How the "Crypto Soros" Profited from the UST Collapse

TechFlow Selected TechFlow Selected

How the "Crypto Soros" Profited from the UST Collapse

A textbook defensive battle.

Author: Onchain Wizard

Translation: TechFlow intern

Note: This is a speculative analysis of how the "Crypto Soros" targeted UST. According to this scenario, if the mastermind behind the attack closed their position around $32,000, they would have made over $800 million in profit.

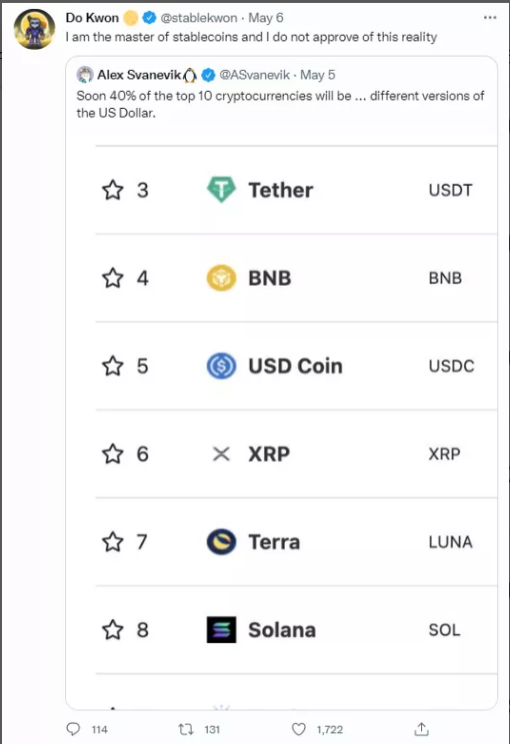

Everyone is talking about UST now — even Janet Yellen has commented. Everyone discusses how much Terra lost during its collapse. Today, let’s shift perspective and examine how much the "Soros" of this war actually earned.

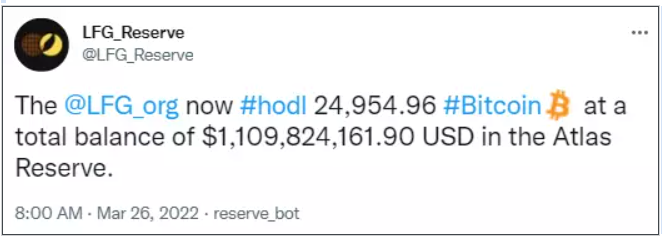

The story begins in late March when LFG announced it would start purchasing BTC and placing them into the treasury to help support UST. From March 22 onward, LFG began accumulating BTC, holding over $1 billion worth by March 26. This laid the groundwork for the "breaking war" of UST.

Then came April 1 — the second phase. Frax's 4pool announced UST integration. Here, the "Soros" finally identified the vulnerability, and his offensive was ready to begin.

First, he borrowed 100,000 BTC and converted 25% of it into UST. We don't know at what price the "Soros" began shorting those 75,000 BTC, but we assume (speculatively) that he sold them into Kwon's buying pressure. LFG purchased 150,000 BTC between March 27 and April 11. Let's take the average price across that period: $42,000.

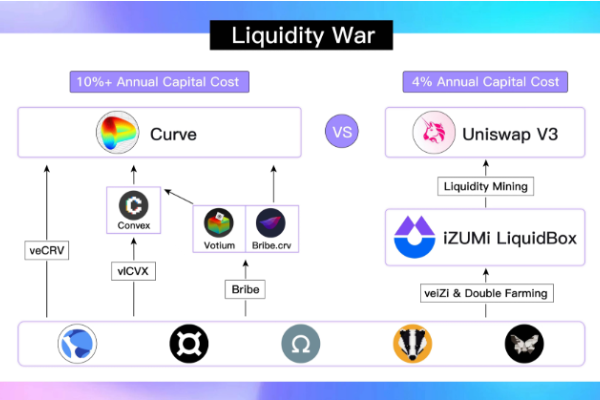

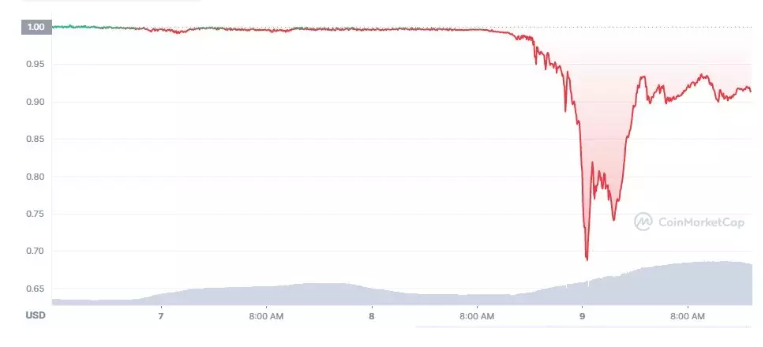

Next, as liquidity shifted within 4Pool, the attacker used a portion of UST to drain liquidity from the Curve UST pool, causing partial depegging (as low as $0.972), triggering market panic.

At this point, LFG began selling BTC to defend the peg, creating downward pressure on BTC. And now, the real action with the remaining UST holdings began.

As Curve liquidity dried up, the "Soros" used the remainder of their ~$650 million (from an initial $1 billion) to dump UST on Binance. Panic spread through the community. True depegging occurred, and everyone scrambled to exit.

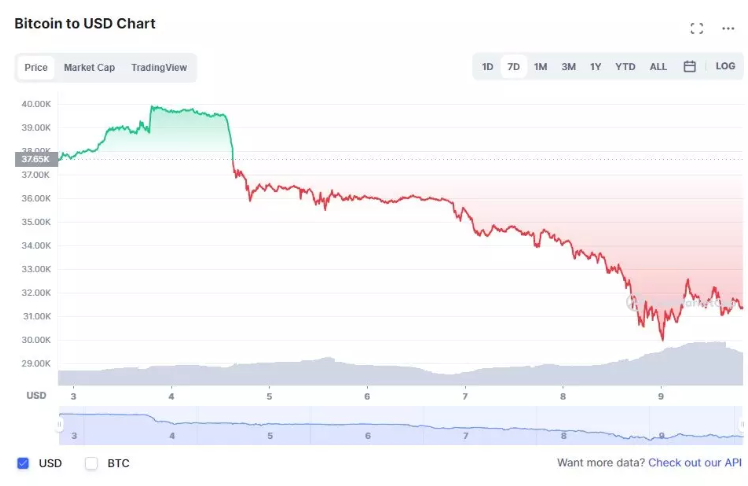

LFG kept selling BTC while the "Soros" dumped UST, eventually congesting the network and forcing CEXs to suspend UST withdrawals. The crypto community panicked, questioning how much BTC would need to be sold to maintain the peg. BTC dropped 25%, from $42,000 on April 11 to $31,300. Finally, BTC's decline accelerated, UST completely lost its peg, and the bears triumphed.

And thus, the battle ended. How much did the "Soros" earn? We lack detailed records. He likely also shorted LUNA simultaneously. But assuming he covered his BTC shorts at an average price of $32,000, he would have made at least $952 million from the BTC short alone. Regarding losses from dumping UST on Curve, I estimate minimal — say $11 million. Then, due to severe depegging on Binance, assume another $125 million cost. After deducting borrowing costs, his total profit would still amount to approximately $815 million.

Let’s review the entire process. BTC was central to this event. Once LFG announced its entry into BTC, the "Soros" anticipated they would keep selling BTC to buy back UST (to prevent LUNA’s price collapse).

Before 4pool launched, 3pool had very low liquidity, allowing the attacker to drain it with just $350 million, sparking panic in both BTC and UST markets.

I admit my profit estimates involve many assumptions, but regardless, he made an enormous profit from this trade — a textbook-perfect assault.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News