Understanding the UST Algorithmic Stability Mechanism: Where Is the Terra Empire Heading?

TechFlow Selected TechFlow Selected

Understanding the UST Algorithmic Stability Mechanism: Where Is the Terra Empire Heading?

Will Terra collapse?

Author: CryptoYC Tech

(Note: This article was written on January 27, 2022.)

We talk every day about the potential collapse of Terra because we remain skeptical of its "left-foot-on-right-foot" economic model. However, if we focus instead on the relationship between its two core components—LUNA and UST—and their utility breadth, how likely is such a collapse? Or even if a crash occurs, are there mechanisms in place to correct it? Today, let's examine whether Terra might走向灭亡 from this perspective.

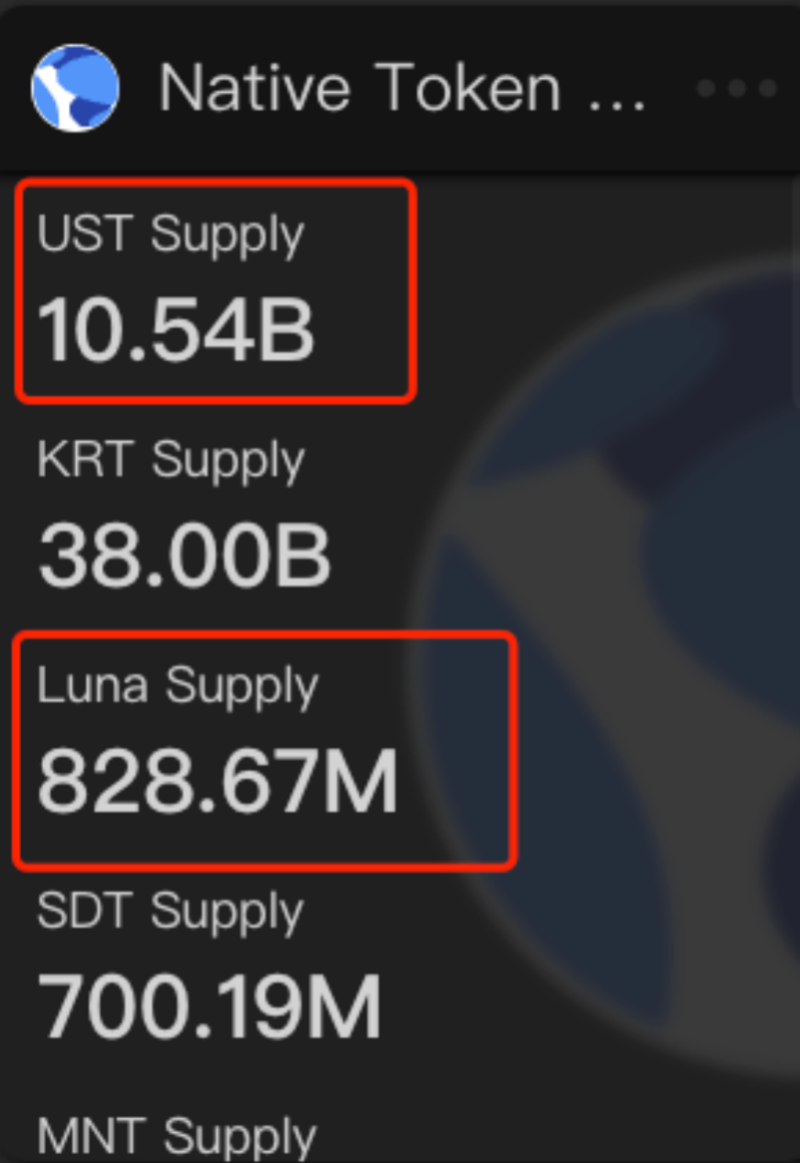

The Foundation of the Terra Empire—Anchor

First, let’s understand what Terra itself actually is. If we consider Terra as analogous to the Federal Reserve, then UST would be like the US dollar, while LUNA plays a role similar to gold reserves (though of course LUNA and gold differ significantly—the comparison here refers only to their function as value stores). It should also be noted that LUNA's own value is reciprocally supported by the utility of UST. With that in mind, we should first look at the current supply levels of both assets. According to data provided by the Terra dashboard, the latest figures are as follows:

Image source: Terra dashboard

If you recall our previous discussions about the Terra chain, you may remember that the official issuance cap for UST was set at $10 billion. In theory, total supply should therefore be around $10 billion when measured against USD. The reason for over-issuance remains unclear, but we can tentatively assume that demand for UST has already exceeded initial expectations. As previously discussed, the PVC mechanism between UST and LUNA implies that increased UST issuance drives up LUNA’s price, potentially creating a virtuous upward spiral. Everything seems promising—but now let’s assess the real-world utility of UST today.

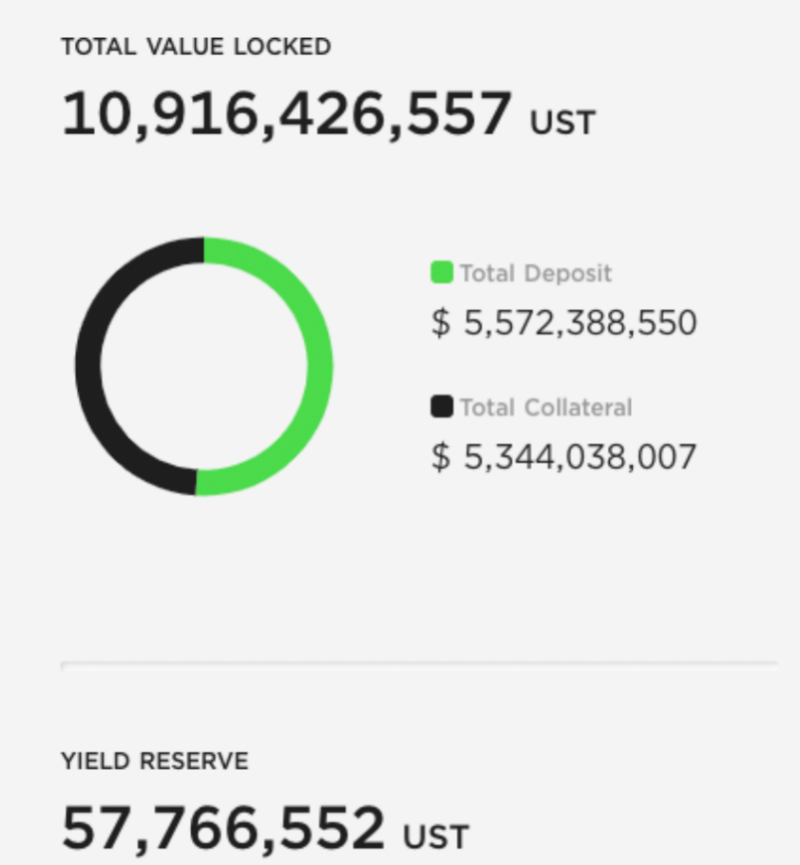

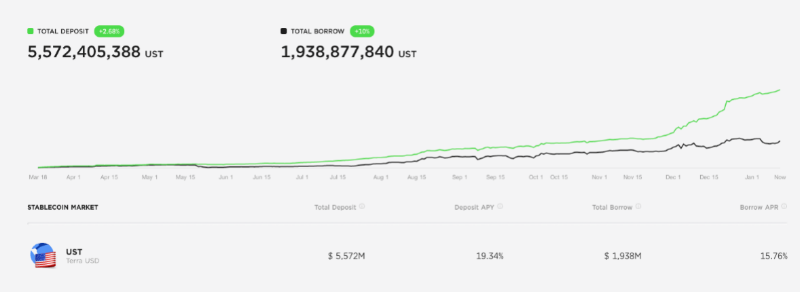

This brings us to Anchor—the cornerstone application upon which Terra stands or falls. Why focus on Anchor? Because currently, the total UST supply stands at $10.54B, while Anchor’s TVL denominated in UST is:

Image source: Anchor dashboard

Of this, the amount of UST staked specifically for lending purposes amounts to $5,572,388,550. That means more than 50% of all circulating UST exists directly within Anchor. If we assume all platform assets are ultimately backed by UST, then over 98% of UST is effectively locked inside Anchor. Keep this proportion in mind as we proceed. Now, let’s turn our attention to another trending application—Abracadabra.

Terra’s Magician—Abracadabra

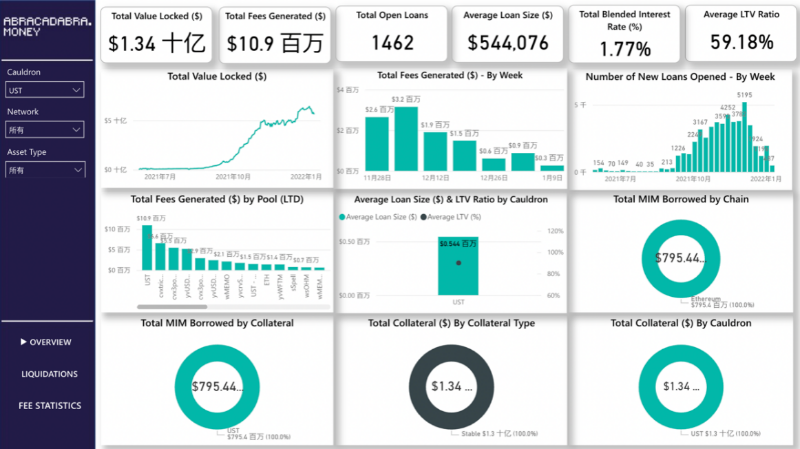

Let’s first examine the current level of UST locked within Abracadabra:

Image source: https://app.powerbi.com

For those familiar with the project, you’ll know that UST activity on Abracadabra surged recently due to Degenbox (launched November 3, 2021). Originally, I intended to discuss only Degenbox, but without broader context, it might not make sense. So let’s briefly review the entire project.

The Magician’s Magic Wand—Leveraged Yield

To begin, Abracadabra resembles Alchemix—it nominally functions as a lending protocol, but essentially issues its own MIM token by unlocking liquidity from deposited collateral tokens. While many features exist, one particularly interesting one is called “leveraged yield positions.” The process can be illustrated as follows:

Image source: https://docs.abracadabra.money/

Here’s the official explanation:

To clarify, consider a user who wants to leverage their yvUSDT position:

-

Steps 1 and 2: User selects desired leverage, obtains yvUSDT, and deposits it as collateral.

-

Step 3: Based on selected leverage, the protocol borrows an equivalent amount of MIM.

-

Step 4: These MIM tokens are swapped into USDT (exchange rate and slippage play key roles here).

-

Step 5: The obtained USDT is deposited into Yearn Vault to generate yvUSDT.

-

Step 6: Newly minted yvUSDT is redeposited into Abracadabra as additional collateral.

Despite multiple steps, the essence is simple: You provide collateral, and rather than receiving MIM outright, the protocol uses flash loans to give you leveraged farming returns—such as multiplied Yearn yields—at your chosen leverage level (up to 10x).

Now, back to Degenbox.

Degenbox

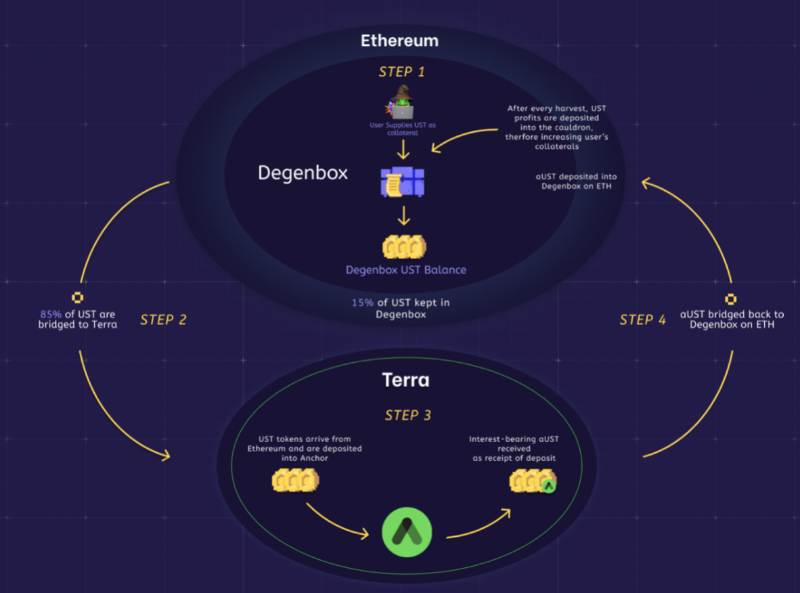

Image source: https://docs.abracadabra.money/

The process involves several steps. In summary, users can stake UST to obtain MIM. However, Abracadabra generates profits primarily through Anchor. More precisely, the protocol bridges 85% of user-staked UST cross-chain to Terra and stakes it in Anchor (via EthAnchor), then brings the resulting aUST receipt back to Degenbox as enhanced collateral, thereby increasing the value of the user’s position.

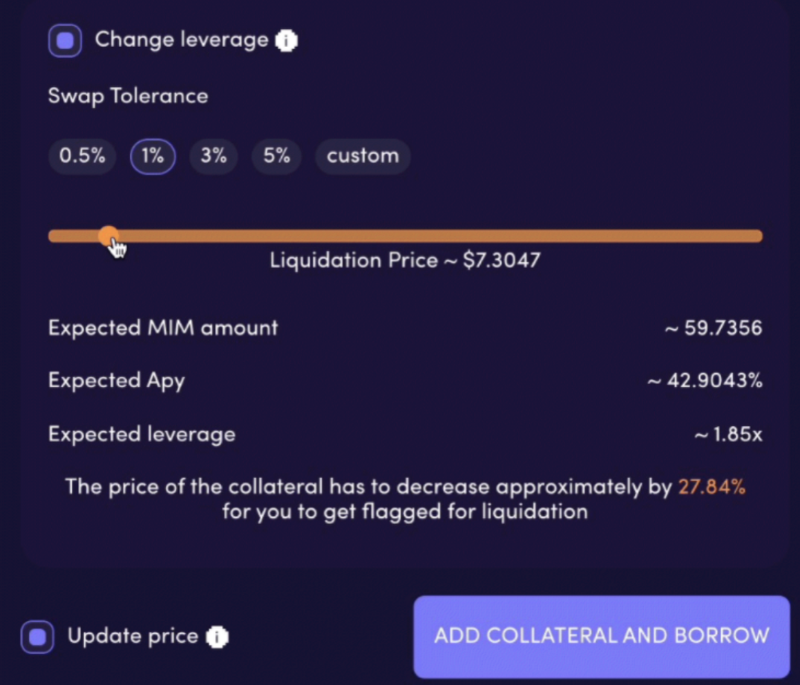

Additionally, leveraged yield positions are also available within Degenbox—a crucial feature. Note that these leveraged returns don’t mean a 10x multiplier on actual profit; various costs including slippage and borrowing fees must be deducted, as shown below:

Image source: https://abracadabra.money/

Therefore, overall, with 1% slippage, selecting 90% of TVL and 10x leverage results in approximately 6.7x return on original capital.

In other words, this allows recursive yield generation in platforms like Yearn: deposit 100 ETH to get 100 yvWETH, then use yvWETH as collateral in Abracadabra with 90% TVL and 10x leverage to achieve 6.7x Yearn ETH yield. Using the latest Yearn ETH APY (1.18%) and Abracadabra’s yvWETH borrowing rate (0%), let’s calculate the final return:

Total yield = R_yearn_ETH × 0.9 × 1.18% × 6.7 − 0 = 7.1154%, compared to unleveraged yield of 1.062%. A significant difference.

However, high reward comes with high risk. Since leveraged yield positions do not disburse MIM directly, during liquidation, users lose everything.

With Abracadabra’s mechanics explained, let’s analyze how it integrates with UST. Since both UST and MIM are stablecoins, the most relevant liquidity pool is clearly the MIM-UST pool on Curve:

Image source: https://llama.airforce/#/curve/pools/mim-ust

Currently stable at ~$1B. Assuming Anchor accounts for roughly 90% of total UST supply via deposits and loans combined, the remaining 10% is largely concentrated in this single Abracadabra-related pool. This highlights how critical these two protocols are to Terra’s stability—especially Anchor, where the majority of UST resides. If Anchor’s promised 20% fixed annual yield suddenly fails and causes UST to depeg from USD, could a storm follow? This will be the central theme of today’s analysis.

Warning Signs Before the Storm

Assuming worst-case scenarios—if Anchor encounters problems (after all, it’s peer-to-peer, and offering such high APY on a stablecoin isn't sustainable forever)—how severely could this impact UST and LUNA? To answer this, we need to examine Anchor’s TVL structure.

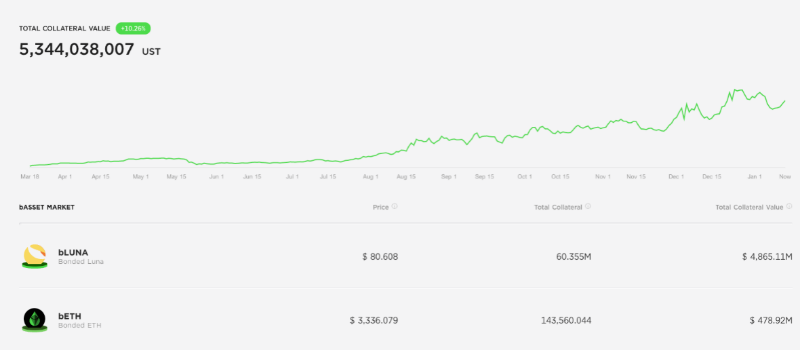

As mentioned earlier, users can stake UST in Anchor and receive around 20% APY (fluctuating slightly, averaging ~20%). This portion totals approximately $5B. The other $5B consists of borrowers’ collateral, mostly in LUNA, with some ETH. Distribution breakdown:

Image source: Anchor dashboard: https://app.anchorprotocol.com/

Now, how does Anchor afford to pay users 20% APY? Typically, a P2P platform earns revenue by charging borrowers higher interest rates than it pays depositors. But given the current loan APRs, few would borrow under such conditions. We can verify this from the displayed borrowing rates:

Image source: Anchor dashboard: https://app.anchorprotocol.com/

The current borrowing rate is merely 2.3% (actual cost being Distribution APR minus Borrow APR; D APR reflects ANC token incentives). Even using the higher Borrow APR of 15.76%, it still falls short of covering the 20% paid to depositors. Clearly, other sources must support this gap. Let’s now examine the collateral—LUNA and ETH.

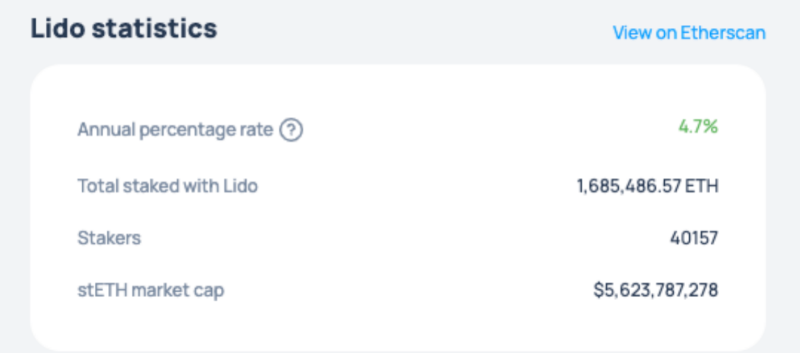

According to official documentation, LUNA used as collateral is staked on the Terra mainnet to earn staking rewards, while ETH is staked via Lido for yield. Current yields are:

Image source: http://defirate.com

Image source: https://lido.fi/#networks

Comparing expected payout obligations against actual yield generated, it becomes evident that current income cannot cover interest payments. First, however, let’s check the ratio between deposits and loans:

Image source: Anchor dashboard: https://app.anchorprotocol.com/

Clearly, deposits far exceed loans. Even calculating at 15% borrow rate, revenues fall well short of depositor payouts. Let’s compute exact numbers.

Using the latest UST deposit rate of 19.34%, Anchor’s annual payout obligation is:

$5,572M × 19.34% ≈ $1,077.62M

Meanwhile, annual yield generated at current rates is:

LUNA: $4,865.11M × 7.02% ≈ $341.53M

ETH: $478.92M × 4.7% ≈ $22.51M

Borrowing: $1,938.87M × 15.76% ≈ $305.56M

Total income: LUNA + ETH + Borrowing = $669.6M

Indeed, Anchor appears to be operating at a loss. This is reflected in declining daily protocol revenue:

Image source: http://www.mirrortracker.info/anchor

Careful inspection of deposit trends reveals that the recent surge in deposits over loans occurred abruptly. What triggered this shift remains unexplained for now. But here’s a key question: Anchor isn’t stupid—what should it do in this situation?

The simplest solution: lower the 20% fixed APY.

But this raises another issue: over half of all spot UST is held in Anchor, attracted precisely by that 20% yield. Lowering it could severely destabilize UST. Given the massive size of the UST-MIM pool, could this ripple into MIM’s stability and even affect other Curve stablecoin pools? Expanding further, this revisits our opening question: what happens to UST if Anchor slashes its rate?

Will the Tower Collapse, or Will It Stand?

If Anchor drastically cuts its APY, we can explore several hypothetical scenarios—optimistic, moderate, and pessimistic. Let’s analyze each.

Optimistic scenario: Despite the rate cut, the market continues to view UST as low-risk. Confidence in UST’s stability remains strong, so no significant impact occurs.

Moderate scenario: Markets remain relatively stable, but participants are profit-driven. Each investor has a threshold. Assume this threshold is 10%. Once deposit APY drops below 10%, users withdraw their staked UST, reducing pool size, causing borrowing rates to spike, which in turn pushes deposit APY back up, attracting new deposits—a cyclical pattern commonly seen in normal markets and the most likely outcome.

Finally, the scenario we’re most curious about—pessimistic case: Here, the market perceives UST as high-risk. Once Anchor’s yield dips below psychological thresholds, panic ensues. Massive withdrawals of staked UST occur instantly, representing highly unstable outflows.

Where would these destabilized UST go? Arbitrage bots would go wild. Consider several possibilities:

-

Hold UST: ******** You believe that? If I think UST is risky, why would I hold it?

-

Sell UST for other stablecoins: This would inevitably cause UST to depeg (regardless of duration):

-

Impacts Curve and Abracadabra’s Degenbox. Magnitude to be analyzed later.

-

Creates selling pressure on LUNA. Excess UST in circulation forces the protocol to buy back UST with LUNA, impacting LUNA’s price.

-

Manually redeem UST for LUNA to arbitrage: Users familiar with Terra’s mechanics may choose this path—redeeming UST for LUNA, then selling LUNA on open markets. This splits into two sub-cases:

-

Deep liquidity exists in public markets; centralized exchanges absorb volatility (no protocol-level mechanism triggered).

-

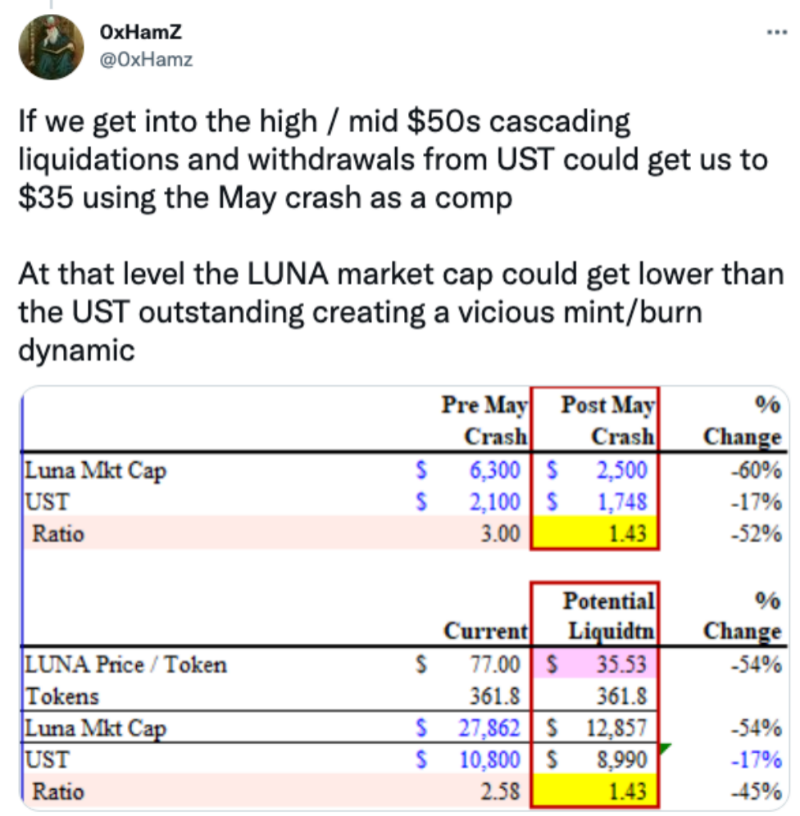

Not enough depth. As more LUNA hits the market, the protocol uses UST to repurchase LUNA, triggering a feedback loop—entering a death spiral (severe UST depeg). According to modeling by 0xHamZ (based on #519):

Image source: https://twitter.com/0xHamz/status/1479261217298468865?s=20

Now, let’s examine impacts on Curve and MIM.

Where Does the Domino Effect Stop?

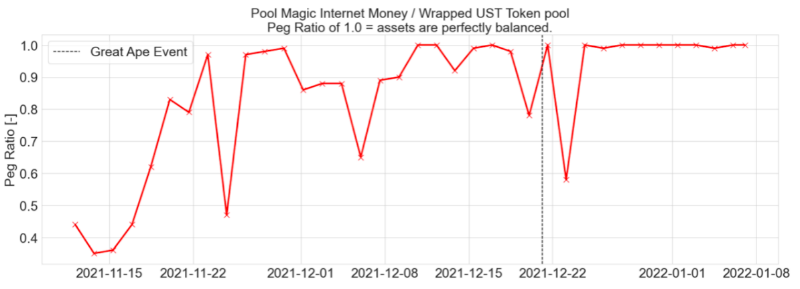

We’ve heard of vampire attacks, but another recent phenomenon—Viking Attack—refers to Degenbox draining Anchor. Under our pessimistic assumption, a drop in Anchor’s rate causes UST to depeg from USD—and consequently from MIM—also affecting the 3CRV pool. However, thanks to Curve’s arbitrage mechanisms, bots quickly restore pegs. Historical data from the MIM-UST or UST-3CRV pools confirms this behavior.

Image source: https://cryptorisks.substack.com/p/on-abracadabra-degenbox-strategies

But deeper analysis is needed:

Massive UST flooding the market makes UST cheaper, leading to conversions into MIM or 3CRV. Simultaneously, Degenbox triggers liquidations, converting large amounts of UST into MIM, increasing downward pressure on LUNA… What happens next? Borrowing insights from analyst Naga King:

“The MIM-UST pool currently holds $1B, with $950M of MIM backed by UST. If 95% of this UST is withdrawn and traded for MIM within the pool, the composition shifts to over 90% UST—projected at 93%.”

Degenbox anticipated this and implemented a safeguard: if withdrawals exceed 10% of the pool’s total, they are temporarily restricted until UST is redeposited back from Anchor to the mainnet—a process taking several hours. During this window, market arbitrageurs typically act to restore price equilibrium. Of course, this assumes consensus hasn’t fully collapsed; otherwise, arbitrageurs won’t engage with worthless assets.

Why didn’t we discuss the 3CRV pool? Primarily because the UST-3CRV pool size is manageable—Curve itself can absorb the shock, limiting systemic risk.

Conclusion

Through UST, we see that the stability of algorithmic stablecoins relies heavily on designed arbitrage mechanisms. But once consensus breaks or extreme market conditions arise, everything can vanish overnight—especially when even arbitrageurs refuse to step in, rendering all mechanisms useless. This reaffirms that complex, recursive financial structures like Terra’s can generate outsized gains in any era. Ultimately, will Terra trigger the next blockchain financial crisis? Can its financial skyscraper withstand the coming tsunami of liquidations? Whether the tower falls or stands—we wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News