How did Curve become a cash machine for buying BTC with LUNA?

TechFlow Selected TechFlow Selected

How did Curve become a cash machine for buying BTC with LUNA?

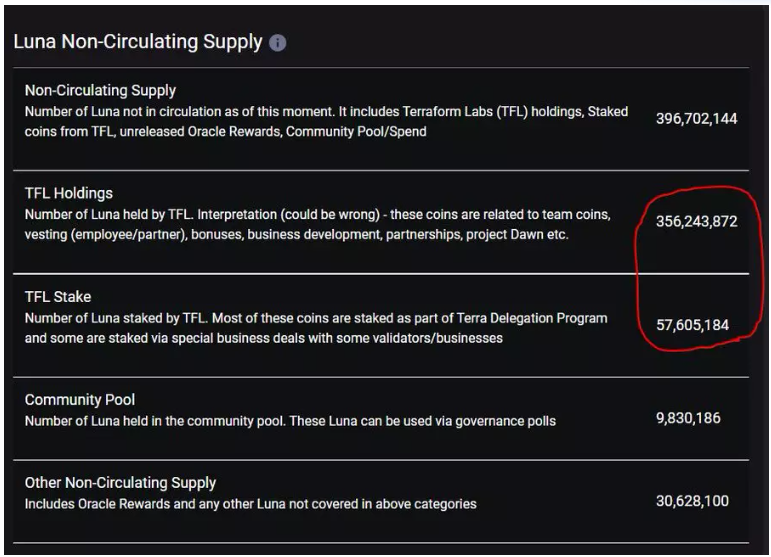

TFL holds 413 million LUNA tokens, worth $43.3 billion today, which is larger than the current circulating token supply.

Author: 0xHamZ

Translation: TechFlow intern

Terraform Labs (TFL) holds 413 million LUNA tokens, worth $43.3 billion today—more than the current circulating supply.

Selling this portion without disruption is like walking a tightrope.

Over the past six months, TFL has started unwinding its reserves—first by donating LUNA to LFG, then through OTC discounted sales. Now, Do Kwon (Terra's founder) wants to build a BTC war chest.

LUNA currently holds $1.5 billion in BTC and plans to grow it into a $10 billion reserve. Where will the funds come from?

One way would be selling LUNA directly and using the proceeds to buy BTC—but that would flood the market, increase circulating supply, and signal weakness in TFL’s long-term value proposition.

Instead, Do Kwon plans to swap LUNA for UST, then use UST to acquire BTC. The problem? Native Terra exchanges don’t offer nearly enough BTC liquidity. So people are beginning to realize: DK will burn LUNA to mint UST, bridge UST to Ethereum, exchange UST for USDC/T on Curve (CRV), and finally use USDC/T to purchase BTC.

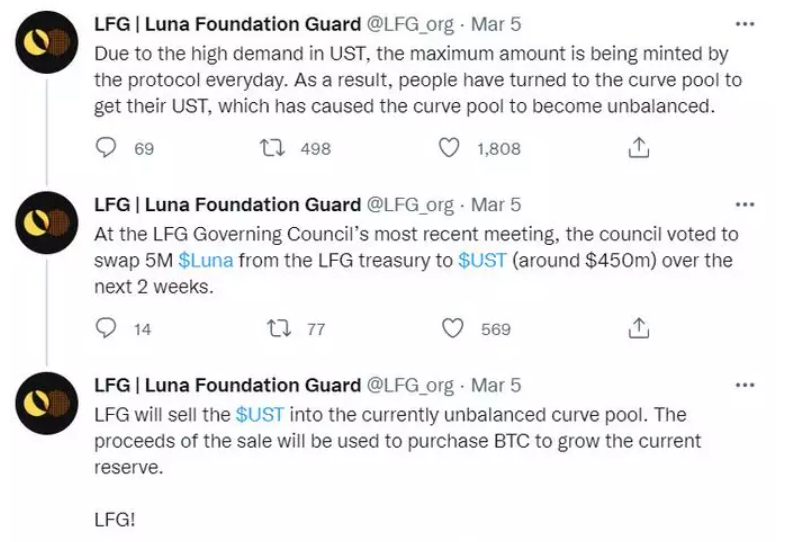

We’ve already seen this happen. On March 5, LFG tweeted about balancing the UST pool on CRV. That same day, $70 million worth of UST was swapped for USDT. Three days later, around $500 million in Tether was transferred to LFG.

Address: 0xe3011271416f3a827e25d5251d34a56d83446159

The issue is that the current CRV pool isn't large enough—only $650 million in USDC/T sits in the UST-CRV pool. He needs $8.5 billion.

This is why the announcement of Pool #4 wasn't surprising—he needs continuous access to large amounts of hard currency, which he can only get via CRV if LPs provide USDC/T against UST.

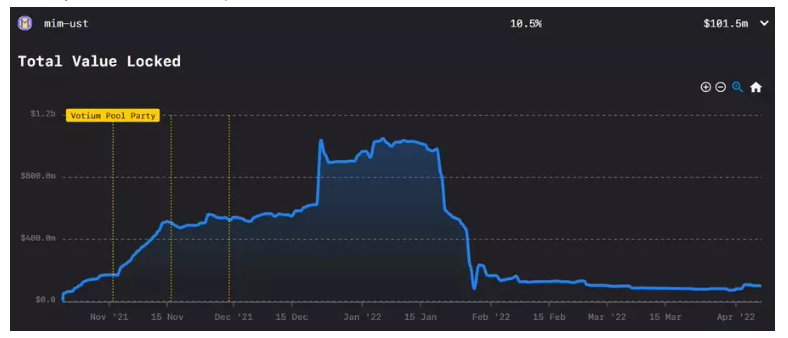

If not, DK may face severe pool imbalances and be forced to sell LUNA directly for dollars. There's some evidence TFL has eyed the MIM/UST pool as an alternative. The MIM/UST pool once peaked at $1 billion but has now shrunk to $100 million. The chart below suggests TFL accelerated the resolution of the MIM issue.

LUNA needs a deep and growing pool of hard currency. As a result, bribes on CRV/CVX will continue to rise. These bribes function similarly to the discount required when offloading billions in LUNA via OTC deals. Since private token sales typically carry 20–30% discounts, we could say that if DK can exit $8.5 billion in LUNA with just a 15% bribe cost—that’s incremental progress.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News