2026 Robotics Race in Practice: Who Is Building the Infrastructure, Who Is Mining Opportunities, and Who Is Developing the Systems?

TechFlow Selected TechFlow Selected

2026 Robotics Race in Practice: Who Is Building the Infrastructure, Who Is Mining Opportunities, and Who Is Developing the Systems?

The three most representative projects: peaq, PrismaX, and OpenMind—each occupies a distinct niche within the robotics economy.

In the 2026 crypto narrative, the convergence of AI and physical infrastructure (DePIN)—termed “embodied AI”—is emerging as a new battleground. The market is no longer satisfied with hype-driven concepts alone; instead, it’s actively seeking use cases with real-world traction.

This article examines three of the hottest and most representative projects in the current landscape: peaq, PrismaX, and OpenMind—each occupying a distinct niche within the robotics economy. We’ll move beyond marketing rhetoric and analyze their current status and potential using concrete data and real-world examples.

TL;DR

- peaq ($PEAQ): Focuses on network infrastructure and asset tokenization. Its key differentiator is “real yield”: its ecosystem’s automated farm has already distributed cash flow to NFT holders. With a current market cap of ~$35 million, it’s widely viewed by the market as an undervalued infrastructure play.

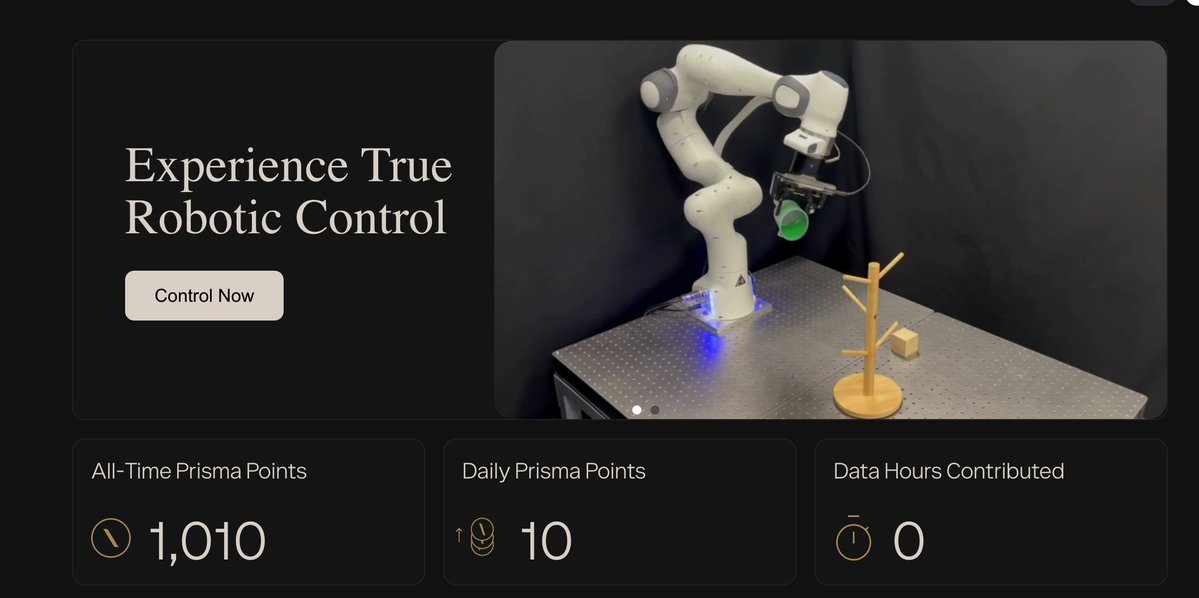

- PrismaX: Focuses on AI training data and human-robot collaboration. Key highlights include its $11M seed round led by a16z—and the anticipated airdrop tied to “earning points by remotely controlling robots.” It tackles robotics’ scarcest resource: physical-world interaction data.

- OpenMind ($ROBO): Focuses on operating systems and application distribution. Its core narrative is “Android for robots,” accompanied by controversy around its $400M FDV valuation. It aims to establish a unified standard for robot app stores.

1. @peaq: A Layer-1 Network That Lets Machines Earn

Positioning: A Layer-1 blockchain purpose-built for the Machine Economy. Core thesis: Machines are not just tools—they’re economic agents capable of holding wallets, signing transactions, and generating income. This is akin to turning every device into an autonomous money-making agent.

Real-World Case #1: Tokenized “Robot Farm”

While most DePIN projects are still selling nodes, peaq has already delivered a live, cash-flow-generating use case.

At the end of 2025, a project in Hong Kong launched the world’s first tokenized robot farm (“Robo-farm”) on the peaq ecosystem, using automated robots to grow hydroponic vegetables. Its operational logic is refreshingly straightforward:

- Users purchase NFTs representing fractional ownership of the farm.

- Farm robots work autonomously to cultivate and sell vegetables.

- Revenue from sales (real-world fiat income) is converted into stablecoins.

- Earnings are distributed directly on-chain to NFT holders.

According to on-chain data and community feedback, the farm completed its first earnings distribution at the end of January 2026:

- Distribution amount: One whale publicly shared earnings of ~$3,820 USDT.

- Annualized yield (APY): Early participants estimate ~18%.

This “earn money by selling lettuce—not inflating tokens”—model delivers a powerful confidence boost for today’s crypto investors, who increasingly prioritize stability and low risk. Real-world asset (RWA) use cases like this are precisely what the market needs.

Real-World Case #2: Strategic Partnerships & Industrial Validation

peaq has forged partnerships with multiple global industry leaders:

- Bosch: Collaborating on IoT sensors and decentralized identity (peaq ID), testing devices that automatically record and submit data on-chain—potentially enabling appliances or industrial equipment to ship from the factory with built-in “wallets.”

- Mastercard: Exploring integration of payment gateways to connect traditional fiat systems with peaq’s machine wallets (e.g., charging an EV via credit card, with backend settlement executed through peaq).

- Airbus: Previously tested supply chain tracking.

These collaborations remain largely in the proof-of-concept (PoC) phase and have yet to generate significant commercial revenue—but they demonstrate that peaq’s technical standards meet industrial-grade security requirements, a bar few other projects can clear.

Fundamentals & Market Performance (Data as of 2026-02-15)

- Current price: ~$0.019

- Market cap (MC): ~$34.25M

- Fully diluted valuation (FDV): ~$78M

- Ecosystem scale: 50–60+ DePIN applications live or in development; over 2–5.2 million physical devices, robots, and sensors connected; spans 21–22 industries—including mobility (EV charging, navigation), energy, telecom, agriculture, and smart cities.

- Risks: As a Layer-1, its token serves primarily for gas and staking—its price depends heavily on ecosystem adoption. Large total supply (~4.3B tokens) may pose inflationary pressure.

peaq’s strength lies in its proven commercial loop and backing from industrial giants. With an FDV under $100M, it trades at a discount relative to other AI infrastructure projects—making it ideal for conservative, infrastructure-focused allocations.

2. @PrismaXai: The Data Goldmine Backed by a16z

Positioning: An AI-robotics data layer built on human-robot collaboration (RLHF). Core thesis: Robots need massive amounts of data to become intelligent. PrismaX enables everyday users to remotely control robots to complete tasks—generating high-quality training data while rewarding participants. It solves AI’s “last-mile problem”: bridging digital intelligence to physical intelligence.

Real-World Case: Teleoperation

PrismaX has built a platform enabling users to remotely control real robotic arms (e.g., lab-based hardware) via web browser:

- Users perform actions (e.g., moving objects) via remote control.

- The system records full operation logs.

- Recorded data is sold to robotics companies for AI training.

- Users earn Points, redeemable for tokens post-launch.

This “Play-to-Train” model differs fundamentally from traditional “compute mining.” It requires genuine human effort, yielding higher-value data—and fueling a self-reinforcing data flywheel: more users → more data → better models → more efficient operations → even more users.

Fundamentals & Market Performance (Data as of 2026-02-15)

- Funding: $11M seed round led by top-tier VC a16z, with participation from Virtuals Protocol.

- Current stage: Points system and airdrop anticipation phase. Users earn points via daily check-ins, whitepaper quizzes, and paid training ($99).

- Ecosystem scale: >500 remote operators globally have completed teleoperation tasks; two full robotic arm systems deployed (“Tommy” and “Bill” by Unitech Walker), both live and interactive.

- Risks: A surge of “points-farming studios” threatens data quality. If the team fails to filter out low-signal noise, points will lose value—and mass airdrop dumping could follow. Industry consensus remains divided on whether teleoperation data can truly train production-grade robots.

PrismaX’s core appeal lies in combining a16z’s credibility with a unique “data flywheel” mechanism—offering zero-cost entry into robotics’ most scarce bottleneck: physical-world training data. Its institutional backing and novel design make it a compelling early-stage alpha opportunity.

3. @openmind_agi: Android for Robots

Positioning: A universal operating system (OS) and app store for robots. Core thesis: Solve hardware fragmentation by letting developers write code once and deploy across diverse robot brands (e.g., Unitree, Fourier)—just as Android unified mobile development.

Real-World Case: App Store Takes Shape

OpenMind has launched its app store and recently announced partnerships with 10 leading embodied AI companies—primarily top U.S. and Chinese firms, including:

- Unitree (YuShu Technology): Market leader in quadruped robots.

- Fourier Intelligence: Specializing in humanoid robots.

- UBTECH: First publicly listed humanoid robot company.

- Deep Robotics (Yun Shen Chu): Industrial-grade quadruped robots.

Details: https://x.com/openmind_agi/status/2015671520899817620?s=20

Per multiple official reports released in late January and early February 2026, OpenMind’s Robot App Store launched with five live, running applications—focused on core domains such as Autonomous Mobility, Social Interaction, Privacy Protection, and Education & Skills Training.

Hardware volume remains modest—but the successful cross-platform deployment proves its underlying “hardware-agnostic” architecture works.

Fundamentals & Market Performance (Data as of 2026-02-15)

- Latest funding round: Backed by top-tier institutions including Pantera Capital and Sequoia China.

- Previous round valuation: ~$200M

- Kaito Launchpad presale valuation: $400M FDV (2x premium)

- Ecosystem scale: >5 apps live in App Store (as of end-Jan); >10 hardware partners (global + domestic); >1,000 developers joined globally.

- Risk analysis: High valuation, low liquidity: $400M FDV implies aggressive pricing, compressing secondary-market upside—and exposing it to early VC unlock pressure. Competition from incumbents: Traditional robotics players (e.g., Tesla Optimus) favor closed ecosystems (like iOS). OpenMind’s open Android-style model must attract sufficient mid-tier hardware vendors to survive amid giant competitors.

OpenMind is currently executing a “narrow entry point, broad compatibility, high ceiling” strategy. Though app count remains early-stage, it has secured buy-in from 10 hardware manufacturers and built a developer foundation of 1,000+ engineers. Its true potential lies in providing the world’s hardware with a unified cognitive layer—and leveraging decentralized networks to solve AI’s hardest challenge: data. A future where robots update skills like smartphones—and share knowledge across machines—is already taking shape inside this app store.

Comparative Analysis

To clarify how these three projects differ, here’s a side-by-side comparison across core dimensions:

In 2026, decentralized embodied AI is no longer theoretical—it’s happening. The three projects analyzed here represent the most emblematic roles in this nascent stack: the network layer, the data layer, and the system layer.

Picture a scenario at year-end 2026: An automated farm robot is working. Its efficiency rests on three foundational layers:

① Data layer (PrismaX): How did it learn “how to grow vegetables”? Through PrismaX’s remote operators. Data from 1,000 global teleoperators trained its AI model on full agricultural workflows.

② System layer (OpenMind): Which brand is it? How does it compete against others? It runs OpenMind OS—and downloads “Agri-Optimization Apps” from the App Store, competing head-to-head with robots from rival brands—all on the same OS.

③ Network layer (peaq): How are its earnings distributed? USDT revenue from hydroponic vegetable sales flows through peaq’s smart contracts, automatically allocating payouts to NFT owners by share.

All three layers are indispensable. Without PrismaX’s data, robots stay dumb. Without OpenMind’s OS, apps can’t scale across hardware. Without peaq’s incentives, no one sustains the entire cycle.

Conversely, when all three layers cooperate, they create a virtuous cycle: more participants → higher-quality data → better-performing apps → stronger economic rewards → more participants. This synergy is Web3’s core value proposition when fused with the physical world.

The opportunity in robotics in 2026 isn’t about picking a single “winner”—but understanding how these three layers collaborate to move embodied AI from concept to scalable reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News