Recapping the 2022 On-Chain Market: The End of NFT 1.0, the Ethereum Merge, and the Collapse of Terra/CeFi

TechFlow Selected TechFlow Selected

Recapping the 2022 On-Chain Market: The End of NFT 1.0, the Ethereum Merge, and the Collapse of Terra/CeFi

2022 started off brutally, with a mix of leverage and fraud leaving the market lacking liquidity and narrative.

Author: Parsec Research

Translation: TechFlow

By the end of November 2021, as BTC reached its peak, a basket of assets along the risk curve was about to melt down. The star of this basket was *DeFi 2.0*, which I describe as a set of reflexive DeFi protocols.

Reflexivity is a property that many market participants actually desire—after all, every successful business is reflexive, and so are traders.

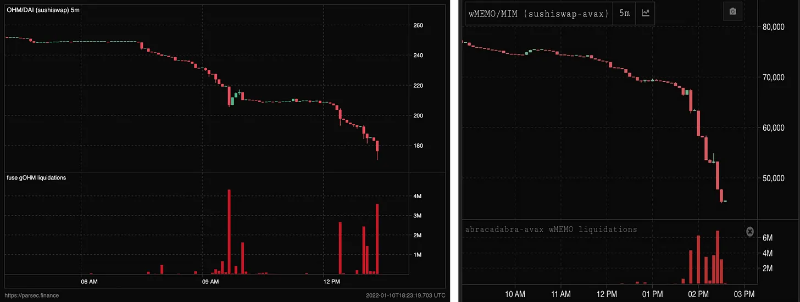

As Trabuco said, “The worst thing that could happen is you lose all your money.” At the start of 2022, OHM—the darling of excessive DeFi yields—was already bleeding from an excited peak. Suddenly, the (9,9) strategy combining OHM with leverage via Fuse was hastily liquidated.

This marked the beginning of the 2022 trend: all the leverage built up in 2021 was merely postponed selling. Abracadabra and its affiliated Wonderland may have been the purest distillation of DeFi 2.0.

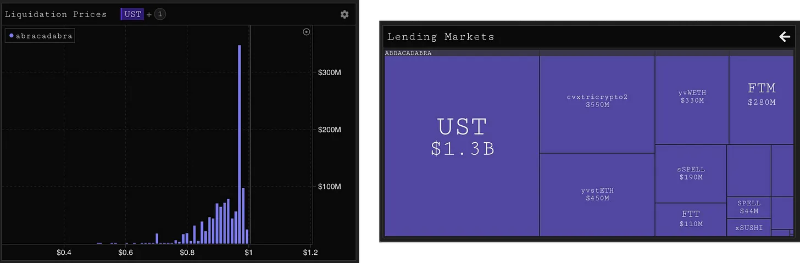

Abra is a leveraged yield farming protocol, with the key innovation being a Maker-style stablecoin ($MIM). Although Abra was categorized as "leveraged yield farming," the entire market was exposed solely to volatile assets (three cryptocurrencies, stETH, SPELL), thus pouring gasoline on a double top. Notably, at the time, the UST market was awarded the most "delta-neutral" title by Degenbox.

Degenbox recycled Anchor deposits, pushing yields above >100% APR. Ultimately, Degenbox served as an important signal of Anchor’s structural issues—a non-marketized supply-side interest rate would be fully exploited to drain incentives. Wonderland was another large-scale "Dani project" that truly took off—a pure OHM fork with more actively managed treasury funds, leveraging the Avalanche ecosystem to attract retail investors looking for the next OHM. Just one week after OHM deleveraged, wMEMO was wiped out as abra faced liquidation.

Months later, the wMEMO collapse was resolved, eventually allowing optional redemption of treasury assets, while book value slowly eroded. From euphoria over price-to-book ratios exceeding 10x, to decline, to fierce governance debates with treasury raiders, it perfectly encapsulated the highs and lows of 2022.

The End of NFT 1.0

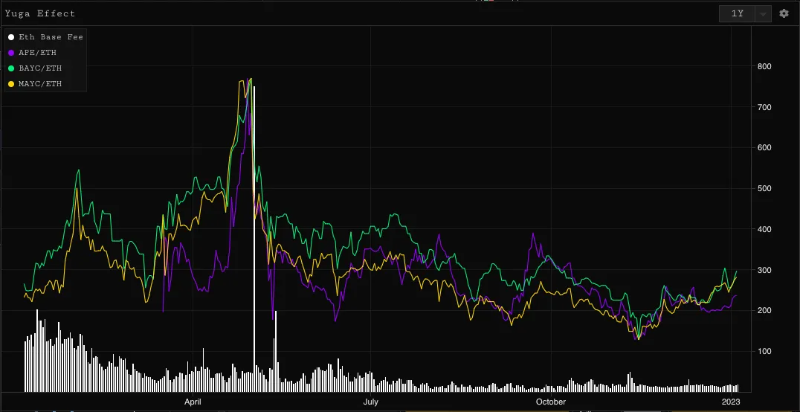

Like the broader cryptocurrency market, the NFT market also peaked. With the launch of $APE, Yuga staged the final act of NFT market excitement in this cycle. The added utility upon APE’s launch was the ability to create further utilities.

Moreover, BAYC and MAYC holders received a free mint—an archetypal tiered airdrop capable of sustaining the entire Bored Ape ecosystem. APE, BAYC, and MAYC all entered minting phases.

Unfortunately, the minting process was botched, triggering an unprecedented gas war that burned over $100 million worth of ETH in a single day, while mint proceeds exceeded $300 million.

For a nascent market—and one where most wealth was purely paper—Otherdeed ignited the remaining liquidity. A week later, Terra collapsed, dragging ETH down with it. For the remainder of 2022, the NFT market struggled—there were movements everywhere, but nothing captured attention like the Yuga frenzy.

For the long-term health of NFTs, a deep cleansing may be necessary. Hopefully, 2023 will bring new approaches and talent.

Terra

At the beginning of 2022, amidst a turbulent market, the only bright spot was Terra. LUNA rose and outperformed all other major L1s, filling a narrative vacuum. The center of the narrative was Anchor, a lending protocol where bLUNA, bETH, and other staked tokens could be leveraged by borrowing UST, enabling depositors to earn a fixed 20% return.

A 20% yield backed by UST was an epic honeypot, attracting over $10 billion in capital. Most of this capital came from bETH and bLUNA depositors borrowing UST at 10% interest and then redepositing it to capture the spread.

For months, demand for UST accumulated such supply (UST market cap peaked around $19 billion), effectively translating into rising LUNA prices and capitalization of LFG.

Anchor's institutionalization ultimately proved disastrous. On Saturday, migration to the new 4pool triggered significant UST selling on Curve. In my estimation, depositors hit their risk limits and dumped everything at maximum speed. What remained was essentially a negative reflexivity—such selling triggered even more selling.

In particular, shorting LUNA quickly became consensus among traders. Once the protocol itself began selling, it turned into a waterfall, rapidly vaporizing eleven-digit wealth. Terra’s destruction brought a violent end to the remaining positive narratives. Undercollateralized decentralized stablecoins were abandoned, and the bribe economy surrounding Curve and Convex was strangled.

Entire L1 chains were erased. Degenbox was liquidated; only because Wonderland manually purchased over $50 million in liquidated assets at a loss was massive bad debt avoided. The impact on DeFi was clear, ruthless, yet swift and definitive.

The Merge

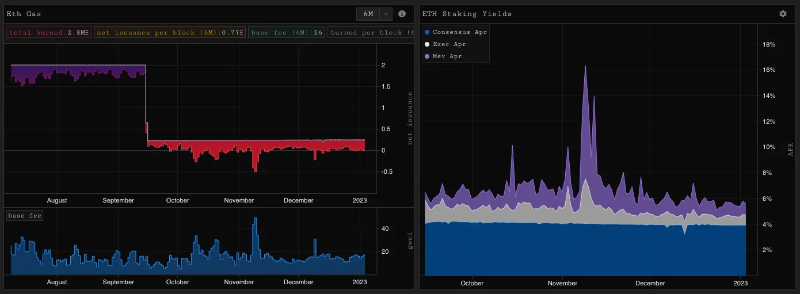

One notable highlight last year was ETH’s seamless transition to Proof-of-Stake (PoS), an upgrade involving over $300 billion in at-risk assets. Beyond the security and roadmap goals represented by PoS, ETH as an asset gained unexpected benefits from this upgrade.

-

First, ETH issuance decreased by an order of magnitude. Despite on-chain activity remaining at historic lows since activation, the protocol is no longer severely unprofitable (and is occasionally profitable).

-

Second, with increasing returns from transaction fees and MEV tips, staked ETH is expanding into a highly attractive asset. Staking yields typically exceed 6%, accompanied by volatility upside options in the form of MEV income.

ETH is not without future catalysts either. Rollup adoption, strongly driven by Arbitrum and Optimism, has proven unexpectedly sticky. Few assets in 2022 exhibited the same combination of economics and catalytic potential as ETH.

CeFi Collapse

The liquidation of 3AC, followed by the collapses of Celsius, BlockFi, and Voyager, pushed the market into the abyss. ETH lingered below $900 (barely avoiding a major liquidation), and stETH dropped to 0.93. With FTX’s collapse at year-end, another nail was driven into the coffin of centralized and cross-leveraged crypto infrastructure.

FTX’s impact on the on-chain market was twofold:

-

On one hand, the $8 billion hole represented a deletion of "hot money," much of which had funded large NFT and altcoin purchases through FTX. It’s no coincidence that December saw suppressed volatility and lackluster price action.

-

On the other hand, FTX’s fraudulent lending activities provided perfect advertising for DeFi use cases. Leverage in DeFi has a long future ahead—there will be both failures and successes.

Looking Ahead

2022 was brutal from the outset, with a mix of leverage and fraud leaving the market devoid of liquidity and narrative. Rather than rehash clichés about dApps yet to be released, I’ll focus on emerging trends that are more likely to continue making an impact and growing.

-

Liquid Staking Derivatives (LSDs): As discussed, ETH—especially staked ETH—possesses strong liquidity and compelling economics. stETH holds a significant lead in many aspects, but challengers like cbETH and frxETH (among others) prove Lido won’t go unchallenged. A leveraged ecosystem has already formed around existing LSDs, with products like icETH and Gearbox offering better user experiences for leveraged staking exposure. I expect more such products to emerge around DeFi, and even some fixed-rate instruments may succeed, despite fixed-income having a cursed history on-chain. Withdrawals enabled in 2023 will broadly reduce derivative risks by allowing tighter arbitrage loops, boosting liquidity and participation (regardless of any “unlock” effects).

-

Perpetual Derivatives: GMX managed to grow their open interest (OI) in the second half of 2022—an impressive feat proving the team remains active. Demand for on-chain perpetuals is clear, and pseudo-AMM models like GMX have created GLP—an asset that bears yield and holds collateral value. With FTX’s collapse leaving a vacuum in cross-collateral leverage, all eyes are on growth within existing systems, and whether any new models can push this trend forward (dydx v4, rage, perennial, etc…).

-

AMMs: Automated Market Makers remain the most compelling native DeFi technology. In my view, on-chain trading volume has been on a downtrend since May 2021. Nonetheless, Uniswap V3, Curve V2, and Solidly have all pushed technical boundaries. Somehow, AMMs still face criticism (unprofitable LPs, CLOB superiority, etc.). I believe there’s a 50% chance this narrative reverses in 2023—if on-chain traffic returns and compelling tech developments emerge (Crocswap, Uniswap upgrades, etc.). With many major market makers eliminated, CEX liquidity is in its worst state since 2020, giving AMMs a real opportunity to compete. The success of both LSDs and perps on-chain depends heavily on AMM liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News