CoinEx 2025 Annual Report: The Four-Year Cycle Is Over—Where Is the Institutionally Driven Crypto Era Heading?

TechFlow Selected TechFlow Selected

CoinEx 2025 Annual Report: The Four-Year Cycle Is Over—Where Is the Institutionally Driven Crypto Era Heading?

This report systematically analyzes the market's transition from "retail speculation-driven" to "institution-led ecosystem," and addresses six key questions regarding asset allocation for 2026.

Author: CoinEx

In Brief

CoinEx's 2025 Annual Report highlights a profound structural shift in the cryptocurrency market. The traditional "four-year halving cycle" is gradually disintegrating under sustained institutional capital inflows.

Spot Bitcoin ETFs have transformed BTC into a standardized asset allocation component, evolving it from a highly volatile speculative instrument into an asset with macro reserve characteristics.

This report systematically analyzes the market's transition from "retail speculation-driven" to "institutionally dominated ecosystems," addressing six key questions regarding asset allocation in 2026.

CoinEx’s baseline forecast is that Bitcoin could reach $180,000 by 2026. However, it clearly states that the broad alt-season is over—the future liquidity will flow only to "blue-chip survivors" with real adoption and clear business models.

Retail investors must adopt a "Double-Track Strategy":

On one hand, focus on BTC, ETH, and compliant yield products to ride institutional capital flows; on the other, seek alpha in smaller, niche on-chain sectors not yet fully covered by institutions.

DeFi has entered a new phase centered on profitability, shifting focus toward Fee Switch protocols akin to equity dividend mechanisms.

In the AI × Crypto space, sustainable advantage lies not in "buying AI tokens," but in utilizing AI tools—through AI Agents and "Vibe Coding"—to upgrade retail investors into productive "super individuals" with leverage.

The 2026 market will reward deterministic cash flows, structural adoption, and technological leverage—not mere volatility bets.

1. Market Outlook: Where Is the Overall Crypto Market Headed?

The Four-Year Cycle Is Undergoing Structural Breakdown

The widely validated "four-year halving cycle" is losing relevance.

In past cycles, post-halving rallies were typically driven by retail sentiment, resulting in parabolic surges followed by deep corrections. In 2025, however, Bitcoin approached $125,000 in October before falling below $90,000—without signs of excessive speculation or euphoria.

Premature profit-taking and restrained sentiment indicate that the supply shock from halving is weakening against steadily rising demand.

The root cause lies in significantly enhanced institutional absorption capacity. By end-2025, spot Bitcoin ETFs had accumulated over $150 billion in assets under management (AUM), drawing capital from corporations, governments, endowments, pensions, and sovereign wealth funds.

Bitcoin's behavioral pattern is shifting toward that of a "new type of reserve asset," rather than a bubble-prone asset.

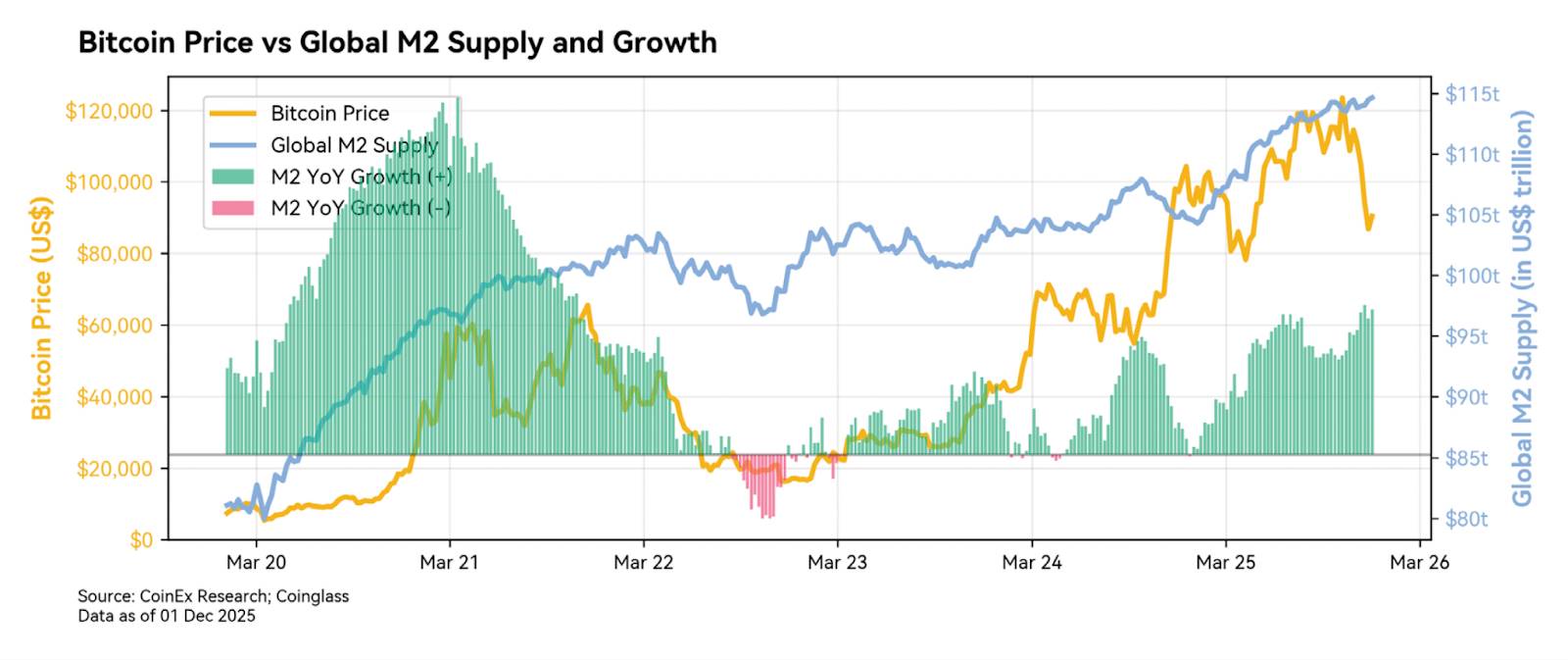

Global Liquidity Remains a Foundational Variable, But Its Marginal Impact Is Declining

Global liquidity will provide limited support in 2026.

The market expects the Federal Reserve to cut rates by 50–75 basis points, while the European Central Bank and People's Bank of China remain cautious, and the Bank of Japan moves toward normalization.

Since the launch of ETFs in 2024, Bitcoin’s correlation with M2 has notably weakened.

Liquidity provides a "floor," but actual price appreciation will be driven by institutional inflows and regulatory progress.

2026 May Hit New Highs, But the "Alt-Season" Won’t Return

CoinEx maintains a cautiously optimistic view, expecting Bitcoin to potentially reach $180,000 in 2026, supported by policy tailwinds and institutional demand.

While 20–30% pullbacks may still occur due to macro or geopolitical factors, the likelihood of a traditional 70–80% crash is extremely low. A roughly two-fold increase from current levels represents the base-case scenario.

However, widespread altcoin rallies will no longer occur.

Retail fatigue, fragmented liquidity, and shortened project lifecycles mean capital will selectively flow only to projects with real adoption, sustained revenue, and profitability.

2. Institutions vs. Retail: Where Are the Opportunities for Retail Investors?

Retail investors remain important, but the space for excess returns is narrowing.

"Simple Alpha" based on narratives and sentiment is disappearing; success now depends more on structural understanding and deep research.

Beta Strategy: Anchoring to Inflation-Hedging Assets and Compliant Yield

Bitcoin and Ethereum are increasingly becoming inflation-resistant value storage tools.

Retail investors should treat them as portfolio core holdings rather than chasing extreme multiples.

Gaining exposure through compliant yield products (such as staking ETFs and insured wrapped instruments)—effectively "riding institutional capital"—is a more stable approach.

Improving regulatory conditions will drive growth in low-volatility, compliant on-chain yield products.

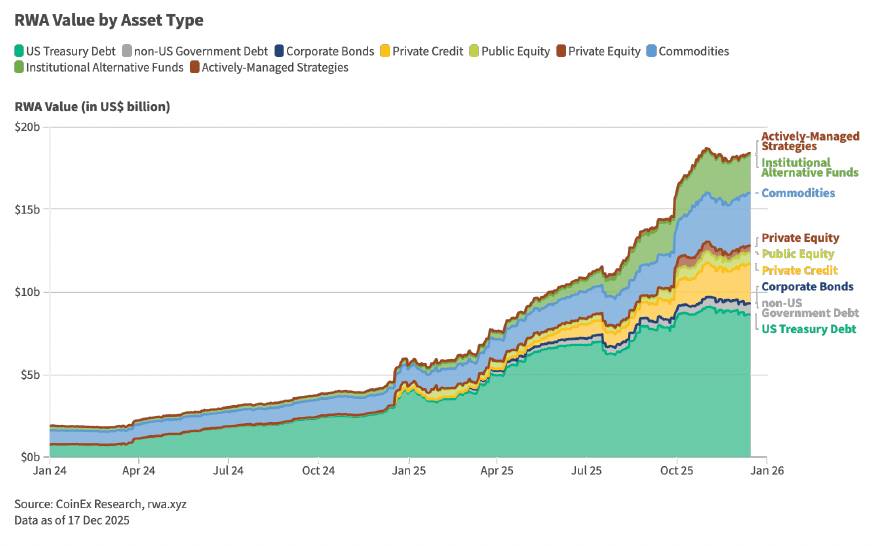

RWA (real-world assets) are building "programmable risk-free rates" via tokenized government bonds.

Selection criteria should prioritize compliance, ecosystem maturity, developer retention, and real income—not price hype.

Alpha Strategy: Shifting from Sentiment Chasing to On-Chain Precision

The $19 billion liquidation event on October 2025 marked the end of retail sentiment peaks.

High FDV projects and VC unlock pressures create valuation traps; without retail buyers stepping in, pump costs have surged dramatically.

Alpha in 2026 requires a "Dual-Track Strategy":

-

Avoid high-FDV, heavily unlocking assets

-

Prefer fairly launched, organically demand-driven projects

-

Focus on PMF, audited revenue, and execution capability

Analysis tools should shift from CEX sentiment to on-chain analytics platforms like Nansen, Glassnode, Santiment, and Dune.

Retail’s advantage lies in agility—enabling faster rotation and tracking of smart money.

Real alpha exists in areas not yet covered by institutions:

Web3 payments, vertical AppChains (gaming, creators), and early liquidity gaps on new chains.

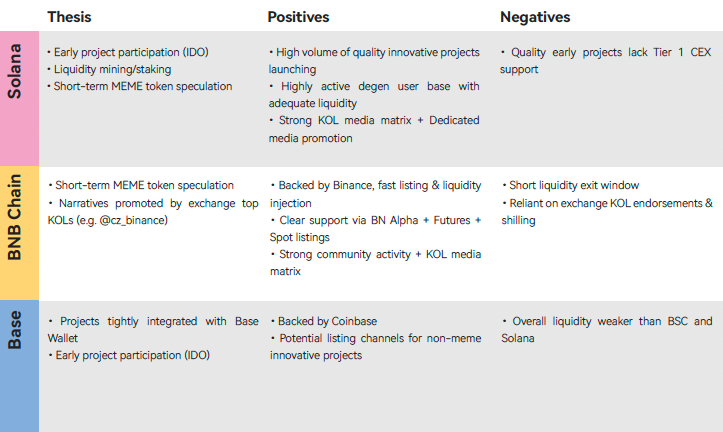

3. Public Chains: A Retail Investor’s Handbook

Under regulatory scrutiny and institutional inflows, top-tier Layer 1s have become "institutional battlegrounds."

Yet in high-volatility niches, retail retains advantages: Memes, AI, privacy, staking, and mining.

The current competitive landscape is stabilizing:

Solana, BSC, and Base lead in liquidity, developer density, and execution efficiency—making them core arenas for retail participation.

Retail Participation Pathways

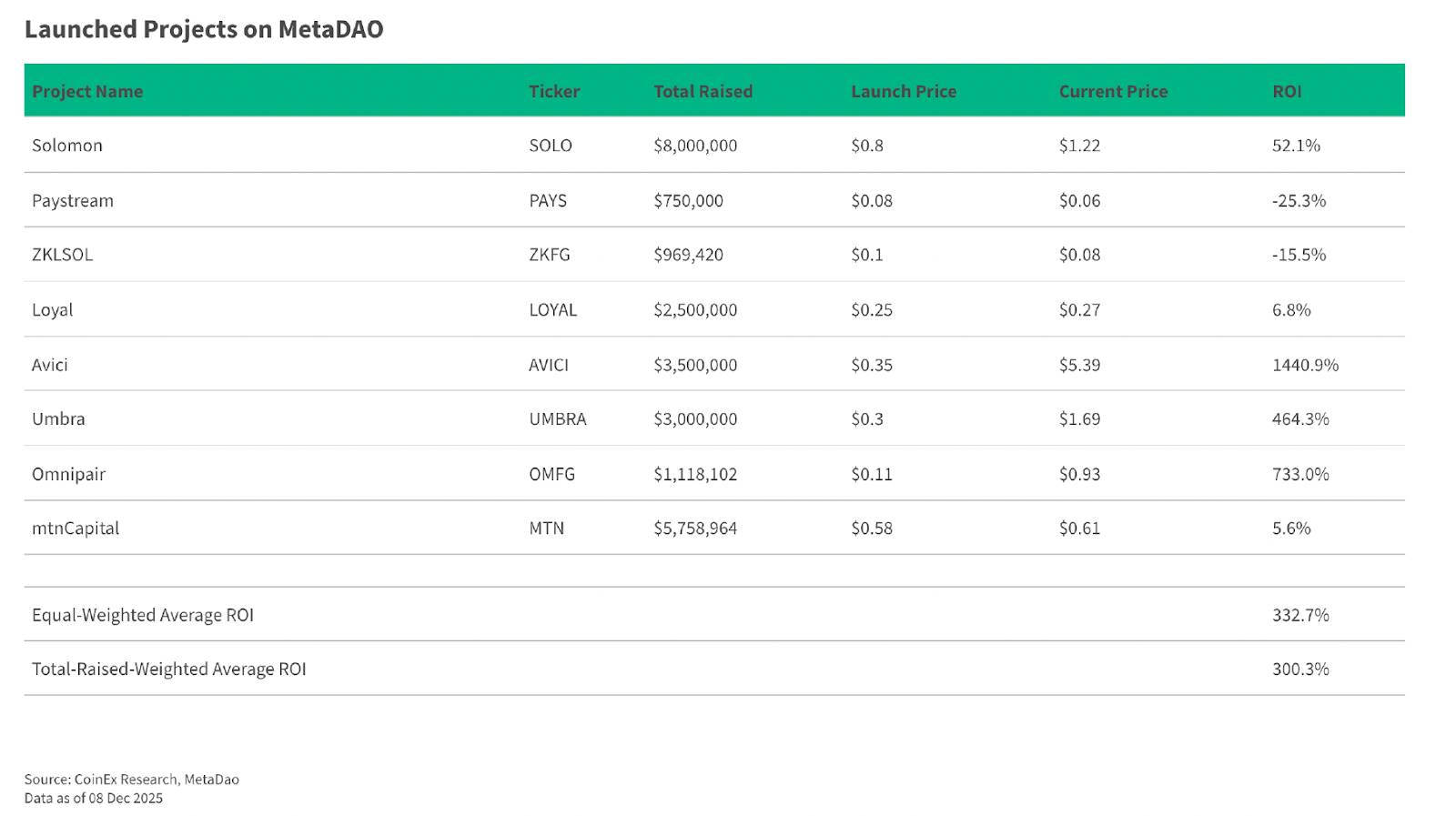

Early Opportunities: ICO / IDO / Launchpad

Through quality launchpads, retail investors can gain vetted early exposure.

Meme Coins

Community-driven, high-risk, high-reward—suitable for retail investors with high volatility tolerance.

On-Chain Staking Yields

Staking and liquidity mining are expected to consistently outperform traditional financial interest rates in 2026, serving as a crucial supplement to beta strategies.

4. TradFi × Crypto: The Next Phase of Convergence

Nonlinear Evolution Path: Issuance → Tokenization → Perpetualization

Tokenization is the core driver, currently exceeding $18 billion in size (mainly government bonds), with stock tokenization around $670 million.

The next step involves expansion into private credit, equity, and alternative assets, led by funds such as BlackRock’s BUIDL.

This will be followed by the "perpetualization phase":

Building perpetual contracts atop tokenized assets and enabling automated deleveraging via AI-powered risk control.

Deeper integration will involve natively issuing stocks and bonds directly on-chain.

The Yield Paradigm Is Shifting

Institutional-grade yields are being "democratized."

Protocols like Plume deliver 4–10% real yields to DeFi using off-chain assets.

Centralized exchanges will fiercely compete on AUM, launching subsidized wealth management products and TradFi-like structured offerings.

5. DeFi: Which Sectors Are Worth Watching?

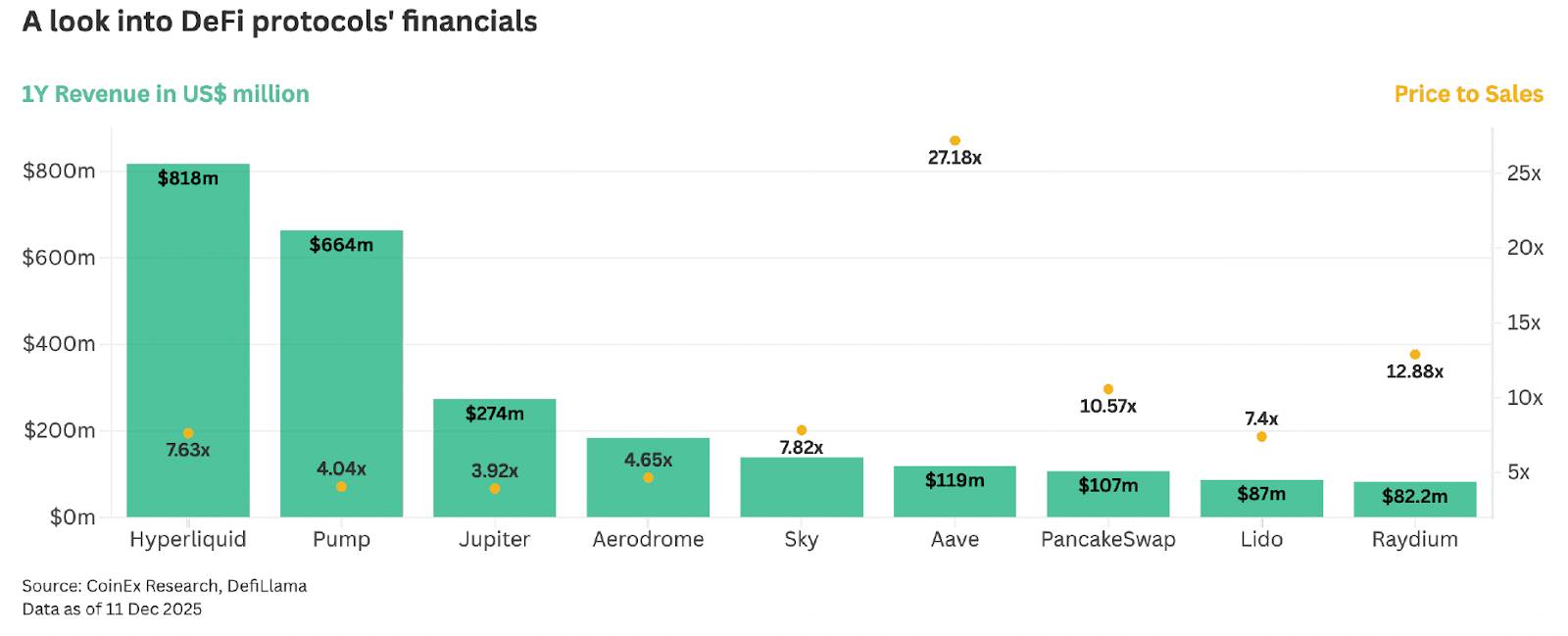

DeFi has moved beyond experimentation into a profit-oriented phase, with capital concentrating around real PMF and cash flow.

Emerging High-Growth Sectors

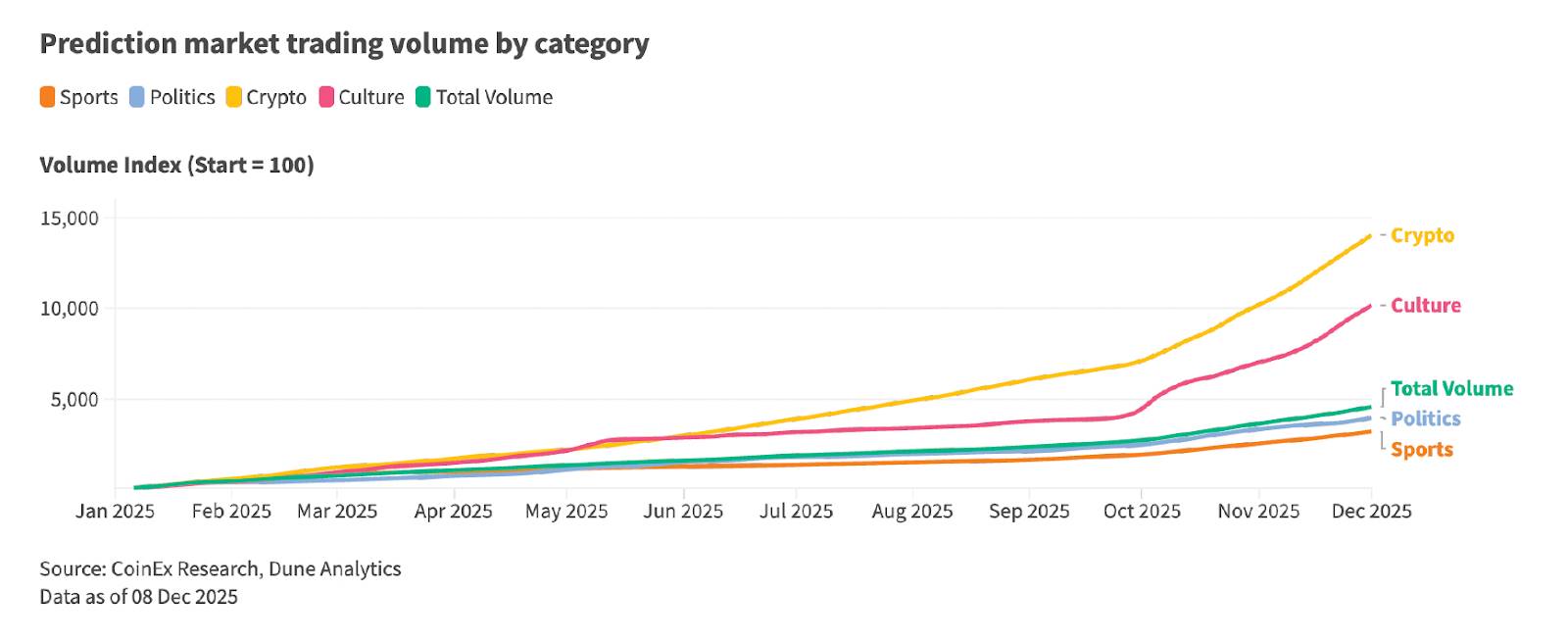

Prediction Markets and Real-Time Data Infrastructure

Weekly trading volume exceeded $3 billion in 2025. In 2026, hybrid products combining prediction markets with traditional derivatives are expected to emerge.

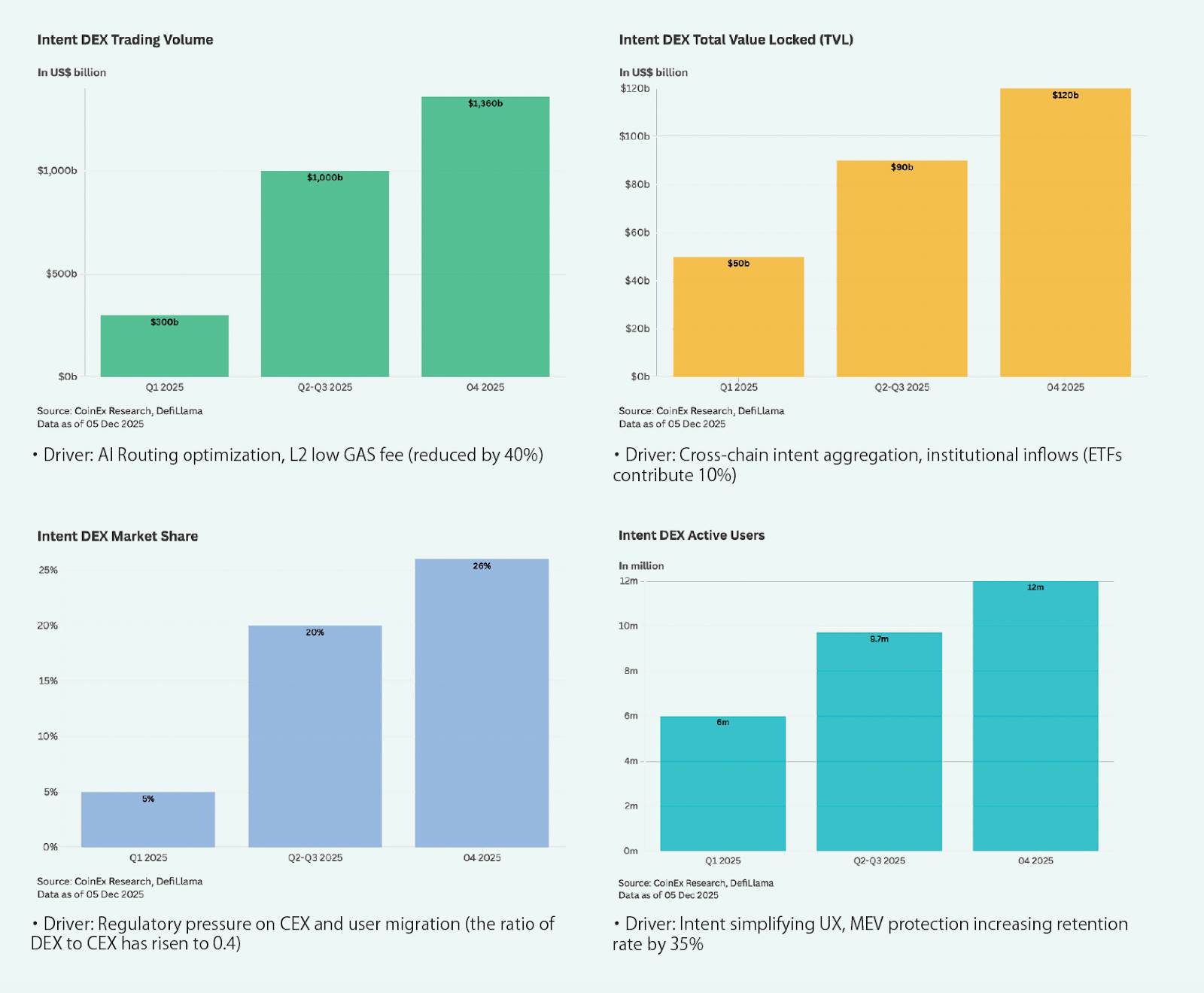

Intent Architecture: The Solver Revolution

Intent-based DEXs have reached $1.2 trillion in scale, using AI Solvers to optimize execution and eliminate MEV.

Competition is shifting toward algorithmic efficiency.

Core Investment Pool: Protocols with Real Value Capture

Priority should be given to Fee Switch protocols (revenue > emissions):

-

Perpetuals: Hyperliquid

-

Aggregators: Jupiter

-

DEXs: Raydium, Aerodrome, PancakeSwap

-

Others: Pump.fun, SKY, Aave, Lido

Avoid governance tokens without cash flows.

6. AI × Crypto: Buy Tokens or Use Tools?

AI × Crypto is diverging:

One path leads to "concept token speculation," the other to tooling and productivity.

Infrastructure for the Machine Economy

Protocols like x402 enable Agent payments under $0.0001 with 200ms latency.

Web3 is becoming critical infrastructure for physical AI and decentralized computing power.

Strategic Shift: From Concept Speculation to Productivity Alpha

Distinguish between real PMF (verifiable reasoning, Agent payments, decentralized GPUs) and marketing narratives.

Build AI-enhanced systems:

-

Research: Agents aggregate on-chain and sentiment data

-

Decision: LLMs filter noise

-

Execution: Automated arbitrage, DCA, and risk management

The ultimate edge lies in "Vibe Coding"—using natural language to build trading Agents, turning retail into "super individuals."

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please conduct your own research; the author assumes no responsibility for any losses.

About CoinEx

CoinEx was founded in 2017 as a user-centric, award-winning cryptocurrency exchange. Established by ViaBTC, one of the world’s leading mining pools, CoinEx was among the first exchanges to publish Proof of Reserves and ensure 100% security of user assets.

CoinEx serves over 10 million users across 200+ countries and regions, supports 1,400+ crypto assets, and issues its native ecosystem token CET.

Learn more: Website| Twitter| Telegram| LinkedIn| Facebook| Instagram| YouTube

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News