UST Depegging: Terra's Past and Future

TechFlow Selected TechFlow Selected

UST Depegging: Terra's Past and Future

An $18 billion stablecoin ecosystem is collapsing.

Written by: Jonwu.eth

Translated by: TechFlow intern

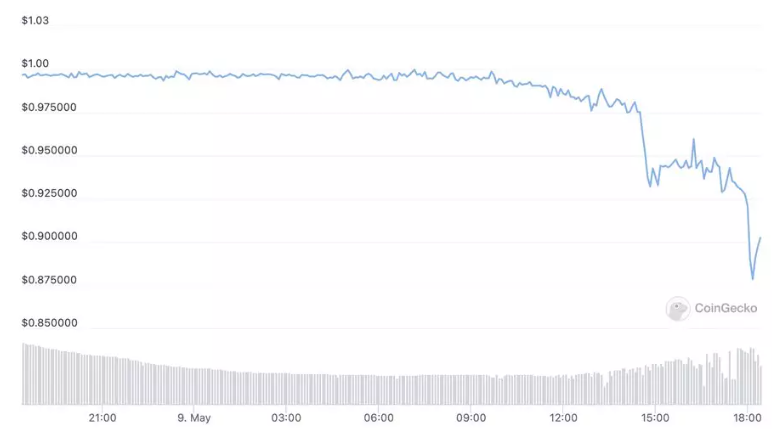

An $18 billion stablecoin ecosystem is unraveling. UST, a dollar-pegged stablecoin, has de-pegged twice in the past few days and is now trading around $0.90 against the US dollar.

Notably, you can always mint 1 USD worth of UST with 1 USD worth of LUNA, and vice versa. So even if UST trades below $1, you can still redeem 1 UST for $1 worth of LUNA—creating an arbitrage opportunity.

We all know that stablecoins require strong demand to maintain stability and their peg.

So how did UST generate such demand? Enter Anchor.

Anchor Protocol is a money market, but crucially, it offered a 19.5% annual yield on staked UST. With such high returns on a stablecoin, who wouldn't be tempted? It was essentially free money, so vast amounts of UST flowed into Anchor.

Of course, this had problems. If a protocol can offer risk-free 20% APY, people could simply borrow large sums, lever up, and boost their yields to 100%. This is exactly what happened previously with Abracadabra / MIM’s Degenbox.

For certain reasons, Degenbox collapsed in January, unleashing massive selling pressure that de-pegged UST and sent LUNA crashing from $100 to $46.Does this sound familiar? History doesn’t repeat, but it often rhymes.

Another issue arises: If UST is supposed to be stable, which institutions can afford to pay 20% interest annually? Well, they claimed they could—and introduced LFG (Luna Foundation Guard), the entity overseeing Terra’s multi-billion-dollar ecosystem fund. But before discussing LFG, we need to understand LUNA’s role.

The narrative around LUNA was: the more UST in circulation, the less LUNA there would be, because minting one UST requires burning one LUNA. Thus, higher demand for UST would drive up LUNA’s price—that’s why LUNA’s market cap grew alongside UST adoption.

But when LUNA’s price falls → users redeem UST for LUNA to arbitrage → increased LUNA supply → more selling pressure → further price decline. This is essentially what’s happening today.

With that context, let’s return to LFG. Initially, LFG supported Anchor by selling treasury-held LUNA to pay out the 20% yield to UST stakers.

So sustained UST demand → reduced UST circulation → rising LUNA price → LFG sells more LUNA. Great in theory, brittle in practice. After the Degenbox collapse challenged this model, LFG adapted: to keep the perpetual motion machine running, they added BTC to the reserve. Now, instead of only UST ↔ LUNA, there’s also UST ↔ BTC.

BTC is precisely what made things far more complicated. Terra extended its death spiral into BTC. Amid spreading market panic, UST de-pegged, forcing LFG to effectively become a short-seller of BTC.

Finally, what do we see ahead? 1) The treasury may be depleted, but UST stabilizes. Currently, BTC appears to have recovered from liquidation fears. 1a) LFG recognizes BTC prices have fallen below average cost and plans to buy back low, restoring UST’s peg. With lower-cost BTC holdings, everything looks optimistic again.

Alternatively, in an extreme scenario, if maintaining the peg becomes too difficult, Do Kwon and LFG might abandon forced stabilization, sacrificing LUNA holders by continuously burning UST and dumping LUNA until UST returns to being fully collateralized. Let’s hope this never comes to pass.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News