Curve War New Front: Will Uniswap V3 Be a Better Choice for UST and DAI?

TechFlow Selected TechFlow Selected

Curve War New Front: Will Uniswap V3 Be a Better Choice for UST and DAI?

If Curve's core value proposition—stablecoin trading—is overtaken by competitors, the value支撑 of its ecosystem projects would rapidly collapse.

Author: 0xJamesXXX, iZUMi Research

Authorized for repost by TechFlow

Introduction: Terra's 4Pool Proposal — The Final Battle of the Curve War?

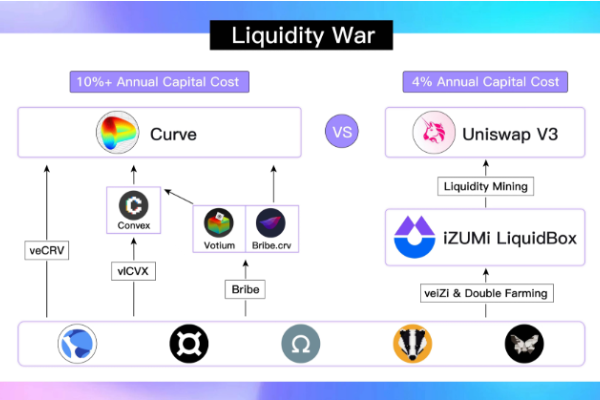

To expand the use cases of UST, Terra’s algorithmic stablecoin, across Ethereum and other compatible blockchains, and to find new ways to reduce the high funding costs associated with Anchor Protocol’s 20% annual yield offering, on April 1, 2022, Terra member Zon (@ItsAlwaysZonny) officially launched the 4Pool proposal on the Terra Research forum. The proposal announced collaboration with Frax Finance and Redacted Cartel, with Olympus joining shortly after. Together, these four parties aim to launch a new stablecoin pool—4Pool—on Curve Finance, comprising USDT, FRAX, USDC, and UST, challenging 3Crv (USDC, USDT, DAI), Curve’s largest existing stablecoin pool. This move has ignited a new wave in the Curve Ecosystem War. (Note: BadgerDAO and Tokemak also joined the 4Pool alliance on April 10.)

(https://agora.terra.money/t/ust-goes-interchain-the-4pool-and-redacted-cartel/5648)

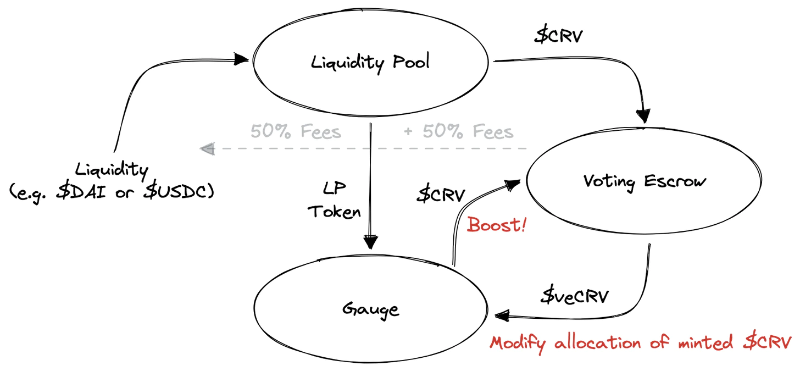

Curve is an AMM-based decentralized exchange specializing in stablecoins and pegged assets. Thanks to its Stable Assets AMM algorithm, Curve offers significantly lower slippage than other DEXs at equivalent liquidity levels, making it ideal for large-scale stablecoin trades. Additionally, Curve incentivizes liquidity providers through CRV token rewards via liquidity mining, encouraging deeper liquidity across its various pools.

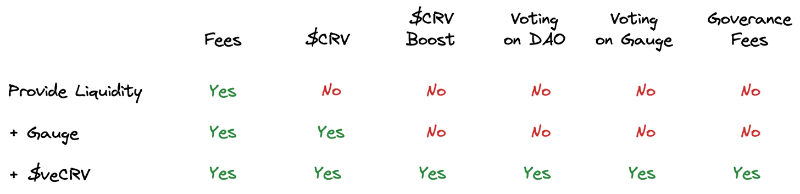

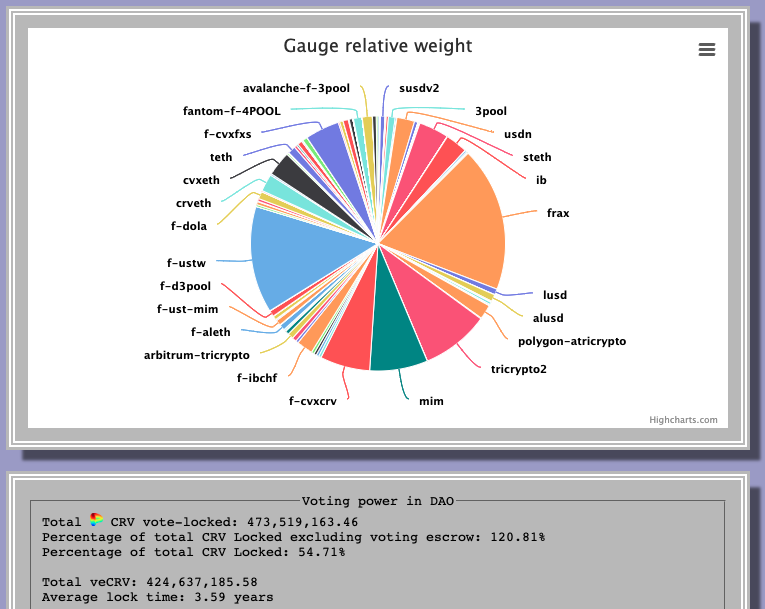

However, the distribution of CRV rewards among different pools is determined by platform governance and voting power from veCRV tokens. Users obtain veCRV by locking CRV, then vote for preferred pools to boost their CRV mining rewards, thereby attracting more liquidity. As a result, many stable asset projects accumulate veCRV to compete for liquidity incentives on Curve, giving rise to what is now known as the "Curve War."

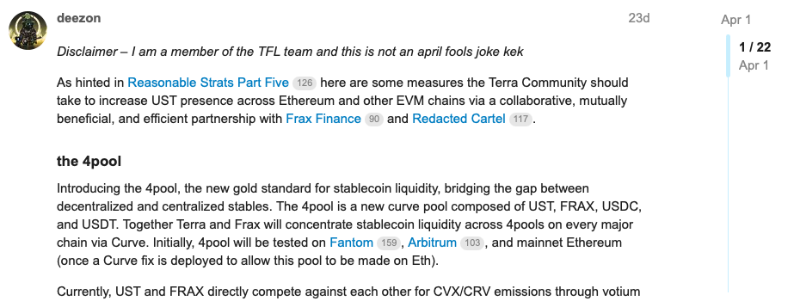

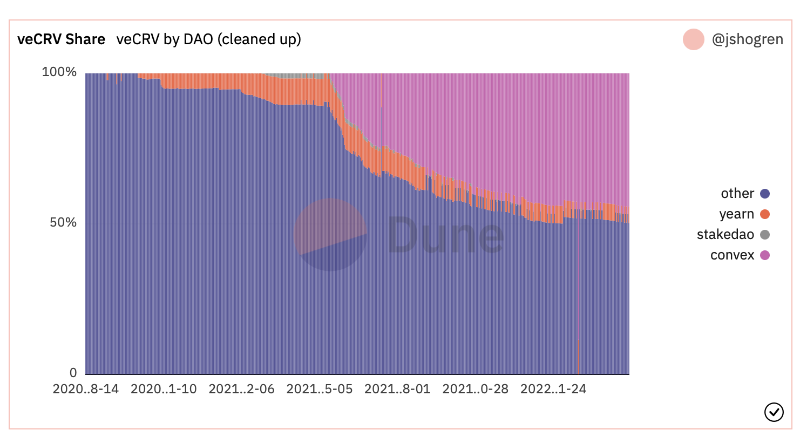

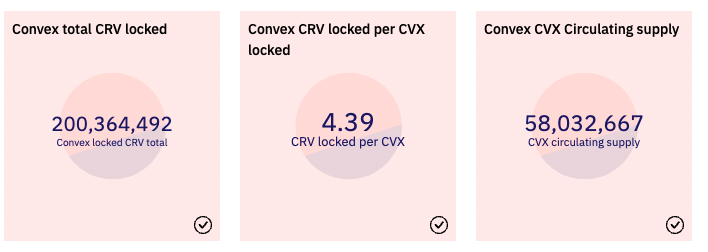

Convex is a DeFi protocol built atop Curve’s veTokenomics model. Convex aims to maximize CRV staking to gain veCRV voting power and influence how CRV emissions are allocated. In return, users receive cvxCRV tokens—pegged 1:1 with locked CRV—to maintain liquidity while earning additional CVX rewards from the Convex platform.

(https://dune.com/jshogren/veCRV-Tracking)

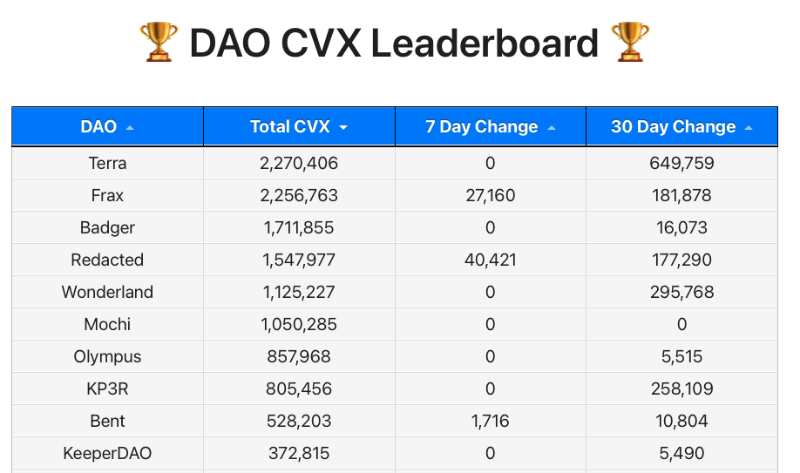

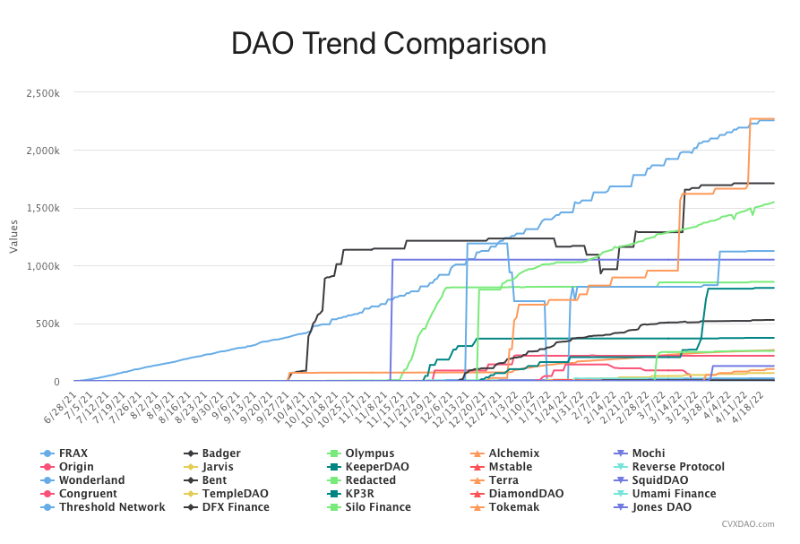

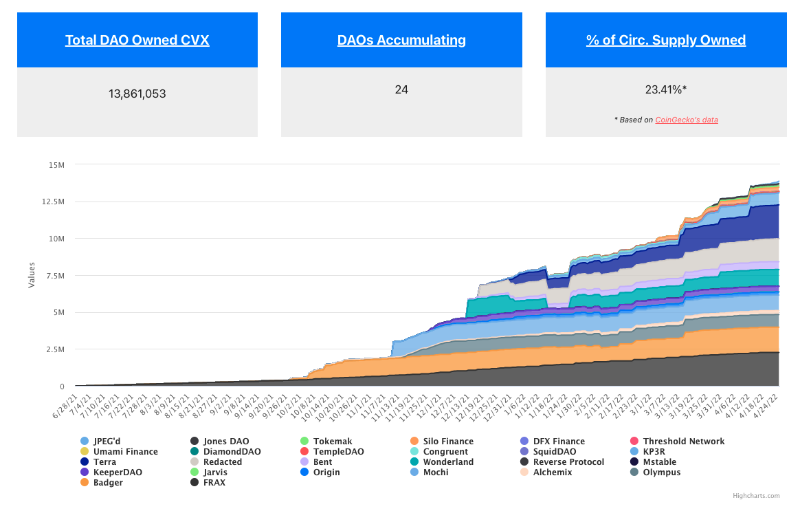

By solving the liquidity lock-up issue of veCRV, Convex has amassed a significant portion of total veCRV—currently around 45%. Convex itself employs veTokenomics: users must lock CVX to obtain vlCVX, which grants voting rights over how Convex allocates its veCRV votes. Thus, control over Convex equates to indirect control over Curve, turning Convex into a key battleground in the Curve War. Protocols such as Terra, Frax, and Redacted are actively competing for CVX dominance.

(Top 10 CVX Holding DAOs, https://daocvx.com/leaderboard/)

Although the four 4Pool initiators collectively hold approximately 6.9 million CVX tokens—about 50.3% of all CVX held by DAOs—they only control 15% of the total vlCVX supply (45.9 million). Despite Terra’s founder declaring victory in the Curve War due to controlling half of the DAO-held CVX, actual voting power remains limited. To gain greater control, Terra and Frax have resorted to bribing CVX holders via Votium, incurring substantial financial costs.

This article analyzes, from Terra’s perspective as a major participant in the Curve War, the financial costs incurred across three layers—Curve, Convex, and Votium—to secure CRV liquidity incentives and deepen TVL in their Curve pools. We will also examine current trading conditions for these stablecoins on Uniswap V3, aiming to provide valuable insights for stablecoin projects and DeFi investors.

On the Curve Layer

(https://dirtroads.substack.com/p/-31-curve-wars-plata-o-plomo?s=r)

From a liquidity provider’s (LP) standpoint, supplying liquidity on Curve yields 50% of trading fees plus $CRV liquidity mining rewards. To maximize returns, LPs stake CRV to obtain veCRV, which entitles them to the remaining 50% of fees, boosts their $CRV rewards up to 2.5x, and allows them to vote via Curve’s Gauge mechanism to increase reward weights for specific pools, thus attracting more capital.

(https://dirtroads.substack.com/p/-31-curve-wars-plata-o-plomo?s=r)

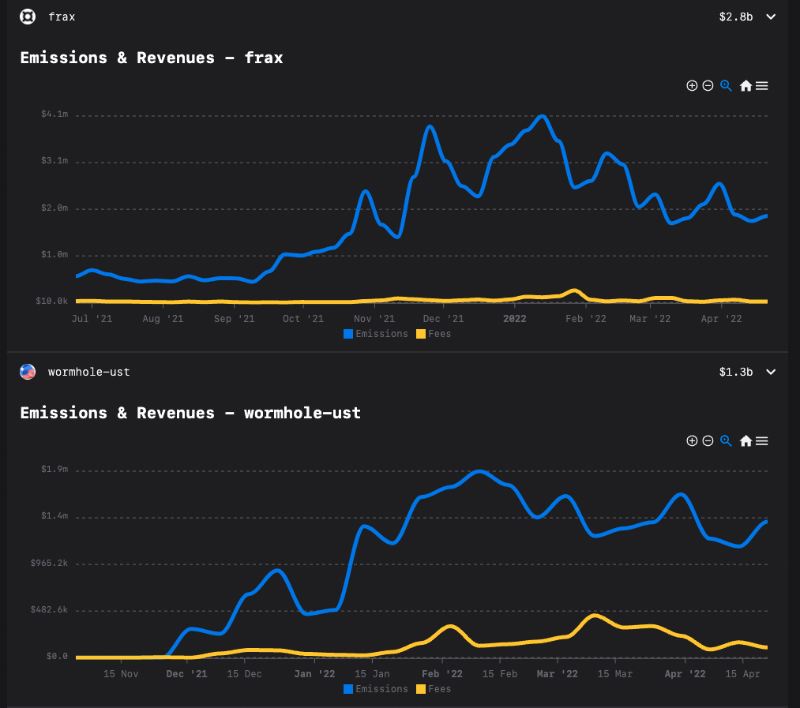

Therefore, for any project seeking to participate in the Curve War and boost liquidity depth for its token, acquiring veCRV through purchasing and locking CRV on the open market is essential. This enables direct participation in Gauge Weight voting, increasing expected returns and attracting more LPs. Data shows that for both UST and FRAX pools on Curve, the primary source of LP income comes from $CRV mining rewards, with fee revenue accounting for only 2–10% of CRV reward value recently.

(https://llama.airforce/#/curve/gauges/mim)

Assuming CRV trades at ~$2.50 (as of April 25, 2022), matching Terra’s current veCRV voting power would require purchasing and locking 57.75 million CRV tokens for four years—a direct cost of ~$144.374 million—to attract ~$1.3 billion in TVL and achieve a current CRV emission yield between 2.74% and 6.85%, including ~$650 million in UST TVL.

(https://dao.curve.fi/minter/gauges)

On the Convex Layer

Convex has become the dominant battleground for DeFi projects vying for control in the Curve War. As previously noted, directly staking CRV requires a four-year lock-up—an impractical timeframe in fast-moving DeFi. Convex solves this by allowing users to deposit CRV and receive 1:1 cvxCRV tokens, which remain liquid and trade closely at par with CRV due to strong market depth. This exit option has enabled Convex to accumulate massive amounts of CRV, holding about 45% of total veCRV supply.

(https://dune.com/jshogren/veCRV-Tracking)

To influence how Convex directs its ~45% share of veCRV votes, CVX holders must lock their CVX to receive vlCVX for voting. Unlike veCRV’s up-to-four-year lock, vlCVX locks last just 16 weeks—significantly reducing time commitment and enhancing CVX token liquidity.

(https://daocvx.com/leaderboard/)

As a result, participants like Terra and Frax now focus heavily on gaining control of Convex. Many DeFi protocols are accumulating CVX, locking it into vlCVX, and directing votes to influence underlying veCRV allocations controlled by Convex.

Assuming CVX trades at ~$26, Terra and Frax’s combined ~4.56 million CVX represents a cost of ~$118.55 million. While they rank first and second among DAOs holding CVX, this accounts for only ~10% of total locked CVX—far short of majority control over Convex.

(https://daocvx.com)

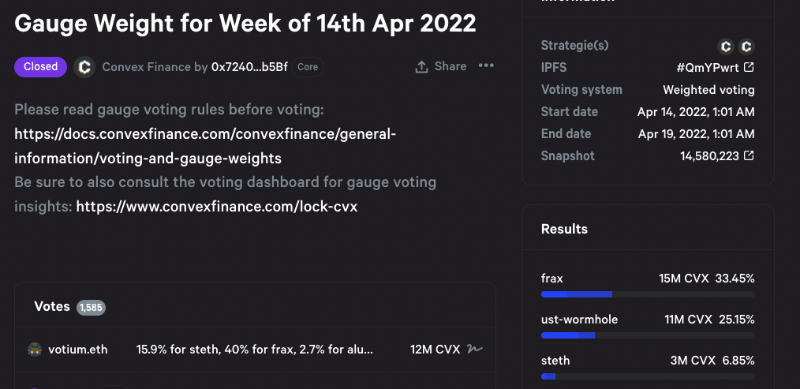

Assuming all their CVX is used to vote for 4Pool, based on the previous round’s results (much of which was secured via bribery, discussed below), Terra and Frax received ~58.6% of Gauge Weight votes. Given Convex controls ~215 million veCRV, this translates to ~126 million veCRV votes directed toward 4Pool. Over the past two weeks, this earned Terra and Frax ~$7.3 million in CRV emissions, supporting ~$4 billion in TVL for their respective pairs.

(https://vote.convexfinance.com/#/proposal/QmYPwrtFLnwc8ryB9ac6ChbFSm5PnP5F6AdomX7CqjpaCF)

On the Bribery Protocol Layer

Beyond buying and locking CRV or CVX, projects now have a more efficient way to gain voting power: bribe platforms like Bribe.crv and Votium, enabled by DeFi composability.

Bribe.crv – Direct veCRV Bribes

Bribe.crv is a platform where third parties can offer bribes to veCRV holders to influence votes on Curve DAO proposals and Gauge Weight allocations.

(https://bribe.crv.finance/)

Currently, most use cases involve projects offering token incentives to bribe veCRV holders into voting for their gauge, increasing their share of CRV emissions. This effectively creates a liquid market for veCRV voting power, priced efficiently through competitive bidding, while generating extra income for veCRV holders.

VeCRV holders simply vote for gauges with active bribes and automatically receive proportional rewards. Since Convex itself is a major veCRV holder, it also earns bribes from Bribe.crv, redistributing them proportionally to its users.

Votium – Targeting vlCVX Holders

Unlike Bribe.crv, which targets veCRV holders (including Convex), Votium focuses on vlCVX holders—the voters who decide how Convex allocates its veCRV.

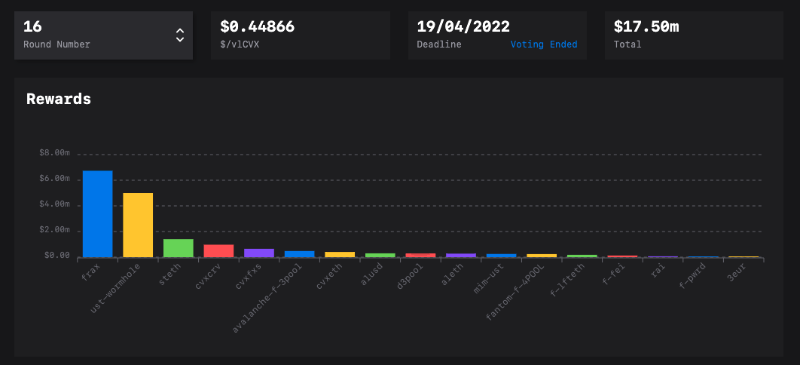

(https://llama.airforce/#/votium/rounds/16)

Similar to Bribe, buyers on Votium offer bribes to incentivize vlCVX holders to vote for specific pools. Voting cycles occur every two weeks, requiring continuous funding. In the last round, FRAX and Terra together offered ~$11.74 million in bribes, yielding ~$0.45 per vlCVX.

If this cost persists, Terra and Frax would spend ~$306 million annually on bribes—an effective annualized cost of 13.5% relative to current TVL on Curve. Considering the already substantial investment in CVX purchases, this does not significantly reduce the cost of maintaining circulation compared to Anchor’s ~20% yield. Moreover, as competition intensifies, bribe costs are likely to rise further.

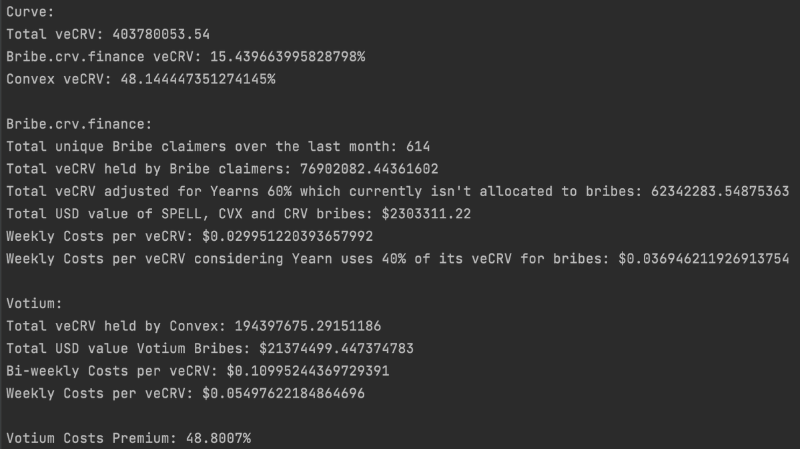

@0xSEM compared March data from Bribe.crv and Votium Round 15, finding that bribing on Votium costs ~48% more than on Bribe.crv—meaning higher capital efficiency could be achieved by using Bribe.crv. However, once participants recognized this gap, the cost difference narrowed and is converging toward parity.

(https://twitter.com/0xSEM/status/1511835532287959040?s=20&t=8aRAGpfVL0WVY3lrUQah9A)

Is Uniswap V3 Ending the Curve War?

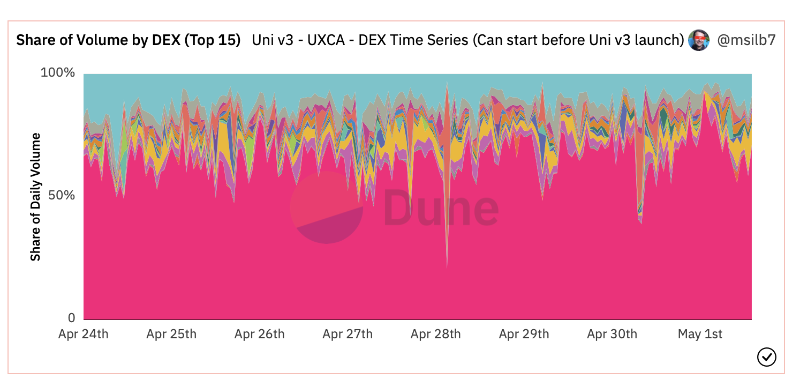

Uniswap V3 launched on May 5, 2021. After nearly a year of operation, it has established dominance in on-chain trading volume, capturing ~70% of Ethereum’s DEX volume—nearly 80% when including Uniswap V2.

(Pink = Uniswap V3, https://dune.com/msilb7/Uniswap-v3-Competitive-Analysis)

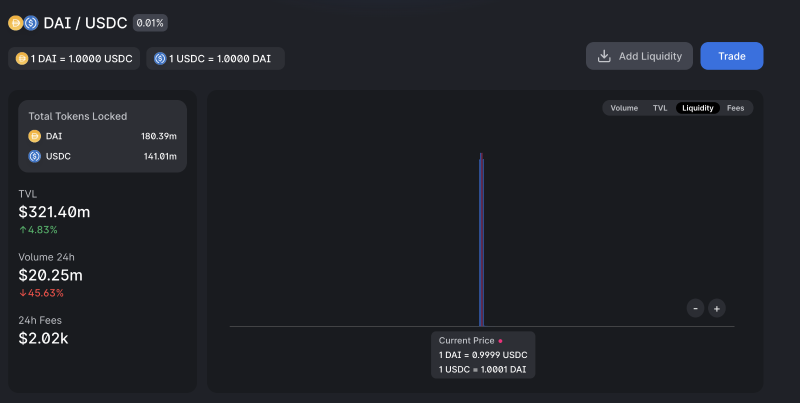

While much of this volume stems from non-stable assets, Uniswap V3’s concentrated liquidity design allows stablecoin LPs to concentrate liquidity near price parity—for example, DAI/USDC within (0.999, 1.001)—drastically reducing slippage compared to traditional AMMs. This makes Uniswap V3 a viable alternative to Curve for stablecoin trading.

(https://info.uniswap.org/#/pools/0x5777d92f208679db4b9778590fa3cab3ac9e2168)

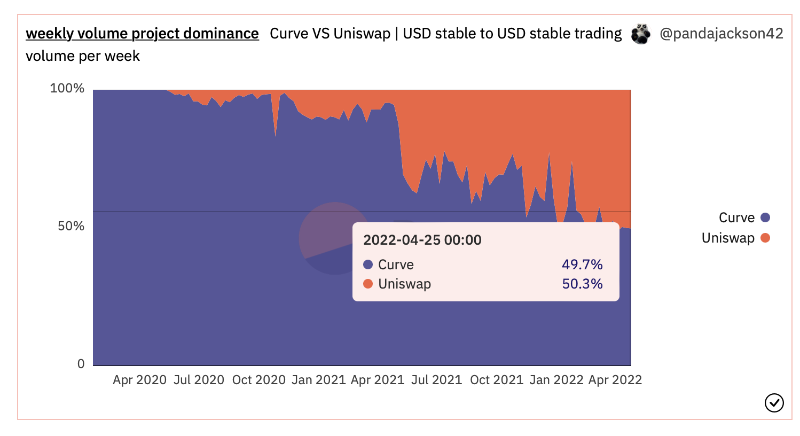

On-chain data reveals that Uniswap V3’s share of USD stablecoin trading volume continues to grow, gradually eroding Curve’s market share. Today, Uniswap V3 has surpassed Curve as the leading DEX for dollar-pegged stablecoins.

(https://dune.com/pandajackson42/Curve-VS-Uniswap-or-USD-Stable-to-USD-Stable-Trading-Volume)

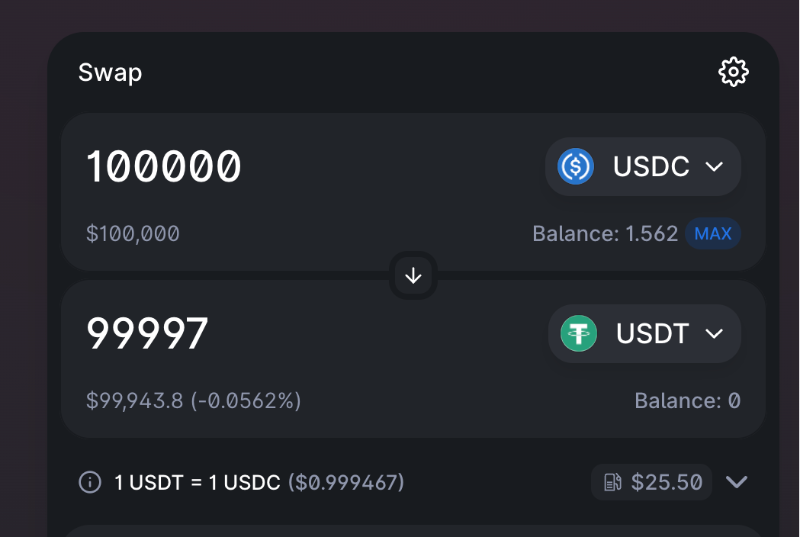

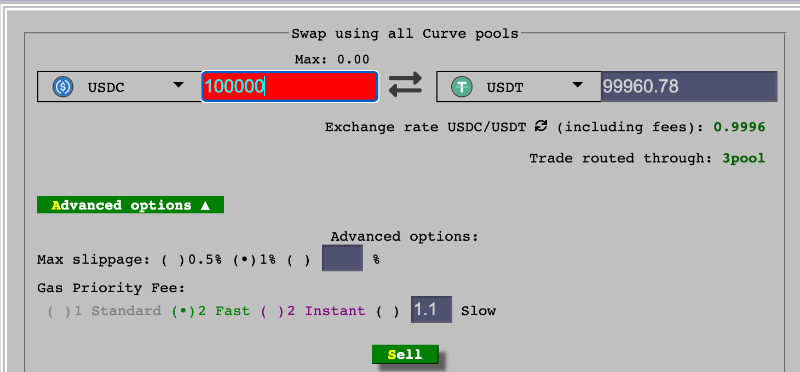

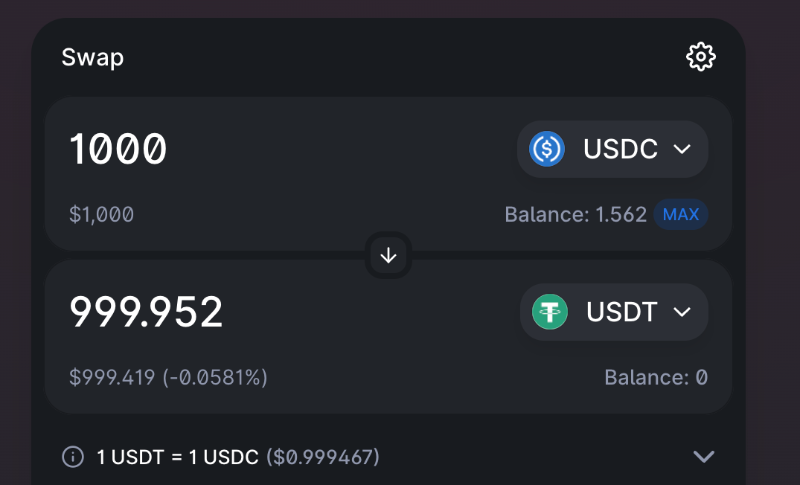

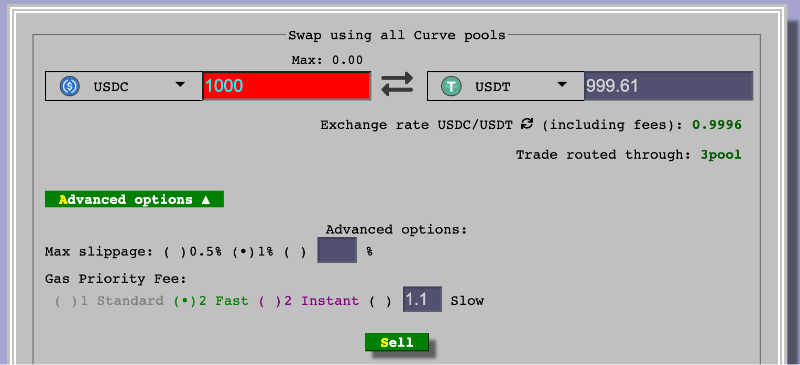

As of May 1, 2022, Curve’s 3Pool holds $1.95B in USDC + USDT TVL, while Uniswap V3’s USDC/USDT pool has $217.43M—about one-ninth. Yet, comparing real-world trading outcomes using $100,000 and $1,000 USDC/USDT swaps:

Regardless of trade size, Uniswap V3 delivers better execution. The main reason isn’t slippage but fees: Uniswap V3 charges 0.01% vs. Curve’s 3Pool at 0.03%.

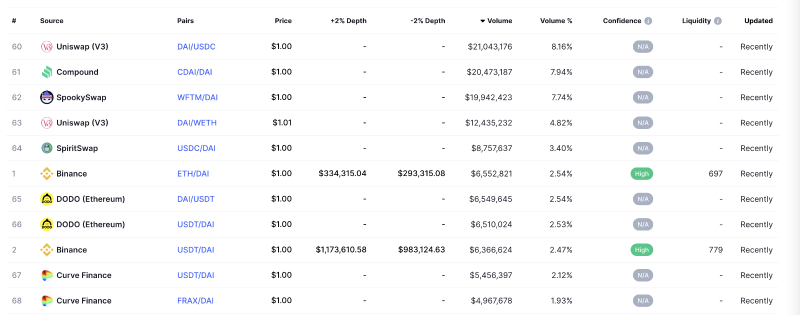

For MakerDAO’s $DAI—the most negatively impacted by the 4Pool proposal—Uniswap V3 already handles its highest trading volume. DAI’s volume on Curve versus USD stables is minimal (<5%). Furthermore, DAI maintains deep liquidity against other major assets, ensuring broad usability across DeFi.

(DAI trading pairs ranked by 24h volume, https://coinmarketcap.com/currencies/multi-collateral-dai/markets/)

Considering MakerDAO’s PSM mechanism—which supports 1:1 DAI-USDC swaps—as co-founder @RuneKek stated, MakerDAO is not particularly concerned about 4Pool’s impact on 3Pool liquidity.

(https://twitter.com/RuneKek/status/1510691073462521857)

Update: On April 29, @MonetSupply proposed that MakerDAO join the Curve War by launching a competing 4Pool—Basepool—with DAI, USDC, USDP, and GUSD. Proposal B suggests issuing mkrCRV, a wrapped staked CRV token, to lock CRV and acquire veCRV, directly entering the Curve War.

(https://twitter.com/MonetSupply/status/1520094314789056514?s=20&t=dWaVozqUEtQlexi3Ahc21Q)

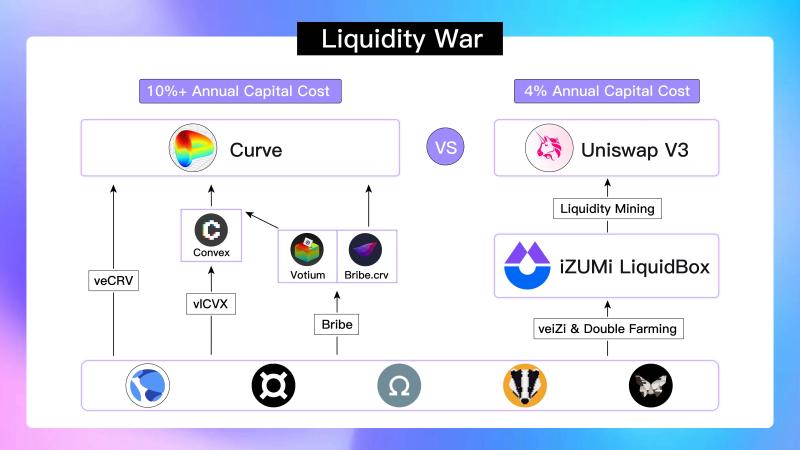

Capital Efficiency: Uniswap V3 > Curve

A key metric for comparing DEXs is capital efficiency: Volume / TVL. Comparing Uniswap V3’s USD stablecoin pairs to Curve, Uniswap V3 achieves a 7-day volume/TVL ratio of 1.15, versus Curve’s 0.06—nearly 19x more efficient. Thus, LPs on Uniswap V3 capture significantly more fee revenue.

The main reason more capital still flows to Curve is the generous liquidity mining rewards from Curve and Convex. APRs for UST and Frax pools reach 9.54% and 5.95%, respectively. In contrast, Uniswap V3’s USDC/USDT pair yields ~1.5% APR based on 7-day volume. Even Curve’s 3Pool offers only 1.26% APR. For risk-averse LPs, Curve remains the superior choice for low-risk stablecoin yield farming.

But what if Uniswap V3 added a similar liquidity mining incentive? Could it close—or surpass—the gap?

iZUMi’s LiquidBox — The Curve Killer on Uniswap V3

In Uniswap V3’s concentrated liquidity model, each user defines custom price ranges, making every liquidity position unique. Consequently, LP tokens transitioned from ERC-20 to NFTs—breaking the traditional model of rewarding liquidity mining based on fungible token balances.

This shift made standard liquidity mining incompatible with Uniswap V3, despite being a core advantage of Curve’s ecosystem. To solve this, iZUMi Finance introduced LiquidBox—a platform enabling users to stake Uniswap V3 LP NFTs and earn token rewards, effectively bringing liquidity mining to Uniswap V3.

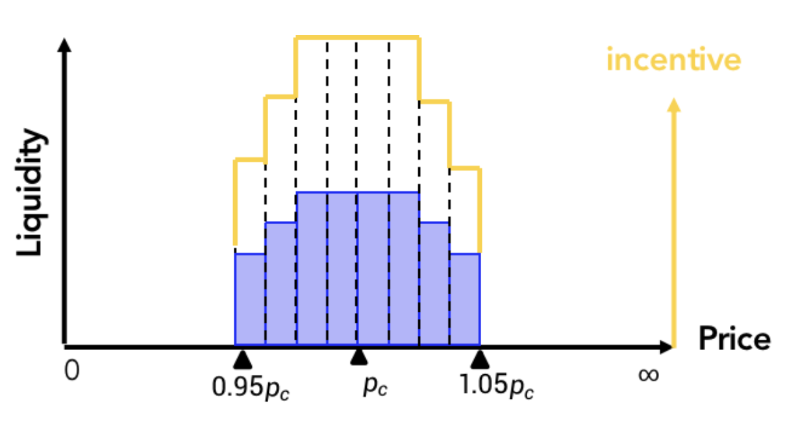

Recognizing diverse needs across assets, iZUMi launched three programmable liquidity mining models on LiquidBox. The “Fixed-range” model specifically addresses stablecoin liquidity needs.

(https://izumi-finance.medium.com/model-1-concentrated-liquidity-mining-model-with-a-fixed-reward-price-range-for-stablecoin-and-b6472f87f93d)

The Fixed-Range Liquidity Mining Model suits stablecoins or low-volatility pegged assets, allowing projects to define precise liquidity zones. Users provide liquidity within specified price ranges on Uniswap V3 and stake the resulting NFTs on iZUMi to earn iZI token rewards alongside swap fees.

This model meets stable assets’ need for concentrated liquidity while enabling Uniswap V3 to directly compete with Curve’s CFMM algorithm and CRV incentive model. Existing Uniswap V3 LPs gain additional yield beyond fees.

iZUMi has deployed this model on Uniswap V3 for USDC/USDT across Ethereum, Polygon, and Arbitrum. On Polygon, of the $4.7M in USDC/USDT liquidity, $4.1M (87%) participates in iZUMi’s mining. On Arbitrum, iZUMi’s $13.3M TVL accounts for 95% of the $13.95M total pool. Such high adoption demonstrates strong appeal to stablecoin holders and significantly enhances trading depth.

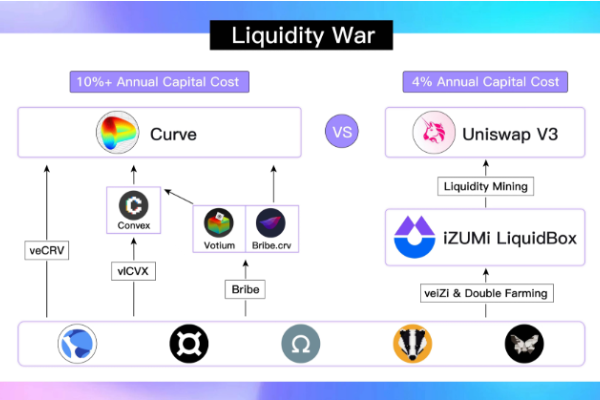

Compared to Curve+Convex’s ~9.5% APR, and Uniswap V3’s base fee-derived ~1.5% LP yield, adding just 8% APR in iZUMi liquidity mining rewards—half from iZI emissions, half borne by the project—reduces the net project cost to only 4% APR.

This represents a dramatic improvement in cost and efficiency over both traditional ERC-20 LP token mining and the costly governance battles on Curve. Projects can now achieve superior on-chain liquidity at lower cost, improving user experience and expanding utility for algorithmic stablecoins like UST and FRAX. For such projects, incentivizing liquidity via iZUMi’s LiquidBox and migrating to concentrated positions on Uniswap V3 may offer a more cost-effective and capital-efficient path forward.

Conclusion

While UST and LUNA have yet to fully prove their long-term value backing, Terra’s 4Pool proposal was arguably the most exciting event in DeFi during April 2022. Its disruptive impact on the Curve War and the uncertainty surrounding 4Pool’s ultimate success highlight DeFi’s innovative spirit and inherent risks.

Through this report, we aim to clarify the financial costs incurred at different layers—Curve, Convex, and bribe platforms—by external participants in the Curve War seeking to boost their token’s liquidity.

Furthermore, our analysis of Uniswap V3’s stablecoin trading performance shows it has already surpassed Curve as the preferred trading venue. With iZUMi Finance’s LiquidBox enabling NFT-based liquidity mining, Uniswap V3 now possesses all necessary components to outcompete Curve comprehensively.

Once a competitor overtakes Curve in its core function—efficient stablecoin trading—the foundation of its ecosystem value begins to unravel. Should this view gain mainstream traction, the endgame of the Curve War may be closer than we think.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News