Nansen: Terra, More Than Just a Stablecoin

TechFlow Selected TechFlow Selected

Nansen: Terra, More Than Just a Stablecoin

Terra is a multi-faceted protocol that is not only a stablecoin protocol but also a layer-1 blockchain on which developers can build decentralized applications.

Author: Martin Lee, Nansen

Translation: TechFlow Intern

Introduction

A truly decentralized world requires decentralized money. Currently, decentralized finance (DeFi) is underpinned by centralized stablecoins. This represents a single point of failure that could have cascading effects on the broader decentralized ecosystem of applications relying on DeFi as a liquidity backbone.

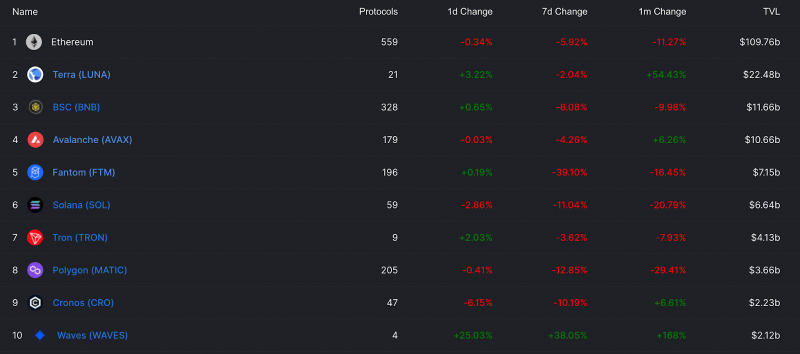

Terra was created to provide an alternative to centralized stablecoins, and its protocol has grown into the second-largest blockchain by total value locked.

What is Terra?

Terra is a multi-dimensional protocol that is not only a stablecoin protocol but also a Layer-1 blockchain where developers can build decentralized applications. Terra was created by the team at Terraform Labs, founded in 2018 by Do Kwon and Daniel Shin. Do Kwon is the current CEO of Terraform Labs.

The Terra Protocol

The Terra Protocol is a public blockchain protocol for creating decentralized algorithmic stablecoins. Decentralized algorithmic stablecoins are tokens pegged to assets—in this case, fiat currencies. The price peg is maintained through rules set in code rather than being backed by the underlying asset. Non-algorithmic stablecoins like USDT and USDC are backed by equivalent amounts of USD or USD-like assets.

Key Data

Currently, Terra supports the creation of stablecoins for 22 different currencies, ranging from major ones such as the dollar, pound, and yen to smaller ones such as the Singapore dollar and MNT. Users can exchange LUNA tokens for an equivalent value of the UST stablecoin, and vice versa. Exchanging LUNA for stablecoins burns LUNA, reducing supply. Similarly, exchanging UST for LUNA burns UST. For example, if 1 LUNA = 50 USD, swapping 1 LUNA would generate 50 UST (TerraUSD) and burn 1 LUNA.

Whenever UST deviates from its dollar peg, it creates an arbitrage opportunity for users. In such cases, users are incentivized to trade in the direction that restores the peg.

When 1 UST > 1 USD, users swap LUNA for UST, then sell UST for USD, profiting from the spread. In the opposite scenario (1 UST < 1 USD), users swap UST for LUNA, effectively buying an equivalent amount of LUNA at less than a dollar each.

Terra Blockchain

The Terra blockchain is a proof-of-stake Layer-1 blockchain built using Cosmos' Software Development Kit (SDK). It uses Tendermint consensus as its consensus mechanism. Once a validator proposes a new block, other validators conduct two rounds of voting to decide whether to accept or reject the proposed block. A two-thirds majority "yes" vote is required to finalize a block. If rejected, another validator is selected as proposer and the process repeats. Validators are rewarded with transaction fees generated from transactions within the block. The proposer receives a larger reward for their additional effort.

The current mainnet supports up to 130 validators, ranked by the amount of LUNA tokens they hold in the validator pool. Thus, the lowest-ranked validator sets the entry threshold for becoming a network validator. The larger the stake, the higher the chance of being selected as a proposer and earning greater rewards. LUNA holders can delegate their tokens to any validator pool of their choice and earn proportional rewards. Staking LUNA allows users to vote on or submit governance proposals. Unstaking LUNA has a 21-day unbonding period during which no rewards are earned. The Terra blockchain is open to the public, allowing other protocols to build on top of it if desired. Rust is the programming language used in the Terra ecosystem, similar to Solana.

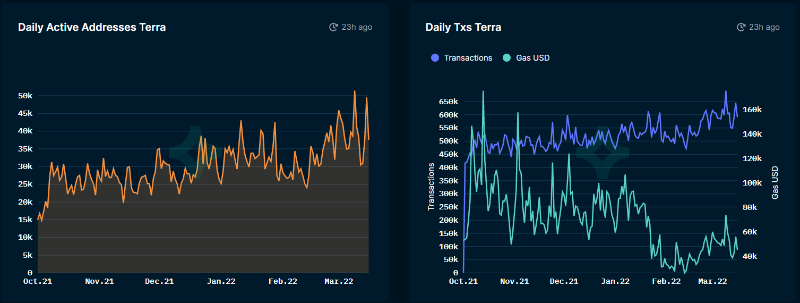

Terra's daily active addresses have shown a steady upward trend, peaking at 51,000 on March 9 and currently ranging between 30,000 and 35,000. Daily transaction counts show a similar rising trend, reaching a historical high of ~690,000 on March 9.

Advantages of the Terra Blockchain (Transactions & Gas)

The Terra blockchain offers three key advantages: speed, low fees, and interoperability.

Speed and Fees

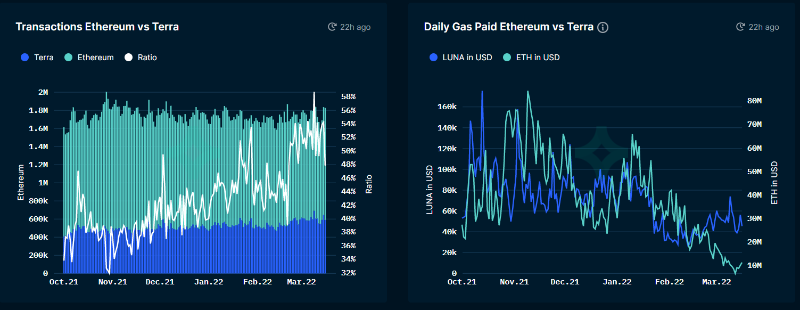

By leveraging the Cosmos Tendermint consensus mechanism, Terra achieves high transaction throughput per second (TPS) while maintaining relatively low fees. It is projected to handle up to 10,000 TPS, with most on-chain transactions costing less than $1 in fees. In contrast, Ethereum handles approximately 15 TPS with average transaction costs around $9. Total transactions on Terra hover around 50% of Ethereum’s volume, while gas fees paid are just 0.2%–0.6% of Ethereum’s.

Interoperability

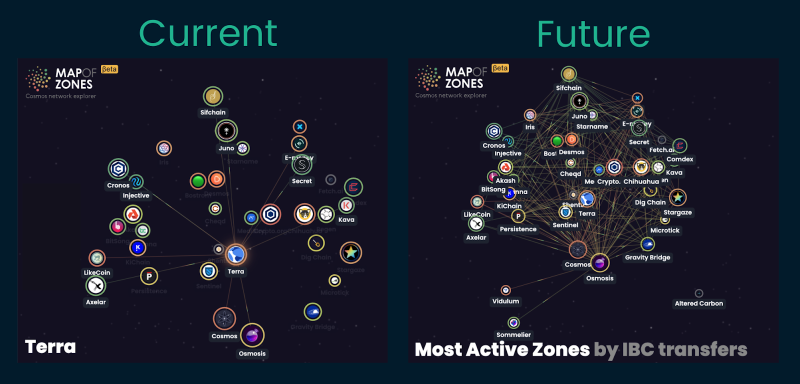

As part of the broader Cosmos ecosystem, projects on Terra and Terra itself can interact with other Cosmos-based protocols via the Inter-Blockchain Communication (IBC) protocol. Currently, Terra can directly communicate with popular protocols such as Osmosis, Juno, Secret Network, and Sifchain. In the future, interoperability will expand further, enabling direct communication with every protocol in the Cosmos ecosystem.

Beyond the Cosmos ecosystem, Terra also has bridges to Ethereum, Harmony, and Solana.

Note: The "Future" screenshot shows the current appearance assuming all chains are enabled, illustrating Terra’s increased interoperability in the future.

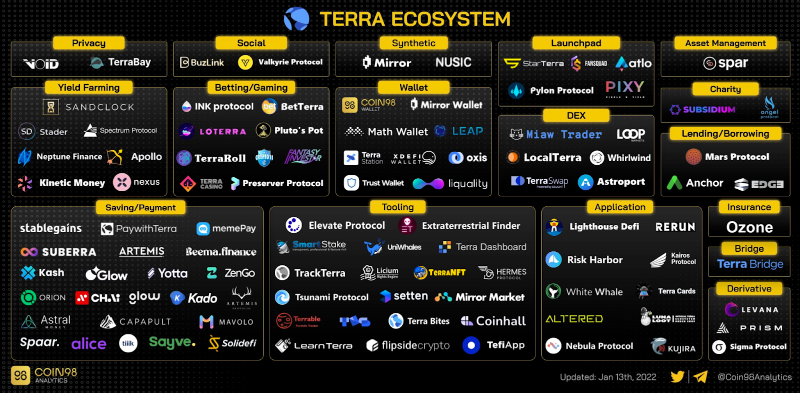

Terra Ecosystem

Terra’s ecosystem is growing rapidly, with over 100 new projects expected to launch in 2022. Due to the strong focus on DeFi applications, the term “TeFi” (Terra Finance) has emerged. At the time of writing, Terra’s total value locked stands at $22.48 billion, ranking second globally and increasing by 54% over the past month. UST’s market cap is around $14 billion, up approximately 25% over the same period. Unlike EVM-compatible chains that attract existing Ethereum protocols to integrate onto their networks, the vast majority of protocols launching on Terra are native to the blockchain. The number of native Terra projects being developed and the significant capital attracted at this early stage demonstrate the quality of its ecosystem.

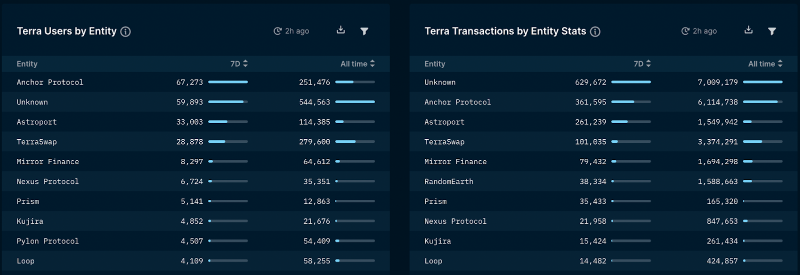

The top three most active protocols by user count and transaction volume are Anchor Protocol, Astroport, and TerraSwap. Below is a brief overview of each:

Anchor Protocol: Designed to be the benchmark for stablecoin yields, analogous to traditional bank deposit accounts but offering significantly higher interest rates—currently around 19–20% annual yield for UST.

Astroport: Aims to be the core DEX/AMM of the Terra ecosystem, facilitating exchanges between all assets on Terra—functionally combining aspects of Uniswap and Curve.

TerraSwap: The first AMM on Terra, similar to Uniswap. The key difference is that TerraSwap does not allow users to freely list tokens or create pools.

Terra focuses on making blockchain technology accessible to the masses—even when they don’t realize it. Payment apps like Chai (Asia), Kash (Europe), and Alice (U.S.) aim to fill the space occupied by current digital payment solutions such as Cash App and PayPal. These protocols offer front-end user experiences similar to traditional digital wallets but are powered by the Terra blockchain in the backend, with users typically unaware they are using a blockchain-based system. Among the three, Chai is the most mature, having processed over $6 billion in transactions across more than 2,200 merchants.

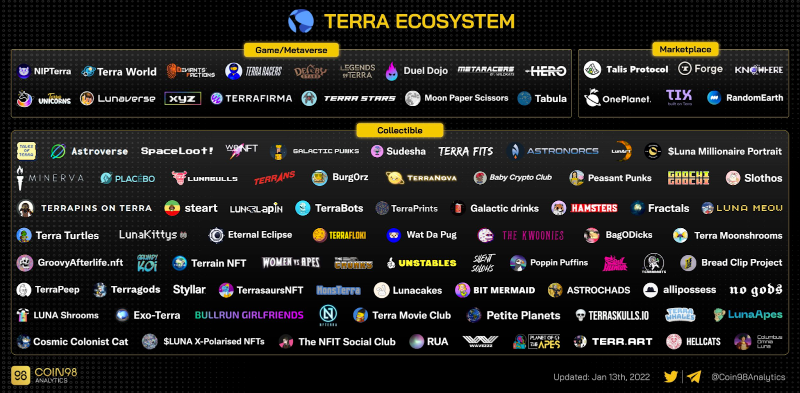

Beyond DeFi, Terra also has an emerging NFT and gaming ecosystem taking shape. After Mirror Finance, RandomEarth is Terra’s primary NFT marketplace by transaction volume. Galactic Punks is the largest collection on Terra and likely the most common profile picture among LUNAtics (Terra fans).

Gamevil, a game publisher known for "Summoners War," is partnering with Terraform Labs to build a gaming and NFT ecosystem.

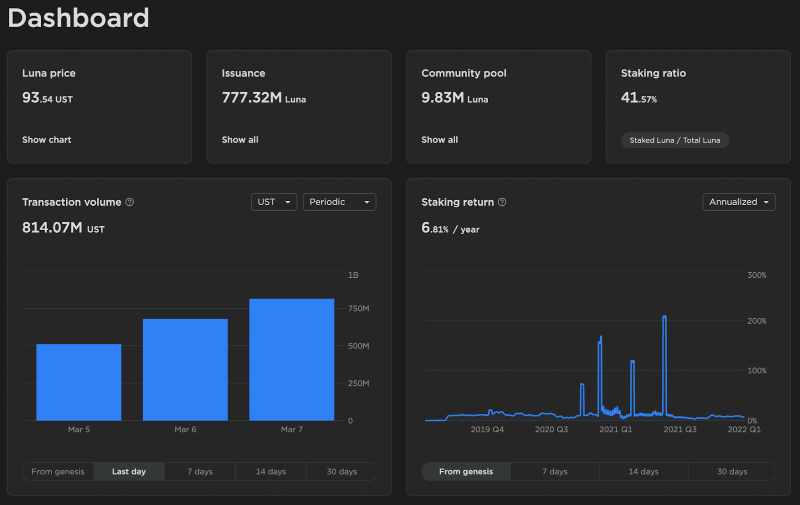

Every blockchain needs a good wallet to enable user interaction with applications and self-custody of tokens. Within the Terra ecosystem, they have developed their own wallet and a dashboard called Terra Station, allowing users to interact with core protocol functions. The dashboard provides insights into key metrics for LUNA and various stablecoins, including staking yields and on-chain transaction volumes.

What’s Next for Terra?

Growing interoperability within the Cosmos ecosystem will create positive spillover effects for Terra. As more protocols are built using the Cosmos SDK and leverage IBC for cross-chain communication, the number of protocols Terra can interact with will increase. Through protocols like Wormhole, cross-chain bridges to other blockchains will continue expanding support to more chains and enable interactions between supported chains.

Increased overall liquidity and potential user base bring significant benefits to Terra. Not only will applications on Terra be used more frequently, but Terra stablecoins like UST will also see wider usage. Each additional chain and exchange supporting UST brings it one step closer to becoming a decentralized medium of exchange in the crypto space.

The TeFi ecosystem will continue to expand, with many more applications launching in the coming months and years. An increasing number of high-quality applications add liquidity to the ecosystem and strengthen TeFi as a whole.

New applications are being created to fill gaps or solve problems present in others, leading to a more comprehensive DeFi experience for end users and building greater confidence in the broader Terra ecosystem. Examples include WhiteWhale, a protocol enabling retail investors to help maintain UST’s peg, and insurance protocols like Nexus Mutual, which offers deposit insurance for Anchor Protocol savers. Terra’s payment applications like Chai will continue driving real-world adoption and usage of the Terra blockchain and its stablecoins.

NFTs and gaming on Terra are also areas to watch. The partnership with Gamevil signals what’s to come—we will begin to see gaming and NFT ecosystems take shape over the next few months.

Conclusion

Terra was built with the ambitious goal of reshaping money to empower decentralized economies. Its dApp ecosystem and LUNA token offer investors an intriguing opportunity to gain exposure to the growth of an emerging Layer-1 blockchain and decentralized stablecoins.

The rapid growth of dApps on Terra, combined with fundamental demand for decentralized money, positions UST as the leading decentralized stablecoin in the cryptocurrency space. Strong emphasis on DeFi, interoperability, and payment applications creates a robust foundation for future growth from both crypto natives and mainstream users. With over 100 new applications expected to launch in 2022, we are clearly still in the early stages of TeFi—and Terra is a protocol worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News