Facing a nearly $200 million debt crisis, former star cross-chain project THORChain launches restructuring plan to save itself

TechFlow Selected TechFlow Selected

Facing a nearly $200 million debt crisis, former star cross-chain project THORChain launches restructuring plan to save itself

Facing insolvency crisis, the protocol hides multiple issues.

Author: Nancy, PANews

As a star cross-chain project during the previous bull market, THORChain is now facing a severe survival crisis. A massive debt burden of nearly $200 million has raised concerns within the community, prompting THORChain to launch a restructuring plan to address the debt crisis.

Insolvency Crisis Reveals Hidden Protocol Risks

On January 24, TCB, a core member of THORChain, published a lengthy post exposing the protocol's serious insolvency issues, highlighting risks such as high leverage, excessive liquidity incentives, and over-complexity.

"If there is a large-scale debt redemption or deleveraging by depositors and synthetic asset holders, THORChain will be unable to meet its obligations denominated in Bitcoin and Ethereum," TCB stated. Currently, THORChain’s total liabilities amount to approximately $97 million in loan debt (denominated in BTC and ETH) and around $102 million in depositor and synthetic asset liabilities. However, THORChain’s assets consist solely of $107 million in externally injected liquidity into pools.

"THORChain fulfills its lending obligations by minting RUNE and selling it into liquidity pools, creating a highly reflexive risk design—and the situation is worse than it appears," TCB further disclosed. In the event of any major debt redemptions or deleveraging by depositors and synthetics, THORChain would fail to honor its BTC- and ETH-denominated obligations.

TCB revealed that since joining the community, he has consistently warned about the dangers of hidden leverage. Since the launch of Impermanent Loss Protection (ILP), he has advocated for deleveraging, noting that the protocol now requires less capital to fill positions because active liquidity providers can participate directly. He believes THORChain has become too complex and must return to first principles in order to grow. Until then, no smart capital will buy RUNE or provide liquidity due to excessive risk. Drawing from past DeFi examples, public knowledge of massive debt becomes a magnet for liquidations. Without intervention, allowing all redemptions to proceed chaotically could trigger a "death switch"—a panic-driven rush to exit that would erase the entire value of the THORChain protocol.

In fact, not long ago, THORChain announced in its latest roadmap that it would focus on the THORChain App Layer in Q1 this year to eliminate risks at the base protocol layer. Specific goals include: integration with Base and Solana networks; scaling back THORFi to reduce base-layer risk while shifting focus to the application layer; adding a CosmWasm execution environment known as the App Layer; using IBC to bring more assets into the application layer; launching active yield initiatives to improve the liquidity provision experience; and upgrading the Ethereum router’s transferOutAndCall function.

As a result, both THORChain’s token RUNE and its TVL have declined significantly. Data from CoinGecko and DeFiLlama show that over the past 24 hours, RUNE dropped 33.3%, while TVL fell more than 8.9% to $250 million.

Protocol Has Generated Over $30 Million in Revenue, Initiates 90-Day Restructuring Plan

"Has THORChain gone bankrupt and paused on-chain operations—akin to a bankruptcy freeze—to prevent capital flight? Is this the first on-chain restructuring?" asked Dragonfly Managing Partner Haseeb Qureshi.

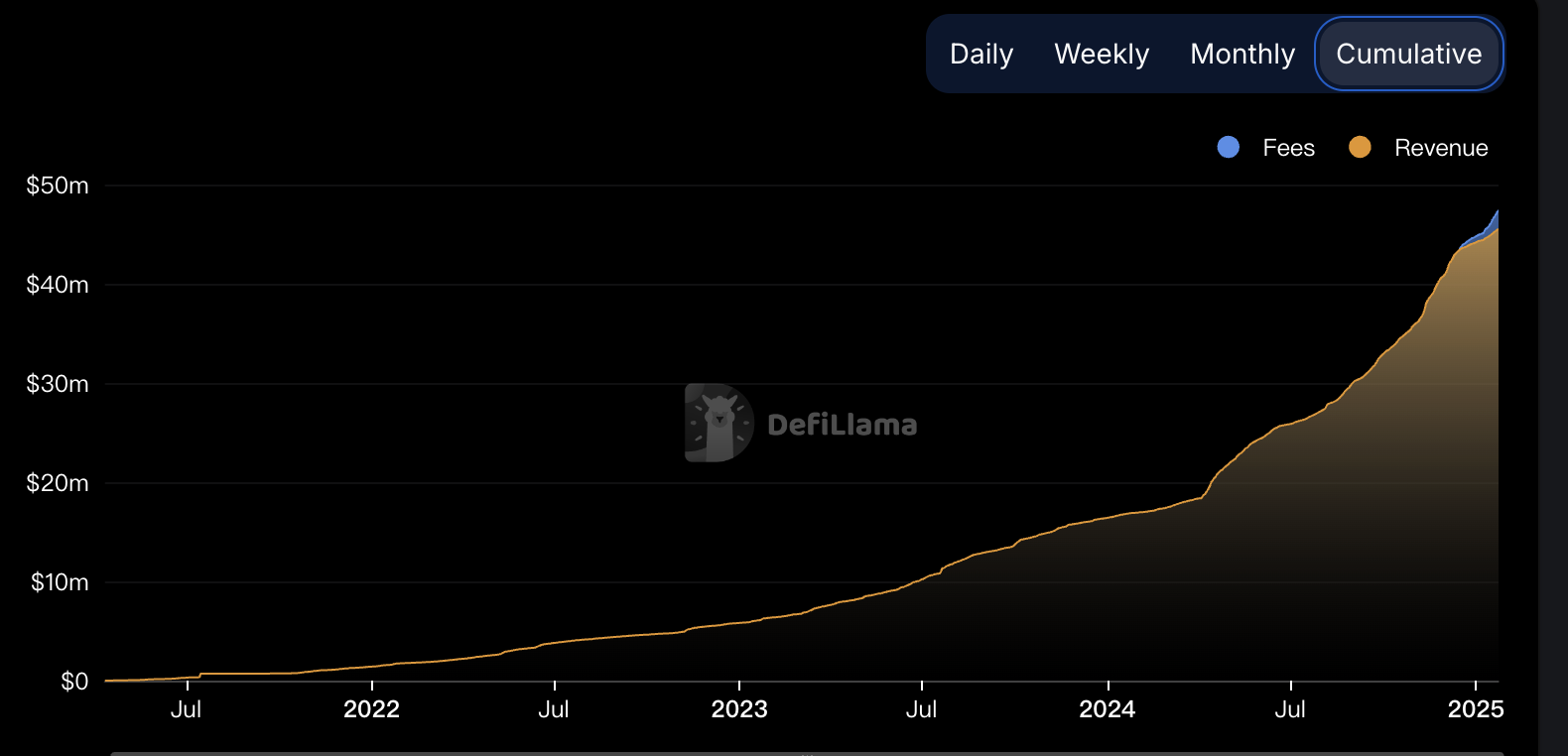

Despite the looming collapse, TCB maintains that the protocol still holds value. THORChain generates around $200,000 in daily revenue, has processed over $50 billion in annual trading volume, and has captured more than $30 million in income—a solid business model that only needs its balance sheet cleansed of toxic debt.

Data from DeFiLlama shows that as of January 23, THORChain’s cumulative fees reached $47.45 million, with $45.54 million in revenue. Within just the past year, THORChain captured approximately $30.5 million in fees and $28.59 million in revenue.

TCB emphasized that the non-collateralized lending product THORFi should be treated as a mistake. All THORChain needs is to clear the toxic debt from its balance sheet and return to its original spirit—back to basics. He proposed two paths forward: one, let events unfold naturally, resulting in roughly 5–7% of value being extracted early by a few, sending RUNE into a downward spiral and ultimately destroying THORChain; or two, default on the debt, declare bankruptcy, salvage the valuable components, develop them as much as possible to repay creditors, all without compromising the long-term viability of the protocol.

TCB recommended that to increase the chances of saving the protocol, THORChain should permanently freeze all lending and depositor positions, tokenize all lending and depositor claims, and fully deleverage. He also proposed establishing an Economic Design Committee to guide THORChain’s recovery, focusing on improving capital efficiency, permanently avoiding leveraged features in future designs, and ensuring Rujira does not endanger L1 ecosystems.

Currently, THORChain has suspended its THORFi lending service as part of a 90-day restructuring plan aimed at reducing issues related to the “savings and lending” initiative and preventing mass withdrawals. John-Paul Thorbjornsen, founder of THORChain, stated, “The protocol itself remains functional and continues to generate substantial revenue. Once restructured, we will be able to repay our debts.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News