive bank run, LUNA’s price plummeted rapidly, meaning each UST burned would mint an ever-increasing amount of LUNA—potentially triggering a death spiral, along with the side effect of network congestion.

5. This congestion further intensified user panic.

6. Positions within Anchor were primarily collateralized by LUNA. As LUNA’s price dropped, liquidations caused more UST to be sold off, further pressuring UST’s price.

7. TFL partners injected over $280 million in non-UST liquidity into the 3CRV + UST pool in an attempt to stem the bleeding. However, this liquidity was quickly drained, as outflows far exceeded the "bailout" inflows.

8. Massive withdrawals occurred from Anchor deposits, significantly increasing market stress on UST.

9. The de-pegged UST flowed in two directions: either exchanged for $1 worth of LUNA (increasing selling pressure on LUNA), or bridged out of the Terra chain and dumped elsewhere, worsening UST’s de-peg.

10. Fewer UST meant more LUNA minted, accelerating LUNA’s price decline.

11. Subsequently, LFG decided to secure an over-the-counter loan of 750 million USD worth of BTC to help restore UST’s peg, planning to repay 750 million UST later to buy back the BTC once markets normalized.

12. The problem was that UST had become so cheap, weakening TFL’s ability to repay market makers. If the BTC collateral were liquidated and sold off, it would drag down the broader market even further, exacerbating the death spiral.

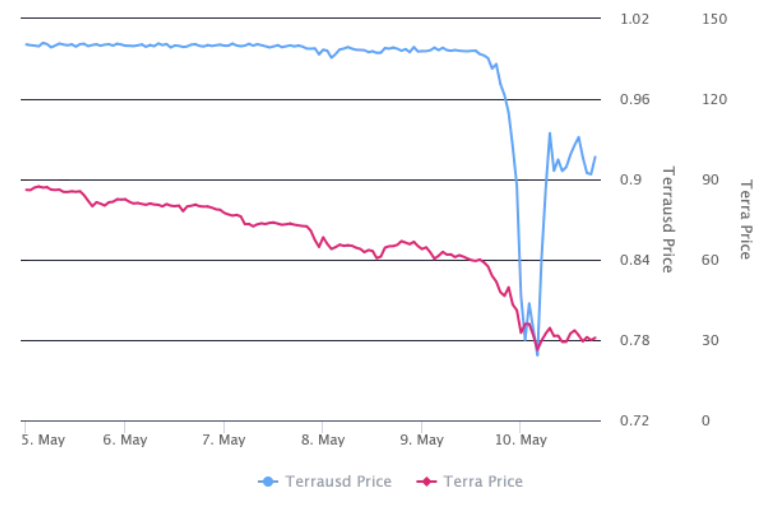

By afternoon, the peg had recovered from a low of $0.66 to $0.90. Nevertheless, as continued conversion of UST into LUNA flooded the market, LUNA’s price steadily declined.

Outstanding Issues

The core of the bearish argument against Terra remains the lack of external yield-generating protocols interacting with UST. Stablecoins are intended to be highly liquid transactional tools, yet for UST, liquidity is leveraged and heavily concentrated on a single platform. Just one week prior, Anchor held $14 billion in deposits while UST’s market cap stood at $18 billion. Clearly, beyond earning yield via Anchor deposits, there are limited real-world use cases.

This makes UST a riskier asset compared to other stable assets backed by cash or cash equivalents like USDC and USDT. The yields generated by UST were largely achieved by compressing Anchor’s returns. As investors shifted from yield-chasing to risk-aversion, UST’s sole appeal diminished in importance. Indeed, capital had already begun flowing out of Anchor even before the “4POOL” incident.

So, What Is Terra’s Solution?

1. First, the team must rebuild confidence in the algorithm and the entire model. Without trust, the underlying “algorithm” cannot function. Selling pressure on LUNA will persist until sufficient backing exists to support the peg. That said, there has been much discussion around fundraising efforts to defend the peg, which could indeed help alleviate fears of de-pegging.

2. Second, and most importantly, UST needs real-world use cases beyond Anchor. While this has long been an ongoing goal for the Terra ecosystem, it has yet to be realized. If UST is held in treasuries, used across various liquidity pools, or truly integrated into DeFi applications, bank runs would become significantly harder to execute.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News