Raoul Pal on the 2026 Turning Point in the Five-Year Mega Cycle: Long-Term Asset Holding Without Relying on Luck

TechFlow Selected TechFlow Selected

Raoul Pal on the 2026 Turning Point in the Five-Year Mega Cycle: Long-Term Asset Holding Without Relying on Luck

"Crypto investing is actually a long-term battle, but many people hope to see results immediately."

Compiled & Translated: TechFlow

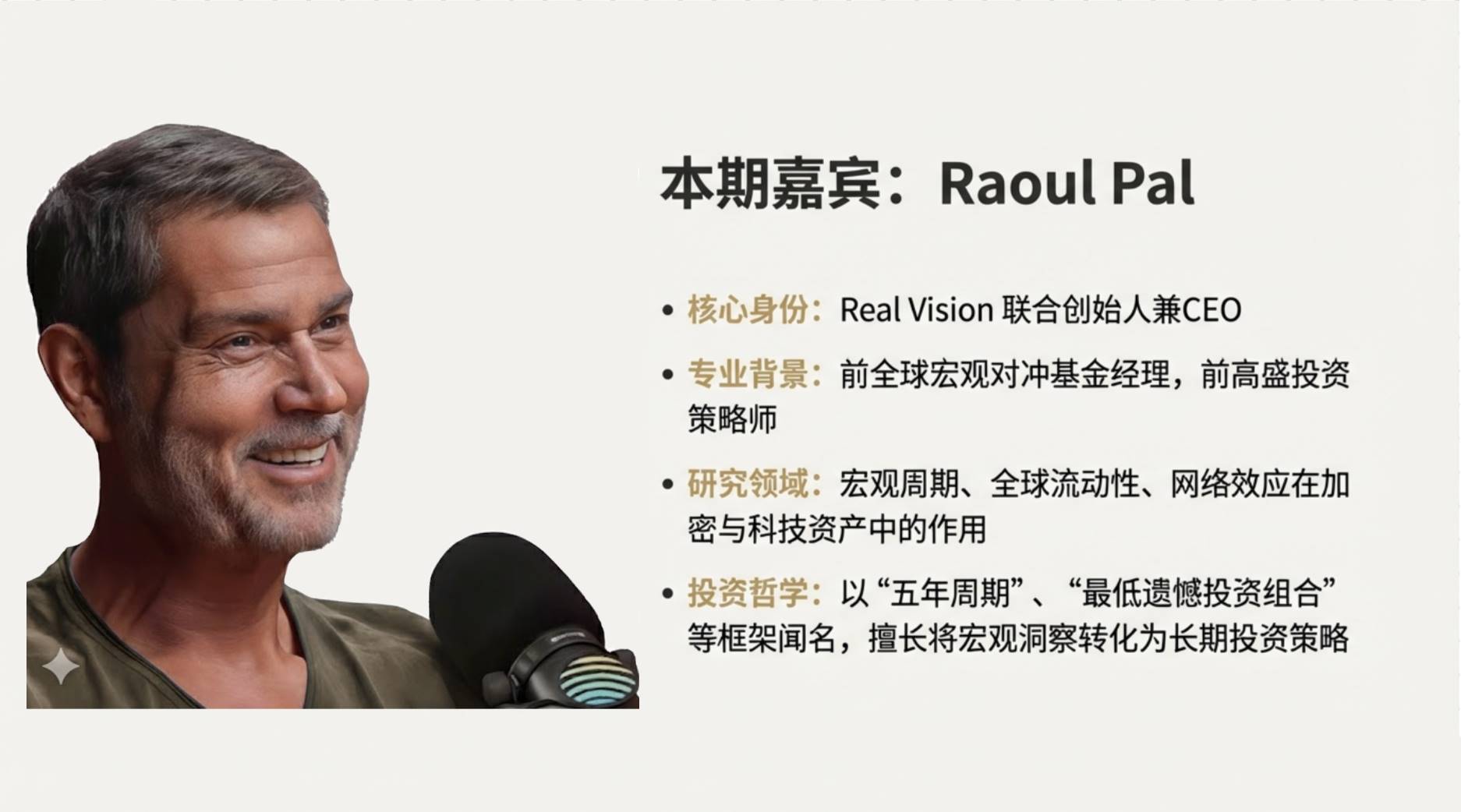

Guest: Raoul Pal, Founder and CEO of @RealVision

Host: Kevin Follonier

Podcast Source: When Shift Happens and Raoul Pal The Journey Man

Original Title: Raoul Pal: How to make it in Crypto in 2026 (without getting lucky) | E152

Release Date: December 18, 2025

Key Takeaways

Raoul Pal shared his investment framework for succeeding in the crypto space by 2026 without relying on luck: choose the right assets, hold long-term, and stay patient. He believes that while many are frightened by short-term market volatility, the overall development of cryptocurrency has only just begun—currently completing only 3% of its journey toward a $100 trillion market.

"When more people are scared by short-term fluctuations, real opportunities lie in long-term liquidity and network effects." In a recent interview, Raoul Pal presented a no-luck-required crypto investment framework for 2026: extend the cycle from four to five years, capture the window when real liquidity arrives, hold adoption-driven quality assets, and manage portfolios under the principle of "minimum regret."

Highlights Summary

-

The market has already bottomed.

-

Bitcoin will become a better store of value than gold.

-

Liquidity is currently the dominant macro factor.

-

Real liquidity demand will emerge in 2026.

-

Crypto investing is actually a long game, but many want immediate results.

-

I used to think the crypto market cycle was four years, but now I’ve extended it to five.

-

People's anger often stems from misaligned time expectations versus reality.

-

I haven’t heard anyone at Coinbase say the market is over—in fact, they believe everything has just started.

-

There’s a classic saying in brokerage accounts: the best-performing clients are often those who have passed away.

-

Betting all your hopes and dreams on crypto isn’t realistic, but for many, it may be their only way out.

-

I’ve learned not to dwell on who upset me or what went wrong at work today. Most things don’t matter—what matters is whether you’re moving toward your goals.

-

Long-term trends are easier to predict; short-term ones are hard.

-

Humans learn through experience and lessons. Now we’re seeing a new generation of investors who must make mistakes to grow and overcome challenges.

-

The key to success in crypto in 2026 is holding the right assets and sticking to your convictions, not depending on others’ opinions.

-

Some tokens still lose investors money even with increased liquidity because they’re simply bad investments.

-

A “minimum regret portfolio” means looking back without regretting rash decisions—avoiding foolish investment choices.

-

Most people never do research. They just say, “Tell me this project will succeed.” But how much do they really know about it?

-

Many investors “borrow belief,” like “Some expert said this project is good, so I bought it.” But such reflexive loops often lead to poor decisions.

-

Zcash is the last true privacy coin and possibly the final opportunity in crypto for a 1000x return.

-

After Bitcoin, only two protocols truly broke traditional models: Ethereum, which enabled programmability, and Zcash, focused on privacy protection.

-

I might wait until the next downturn to buy—I expect that cycle around 2027—then Zcash could become one of my targets.

-

Crypto is now a $3.5 trillion asset class. We could reach $100 trillion in market cap within ten years—meaning we've only traveled about 3% of the path so far.

-

All gaming assets are essentially NFTs or non-fungible contracts, meaning all future gaming assets will exist as NFTs.

-

You need to understand—you can’t save everyone. Some people don’t want help.

-

If I believe crypto’s total market cap will eventually hit $100 trillion, I focus on that long-term goal, not on Bitcoin dropping 30% last week.

-

For high-quality assets like Solana, I’ll hold firmly through price drops because I believe in their long-term potential.

From “God” to “Idiot” Every Six Months

Host: Online, your reputation is always polarized. Every six months, you're either hailed as a “god” or insulted as an “idiot.” How do you handle this?

Raoul Pal:

Those criticizing me often don’t understand my full body of work—they fixate on isolated points. I once tried filtering comment accounts to distinguish verified from unverified ones—the difference was huge. Many criticisms seem deliberately manufactured, possibly involving state actors spreading discontent via comments. They attack anyone or any topic for various reasons.

Host: Can you elaborate? Is this bot activity or orchestrated manipulation?

Raoul Pal:

I suspect both. Some accounts look suspicious—registered only three to six months ago, following only me, attacking specific views. Dig deeper and you’ll find little original content—just reposts followed by sudden aggressive criticism. Certain state actors likely realize that attacking individuals and events this way effectively spreads discontent. Regular users see these comments, get angry, and amplify the negativity.

Of course, some criticism comes from real users who misunderstand or blame others for their own errors. But many comments are malicious. Twitter now shows account origin data, but manipulators use VPNs to fake locations—say, appearing from the U.S.—making detection difficult.

FUD Online and State Actors

Host: You mentioned state actors. Why would they deliberately attack anyone?

Raoul Pal:

Because it creates societal anxiety. When no one knows what’s real or certain, everyone is suspected of being a scammer, everything deemed wrong—this chaos pushes society into collapse, and that condition is often intentionally created.

Russia realized early on that the most effective way to dismantle a social system is to blur the truth. They support both anti-government and pro-government movements simultaneously, creating conflict and division. They spread mixed true-and-false information, making it impossible to discern facts. As a result, society loses trust in truth—and once trust collapses, society becomes easily manipulable.

For example, America’s political system is now extremely polarized. State actors aren't simply backing one side; they intensify conflicts, pushing people into more extreme positions. They create tension on both sides, resulting in mutual hostility. In reality, most people aren’t that extreme. This artificially manufactured division erodes consensus on everything, making political decision-making increasingly difficult.

Host: What benefit do they gain from this?

Raoul Pal:

State actors generate massive dissatisfaction and conspiracy theories, making people doubt everything. When major events occur—such as actions by the U.S., Europe, UK, or France—public response usually follows. But if media is flooded with distrustful and contradictory messages, people lose faith in everything and won’t support any action. This public consensus is essential for international affairs—even in a politically divided world, such consensus enables critical actions. But state actors aim to destroy this consensus, leading to chaos and ungovernability. The harder society is to govern, the angrier people become, feeling attacked by other groups. If hatred deepens, society cannot agree on anything—a very serious problem.

This phenomenon is widespread and has persisted for a long time. It was especially visible during Brexit—many thought attacks targeted one side, but both left and right were attacked. In U.S. elections, it’s even clearer, permeating the entire internet.

Some assume attacks come from opposing factions, but studying extreme MAGA and radical left accounts reveals foreign control. During international events, information contradictions abound, and almost no one can identify the truth.

Host: This causes division. So what should we do?

Raoul Pal:

I believe we need digital identity and zero-knowledge proof technology to solve this. We need ways to verify user authenticity, confirming they’re real humans in real locations—not faking via VPN—but using passport info. Of course, this data doesn’t need public exposure. That’s the advantage of zero-knowledge proofs: verifying truth while protecting privacy. We must find a way—because with AI proliferation, we’re building machines capable of infinitely generating content. AI can quickly produce a 10-minute interview indistinguishable from real ones.

Is Betting All Hopes and Dreams on Crypto Realistic?

Host: For emotionally charged, angry individuals—who are real people—this emotion is normal. After all, you often say everyone invests hope and dreams into their portfolios, especially in crypto.

But is betting all hopes and dreams on crypto realistic?

Raoul Pal:

It’s not realistic, but for many, it may be their only option. Some might suggest taking a second job, but many already work three jobs. The issue is, we can’t change the current political system or stop currency devaluation used to repay debt. What alternatives exist? Direct subsidies? More often, people treat crypto as a “casino-style” chance—especially the more desperate. As you noted, crypto investing is a long game, but many want instant results. Telling them their capital might grow 20x in ten years sounds appealing. But most don’t want to wait—they expect 20x returns in a month or year. So they deceive themselves, believing catching this cycle, quarter, or trade will fulfill their dreams. When outcomes disappoint, they get angry—because this approach never works.

We discussed earlier that people’s anger often stems from mismatched time expectations versus reality. You can explain technological adoption and market expansion are unstoppable. Crypto’s market size is now $3 trillion, potentially growing to $100 trillion—meaning we’ve only completed 3% of the journey. But when you tell them this may take ten years, their reaction is: “What about today? What if the market drops?”

Host: I’ve seen people say you always dodge poor market performance with “think long-term.” How do you respond to hostile critics?

Raoul Pal:

Short-term market moves are often noise-driven, while long-term trends rely on two core drivers: speed of technology adoption and currency devaluation. Statistically, long-term trends are easier to predict; short-term ones are hard.

Markets frequently deviate from long-term trends in the short term—this is common, yet many refuse to accept it. They pin hopes on certain metrics like M2, expecting perfect predictions, but markets always diverge. As a macro analyst, my job is understanding why. Grasping these deviations helps refine long-term trend assessments. In the short term, noise often drowns signals; in the long term, real trends become clear—that’s the key insight investors need.

Buy and Hold

Host: The crypto market is maturing—more institutional participation, more professional traders—yet alpha in crypto is nearly squeezed out, leaving only long-term investment as the remaining opportunity. We ordinary investors can only “buy and hold” or bet on the long-term trends you mention. I mostly agree with this.

Raoul Pal:

I’ve seen similar situations—that’s why I left the hedge fund industry in 2004. Back then, I focused on macro trading, analyzing long-term economic data trends. Trades typically lasted six months to three years, sometimes longer—this was the essence of macro trading.

However, as more new investors entered hedge funds, they demanded monthly performance reviews. Consequently, even profitable long-term trades were often closed early due to short-term drawdowns. This short-sighted behavior compressed market volatility and reduced overall returns.

Today’s crypto market faces similar issues. With changing macro conditions and rising systematic funds and high-frequency traders, short-term trading space is further compressed, weakening macro trading’s short-term edge.

Many are too eager—they always want to act, to trade. But if seeking excitement, there are other options. Time horizon is an investor’s most valuable asset.

Liquidity Is the Game

Host: 2025 was tough for crypto investors—if you didn’t pick the right coins, you barely made money. Many underperformed—there’s no more “only up” market. Why is that?

Raoul Pal:

I keep trying to explain: it’s all about liquidity—liquidity is the dominant macro factor now. The entire market is like a game, and its core rule is how liquidity flows. In crypto, there’s an additional “game rule”: actual token adoption. Whether Layer 2, L1, or application layer, what matters is the speed of tech adoption and the rate of token depreciation. These jointly determine market performance.

But liquidity mechanics are complex. In traditional finance, liquidity ties to QE—“printing money” to inject funds—but that process has stopped. We must consider the Fed’s net liquidity, involving the Treasury General Account (TGA) and Reverse Repo (RRP). The TGA acts like the government’s checking account, constantly flowing in and out, while RRP is another tool affecting liquidity flow. Together, they determine market liquidity levels.

One reason is low liquidity growth rate; another is prolonged debt cycles. People claim crypto has a four-year cycle, closely tied to economic cycles. Since the 2008 crisis, nations cut rates to zero and set debt maturities at 3–5 years, causing refinancing waves every four years.

But I noticed recent business cycles haven’t recovered as expected. Re-examining data, I found that in 2021 and 2022, many countries extended debt maturities beyond five years. This delays the expected Year-4 liquidity surge to Year 5—2026. That’s why liquidity hasn’t surged yet. Real liquidity demand will emerge in 2026, when $10 trillion in debt needs refinancing.

Additionally, the number of tokens has exploded. Finding genuinely valuable ones is harder than ever. Filtering through tens of thousands of tokens is complex—so we advise simplifying investment strategies. Focus on holding major mainstream tokens, avoid excessive risk. For small experiments, use minimal capital. We’ve discussed this repeatedly.

Many ask me: “Why did my portfolio drop 90% this cycle?” I reply: “Who told you to invest in these tokens?”

Host: So liquidity operates on two levels—it flows in and out, but long-term, overall liquidity still increases, right? Yet today’s market has too many tokens—even with more liquidity, not all benefit. I think this is crucial—some tokens still lose investors money despite rising liquidity because they’re inherently poor investments.

Raoul Pal:

Exactly—these tokens lack real utility. Some may briefly attract attention as memes, but such hype rarely lasts. People must understand even among major tokens, risk varies significantly—drawdown differences depend on maturity, user base, and market depth.

Minimum Regret Portfolio

Host: You previously advised against blind investing—we can place this advice in traditional frameworks promoting conscious investing. To young crypto investors, this may sound boring—many start with gambler mindsets, especially the easily distracted “ADHD generation.” But investing isn’t about quick riches—it’s about avoiding big losses and accumulating wealth through long-term compounding.

I feel most cryptos lost money this cycle, so people are realizing timeless investment principles. What exactly do you mean by “minimum regret portfolio”?

Raoul Pal:

A “minimum regret portfolio” means looking back without regretting impulsive decisions. We’ve all made absurd investment choices—allocating 10% of funds to high-risk projects, holding tokens with ridiculous names that later went to zero. I kept holding due to not wanting to disappoint others or other silly reasons. This is the “shame wallet”—a small account full of failed investments. If the amount is small, impact is limited; if large, it’s disastrous. Thus, the core of a “minimum regret portfolio” is avoiding such stupid decisions.

For instance, investing in Layer 1 is relatively simple. Compared to other tokens, they’re larger and more adopted. Within a market cycle, these assets won’t go to zero. Even if their value gradually declines over time, they won’t crash instantly like high-risk projects. You avoid “LUNA effect” or sudden DeFi protocol collapses. First-layer blockchains offer relative stability—that’s their advantage.

Next, ask yourself: Am I blindly following market narratives? You can now do basic research yourself. Ask ChatGPT: “How are this blockchain’s on-chain metrics? What’s user growth like?” Such info takes seconds to find. Yet most never check. They just say: “Tell me this project will succeed.” But how much do they truly know about it?

ChatGPT and On-Chain Data Metrics

Host: How well does ChatGPT perform in analyzing on-chain data metrics?

Raoul Pal:

Exceptionally well. Last weekend, I wrote an article in Global Macro Investor about Metcalfe’s Law and valuation approaches. Brainstorming with my AI, we found a simple way to measure it: examining stablecoin liquidity, value transfer of stablecoins on L1s, and active user counts—metrics suggested by ChatGPT. It proposed referencing five key DeFi indicators to rank different blockchains. This method effectively identifies overvalued and undervalued blockchains.

It’s also strong in technical chart analysis. Upload a chart and ask, “What do you think?” It delivers insightful analysis. Keep conversing, refining questions until you find the right phrasing—it’ll give you what you need. Initially, you might think, “It can’t answer my question.” But often, the problem lies with us—asking incorrectly. I learned through trial and error. It takes time, but once mastered, it becomes a powerful tool.

Does Raoul Follow His Own DTFU (Don't Fuck This Up) Framework?

Host: I must praise your DTFU (Don't Fuck This Up) framework—it helped me greatly in this investment cycle. Do you fully follow your own “don’t fuck this up” framework?

Raoul Pal:

The answer is: yes and no. I do focus more on my investment decisions. When I say “focus,” many assume they should do the same. But I can take higher risks because I built a valuation model based on multiple factors, helping me decide when to increase exposure. I may adjust strategies later, but currently, I’m comfortable with my allocation. This strategy is more volatile—designed for early-stage and early-network adoption. Understand: this model has higher volatility during rallies and sharper drawdowns during declines—not everyone can endure such swings. So, do I fully follow my framework? Answer: I mostly do, but I also adjust based on my research and risk tolerance.

Besides, I have other investments—digital art and Ethereum-related projects. Though somewhat risky, they generate cash flow, giving me flexible asset allocation. Of course, this doesn’t mean I’m right—I just did more research and am willing to take more risk. If I mess up, it’s my responsibility—others shouldn’t blindly copy my allocations. My advice: follow basic principles, not replicate my portfolio.

Host: Never “borrow belief.” That’s the most important point. Whenever I lose money, it’s because I “borrowed belief.”

Raoul Pal:

I’m the same—whenever I don’t research deeply, outcomes are usually poor. Recently, I interviewed Mert about Zcash. Noticing Zcash dropped while the market rebounded, I asked: “Are we sure this isn’t market rotation? Are people seeking new hotspots in a sideways-down market?” Many investors “borrow belief”—like “Some expert said this project is good, so I bought it.” But such reflexive loops often cause wrong decisions.

I actually like Zcash’s narrative, but I don’t hold it. I understand privacy coin importance, but choosing one means fighting governments—a tough battle. Since 2013, I’ve seen its complexity—it’s not easy.

We should have the right to use private money. But reality is the U.S. exerts massive global control via financial regulation. Privacy coins directly challenge this control, facing strong opposition from banks and governments. Many banks don’t hate crypto—they fear failing KYC and AML requirements, risking U.S. lawsuits. So, regulation is the root cause.

Naval and Balaji Like Zcash: Is This a “God Signal”?

Host: I bought my first Bitcoin between late 2018 and early 2019. Back then, I followed three highly insightful people online: Naval, Balaji, and Chamath. They excelled at predicting tech futures. Bitcoin was around $3,000, and all three believed it would reach $100,000. I recall they reached consensus on Bitcoin as early as 2012.

Their wisdom far exceeds mine—so when they agreed, I knew I should buy some Bitcoin. Seven years later, Bitcoin indeed approached $100,000 as predicted. Now, two of them—Naval and Balaji—are voicing a major new view—about the importance of privacy.

As you noted, crypto always has phase-specific hot topics. But I remember clearly—it was these figures who alerted me to Bitcoin, prompting my purchase years ago. Now, two of them state: Naval believes Zcash is the last true privacy coin and the final possible 1000x return opportunity in crypto. Naval also compares Zcash’s privacy features to Bitcoin. Balaji’s view: after Bitcoin, only two protocols truly broke traditional models—one is Ethereum, enabling programmability; the other is Zcash, focusing on privacy protection. So I think we should pay close attention to this direction.

When Will Raoul Buy Zcash?

Host: What conditions would make you decide to buy Zcash?

Raoul Pal:

I can’t yet confirm if now is the optimal time to buy Zcash unless the market shows a clear, sustained uptrend. Currently, the market seems to validate the “rotation” theory (capital shifting between asset classes). But I think Zcash may already be overbought. Next, observe if it finds a stable price range before starting a new rally.

Do I need to buy Zcash now? Not necessarily. My current crypto allocation is sufficient. I don’t need to buy Zcash to prove I’m an early adopter. So I’m unsure about chasing highs now, but I might wait for the next downturn to buy—expecting that cycle around 2027—then Zcash could become one of my targets. Because I believe it may undergo a significant correction. Buying then might be cheaper than now. I’ve set my investment strategy—unless major changes occur, I won’t adjust now. But I’ll keep watching. If prices fall to a more reasonable range, I’ll reconsider. My logic: if an asset proves its value and stops sharply correcting after each rally, it could become a better investment. Of course, it might also return to current levels or briefly rise to $1,000 or higher before correcting.

Is DCA (Dollar-Cost Averaging) Bitcoin the Only Proven Way to Make Money?

Host: I saw a tweet about a boy whose girlfriend started DCAing Bitcoin and Ethereum in 2019. She completely ignored noise on crypto Twitter, and her investment vastly outperformed her boyfriend’s.

Raoul Pal:

This is interesting. There’s a classic saying in brokerage accounts: the best-performing clients are often those who have passed away.

Host: DCA seems the only proven way to profit in crypto—like investing in the S&P 500, but with potentially higher returns.

Raoul Pal:

Yes. But I think there’s a better approach: increase DCA amounts when the market drops significantly. For example, triple your DCA when the market falls 30% or more. This boosts compounding returns—and today, this strategy is quite feasible.

Host: Psychologically hard—like me, I DCA Bitcoin monthly, but I always think it’ll rise first then fall, so I end up buying near local highs.

I’m basically a novice version of Michael Saylor. Just weeks ago, I thought, “Bitcoin will hit $106,000,” so I bought at month-end as usual. Five days later, it dropped significantly, and I adjusted my position. I thought maybe it’d keep rising. But it fell, even below my entry price—after just three weeks. But ultimately, I don’t care. If you stay in markets long enough, you stop caring about exact entry prices. You won’t remember if you bought at the lowest point—unless there was a major drop. Without that, you forget. Impulse buys at local highs don’t matter. Looking back at charts, you’ll think, “So what?”

But do you remember buying Bitcoin at $10,000, then it crashed from $35,000 to $3,500? Even so, you’re still up 10x from your initial buy.

Raoul Pal:

In that case, you might curse those you followed, calling them scammers who ruined your life, right? But now, you’re up 10x from your initial buy. That’s the issue. True crypto believers know time is key.

You must know: does the investment fit your risk tolerance? Do you understand what you’re buying? For example, do you know early-stage tokens face adoption risks? Assets like Bitcoin and Ethereum benefit from network effects. Even Ethereum—months ago, some claimed it would drop below $1,000 and everything was over. But these people blindly followed market narratives, ignoring reality.

Kevin’s Silicon Valley Lessons and Raoul’s View

Host: Earlier, I mentioned visiting Silicon Valley, learning concepts like exponential growth from top investors and entrepreneurs. I’ll share insights gathered from podcasts and ask your opinion.

First, I noticed many early crypto believers—by “early” I mean 2017, 2018, 2020, 2021—some are shifting to other industries, especially AI.

Now we see Wall Street ETFs and stablecoins, but I’m disappointed with crypto’s outcome, so I’m leaving. Reading between the lines, their real reason is they couldn’t easily profit in recent years. Or the market got tougher—they may not have lost money this cycle, but didn’t earn much either.

Essentially, they feel they’ve lost their edge, right? So they claim crypto’s high-return era is over. But when I visited Silicon Valley, talking to those who invested in Notion and Figma, their views differ completely. These people build ETFs, watch market liquidity and narrative shifts, deeply understand market realities. They believe crypto’s high returns are still ahead.

Crypto is fluid—most think, “Yes, everything will rise, right?” But reality is, the vast majority of investments eventually go to zero. They fail. We’ve witnessed this in crypto over recent years. Yet, some exceptional investments deliver astonishing returns. Most people’s mistake: they don’t hold these assets long-term—once exponential investments succeed, their growth exceeds imagination.

Raoul Pal:

Yes, but I have a slightly different view. As venture investors, you typically invest pre-token launch, giving more valuation cushion. But when tokens enter public markets, the “winner takes all” rule doesn’t always apply. “Winner takes all” describes a distribution: 5% of investments deliver all returns, while most others underperform or fail.

Actually, your entry price is crucial. I’ve tried both methods. In the 2020 cycle, I bought a broad portfolio. Ultimately, most returns came from Ethereum, Bitcoin, and some Solana at the time. I think in this cycle, even if some trades performed well, most assets still underperformed. So I’m unsure if this is an easy investment method—but buying at very low prices makes it much easier.

Host: I think the point here is, even if Bitcoin, Ethereum, or Solana prices aren’t cheap today, if they ultimately succeed, they’ll still deliver massive returns.

Raoul Pal:

My view: Crypto is now a $3.5 trillion asset class. Looking at market cap growth trends and doing logarithmic regression forecasting, even assuming slower growth, we can reach $100 trillion in market cap within ten years. So even with slower growth, we’ll achieve this. Meaning, we’ve only completed about 3% of the journey.

Besides, Bitcoin’s market dominance may gradually decline over time, while smart contract dominance rises. Smart contracts have more use cases than Bitcoin as collateral layer in economic systems. This isn’t dismissing Bitcoin—it’s because application layer value far exceeds underlying collateral layer. Think of Bitcoin as the economy’s “U.S. Treasury bonds,” while all financial leverage and applications built upon it form a much larger structure. Long-term, smart contracts may outperform. So ensure your portfolio has sufficient smart contract assets to capture growth from $3 trillion to $100 trillion. Not all growth comes from Bitcoin.

Still, this is hard to achieve. Buying alone doesn’t guarantee success. But undoubtedly, total market cap still has 30x room to grow. Thirty times is huge. What does this mean for successful tokens? Of course, not all tokens will achieve 1000x returns.

Silicon Valley vs. Wall Street Crypto Frameworks

Host: This is the tech knowledge I learned in Silicon Valley—applicable, but Wall Street doesn’t understand. Their thinking is linear, prioritizing sequence.

Raoul Pal:

Wall Street thinks in linear growth and mean reversion. These are their two traits. So when viewing crypto, whenever the market goes through boom-bust cycles, they always expect mean reversion. But we know, converting crypto price charts to logarithmic scales reveals a surprisingly smooth growth trend. Look at Amazon, Google, Tesla—their network adoption models are identical. Early stages show high volatility, decreasing as they mature. It’s the same logic—Silicon Valley intuitively understands this pattern, forming the basis of their entire business model.

Host: And this volatility might swing wildly like Ethereum for five years, right? But stretch the timeline to 20 or 25 years, you’ll see it’s not just potential—real growth emerges later.

Raoul Pal:

I have a close friend, a Ribbit Capital investor and early seed investor in Robinhood—arguably one of the greatest fintech investors ever. Look at Robinhood’s journey—initially little progress, not attracting youth, millennials uninterested in stock trading. Then came the pandemic, and growth turned exponential.

Then the GameStop event happened—Robinhood nearly collapsed. But looking back now, you can barely spot these bumps on the chart. Such success requires immense patience and deep understanding of existential risks. If you persist and survive, the business’s network value grows over time.

Exponential Growth

Host: Last year, we hosted Haseb, raised in Silicon Valley, who like you believes in exponential growth. Personally, I believe in it—I’ve experienced it firsthand, witnessing its power repeatedly. You might say stablecoin growth is exponential, DeFi trading volume is exponential, but this growth hasn’t directly reflected in Ethereum’s value—on-chain value isn’t fully captured.

Do you still believe in exponential growth? Because every time it’s mentioned, the answer is the same: regardless of our thoughts, these things will ultimately grow much larger than today. When they reach scale, network effects bring greater value. That’s the core of exponential growth in tech—no matter how big you think it’ll get, it’ll exceed your imagination.

This is something Silicon Valley understands better than Wall Street. Silicon Valley thinks exponentially, while Wall Street leans toward linear thinking. Over recent years, crypto’s center shifted from Silicon Valley to Wall Street—this may unsettle some. If you believe in exponential growth and look ahead, Ethereum or Solana still appear cheap today. More importantly, I think we should be true believers—not just believe, but hold long-term.

Raoul Pal:

Many don’t understand, a debate surrounds this issue. On one side are supporters of Metcalfe’s Law and network models; on the other, those trying to pick cheap assets using cash flows and traditional valuation methods, aspiring to be the “Warren Buffett of crypto.” But time and again, network models prove superior to traditional analysis. Network models compound because the more valuable a network, the more users it attracts, and more users create more value—a rising loop. This growth is exponential.

Some say we should value Ethereum based on fee revenue. But this ignores its essence. Ethereum isn’t a company profiting from income—it’s a network supporting an entire commercial ecosystem. Metcalfe’s Law captures total value and the user count driving it. Thus, you calculate per-user unit value. Current math shows adding one new user to Ethereum is worth ~$313,000. On Solana, ~$65,000. Yes, data may skew due to Layer 2 solutions attracting users. But the overall logic holds: each new user significantly boosts network value. As more people and businesses join, this value grows further. People forget this is compounding, not linear like traditional cash flows.

Host: Maybe another angle helps understand Bitcoin’s potential. Bitcoin generates virtually zero income, so we can’t even apply traditional valuation. People can’t even debate this, right?

Our mutual friend, Bitcoin expert Matt Hougan, discussed Bitcoin. Weeks ago, I asked him about Bitcoin’s potential. His answer was simple: Bitcoin will become a better store of value than gold. Today, gold’s market cap is roughly $25–30 trillion, while Bitcoin’s is only $2 trillion. Twenty years ago, gold’s market cap was ~$3 trillion—growing 10x in 20 years. If Bitcoin catches up to gold’s market cap, that’s over 10x growth. Bitcoin could reach $1 million. Considering gold itself keeps growing, Bitcoin’s potential upside could be even greater.

Another angle is user experience. What happens when Bitcoin as “digital gold” appears on billions of phones? That’s the true power of exponential growth. Like e-commerce—once considered strange, Amazon seen as niche. But when e-commerce wasn’t just Amazon, but the entire industry going mobile, it became enormous, exceeding anyone’s imagination.

Similarly, what happens when Bitcoin as digital gold appears on everyone’s phone? Once Bitcoin touches everyone’s life, its growth will exponentially surpass all expectations.

Raoul Pal:

Exactly—all this boils down to Metcalfe’s Law and the relationship between user count and total transaction value (the law’s core is network effects: the larger the user base, the stronger the network’s utility and appeal—like more phones enabling more connections, increasing value). Now, to use Bitcoin, you need a Coinbase account and various steps—limiting user numbers. People say there are ~650 million crypto wallets globally—good. But if Bitcoin embeds simply in every phone—via Apple Wallet or similar tools—user count could instantly hit 5 billion. If each transacts equal value, network value explodes. That’s the power of exponential growth—simple once understood.

Many are short-sighted—they say “it’s over” or “this time it’s really finished”—this mindset happens daily. They forget these things compound over time because they lack temporal perspective.

Internet and Bitcoin Similarities

Host: Around 2000, I was ten. Later encountering crypto, I felt too young to grasp its significance. I wondered, if I reached investing age, would there be another wave like the internet? I missed that chance—now a similar situation arises. But think carefully, not everyone succeeds in such waves. If everyone succeeded, no one would’ve failed in the internet era. If someone held certain stocks throughout, they’d have gotten rich. But I host this podcast hoping that 20 years later, people won’t say, “I gave up, I missed the chance—though I heard the info, tried investing, but still missed out.”

Raoul Pal:

To illustrate investment difficulty, consider Amazon. It began as a company selling books via the internet. Initially, its stock soared on “internet” hype—people believed it could sell more than books. Then Amazon’s stock crashed 95%, many thought it was done. But as the market recovered, Amazon rose again. Even without profits, its P/E ratio skyrocketed. Between 2014 and 2017, Amazon’s P/E even hit 850. Almost all hedge funds shorted it, unable to see how a book seller could become the world’s largest online marketplace. Amazon profited not just from sales, but by becoming a platform enabling countless businesses. This embodies Metcalfe’s Law—a network’s value grows exponentially with user count and affiliated services.

For example, Amazon faced massive computing demands, so developed AWS cloud services. Then built a full logistics supply chain. Ultimately, this network created enormous value. Evaluating Amazon’s total worth based solely on sales commission is insufficient. Amazon’s scale exceeds imagination—a behemoth. But seeing this from the start and holding the stock was extremely difficult—that’s the challenge of investing. Microsoft’s success, by contrast, was more intuitive—almost everyone saw its potential.

Host: But now we have tech and Silicon Valley experience to help understand crypto investment logic. So compared to the past, it might be less difficult. Still, crypto investing remains tough—filled with noise and extreme volatility. This volatility isn’t just short-term—it can last a year or longer. This is truly painful, especially since crypto is highly liquid, right?

Raoul Pal:

That’s the issue—unlike regular investors, venture capitalists face far less pressure. They usually assess investments annually, often mere estimates. Thus, they can largely ignore short-term asset volatility. But for entrepreneurs, it’s entirely different—every day oscillates between “we’re doomed” and “we’ll succeed.” Entrepreneurship involves constant survival crises and hope—this state occurs almost daily.

Host: Some say wealth compounding over time is actually a very boring process. Does this mean today’s generation—especially youth attracted to short-term thrills—may ultimately fail to accumulate long-term wealth? Because they always seek short-term gratification, potentially leading to financial failure?

Raoul Pal:

Do you remember falling when learning to ride a bike? I think yes. Riding over gravel, if you brake hard, wheels skid, and you fall. Through such experiences, you learn better bike control. Humans learn through experience and lessons.

Now we welcome a new generation of investors. They need to make mistakes to learn, gradually grow, and overcome difficulties. We all made investment mistakes—so we can’t judge today’s speculators as incapable of mastering compounding later. I understand their situation: limited funds, lacking long-term job security, perhaps no time for long-term investing. So their behavior resembles casino gambling. But I believe over time, they’ll learn more rational investing. Yes, compounding requires patience—can seem “boring.” But once people experience earning and losing money, they’ll be more cautious next time. Actually, you’re a great example.

Time itself is a kind of leverage. I once used leverage on assets with 70–90% volatility, even higher-volatility assets. Eventually, every time, problems arose.

Raoul’s 2026 Investment Portfolio Preparation

Host: Last time we discussed portfolios, you mentioned some people concentrate investments to extremes. Now it’s December 2025—what does your portfolio look like?

Raoul Pal:

Frankly, except for an adjustment three weeks ago, I’ve made almost no trades. I did buy some NFTs, but nothing else. No asset reallocations, no major changes. I share my portfolio because it’s my choice. I share confidence in certain things, but understand—don’t directly copy my approach. My risk tolerance differs from yours. I just want to honestly share my strategy. Not to tell you what to do, but to inspire your own decisions. So podcast editors, please don’t take things out of context or use my words to create misleading content.

Raoul’s True View on SUI at End of 2025

Host: Tell me your true view on Sui at end of 2025—what keeps your conviction firm despite severe market volatility?

Raoul Pal:

Sui’s performance hasn’t been particularly abnormal compared to other tokens—it remains on the high-risk curve, which itself is a significant signal. We notice its overall performance leads Ethereum and Solana, though recently lagged slightly—still, the overall trend is upward, improving steadily.

Sui’s core issue is proving real-world application of its excellent technology. The technology itself is unquestionably strong, but the key is widespread adoption. This is the central concern for all of us. So, how’s Sui’s adoption? We need to see user growth. Currently, its user growth rate exceeds Solana’s during the last bull run and outpaces most L1s. Though Sui started late with a smaller user base, precisely for this reason, its growth potential is greater.

Next, the key is value creation on the network. We need to monitor total transaction value. We see Sui experimenting in new directions—some projects may fail, but some succeed—like holding substantial Bitcoin on-chain. This is a vital value driver, as Bitcoin’s movement as a large-scale asset adds value to the entire network.

Besides, stablecoin ecosystem on Sui performs well, growing rapidly. DeFi performance is moderate, still fragmented. Because Sui remains in early development. They’ve promoted to the general public for only about three years—perhaps two and a half—when the market truly noticed them. So from a business development standpoint, Sui is still a very young project.

Breaking down this data, inputting into ChatGPT and other analytical tools, comparing with Real Vision’s chief crypto analyst Jamie Coutts, we reached similar conclusions. Using Metcalfe’s Law and user adoption models, avoiding deception by superficial active user metrics, results are clear. I found Sui’s valuation approximately 80% lower than Solana’s. While Sui hasn’t matched Solana’s user numbers, this indicates huge growth potential. So we need overall market growth pushing Sui to higher price levels.

Next, we must observe whether Sui gains more adoption and higher activity as expected. This remains unproven, but current indicators show, as an L1, Sui develops faster than any other project—and every active, verified user creates considerable network value.

Where Do SUI Network Users Come From?

Host: Where do you think SUI’s users mainly come from?

Raoul Pal:

I don’t fully know the specific sources, but typically, these users mainly come from Web3 communities. Besides, whenever breakthrough applications attract Web2 users to Web3—like blockchain games—these users become new active participants. They may use blockchain tech, but since transactions are usually small, their network value contribution is limited. To truly create value, you need numerous small transactions, not reliance on single-user contributions.

The users truly bringing massive network value are those similar to Bitcoin network users. These users are not only numerous but conduct large-value transactions. Especially when attracting institutional investors like sovereign wealth funds—they can hold large assets—or super-investors like Michael Saylor, personally holding billions in Bitcoin. Reaching this scale of user group is the network’s true core force.

How to Ensure On-Chain Data Isn’t Faked?

Host: In crypto, how to ensure on-chain data authenticity and accuracy? This isn’t just about Sui—it concerns the entire crypto ecosystem. How do you verify and ensure the data you use is reliable?

Raoul Pal:

You can’t fully ensure it—so your task is consistency in analysis. When measuring Sui’s active users, the standards and methods should match those for Solana, Ethereum, or Bitcoin. Consistency minimizes errors, ensuring relative data reliability.

From existing analysis, blockchains like Avalanche, Near, and Sui appear relatively undervalued. This is understandable—they’re experiencing significant user activity growth, spawning new use cases, achieving certain scale. From this view, their valuations are reasonably justified.

Stay Cautious About Crypto Data

Host: Last time we discussed this, you emphasized staying vigilant in crypto—I strongly agree. Clearly, some haven’t experienced similar events—like Luna’s collapse. Now regardless of asset prices, I remain skeptical of any data in crypto—everything feels gamified.

Raoul Pal:

One filter I use is persistence of active users. Telegram often hosts game activities—appearing to attract many users, but actually manipulated by developers. They lure people in once, then users vanish—so not truly active. Data looks good, but lacks real value.

Host: You mean some blockchain protocols might have incentives to fake data—for fundraising. I wonder if some foundations have similar incentives—because it all feels like a game.

Raoul Pal:

Yes, they want data to look better to push prices up—that’s the issue. We can’t fully trust these numbers. So we need comparable metrics, observing data persistence and whether it passes reasonableness checks. This is the so-called “sniff test”: can user data be reasonably explained? Then verify with charts.

How to interpret charts? First, analyze charts independently, examining long-term and short-term trends. Short-term, study daily charts; long-term, weekly or monthly charts—use logarithmic charts for better data interpretation. Then, compare the asset with others to spot abnormal trends. Usually, such comparisons send signals—showing certain data anomalies. Might be noise, but could indicate deeper issues.

In short, much work is needed—but such analysis is necessary. Because you can never fully know your position on the risk curve. As an investor, your task is constant vigilance—ensuring your allocation doesn’t expose you to excessive risk or underperformance. Constantly reflect: did I misjudge?

How Raoul Handles Monthly Income

Host: What do you do with the money you earn monthly from your business?

Raoul Pal:

Before answering, let me step back. Actually, we often don’t realize how lucky we are. Whether you or I—we can work, spend time, and receive rewards. That’s wonderful—this is true for all work. But more importantly, through this work, we build networks—possibly one of the most valuable things humans can do.

Through this network, you can talk to people like Hunter Horsley, contact Haseb anytime, even reach Brian Armstrong. That’s the biggest value. What truly matters isn’t how much money you earn from business, but what this network brings you—or more importantly, what you contribute to it. Because only when you continuously provide value to the network will it sustainably reward you. If you only take without giving, it’ll eventually stop.

Host: Once you have monthly income, how do you usually handle this money?

Raoul Pal:

My cash flow mainly goes to investments and daily expenses—similar to most people. Investments focus on digital art and artworks.

As assets grow, you’ll want lifestyle upgrades—buy new things, upgrade stereo systems, change cars. These updates aren’t just for enjoyment—they maintain asset quality. Without maintenance and updates, property value declines over time. Cars age, break down, requiring frequent repairs—annoying. So I regularly do such things to keep my asset base high-quality.

Current State of NFTs

Host: Has everything become liabilities now? You just mentioned digital art—that is, NFTs. We touched on this earlier. What’s the current state of NFTs?

Raoul Pal:

Art Basel is ongoing—half the digital art market is there. Although personally, most of my art investments aren’t digital. Now, whenever Ethereum or Solana hits a peak, NFT sales explode again—as people convert wealth into other forms. But when prices drop, people lack extra funds for NFTs—opportunity cost of converting liquid assets to illiquid ones decreases. Theoretically, art markets become focal points whenever prices peak.

We’re seeing major investors enter. For example, Ribbit Capital’s Micky Malka bought Crypto Punks’ IP, building a massive art collection. He’s creating a permanent exhibition space called “The Node” in Palo Alto, California, displaying these artworks for visitors to Stanford and Silicon Valley. Investors like Alan Howard are heavily investing here. We see more large investors joining, establishing massive collections.

Though NFT values still fluctuate with crypto prices, overall, artwork values are rising. Even when Ethereum weakens, the market may temporarily dip, but recovers over time. Many view NFTs through surface phenomena like “APE” “JPEG”—thinking they’ve depreciated, seeing it as foolish speculation. But they fail to realize crypto accelerates validating new ideas through speculation.

Speculation proved digital assets can have value beyond trading tokens. Take Crypto Punks—its collection has a $10 billion market cap. This is history’s most valuable single artwork collection—worth $10 billion. But people don’t realize we’re using NFTs to validate other possibilities. For example, Pudgy Penguins’ IP proves IPs can go on-chain. Or Crypto Punks—Jay-Z’s social avatar is a Crypto Punk. I know many owning Punks—Punks have become social signals and identity symbols in the digital world.

Beyond this, all gaming assets are essentially NFTs or non-fungible contracts—meaning all future gaming assets will exist as NFTs. The gaming industry is huge—though not fully exploded yet, clearly players want real value for gaming assets.

Moreover, every future contract could be digitized into NFTs. This means every financial option could be an NFT. For example, every ticket we own—sports games or concerts—is essentially a contract. If tickets become NFTs, they could accumulate value due to loyalty. Holders could then sell these NFTs, transferring value to others, or use the value elsewhere.

Thus, we have financial options, consumer-brand relationships, culture, artist/fan interactions, in-game virtual assets, and the art market itself. All can be realized via NFTs. Broadly, digital identity concepts can be implemented via NFTs—each person’s digital identity could be a zero-knowledge-proof non-fungible token or contract.

Host: I’m thinking, realizing all this will take a long time, right? If considering long-term trends, underlying chains like Ethereum or Solana need further development. But on the other hand, if you truly believe in this vision, it means these NFTs will bring massive value to underlying blockchains—obvious for the base layers, right?

Raoul Pal:

But the issue is, people often don’t understand these things—they want simple narratives. Actually, Beeple’s (Mike Winkelmann, American digital artist) NFT sold for $69 million represents one of blockchain’s most valuable block spaces. This block space stores unique digital assets like property deeds—not ordinary transactions. Many deeds now reside on centralized servers like AWS, but without NFTs, these assets couldn’t truly exist.

More importantly, this proves in an increasingly digital world, digital scarcity maintains value. In the future, AI may reduce knowledge costs to zero, robots reduce labor costs to zero—but in this “zero-cost” world, digital scarcity will be the most important value expression.

Discussing wealth flows, we find all wealth origins ultimately point to art. This was true in the past, will be in the future. Many may not understand. They see NFTs as mere tokens, but the signal is clear. You see transaction values and who collects these artworks—it’s not pure speculation. Instead, it’s thoughtful collecting. Those building collections now may own hundreds of millions in art later—while their current investment is far below that.

Bottom Fishing?

Host: In early November, you posted a long thread. At the time, you said no one wants to hear bullish views—everyone panics, even attacks each other—but you mentioned the path to a bright future is approaching. You explained liquidity issues, suggesting bottom fishing where possible. You referred to the total liquidity index. Now it’s December 2025—do you still recommend continuing to bottom fish?

Raoul Pal:

I believe the market has already bottomed. In October, we faced a liquidity crisis—U.S. government withdrew massive liquidity via Treasury General Account (TGA), creating a market liquidity vacuum

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News