Goodbye to Wild Growth: Will the Four-Year Cycle Repeat? The New Order of Cryptocurrency Has Arrived

TechFlow Selected TechFlow Selected

Goodbye to Wild Growth: Will the Four-Year Cycle Repeat? The New Order of Cryptocurrency Has Arrived

Institutional adoption, stablecoin growth, and RWA tokenization— the crypto market is undergoing structural transformation.

Author: Ignas | DeFi Research

Translation: TechFlow

I'm a big fan of Ray Dalio's "Changing World Order" model because it allows us to zoom out and see the bigger picture.

Instead of getting caught up in daily "mini-dramas" within the crypto space, we should focus on long-term industry trends. This is how we ought to view cryptocurrency.

This isn't just about rapidly shifting narratives—it's about a fundamental transformation of the entire industry structure.

The crypto market is no longer what it was in 2017 or 2021.

Below are several areas where I believe the industry order has already changed.

Great Rotation: Asset Rotation in the Crypto Industry

The launch of Bitcoin and Ethereum ETFs marks a major shift.

This month, the SEC approved listing standards for commodity-based exchange-traded products (ETPs), accelerating approval processes and paving the way for more assets to enter the market. Grayscale has already filed applications based on this change.

Bitcoin ETFs have achieved the most successful launch in financial history. Ethereum ETFs started slowly but now hold billions of dollars in assets even amid weak markets.

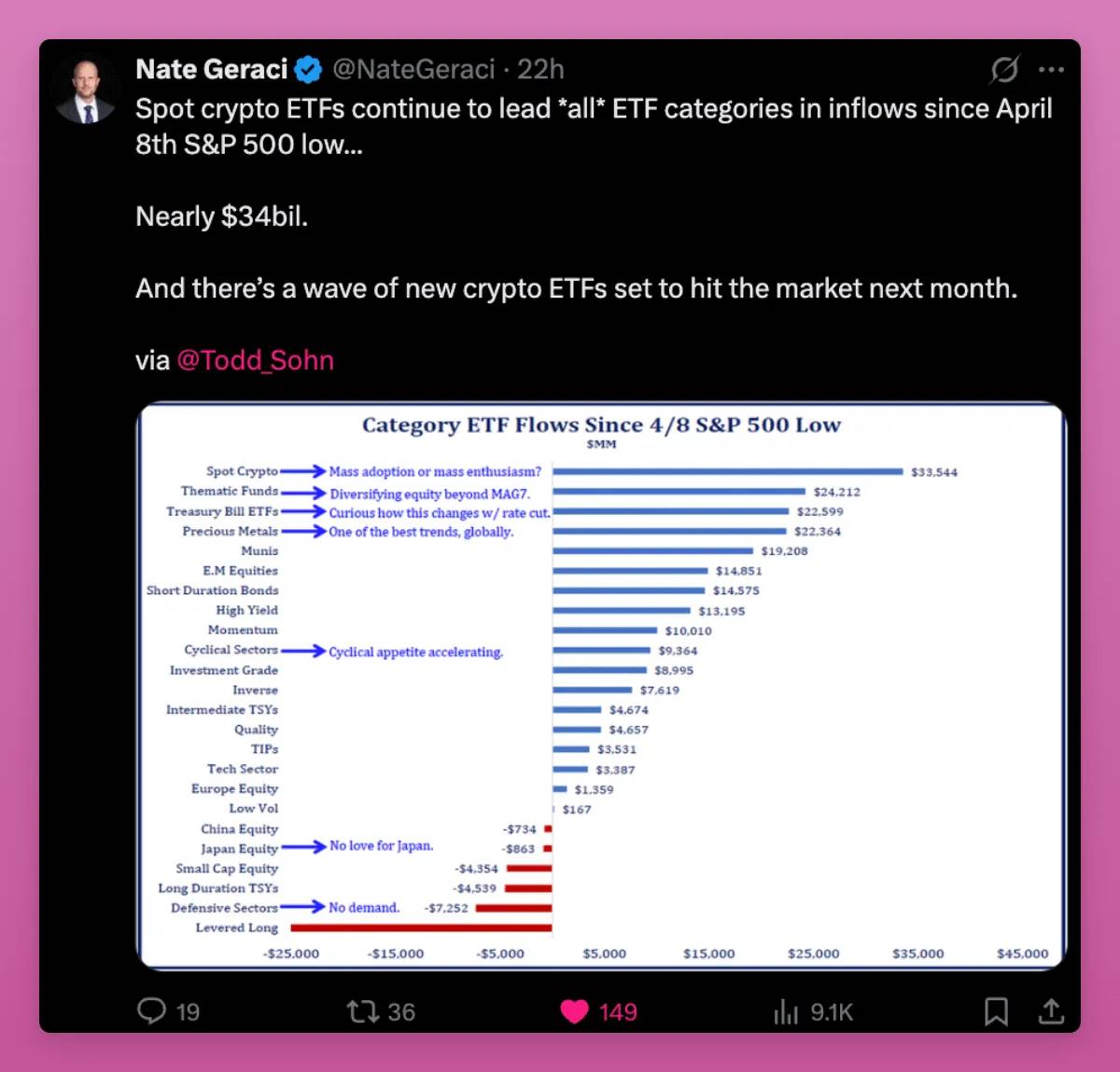

Since April 8, spot crypto ETFs have led all ETF categories in fund inflows, reaching $34 billion—surpassing thematic ETFs, government bonds, and precious metals.

Buyers include pension funds, advisors, and banks. Cryptocurrencies are now part of investment portfolios just like gold or Nasdaq.

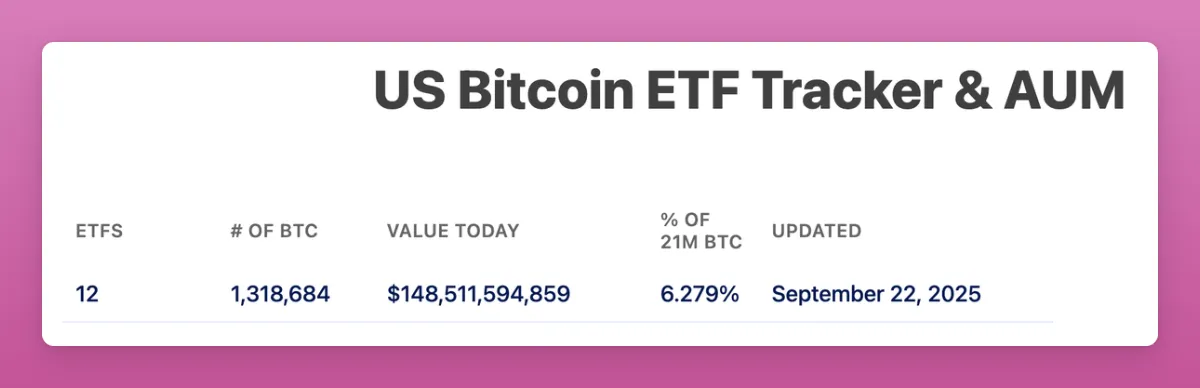

Bitcoin ETFs manage $150 billion in AUM, representing over 6% of total supply.

Ethereum ETFs hold 5.59% of total supply.

All of this happened in just over a year.

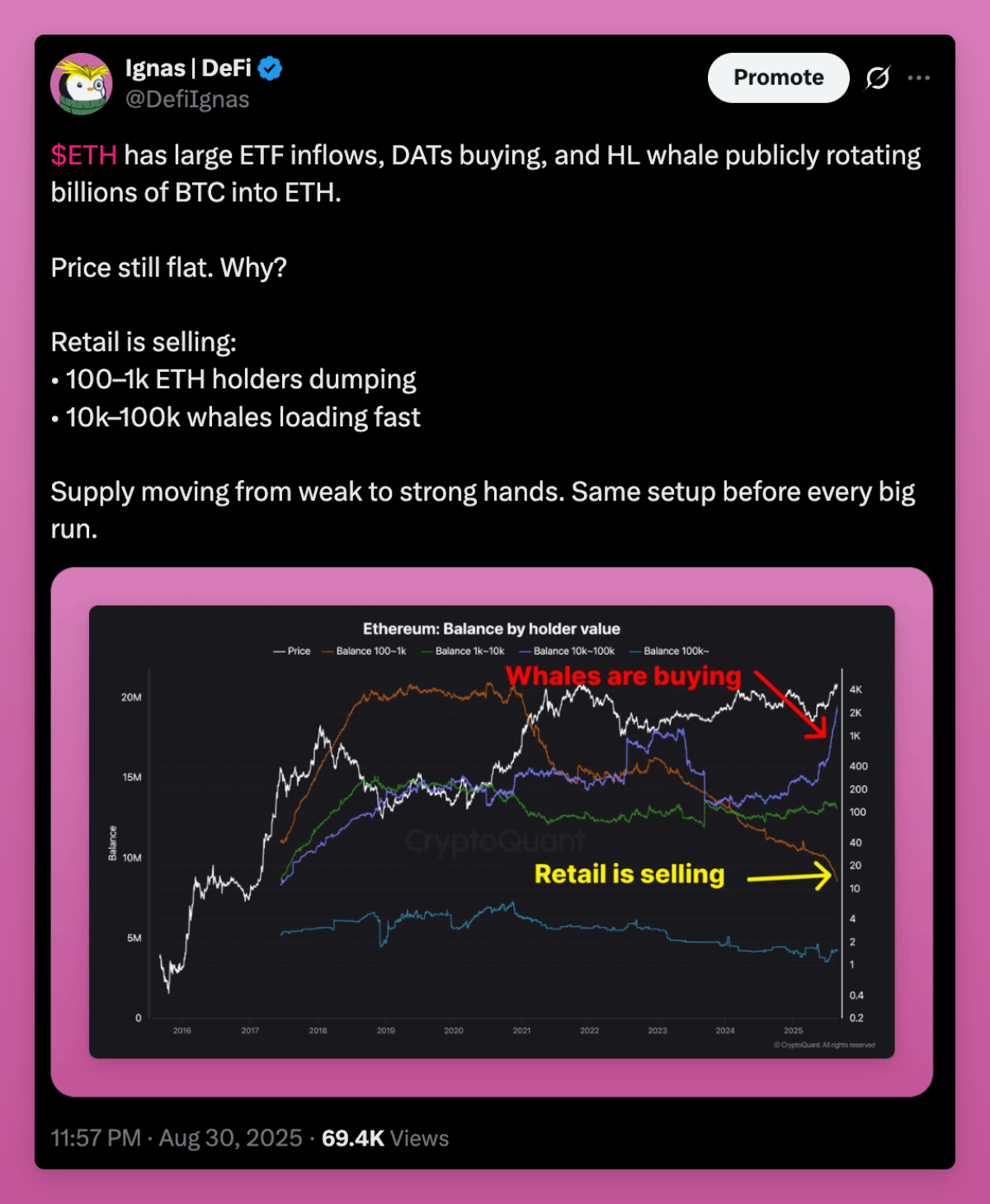

ETFs are now the primary buyers of Bitcoin and Ethereum, shifting ownership from retail investors to institutions. As shown in my posts, whales are buying while retail is selling.

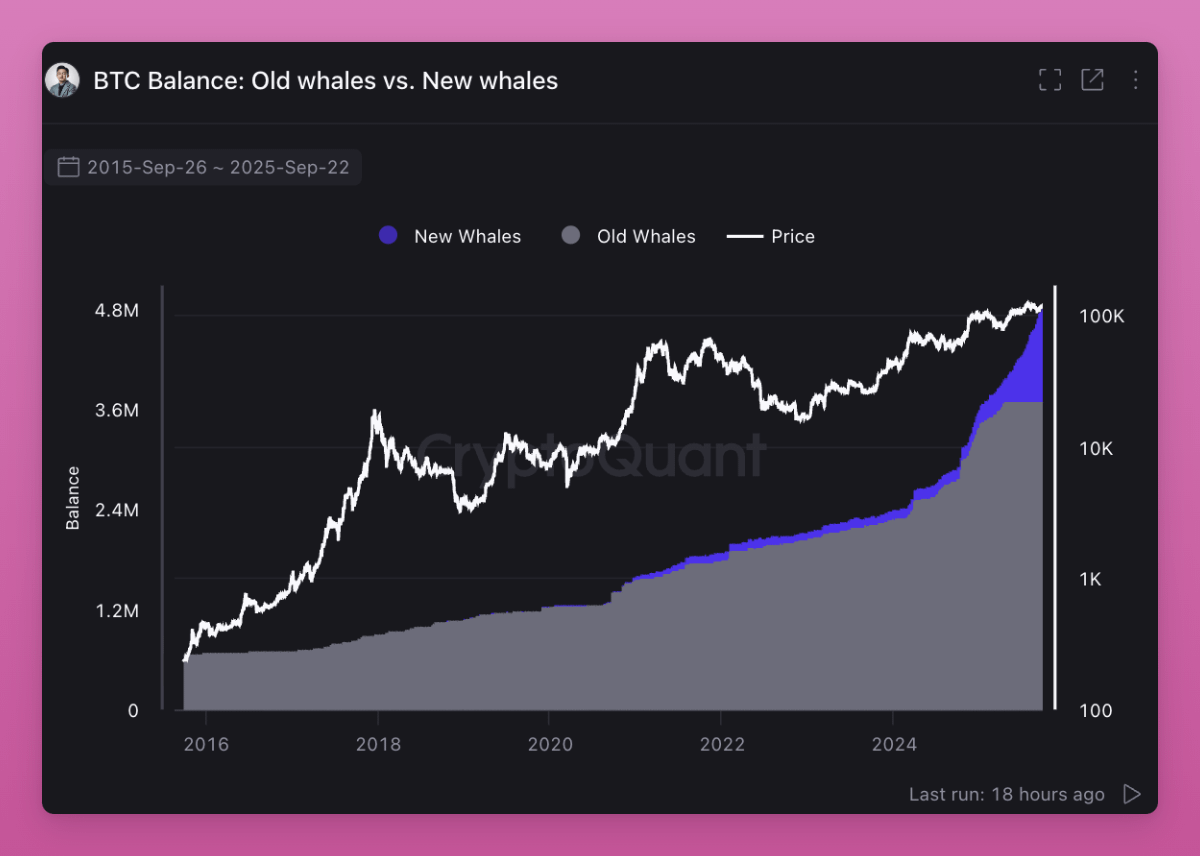

More importantly, "old whales" are selling to "new whales."

Ownership is rotating. Investors who believe in the four-year cycle are selling, expecting the old script to repeat. But something different is happening.

Retail investors who bought low are selling to ETFs and institutions. This transfer raises cost bases and sets higher floors for future cycles, as new holders won’t sell out with small profits.

This is the great rotation in crypto—the movement of crypto assets from speculative retail hands into long-term allocators.

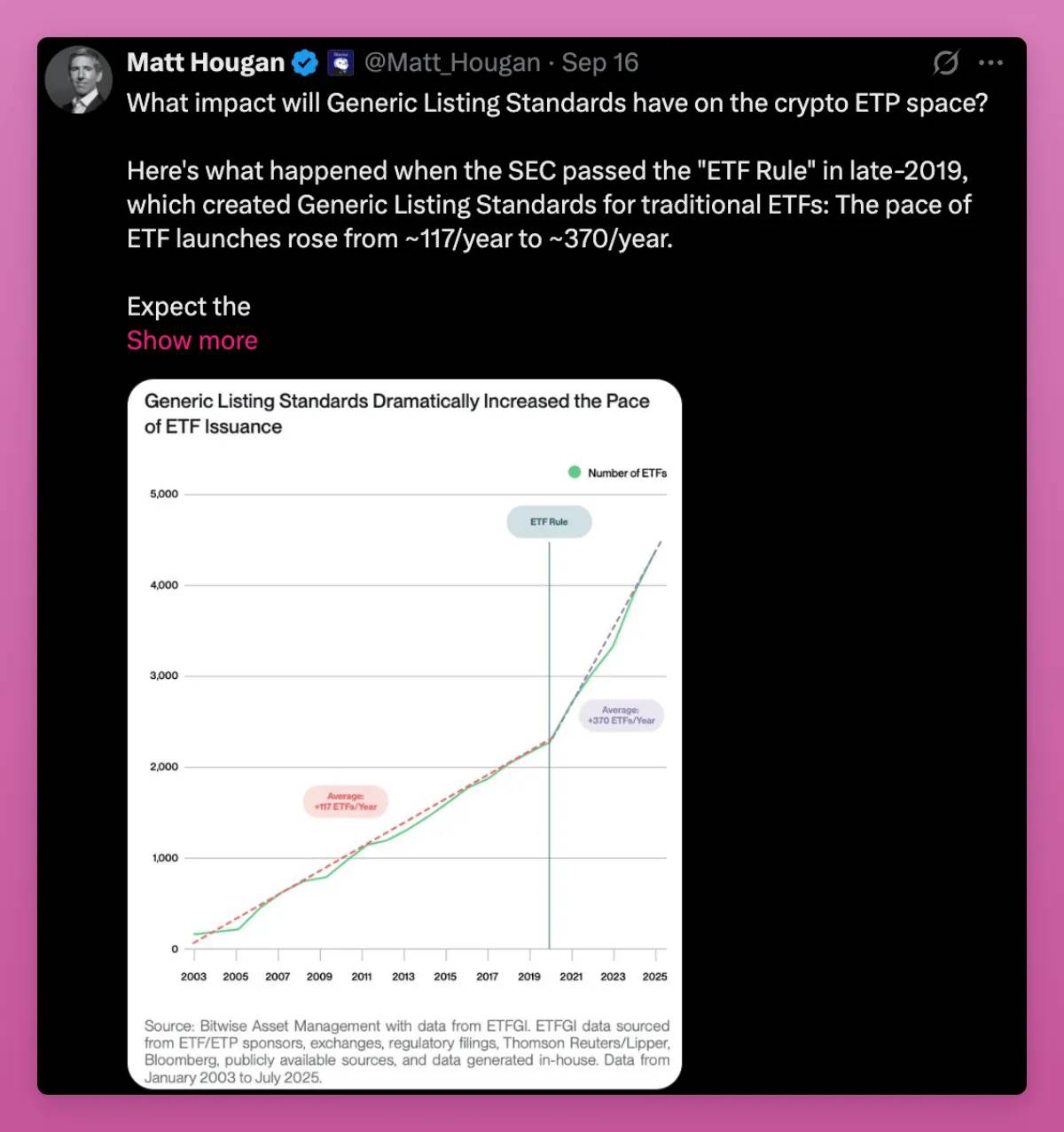

Generic listing standards open the next phase of this rotation.

In 2019, similar rules tripled ETF launches in equities. A comparable surge is expected in crypto. Many new ETFs are coming—SOL, HYPE, XRP, DOGE—providing liquidity for retail exits.

The key question remains: Can institutional buying power balance retail selling pressure?

If macro conditions remain stable, I believe those selling now, anticipating the four-year cycle, will buy back in at much higher prices.

The End of Broad Market Rallies

In the past, the crypto market typically moved together. Bitcoin would lead, followed by Ethereum and then other assets. Small-cap tokens would surge as liquidity flowed down the risk curve.

This time is different—not all tokens are rising in sync.

There are now millions of tokens in the market. New coins launch daily on pump.fun, as "creators" shift attention from old tokens to their own Memecoins. Supply is exploding while retail attention stays constant.

Liquidity is spread too thin across too many assets, given the near-zero cost of issuing new tokens.

Previously, low-circulating-supply, high-FDV tokens were popular and ideal for airdrops. But retail has learned its lesson. They now prefer tokens that deliver real value returns or strong cultural appeal (e.g., $UNI showed strong volume but failed to rise).

Ansem is right—we've hit peak pure speculation. The new trend is revenue, due to its sustainability. Apps with product-market fit and fees will rise; others won't.

Two points stand out: users paying high fees for speculation, and blockchain efficiency compared to traditional finance. The former has peaked, while the latter still has room to grow.

Murad raised another good point I think Ansem missed. Tokens that still manage to rise are usually new, strange, easily misunderstood—but backed by strong, belief-driven communities. I’m one of those people drawn to novelty (like my iPhone Air).

Cultural significance determines survival versus failure. A clear mission—even if initially seen as crazy—can keep communities intact until adoption gains momentum. I’d categorize Pudgy Penguins, Punk NFTs, and Memecoins here.

However, not every shiny new thing succeeds. Runes, ERC404, etc., show how quickly novelty fades. Narratives may disappear before reaching critical mass.

I believe these views together explain the new order: revenue filters out weak projects; culture sustains misunderstood ones.

Both matter, but differently. The biggest winners will be the few tokens that combine both.

Stablecoin Order Gives Crypto Credibility

Initially, traders held USDT or USDC to buy BTC and other cryptos. New inflows were bullish because they translated into spot purchases. Back then, 80% to 100% of stablecoin inflows ended up buying crypto.

Now, things have changed.

Stablecoins are now used in lending, payments, yield, treasury management, and airdrop farming. Some funds never touch spot BTC or ETH buys but still boost the system. More L1 and L2 transactions. More DEX liquidity. More income in lending markets like Fluid and Aave. Deeper money markets across the ecosystem.

A new trend is payment-first L1s.

Stripe and Paradigm’s Tempo is designed for high-throughput stablecoin payments, equipped with EVM tools and native stablecoin AMMs.

Plasma is a Tether-backed L1 built for USDT, featuring banking apps and payment cards targeting emerging markets.

These blockchains push stablecoins into real-world economies, beyond just trading. We’re returning to the idea of “blockchain for payments.”

What could this mean (to be honest, I’m still unsure)?

-

Tempo: Stripe has massive distribution power. This could drive broad crypto adoption but might bypass spot demand for BTC or ETH. Tempo could end up like PayPal—huge volume but little value accrual to Ethereum or other blockchains. It’s unclear whether Tempo will issue a token (I think it will) and how much fee revenue will flow back into crypto.

-

Plasma: Tether already dominates USDT issuance. By combining blockchain + issuer + apps, Plasma could centralize a large portion of emerging market payments into a closed ecosystem. This mirrors the battle between Apple’s walled garden and the open internet championed by Ethereum and Solana. It sparks a fight with Solana, Tron, and EVM L2s over which chain becomes the default for USDT. I think Tron stands to lose the most, and Ethereum was never a payment chain to begin with. However, Aave and others launching on Plasma poses a huge risk to ETH…

-

Base: Savior of ETH L2s. With Coinbase pushing payments via the Base app and earning USDC yield, they’ll continue driving up fees for Ethereum and DeFi protocols. The ecosystem remains fragmented but competitive, further expanding liquidity.

Regulation is aligning with this shift. The GENIUS Act is pushing other countries to catch up globally on stablecoins.

Additionally, the U.S. Commodity Futures Trading Commission (CFTC) recently allowed stablecoins to be used as tokenized collateral in derivatives. This adds payment demand on top of non-spot demands in capital markets.

Overall, stablecoins and new stable L1s give crypto credibility.

Once seen merely as gambling venues, they now carry geopolitical significance. Speculation remains the top use case, but stablecoins are clearly crypto’s second-largest application.

Winners are blockchains and apps that capture stablecoin flows and convert them into sticky users and cash flow. The biggest unknown is whether new L1s like Tempo and Plasma can become leaders locking value within their ecosystems, or whether Ethereum, Solana, L2s, and Tron can fight back.

The next big transaction will occur on September 25 on the Plasma mainnet.

DAT: New Leverage and IPO Model for Non-ETF Tokens

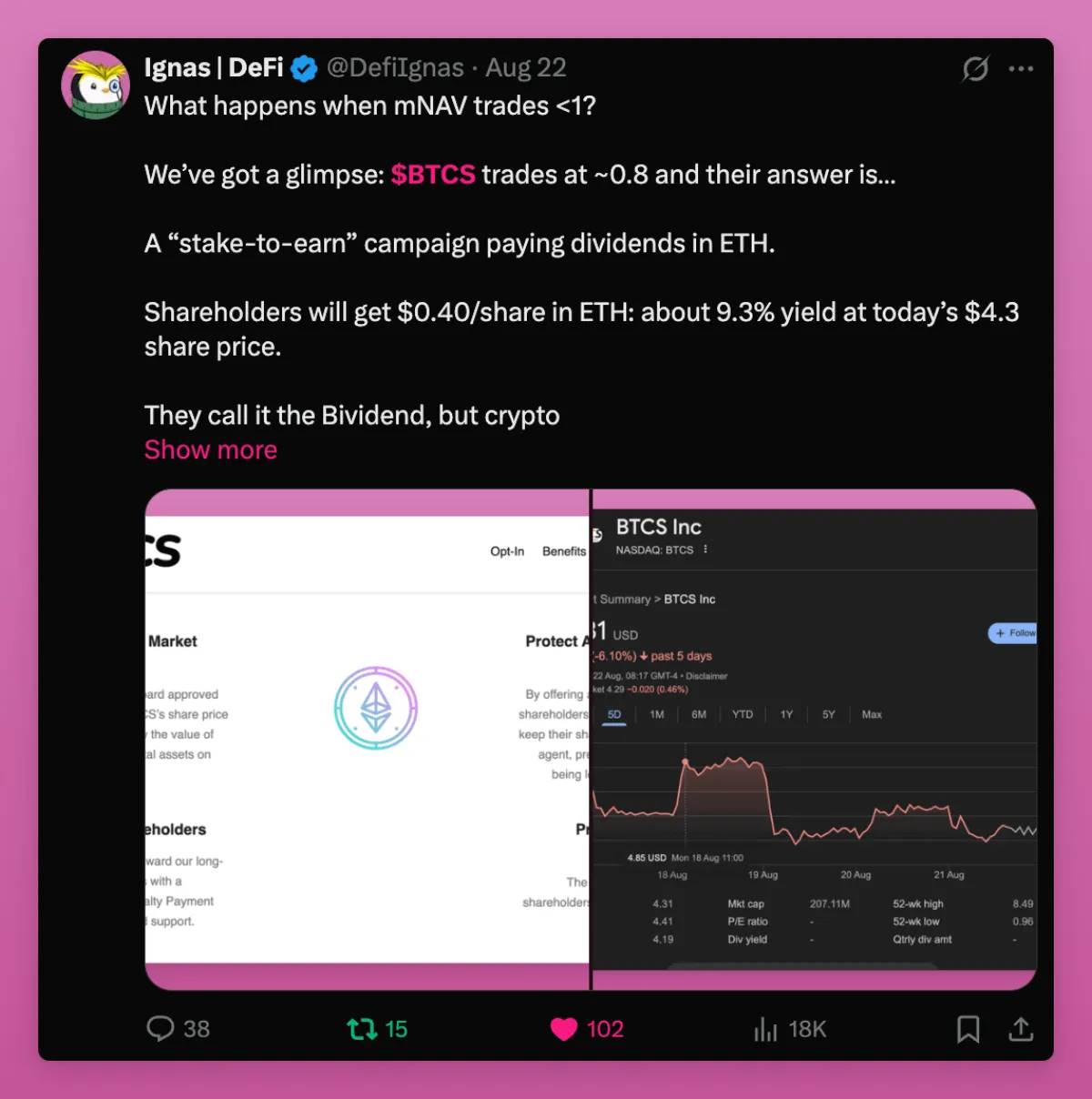

Digital Asset Treasuries (DATs) worry me.

In every bull cycle, we find new ways to leverage tokens. This drives prices far beyond what spot buying alone could achieve, but deleveraging during downturns is always brutal. During the FTX collapse, forced selling from CeFi leverage crushed the market.

In this cycle, leverage risks may come from DATs. If they issue shares at a premium, raise debt, and deploy funds into tokens, they amplify rallies. But when sentiment turns, these structures could intensify declines.

Forced redemptions or exhausted share buyback funds could trigger heavy sell pressure. Thus, while DATs expand market access and bring in institutional capital, they also add a new layer of systemic risk.

Let’s look at an example of what happens when mNAV > 1. In short, they distribute ETH to shareholders, who are likely to dump it. Yet despite such "airdrops," BTCS trades at 0.74 mNAV. That’s bad.

On the other hand, DATs represent a new bridge connecting token economics with stock markets.

As Ethena’s founder wrote:

"I’m concerned we may have exhausted native crypto capital needed to push altcoins above the previous cycle’s peak. Looking at Q4 2021 and Q4 2024 altcoin nominal market cap peaks, both hover around $1.2 trillion. Adjusted for inflation, the numbers are nearly identical. Is this perhaps the limit of what global retail capital can bid for 99% ‘shitcoins’?”

This is why DATs matter.

Retail capital may have peaked, but tokens with real businesses, real revenue, and real users can now access the much larger stock market. Compared to global equities, the entire altcoin market is negligible. DATs open a door for new capital inflows.

Beyond that, since few altcoins have the expertise to launch DATs, those that do redirect attention from millions of tokens back to a few “Schelling points.”

He also noted that NAV premium arbitrage isn’t important—and that itself is positive.

Most DATs can’t use capital structure leverage like Saylor to sustain NAV premiums continuously. The real value of DATs isn’t in premium games, but in access to capital. Even a stable 1:1 NAV with steady inflows is better than zero access.

ENA and even SOL’s DATs have been criticized as tools for VCs to cash out their token holdings.

ENA, in particular, is especially vulnerable due to large VC holdings. But precisely because of capital allocation issues—where private VC demand vastly exceeds liquid secondary market demand—exiting via DATs is beneficial, allowing VCs to reallocate capital to other crypto assets.

This is important because VCs suffered heavily in this cycle due to lack of exit opportunities. If they can sell and gain new liquidity, they can fund new innovations in crypto, driving the industry forward.

Overall, DATs are bullish for crypto, especially for tokens that can’t get ETFs. They allow projects like Aave, Fluid, Hype—with real users and revenue—to channel investments into stock markets.

Of course, many DATs will fail and spill over into the market. But they also offer ICO-era projects a path toward IPO-like exits.

RWA Revolution: Possibility of On-Chain Financial Life

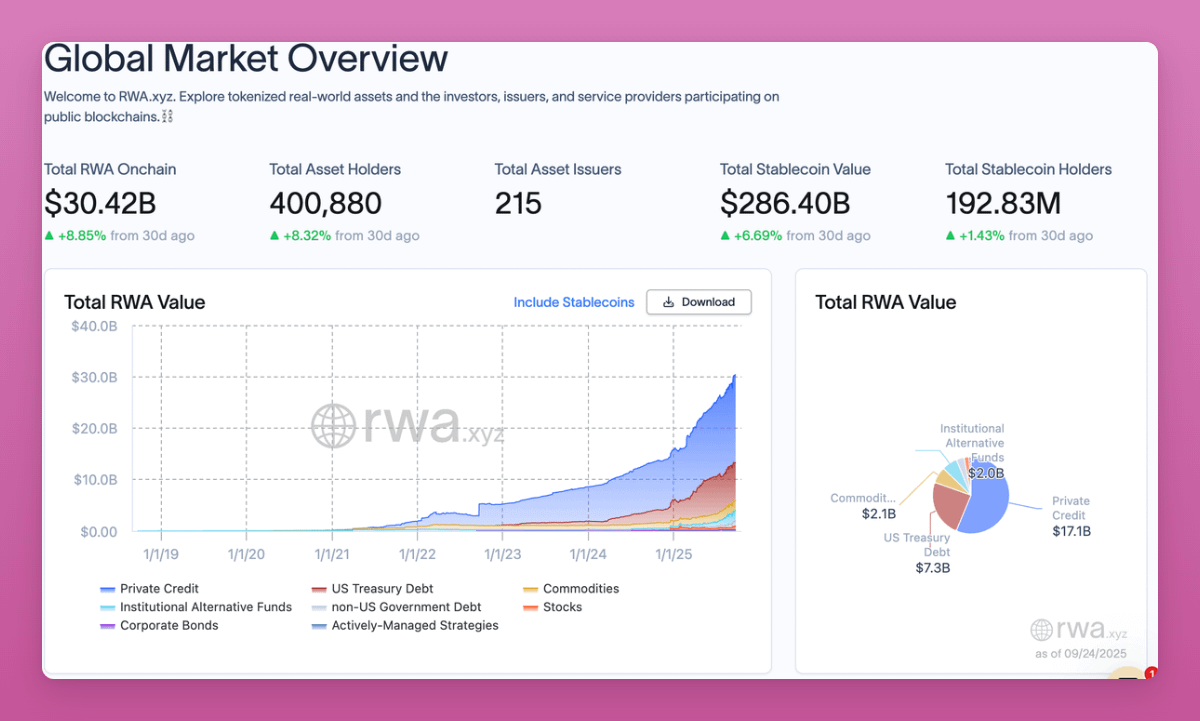

The total market size of on-chain RWA has just surpassed $30 billion, growing nearly 9% in a single month. The trend line continues upward.

Treasuries, credit, commodities, and private equity are now tokenized. The pace of transformation is accelerating rapidly.

RWAs bring the world economy on-chain. Major shifts include:

-

Previously, you had to sell crypto for fiat to buy stocks or bonds. Now, you can keep holding BTC or stablecoins on-chain, move into treasuries or stocks, and self-custody.

-

DeFi escapes the "Ponzi" trap that constrained growth for many protocols. It brings new revenue streams to DeFi and L1/L2 infrastructure.

The most important change is collateral.

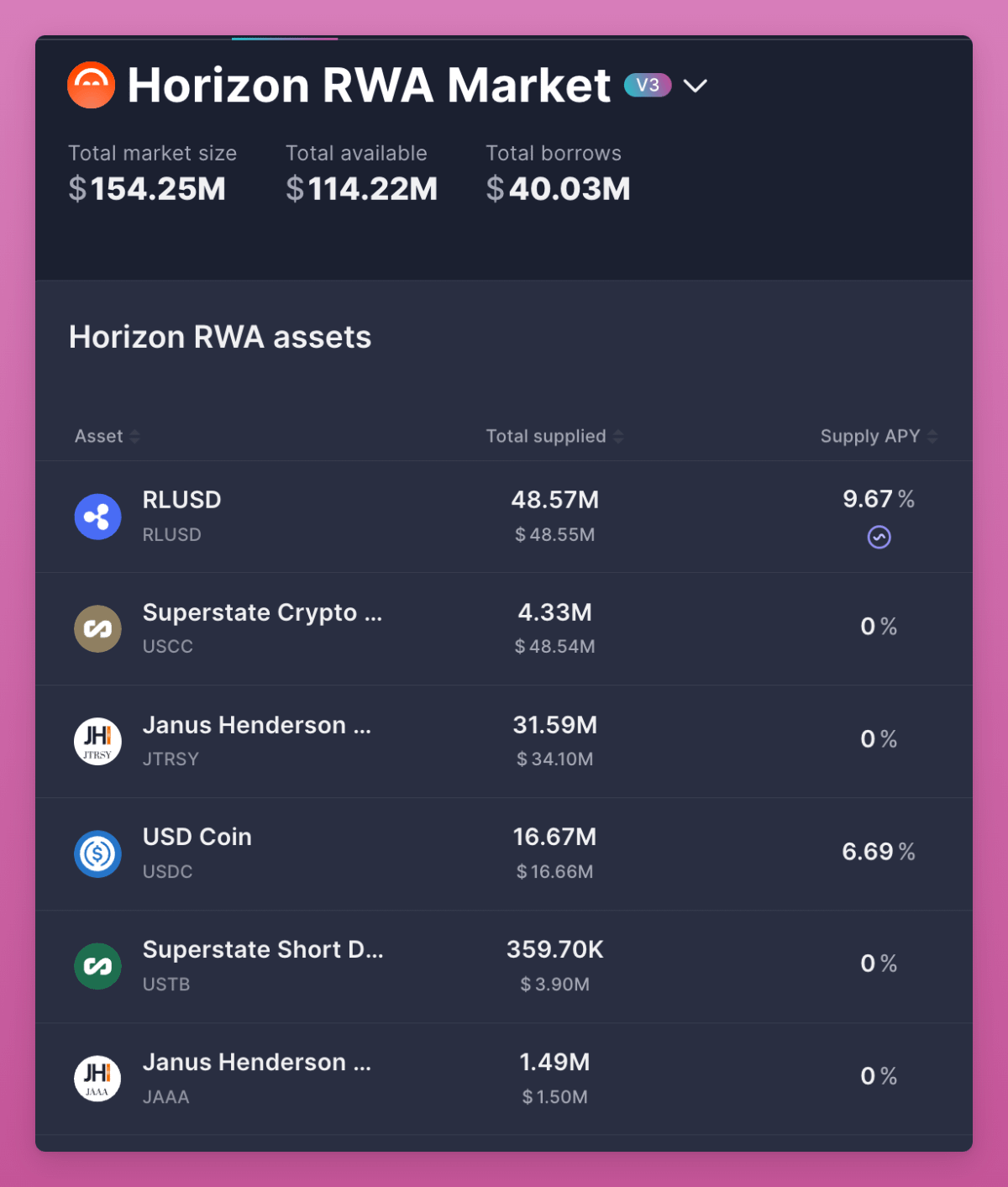

Aave’s Horizon lets you deposit tokenized assets like the S&P 500 index and borrow against them. But its TVL remains small at $114 million, indicating RWA is still relatively early-stage. (Note: Centrifuge is working hard to bring official SPX500 RWA on-chain. If successful, CFG could perform well. I have confidence in this.)

This would be nearly impossible for traditional finance to offer retail investors.

RWAs ultimately make DeFi a true capital market. They set benchmark rates through treasuries and credit. They expand global reach, letting anyone hold U.S. Treasuries without a U.S. bank—this is becoming a global battleground.

BlackRock launched BUIDL, Franklin launched BENJI. These aren’t fringe projects—they’re bridges connecting trillions of dollars to crypto.

Overall, RWAs represent the most important structural revolution today. They make DeFi relevant to the real economy and build infrastructure for a fully on-chain world.

Four-Year Cycle

The most critical question for the native crypto market is whether the four-year cycle is over. I hear people around me already selling, expecting it to reappear. But I believe that with the changing crypto order, the four-year cycle will repeat—this time differently.

This time is different.

I’m betting my own capital because:

-

ETFs transform BTC and ETH into institutionally allocable assets.

-

Stablecoins become geopolitical tools, now entering payments and capital markets.

-

DATs open a path to stock markets for tokens without ETF access, while enabling VCs to exit and fund new projects.

-

RWAs bring the global economy on-chain, creating benchmark rates for DeFi.

This is not the 2017 casino, nor the 2021 mania.

This is a new era of structure and adoption—crypto integrating with traditional finance, while still driven by culture, speculation, and belief.

The winners of the next cycle won’t come from a "buy everything" strategy.

Many tokens may still experience four-year-cycle crashes. You need to choose carefully.

The real winners will be tokens that adapt to macro and institutional changes while maintaining cultural appeal to retail.

This is the new order.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News