Huobi Growth Academy | In-Depth Outlook on the 2026 Crypto Market: From Cyclical Gameplay to Paradigm Shift—How Will the Next Decade Define Cryptocurrency?

TechFlow Selected TechFlow Selected

Huobi Growth Academy | In-Depth Outlook on the 2026 Crypto Market: From Cyclical Gameplay to Paradigm Shift—How Will the Next Decade Define Cryptocurrency?

2026 is not the beginning of a new bull market, but the start of the next decade.

Executive Summary

As we enter 2026, the crypto market is undergoing a profound structural transformation. The long-validated "four-year bull-bear cycle" is losing its explanatory power, giving way to a more complex, multi-layered evolution characterized by parallel asset logics, divergent capital behaviors, and slower price rhythms. Markets no longer move in unison around a single narrative; instead, different asset types are being independently priced at their respective stages. The cycle has ceased to be the core variable determining direction and has instead become a background factor influencing timing.

1. The Cycle Is Failing: Why We Can No Longer Use “Bull” or “Bear” to Understand the 2026 Crypto Market

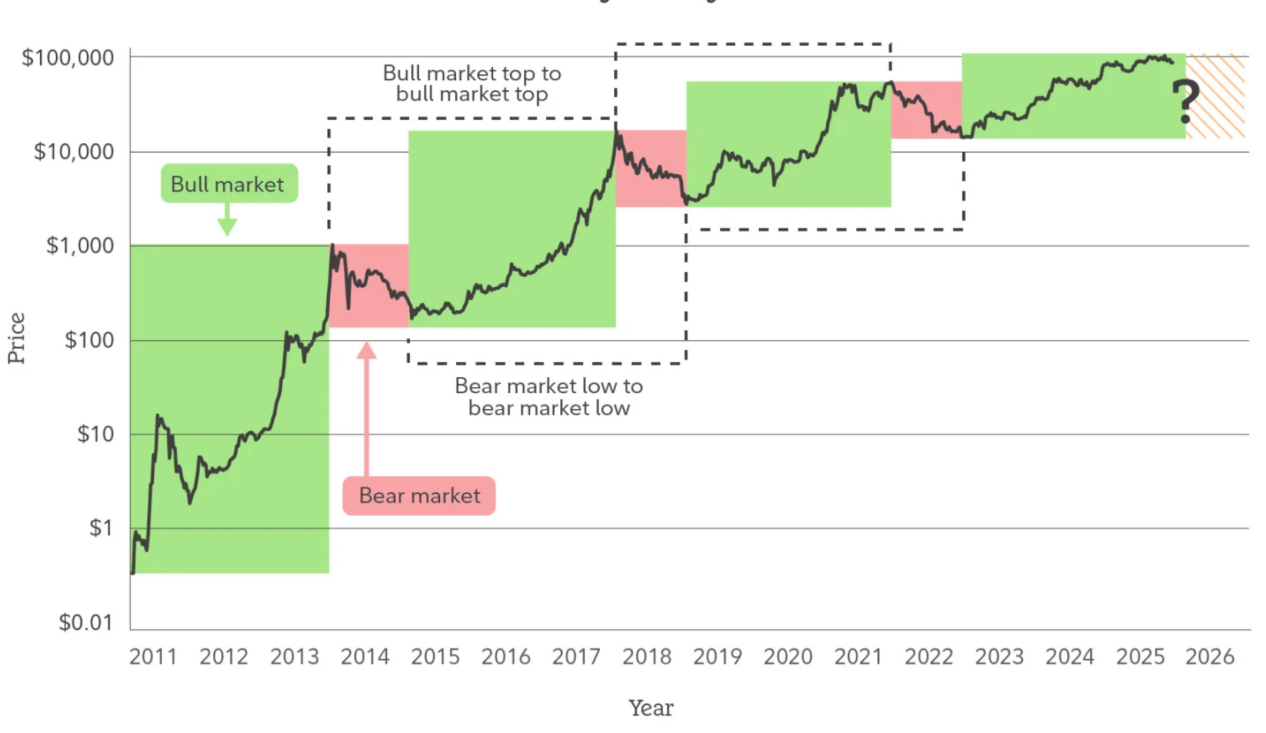

For much of its history, the crypto market was dominated by a single narrative: the "four-year bull-bear cycle." Halving events, liquidity turning points, sentiment bubbles, and price collapses were repeatedly validated as effective analytical tools, shaping generations of market participants’ cognitive habits. However, beyond 2025, this once-powerful cyclical model began showing systematic signs of weakening explanatory power: markets failed to exhibit emotional extremes at key junctures, pullbacks no longer triggered broad-based liquidity crises, so-called "bull market signals" frequently failed, and price movements increasingly reflected a mix of range-bound trading, structural divergence, and gradual appreciation. This does not mean the market has become “boring,” but rather that its underlying mechanisms are undergoing deep structural change.

The essence of cyclical models lies in highly homogeneous capital behavior—similar risk appetites, comparable holding periods, and extreme sensitivity to price movements. But by 2026, the crypto market is gradually departing from these assumptions. With the opening of regulated channels, maturation of institutional custody and audit systems, and increasing inclusion of crypto assets in broader asset allocation frameworks, the marginal pricing forces in the market have shifted. A growing portion of capital enters not for timing trades, but for long-term allocation, risk hedging, or functional use. Such capital avoids chasing extreme volatility, absorbs liquidity during downturns, and reduces turnover during rallies—its very presence weakens the sentiment feedback loops that traditional bull-bear cycles rely on.

More importantly, the internal complexity of the crypto market is dismantling the assumption of uniform "all-up, all-down" movement. The fundamental logic behind Bitcoin, stablecoins, RWA (real-world assets), public chain tokens, and application-specific tokens continues to diverge. Their sources of funding, use cases, and value anchors can no longer be captured under one unified cyclical framework. As Bitcoin increasingly resembles a long-term value reserve, stablecoins evolve into infrastructure for cross-border settlement and on-chain finance, and some application tokens begin pricing based on cash flows and real demand, the terms “bull market” or “bear market” lose their meaning as coherent descriptive categories.

Therefore, a more accurate way to understand the 2026 crypto market is not asking “is the next bull market starting?” but rather “are the structural phases of different assets changing?” Cycles haven’t disappeared—they’ve simply degraded from a directional driver to a background influence on timing. The market no longer resonates rapidly around one central narrative, but evolves slowly under multiple concurrent logics. This implies that future risks will stem less from singular top-level collapses and more from structural mismatches and cognitive lags. Similarly, opportunities will no longer come from betting on overall market trends, but from early recognition of long-term shifts and role differentiation.

In this light, the "failure" of cycles isn't a cost of market maturation—it's precisely the sign that crypto is beginning to shed its early speculative nature and transition toward becoming a systematized asset class. The 2026 crypto market doesn't need bulls and bears to define its direction; it requires understanding through structure, function, and time.

2. Bitcoin’s Role Transformation: From High-Volatility Asset to Structural Reserve Tool

If cyclical logic is fading, Bitcoin’s own role shift is the most direct and compelling evidence of this change. For years, Bitcoin was seen as the most volatile and risk-concentrated asset in crypto, driven primarily by sentiment, liquidity, and narratives rather than stable usage demands or balance sheet fundamentals. But from 2025 onward, this perception began shifting: Bitcoin’s volatility has steadily declined, drawdown patterns have flattened, chip stability at key support levels has significantly improved, and market sensitivity to short-term price moves has diminished. This isn’t due to waning speculation, but reflects Bitcoin’s reintegration into a pricing framework more aligned with “reserve assets.”

The crux of this transformation lies not in whether Bitcoin is “more expensive,” but in *who holds it* and *why*. As Bitcoin is increasingly incorporated into corporate balance sheets, long-term investment portfolios, and even discussions among sovereign or quasi-sovereign entities, the rationale for holding it has shifted—from capturing price elasticity to countering macro uncertainty, diversifying fiat risk, and gaining exposure to non-sovereign assets. Unlike early retail-dominated markets, these holders exhibit greater tolerance for price corrections and higher patience over time, effectively reducing circulating supply and lowering overall selling pressure.

Simultaneously, Bitcoin’s financialization path is undergoing structural change. Spot ETFs, compliant custody solutions, and mature derivatives ecosystems now provide the foundational infrastructure needed for Bitcoin to be widely integrated into traditional finance. This doesn’t mean Bitcoin has been fully “tamed,” but that its risks are being repriced: price discovery is no longer confined to emotionally charged on-chain or offshore venues, but increasingly occurs within deeper, more regulated trading environments. In this process, Bitcoin’s volatility hasn’t vanished—it has evolved from chaotic swings into structural fluctuations tied to macro variables and capital flow rhythms.

More significantly, Bitcoin’s “reserve attribute” stems not from external credit backing, but from the long-term validation of its supply mechanism, immutability, and decentralized consensus. Amid rising global debt, escalating geopolitical tensions, and increasing fragmentation of financial systems, demand for “neutral assets” is growing. Bitcoin doesn’t need to fulfill traditional monetary functions to serve as a valuable asset—a trustless, policy-independent, cross-system value carrier. This property positions it less as a high-risk speculative instrument and more as a structural reserve tool within diversified portfolios.

Thus, in 2026, Bitcoin should no longer be judged by how fast it rises, but assessed through long-term allocation and strategic positioning. Its significance lies not in replacing existing assets, but in offering the global financial system a new, decentralized reserve option. It is within this role transformation that Bitcoin’s impact on the crypto market also changes: it is no longer merely an engine of price momentum, but is emerging as an anchor of systemic stability. As this shift deepens, Bitcoin’s existence itself may matter more than its short-term price performance for the crypto market beyond 2026.

3. Stablecoins and RWA: Crypto’s First Systemic Integration with Real-World Finance

If Bitcoin represents crypto’s self-affirmation at the asset level, then the rise of stablecoins and RWA marks the first systemic integration of crypto with real-world financial structures. Unlike previous growth waves driven by narratives, leverage, or token incentives, this shift is not about sentiment expansion—but about real assets, real cash flows, and genuine settlement needs flowing steadily onto the blockchain. This transition is transforming crypto from a relatively closed, self-referential system into an open architecture deeply coupled with real-world finance.

The role of stablecoins now extends far beyond mere “medium of exchange” or “safe-haven tool.” As their scale expands and use cases proliferate, stablecoins have effectively become a “on-chain mirror” of the global dollar system. With lower settlement costs, higher programmability, and cross-border accessibility, they perform critical functions such as cross-border payments, on-chain clearing, treasury management, and liquidity distribution. Particularly in emerging markets, international trade settlements, and high-frequency cross-border capital flows, stablecoins do not replace existing systems but address structural inefficiencies in speed and access. These use cases are independent of bull-bear cycles, closely tied instead to global trade, capital flows, and financial infrastructure upgrades—making them far more stable and sticky than traditional crypto trading demand.

On top of this foundation, RWA introduces a transformative change in crypto’s asset composition logic. By tokenizing real-world assets like U.S. Treasuries, money market instruments, accounts receivable, and precious metals, RWA brings crypto a long-missing element: sustainable, real-economy-linked income streams. For the first time, the crypto market no longer depends solely on price appreciation to justify asset value, but can build value anchors through interest, rent, or operating cash flows—much like traditional finance. This shift not only improves pricing transparency but also enables on-chain capital to reallocate based on “risk-return” analysis rather than narrative alone.

A deeper transformation lies in how stablecoins and RWA are reshaping crypto’s financial division of labor. Stablecoins provide the base layer for settlement and liquidity; RWA offers divisible, combinable, and reusable exposures to real assets; smart contracts enable automated execution and risk control. Within this framework, crypto ceases to be just a “shadow market” of traditional finance and begins to independently host meaningful financial activity. This capability did not emerge overnight, but accumulated gradually as compliance, custody, auditing, and technical standards improved. Therefore, in 2026, stablecoins and RWA should not be seen as mere “new赛道” or “thematic plays,” but as pivotal nodes in crypto’s structural upgrade. They represent the first real possibility for crypto to coexist and interpenetrate with real-world finance over the long term, shifting the market’s growth logic from cycle-driven to demand-driven, and from closed competition to open collaboration. What matters most is not individual project performance, but the emergence of a new financial infrastructure whose implications extend far beyond price—reshaping the operation of global finance for the next decade.

4. From Narrative-Driven to Efficiency-Driven: The Collective Repricing of the Application Layer

After cycling through multiple rounds of narrative booms and busts, the application layer of crypto is reaching a critical inflection point: valuation models built purely on grand visions, technical buzzwords, or emotional consensus are systematically failing. The cooling phase of DeFi, NFTs, GameFi, and even parts of the AI narrative does not imply these areas lack value, but indicates a sharp decline in market tolerance for “future imagination premiums.” Around 2026, the application layer is transitioning from a story-centric pricing model to a new paradigm centered on efficiency, sustainability, and real usage intensity.

This shift stems from changes in participant composition. As institutional capital, industrial investors, and hedging-oriented funds gain prominence, the market focuses less on “how big a story you can tell” and more on “whether you actually solve a real problem, offer cost or efficiency advantages, and can operate sustainably without subsidies.” Under this scrutiny, many previously overvalued applications are being repriced, while a select few protocols with clear advantages in efficiency, user experience, and cost structure are securing more stable capital backing.

The hallmark of this efficiency-driven shift is competition based on “unit capital output” and “unit user contribution.” Whether in decentralized exchanges, lending, payments, or foundational middleware, attention is moving away from coarse metrics like TVL and user registrations toward deeper indicators such as trading depth, retention rates, fee income, and capital turnover efficiency. Applications are no longer just “narrative ornaments” in a public chain ecosystem but must function as self-sustaining economic entities with clear business models. For apps unable to generate positive cash flow or overly reliant on incentive subsidies, the weight of “future expectations” in their valuations is rapidly shrinking.

Meanwhile, technological advances are amplifying efficiency differences and accelerating application-layer fragmentation. Account abstraction, modular architectures, cross-chain interoperability, and mature high-performance Layer 2 solutions make user experience and development cost quantifiable and comparable. As a result, user and developer switching costs continue to fall. Without natural moats, only products with clear advantages in performance, cost, or UX can retain traffic and capital. This environment inherently disadvantages projects relying on narratives to maintain premium valuations, while creating long-term survival space for truly efficient infrastructure and applications.

Crucially, this repricing of the application layer doesn’t occur in isolation—it resonates with transformations in stablecoins, RWA, and Bitcoin’s evolving role. As blockchains host more real-world economic activity, application value is no longer derived from “internal crypto circular games,” but from their ability to efficiently handle real capital flows and real demand. This elevates applications serving payments, settlements, asset management, risk hedging, and data coordination above purely speculative ones, making them the new focal points of market attention. This doesn’t eliminate risk appetite altogether, but shifts how risk premiums are allocated—from narrative diffusion to efficiency realization.

Thus, the 2026 “collective repricing” of the application layer is not a short-term style rotation, but a structural revaluation. It signals that the crypto market is gradually shedding its dependence on emotion and storytelling, adopting efficiency, sustainability, and real-world fit as core evaluation criteria. In this process, the application layer may cease to be the most volatile segment of the cycle and instead become the key bridge connecting crypto to the real economy. Its long-term value will increasingly depend on whether it successfully integrates into the operational fabric of the global digital economy.

5. Conclusion: 2026 Is Not the Start of a New Bull Market—It’s the Beginning of the Next Decade

If you’re still trying to understand the 2026 crypto market by asking “when will the next bull market start?”, you’re already operating within a fading analytical framework. The true significance of 2026 lies not in whether prices reach new highs, but in the fact that the crypto market has completed a fundamental shift in cognition and structure: it is transitioning from a fringe market highly dependent on cyclical narratives, sentiment contagion, and liquidity games, into a long-term infrastructure system embedded in real-world finance, serving tangible economic needs, and developing institutionalized operational logic.

This shift first manifests in a change of market objectives. Over the past decade, crypto’s central question was “how to prove its legitimacy.” Beyond 2026, that question is being replaced by “how to operate more efficiently, how to collaborate with real-world systems, and how to support larger-scale capital and users.” Bitcoin is no longer just a high-volatility risk asset but is entering structural reserve and macro allocation frameworks; stablecoins are evolving from transactional tools into key conduits for digital dollars and digital liquidity; RWA is enabling crypto, for the first time, to connect directly with global debt, commodity, and settlement networks. These developments won’t trigger immediate price euphoria, but they define the boundaries and ceilings of crypto’s next decade.

More importantly, 2026 marks the completion—not the beginning—of a paradigm shift. From cyclical games to structural games, from narrative-based pricing to efficiency-based pricing, from isolated crypto loops to deep integration with the real economy, the market is forming a new value assessment system. In this system, long-term allocative value, sustainable cash flow generation, and real improvements in financial and collaborative efficiency matter more than “how sexy the narrative sounds.” This means future gains will be more fragmented, slower, and path-dependent—but also indicate a declining probability of systemic collapse.

Historically, what determines the fate of an asset class is never the peak of one bull market, but whether it successfully transitions from speculation to infrastructure. The 2026 crypto market stands precisely at this turning point. Prices will still fluctuate, narratives will still rotate, but the underlying structure has changed: crypto is no longer just a fantasy of replacing traditional finance, but is becoming its extension, supplement, and potential reinvention. This transformation means the crypto market of the next decade will resemble a slowly expanding mainline—rather than a series of emotion-driven pulses.

So rather than ask if 2026 is the start of a new bull market, we should recognize it as a kind of “coming-of-age ceremony”—the moment when the crypto market, for the first time, redefines its role, boundaries, and mission in a manner increasingly resembling real financial systems. The real opportunity may no longer belong to those best at chasing cycles, but to those who understand structural change, adapt early to the new paradigm, and grow alongside this evolving system over the long term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News