Huobi Growth Academy | 2025 In-Depth Crypto Market Research Report: Institutions, Stablecoins, and Regulation, 2025 Crypto Market Review and 2026 Outlook

TechFlow Selected TechFlow Selected

Huobi Growth Academy | 2025 In-Depth Crypto Market Research Report: Institutions, Stablecoins, and Regulation, 2025 Crypto Market Review and 2026 Outlook

Looking ahead to 2026, the key variables will be compliant capital cost, on-chain dollar quality, and the sustainability of real yields.

Executive Summary

The turning point for the crypto market in 2025 lies not in price, but in structure: a shift from retail-driven to institution-led capital flows; an evolution of assets from "crypto-native narratives" to an on-chain dollar system centered on stablecoins and RWA; and a transition in regulation from gray-area博弈 to global regulatory normalization. Institutional capital, entering via compliant channels such as spot ETFs, becomes the marginal buyer—reducing market volatility while increasing sensitivity to macro interest rates. Stablecoins surge in annual transaction volume to become global settlement infrastructure, while yield-bearing and algorithmic stablecoin failures expose systemic fragility. RWA, especially on-chain U.S. Treasuries, scales into reality, integrating on-chain yield curves with traditional finance. Regulatory clarity further lowers institutional entry barriers, pushing crypto from speculative cycles into a phase of modelable, allocatable, and auditable infrastructure. Looking ahead to 2026, the key variables will be compliant capital cost, quality of on-chain dollars, and sustainability of real yields.

1. Institutions as Marginal Buyers: Lower Volatility, Higher Interest Rate Sensitivity

In the early stages of crypto market development, price behavior and market rhythm were almost entirely driven by retail traders, short-term speculative capital, and community sentiment. The market showed extreme sensitivity to social media trends, narrative shifts, and on-chain activity metrics—a pricing mechanism primarily fueled by emotion and storylines, often summarized as "community beta." Under this framework, asset price increases were rarely rooted in fundamental improvement or long-term capital allocation, but instead propelled by rapidly accumulating FOMO. Conversely, once expectations reversed, panic selling would quickly amplify in the absence of long-term capital support. This structure caused core assets like Bitcoin and Ethereum to exhibit highly nonlinear price volatility for an extended period: sharp rallies followed by severe drawdowns, with market cycles dictated more by sentiment than capital constraints. Retail investors, as both primary participants and key amplifiers of volatility, tended to focus on short-term price moves rather than risk-adjusted returns, leaving the crypto market in a prolonged state of high volatility, high correlation, and low stability.

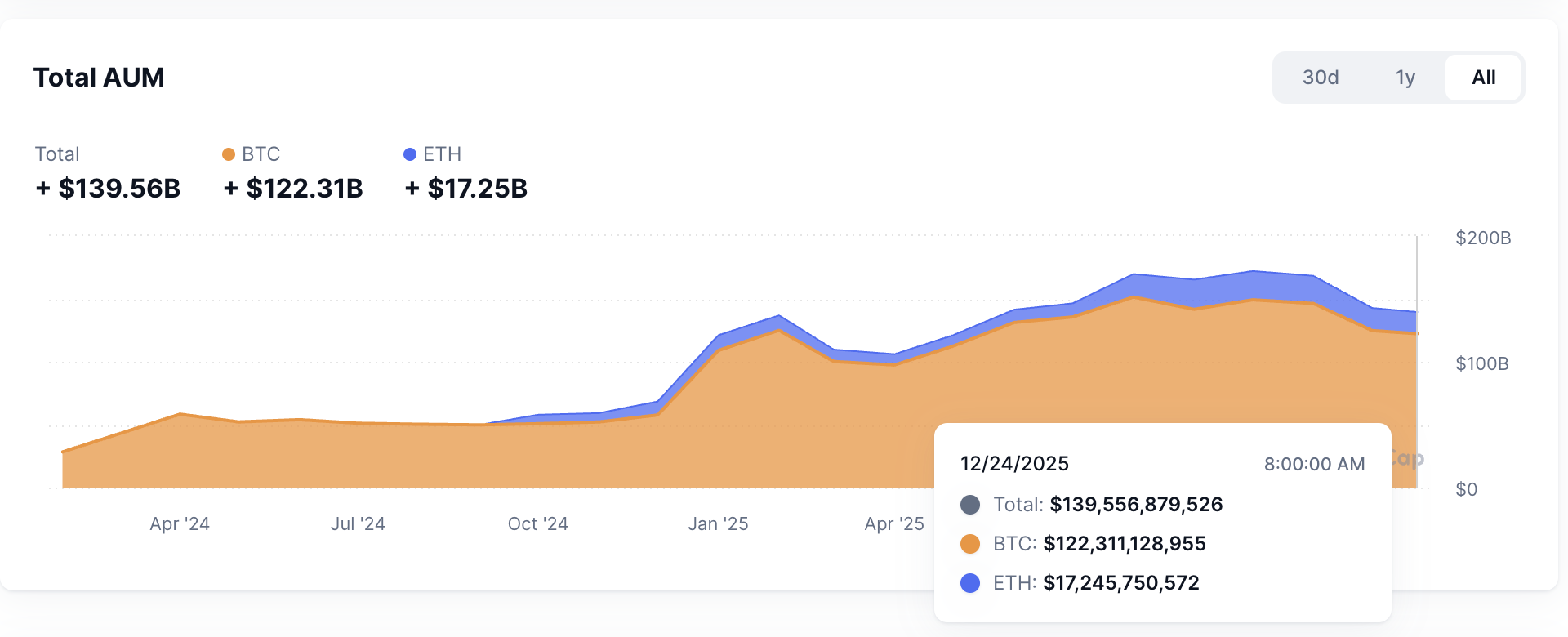

However, from 2024 to 2025, this long-standing market structure underwent a fundamental shift, with specific ETF AUM data shown in the chart below. With the approval and successful operation of U.S. spot Bitcoin ETFs, crypto assets gained their first systematic, compliant channel for large-scale institutional capital allocation. Unlike previous "suboptimal paths" such as trusts, futures, or on-chain custody, ETFs significantly reduced the operational and compliance costs for institutions entering the crypto market through their standardized, transparent, and regulated structures. By 2025, institutional capital was no longer merely "testing the waters" cyclically—it began continuously acquiring positions through ETFs, regulated custodianship, and asset management products, gradually evolving into the market’s marginal buyer. The significance of this change lies not in the sheer size of capital, but in the transformation of its nature: new demand was now coming not from emotionally driven retail, but from institutional investors guided by asset allocation and risk budgeting logic. When the marginal buyer changes, so does the market's pricing mechanism. The defining trait of institutional capital is lower trading frequency and longer holding periods. Unlike retail traders who frequently enter and exit based on short-term price movements and舆论 signals, decisions by pension funds, sovereign wealth funds, family offices, and large hedge funds are typically grounded in medium- to long-term portfolio performance, requiring investment committee reviews, risk control assessments, and compliance checks. This decision-making process naturally suppresses impulsive trades, making position adjustments more gradual rebalancing rather than emotional chasing of momentum. As institutional capital share continues to rise, the weight of high-frequency, short-term trading in overall market volume declines, and price movements increasingly reflect capital allocation trends rather than immediate sentiment shifts. This is directly reflected in the volatility structure: although prices still adjust in response to macro or systemic events, extreme swings triggered by sentiment have clearly narrowed—particularly evident in deep-liquidity core assets like Bitcoin and Ethereum. The market as a whole begins to exhibit a “static sense of order” akin to traditional assets, with price dynamics no longer solely dependent on narrative leaps, but gradually returning to capital-constrained behavior.

At the same time, the second notable feature of institutional capital is its high sensitivity to macro variables. The primary goal of institutional investing is not maximizing absolute returns, but optimizing risk-adjusted returns—meaning their asset allocation is deeply influenced by the broader macroeconomic environment. In traditional finance, interest rate levels, liquidity conditions, shifts in risk appetite, and cross-asset arbitrage opportunities form the core inputs for institutional position adjustments. When this logic is imported into the crypto market, crypto asset prices begin to show stronger correlations with macro indicators. Market developments in 2025 have clearly demonstrated that expectations around interest rates now exert a significantly stronger influence on Bitcoin and the broader crypto market. When major central banks—especially the Federal Reserve—adjust their policy rate outlook, institutions reassess their crypto allocations not due to changing confidence in crypto narratives, but because of recalculations of opportunity cost and portfolio risk.

In sum, the emergence of institutions as marginal buyers in 2025 marks a transition of crypto assets from a “narrative-driven, sentiment-based pricing” phase to a new era of “liquidity-driven, macro-based pricing.” Declining volatility does not mean risk has disappeared—it means risk sources have shifted: from internal emotional shocks to heightened sensitivity toward macro interest rates, liquidity, and risk appetite. For research in 2026, this shift carries methodological implications. Analytical frameworks must evolve from focusing solely on on-chain metrics and narrative changes, to systematically studying capital structure, institutional behavior constraints, and macro transmission pathways. Crypto markets are being integrated into the global asset allocation system—prices no longer just answer “what story is the market telling,” but increasingly reflect “how capital is allocating risk.” This transformation is one of the most impactful structural shifts of 2025.

2. Maturation of the On-Chain Dollar System: Stablecoins as Infrastructure, RWA Bringing Yield Curves On-Chain

If the large-scale entry of institutional capital in 2025 answers the question of “who is buying crypto assets,” then the maturation of stablecoins and tokenized real-world assets (RWA) addresses the more fundamental questions of “what they are buying, what they are settling with, and where returns come from.” It is at this level that the crypto market completed a critical leap in 2025—from “crypto-native financial experimentation” to a functional “on-chain dollar financial system.” Stablecoins evolved beyond mere mediums of exchange or safe-haven tools, becoming the clearing and pricing foundation of the entire on-chain economy. Meanwhile, RWA—particularly on-chain U.S. Treasuries—began scaling in earnest, providing the first sustainable, auditable, low-risk yield anchor on-chain, fundamentally reshaping DeFi’s return structure and risk pricing logic.

Functionally, stablecoins became indisputably the core infrastructure of on-chain finance in 2025. Their role has expanded far beyond “price-stable transaction tokens,” now encompassing cross-border settlements, trading pair denominations, DeFi liquidity hubs, and institutional capital on/off ramps. Whether in centralized exchanges, decentralized trading protocols, or applications involving RWA, derivatives, and payments, stablecoins form the underlying rails of capital flow. On-chain transaction volume data clearly show that stablecoins have become a significant extension of the global dollar system, with annualized on-chain transaction volumes reaching tens of trillions of dollars—surpassing the payment systems of most individual countries. This reality means that in 2025, blockchains truly assumed the role of a “functional dollar network,” rather than just an ancillary system for high-risk asset trading. More importantly, the widespread adoption of stablecoins transformed the risk structure of on-chain finance. Once stablecoins became the default unit of account, market participants could engage in trading, lending, and asset allocation without direct exposure to crypto price volatility—significantly lowering the barrier to entry. This is particularly crucial for institutional capital. Institutions do not inherently seek high-volatility crypto returns, but prioritize predictable cash flows and risk-controlled yield sources. The maturity of stablecoins enables institutions to gain “dollar-denominated” exposure on-chain without bearing traditional crypto price risk—laying the foundation for the expansion of RWA and yield-generating products.

Against this backdrop, the scaling deployment of RWA—especially on-chain U.S. Treasuries—became one of the most structurally significant developments of 2025. Unlike earlier attempts focused on “synthetic assets” or “yield mapping,” RWA projects in 2025 began introducing real-world, low-risk assets onto the blockchain using issuance methods closer to those in traditional finance. On-chain Treasuries are no longer conceptual stories, but exist in auditable, traceable, composable forms, with clear cash flow sources, defined maturity structures, and direct linkage to the risk-free yield curve in traditional finance.

Yet, precisely during the rapid expansion of stablecoins and RWA, 2025 also revealed another side of the on-chain dollar system: its potential systemic fragility. Particularly in the space of yield-bearing and algorithmic stablecoins, multiple de-pegging and collapse events served as wake-up calls. These failures were not isolated incidents, but reflected a common structural issue: implicit leverage from recursive re-staking, opaque collateral structures, and excessive concentration of risk within a few protocols and strategies. When stablecoins no longer rely solely on short-term Treasuries or cash equivalents as reserves, but instead pursue higher yields through complex DeFi strategies, their stability ceases to derive from the underlying assets themselves, but from implicit assumptions about continuous market prosperity. Once these assumptions break down, de-pegging is no longer a technical fluctuation, but a potential systemic shock. The events of 2025 made clear that the risk of stablecoins is not whether they are “stable,” but whether the source of their stability can be clearly identified and audited. While yield-bearing stablecoins may offer returns significantly above risk-free rates in the short term, these returns are often built on layers of leverage and liquidity mismatches whose risks remain underpriced. When market participants treat these products as “cash-like” equivalents, the risks become systemically amplified. This phenomenon forced the market to reevaluate the role of stablecoins: are they payment and settlement tools, or financial products embedded with high-risk strategies? This question was posed in 2025 at real economic cost.

Therefore, looking ahead to 2026, the research focus is no longer “whether stablecoins and RWA will continue growing.” From a trend perspective, the expansion of the on-chain dollar system is nearly irreversible. The real issue is “quality stratification.” Differences among stablecoins in reserve transparency, maturity structure, risk isolation, and regulatory compliance will directly impact their capital costs and use cases. Similarly, variations in legal structure, liquidation mechanisms, and yield stability across RWA products will determine whether they can become part of institutional-grade asset allocation. It is foreseeable that the on-chain dollar system will cease to be a homogeneous market, instead forming a clear hierarchy: high-transparency, low-risk, strongly compliant products will enjoy lower funding costs and wider adoption, while those relying on complex strategies and implicit leverage may be marginalized or phased out. At a macro level, the maturation of stablecoins and RWA has for the first time fully embedded the crypto market into the global dollar financial system. On-chain environments are no longer just experimental grounds for value transfer, but extensions of dollar liquidity, yield curves, and asset allocation logic. This transformation reinforces the entry of institutional capital and regulatory normalization, collectively advancing the crypto industry from cyclical speculation toward infrastructure-level development.

3. Regulatory Normalization: Compliance as Moat, Reshaping Valuation and Industry Structure

In 2025, global crypto regulation entered a phase of normalization—not marked by any single law or regulatory event, but by a fundamental shift in the industry’s overall “existence assumption.” For many prior years, the crypto market operated under a highly uncertain institutional environment, where the central question was not growth or efficiency, but “whether this industry is allowed to exist.” Regulatory uncertainty was treated as systemic risk, forcing capital to price in extra risk premiums for potential compliance shocks, enforcement actions, or policy reversals. In 2025, this long-unresolved issue was resolved—at least temporarily. As major jurisdictions in North America, Europe, and Asia-Pacific established relatively clear and enforceable regulatory frameworks, market focus shifted from “whether we can exist” to “how to scale under compliance.” This shift profoundly impacted capital behavior, business models, and asset pricing logic.

Regulatory clarity first dramatically lowered the institutional entry barrier into crypto. For institutional capital, uncertainty itself is a cost, and regulatory ambiguity often implies unquantifiable tail risk. In 2025, as key components—stablecoins, ETFs, custody, and trading platforms—were progressively brought under defined regulatory oversight, institutions finally gained the ability to assess crypto asset risks and returns within their existing compliance and risk control frameworks. This does not mean regulation became looser, but more predictable. Predictability itself is the prerequisite for scalable capital entry. Once regulatory boundaries are clear, institutions can internalize these constraints through internal processes, legal structures, and risk models, rather than treating them as “uncontrollable variables.” As a result, more long-term capital began entering the market systematically, with participation depth and allocation scale rising together, gradually incorporating crypto assets into broader asset allocation systems. More importantly, regulatory normalization reshaped competitive dynamics at the enterprise and protocol level.

The deeper impact of regulatory normalization lies in its restructuring of industry organization. As compliance requirements take hold across issuance, trading, custody, and settlement, the crypto industry began showing stronger trends toward centralization and platformization. More products chose to launch and distribute on regulated platforms, and trading activity concentrated in venues with licenses and compliant infrastructure. This trend does not imply the disappearance of decentralization ideals, but rather a reorganization of the “entry points” for capital formation and movement. Token issuance evolved from chaotic peer-to-peer sales into a more standardized, process-driven approach resembling traditional capital markets—giving rise to a new form of “internet capital marketization.” In this system, issuance, disclosure, lock-up periods, distribution, and secondary market liquidity are more tightly integrated, leading to more stable participant expectations around risk and return. This industrial reorganization is directly reflected in shifts in asset valuation methodologies. In past cycles, crypto valuations heavily relied on narrative strength, user growth, and TVL, with limited consideration of institutional and legal factors. Starting in 2026, as regulation becomes a quantifiable constraint, valuation models began incorporating new dimensions. Regulatory capital requirements, compliance costs, legal structure stability, reserve transparency, and access to compliant distribution channels gradually emerged as key variables affecting asset prices. In other words, the market began applying “institutional premiums” or “institutional discounts” to different projects and platforms. Entities capable of operating efficiently within compliance frameworks—and turning regulatory demands into operational advantages—often secured funding at lower capital costs. In contrast, models reliant on regulatory arbitrage or institutional ambiguity faced valuation compression or even marginalization.

4. Conclusion

The 2025 inflection point in the crypto market is essentially three simultaneous transformations: capital shifting from retail to institutions, assets maturing from narratives to an on-chain dollar system (stablecoins + RWA), and rules transitioning from gray zones to normalized regulation. Together, these forces push crypto from “high-volatility speculative assets” toward “modelable financial infrastructure.” Looking ahead to 2026, research and investment should center on three core variables: the strength of macro interest rate and liquidity transmission into crypto, the quality stratification of on-chain dollars and sustainability of real yields, and the institutional moat formed by compliance costs and distribution capabilities. Under this new paradigm, winners will not be the best storytellers, but the infrastructures and assets capable of sustained expansion under the constraints of capital, yield, and regulation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News