The Unanchored Moonlight: The Fall of LUNA

TechFlow Selected TechFlow Selected

The Unanchored Moonlight: The Fall of LUNA

I saw it rise with its vermilion towers, I saw its towers fall.

By 0xTodd

The moon will eventually set

Watch it rise to glory, watch its collapse.

In truth, $Luna’s problem boils down to just one word: "liquidity."

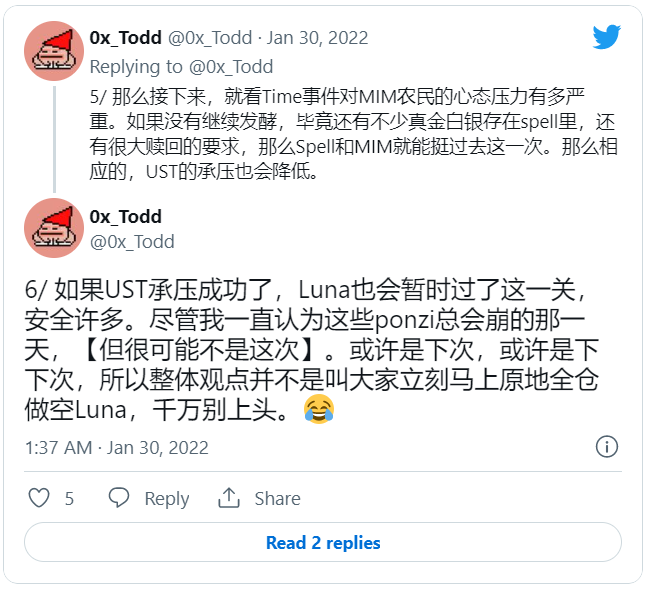

Luna, as a volatile asset with poor liquidity, was allowed to mint UST at a 1:1 ratio and leveraged platforms like Curve to gain fiat-level liquidity reserved for real stablecoins. From that moment on, its fate was sealed. And the 20% APR? That was merely the final trigger.

--Origin--

First, the cause — the spark: large UST holders exiting.

On May 8, Terra enthusiastically withdrew liquidity from its old pool in preparation for 4pool (a new Curve pool) — touted as the end of the “Curve War.” But 84 million UST, whether misjudged or deliberately dumped, broke UST’s peg on Curve, catching the system off guard and sending UST into immediate de-pegging.

Escalation — Terra's flawed crisis PR.

I’ve said it before: confidence markets run on confidence. Once lost, there’s no return.

After de-pegging, they should have doubled down with reassurance — soothing words, calm narratives — and brushed it off lightly.

Instead, Terra did the opposite: “We’re rescuing the market! We’re stepping in to stabilize the peg!”

This was disastrous — it signaled weakness. If you're healthy, why see a doctor?

External conditions — bearish macro environment

BTC has become tightly correlated with US equities due to institutional influence. With interest rate hikes and balance sheet contraction dragging down stocks, BTC entered a prolonged downtrend. Unfortunately, LFG made a critical error at the worst possible time. Having bought ~100,000 BTC at an average cost of around $40k, LFG couldn’t afford to sell at a loss. Yet propping up UST required capital. So LFG pledged BTC as collateral to market makers in exchange for fiat to support UST.

Deterioration

But BTC kept falling, putting LFG in deeper trouble. If UST continued to de-peg, their newly pledged BTC faced liquidation risk. As a result, we saw LFG quickly move out the remaining BTC — possibly selling, preserving gains, or more likely posting additional margin — which only accelerated the downward spiral.

The narrative of “UST-BTC mutual survival” had just been established — and now it officially collapsed. This triggered fresh waves of FUD, leading directly to today’s disaster.

--Dilemma--

What is DK’s current dilemma?

With dwindling funds, full-scale defense is no longer feasible. He faces a brutal choice — save $Luna or save $UST. Ammo is scarce; saving either would require exhausting every last resource.

Save $Luna

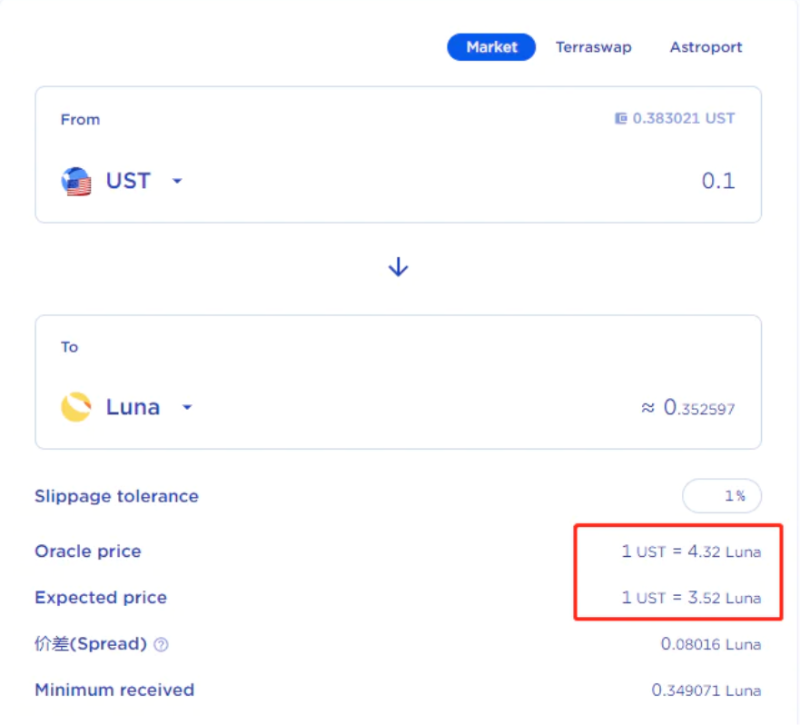

This means manually adjusting oracle prices (using expected price), abandoning the 1:1 redemption mechanism, and maintaining a premium of Luna over UST. This disincentivizes burning UST — for example, if Luna trades at $1.1 but burns at $1.3, arbitrage margins vanish. This explains why UST hasn't re-pegged.

But this severely damages UST’s fundamentals (it’s no longer stable), and such a premium can’t last forever.

Burn UST for Luna

Save $UST

This means allowing UST to be swapped into Luna and dumped onto the market — restoring the peg. But Luna is already under $1. Its market cap is less than 1/5 of UST’s. Even if completely burned, there isn’t enough Luna to satisfy all UST holders wanting to exit.

There’s a perfect English term for this: insolvent (effectively bankrupt). This is the inevitable end of every Ponzi scheme.

“technically insolvent”

DK’s response

After what may have been careful consideration, DK finally posted a concise Twitter thread on May 11, conveying one clear message: he still wants to save UST.

If I were DK, I’d shut down the cross-chain bridge and ask Jump Trading and Binance to fully support UST on Binance, bringing it back to $1. That could restore market confidence — perhaps offering a sliver of hope.

Tweet of DK

Breaching psychological resistance

Yet after posting this, everyone understood his intent — it seemed like Luna was being abandoned.

Luna plunged further, shattering all defenses. People saw Luna drop below $0.1. Binance even reduced the precision of Luna futures contracts. Just one month earlier, it was trading in triple digits — now, we’re tracking three decimal places.

Announcement from Binance

--Projection--

Can UST really be saved?

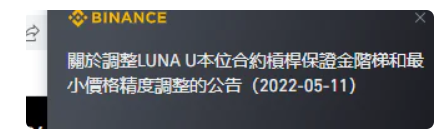

Liquidity is everything. This is the core theme of this entire thread.

Looking across the board, UST currently trades around $0.8, but Curve liquidity is nearly dried up — under $20 million. Terraswap and Astro each have about $3 million left. Binance and FTX order books might hold another few tens of millions combined for UST and Luna.

Yet 13 billion UST want to exit.

I’ve spoken with many Luna farmers — most are extremely sharp, though some were genuinely deceived, especially ordinary Koreans and small businesses — which I won’t dwell on here. Regardless, in the current climate, escaping is everyone’s shared goal.

But fewer than 1% will make it out alive. While UST appears to still hold $0.8, many dream of re-pegging. The reality is harsh: only a few hundred million UST can exit at $0.8. The remaining over 10 billion will be worth zero.

In one sentence: insufficient liquidity!

Without liquidity, any token is worthless paper. That’s the difference between a Ponzi and a real asset.

--Possible Ways Out--

So what can be done?

Even if one side is saved through sheer effort, ammunition will soon run out anyway.

I deeply admire DK’s operational skill and leadership charisma. But even the most capable individual cannot overcome forces beyond their control — external help is essential.

After careful analysis, I believe only three desperate options remain.

Option One

Hope for a miraculous rebound in US equities, pulling BTC along, quickly returning to $40k then $50k, reigniting FOMO across the market.

But given current expectations of rate hikes and quantitative tightening, such a rebound is highly unlikely.

Option Two

Persuade Jump Trading to step in and rescue the project. Other investors like 3AC and Binance clearly intend to cut losses, but deeply entangled Jump might still act.

But here’s the issue: reviving the system requires tens of billions of dollars. Even if Jump injects that much, once the price recovers, everyone will dump — rendering the project meaningless afterward.

Moreover, according to The Block, Luna’s fundraising efforts appear to have failed.

Option Three

Shock therapy.

As the name suggests — do nothing and let it crash.

For instance, wait until Luna drops to $0.01 and UST to $0.01. At that point, LFG might realistically buy back everything. But who pays the price? We all know the answer.

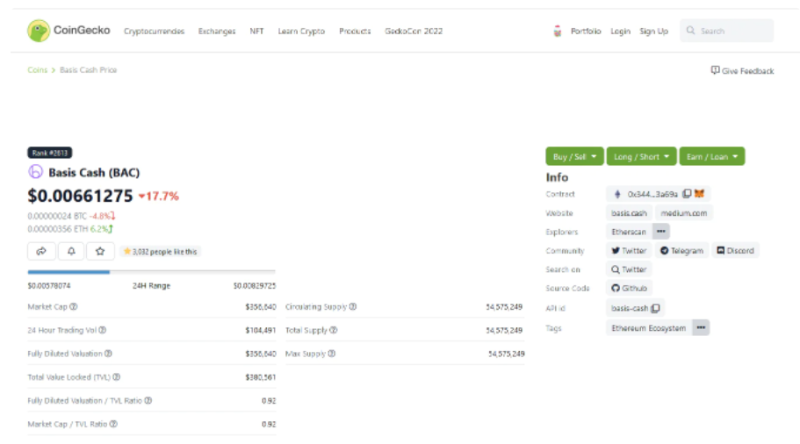

The last project that attempted shock therapy was Basis Cash — once hailed as the third-generation algorithmic stablecoin king. Take a look at $BAC, the so-called “algorithmically guaranteed USD stablecoin,” and see how much value remains.

PS: Ironically, Terra insiders revealed that DK was also a major participant in BAC.Coindesk

--Reflections--

A few personal thoughts.

I love Twitter, but the one thing I dislike about CT culture is how many people never warn others about risks — instead calling those who avoid Ponzis “Few” or “NGMI.”

Worse, some actively glorify Ponzis, hype them to the sky, and take pride in dumping them onto latecomers while boasting about their perfect timing.

Recently, I joined Terra’s Discord (its Telegram seems banned), attended multiple Twitter Spaces. Many foreigners poured their life savings into Anchor — now they’re helpless, suffering, and you can hear faint sobs in their voices when they speak.

Many were deceived — by DK, by Terra, by those who championed these Ponzis. Lifelong savings turned into illiquid paper wealth.

I’m not a major KOL — just a crypto researcher managing a modest fund (@NothingResearch) with my partner, mostly our own money. I don’t run ads or accept commissions. My role model is @ZachXBT, known for exposing scams.

My conscience compelled me to write these words over the past six months. Many friends hold Luna — perhaps I opposed it too strongly, and some now resent me.

Scroll through my tweets — for a long time, I avoided mentioning Luna by name, fearing backlash from holders. Of course, I don’t blame them; everyone investing in crypto hopes to make money.

But I’ll still say it: when I see a Ponzi, I’ll call it out — firmly.

It’s a matter of principle. Saving even one person brings me peace of mind.

The above is just rambling — feel free to skip if uninterested.

--Finally--

Back to $Luna

I don’t recommend large short positions at this level — a centipede may die, but it doesn’t stiffen immediately. A $1 Luna may ultimately head to zero, but it could briefly rebound to $2 or $4. I also don’t recommend constant swing trading — most will just slowly give their capital back to exchanges.

Perhaps UST still has room to fall, though its upside is limited — maximum $1;

Perhaps ecosystem projects like $ANC on Terra won’t fare well either — look at former EOS blue-chips for reference;

Perhaps DK can pull off one last miracle — but likely his final attempt, and the odds are truly slim.

Lastly, many are obsessed with algorithmic stablecoins — including me.

I believe algorithmic stables are fairies in the DeFi forest — so alluring, seemingly within reach, yet perhaps mythical, drawing endless pioneers forward.

But remember: don’t gamble your entire stack on a social experiment.

I still hope for a non-custodial, purely algorithmic stablecoin to emerge — bringing fairy-like brilliance to this increasingly chaotic world.

Seeking the Fairy

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News