How to Get Rich in Crypto Without Relying on Luck? Raoul Pal's Macro Insights and Investment Philosophy

TechFlow Selected TechFlow Selected

How to Get Rich in Crypto Without Relying on Luck? Raoul Pal's Macro Insights and Investment Philosophy

Raoul Pal, who predicted the 2008 financial crisis, discusses cryptocurrency wealth building and insights into macro trends.

Compilation: KarenZ, Foresight News

Raoul Pal, former Goldman Sachs executive, author of "The Global Macro Investor," and founder of Real Vision, is widely known for successfully predicting the 2008 financial crisis. Recently, in a conversation with "When Shift Happens" and during his speech at Sui Basecamp in Dubai, Raoul Pal offered deep insights into how to steadily accumulate wealth in the crypto space, discussing topics including Bitcoin, Ethereum, Memes, AI, NFTs, the Sui ecosystem, Strategy’s Bitcoin strategy, investment strategies, macro trends, and market direction.

Key Takeaways from Raoul Pal's Conversation with When Shift Happens

1. How to Get Rich in Crypto Without Relying on Luck?

To get rich in crypto without relying on luck, simply buy Bitcoin and apply the DCA (Dollar-Cost Averaging) strategy.

Newcomers often fall into the trap of chasing quick riches, a mindset that is inherently dangerous.

The moment you start envying others who have made 100x returns, you enter a risky zone—losing rationality and succumbing to greed can easily ruin your entire investment.

The crypto space is full of risks such as DeFi hacks and wallet thefts, requiring investors to stay vigilant and maintain rationality at all times.

2. On Memes

Regarding meme coins, Raoul Pal stated he does not hold Fartcoin but owns SCF (Smoking Chicken Fish) and DODE. Although SCF dropped by 90%, it has recently shown strong signs of recovery. He specifically warned investors not to let meme coins like Fartcoin, WIF, or BONK occupy too large a portion of their portfolios, as these assets carry an 85% chance of going to zero. He was even surprised that LUNA didn’t evolve into a meme coin, having expected people to rush into it.

3. Avoid Market Panic, Return to Value Investing

If investors feel panicked about the market, Pal advises stepping back and returning to normal life, away from trading screens. Those 5-minute and 1-hour candlestick charts actually offer little real help for investment decisions.

Many dream of becoming successful traders making 100x returns, but in reality, those who truly build wealth in this field are the ones who consistently buy and hold over the long term.

4. Beware of Crypto Yield Risks

Crypto yield, such as staking rewards, also carries risk. For ordinary investors, when facing an opportunity promising 20% returns, it's essential to clearly understand the underlying risks.

5. Thoughts on Michael Saylor's Bitcoin Acquisition Strategy?

Strategy’s Bitcoin strategy creates leverage within the system. Strategy purchases Bitcoin by issuing convertible bonds, which is essentially selling options at a low cost. Arbitrageurs (options traders) buy these options and then hedge on exchanges to manage exposure to Bitcoin price fluctuations and MicroStrategy stock options.

Additionally, arbitrageurs exploit volatility in the ratio between MicroStrategy’s NAV and Bitcoin price, using market instruments such as perpetual vs. spot spreads and futures vs. spot spreads.

Currently, buyers of Strategy’s convertible bonds are mostly TradFi hedge funds and other institutions. Sovereign wealth funds like Norges Bank may focus only on the Bitcoin component, while major hedge funds such as Citadel, Millennium, and Point72 engage in arbitrage. These institutions have extensive risk management experience, likely enjoy systemic support, manage position sizes prudently, and are less prone to liquidation.

In stark contrast, traders using excessive leverage face significant risks, and failures due to over-leverage are common in the market.

6. Raoul Pal's Capital Allocation

On capital allocation, Raoul Pal said Sui accounts for 70%, now far surpassing Solana. Sui’s adoption and developer activity are performing well. In addition, he holds some DEEP (DeepBook), a liquidity layer protocol within the Sui ecosystem.

7. The Value and Potential of NFTs

NFTs, as an innovative technology enabling permanent storage and trading of non-transferable assets, hold great promise according to Pal. From a macro perspective, today’s crypto industry is valued at $3 trillion. If it grows to $100 trillion over the next decade, it would generate $97 trillion in new wealth; even conservatively reaching $50 trillion would still create $47 trillion in incremental wealth.

This wealth will flow to different individuals. Art is upstream of everything, and digital art, as an emerging field, could become a major destination for this wealth. Within digital art, we have pioneers like XCOPY and Beeple, followed by the generative art movement. I’ve spent a lot of time talking with very prominent figures who show strong interest in this space. After earning substantial profits, crypto OGs develop a strong desire to collect art. For example, a CryptoPunk symbolizes your identity and helps you connect with like-minded people. From institutions to ultra-wealthy individuals and everyday people, awareness of digital art’s importance is growing. We’re still in the early stages. I own many artworks, and I see this as a multi-decade journey.

8. Ethereum's Advantages and Outlook

On Ethereum, its network capacity already exceeds current system demands, and future adjustments might bring it back toward Layer1. The EVM is like Microsoft—countless banks, insurance companies, and large enterprises worldwide rely on Microsoft, not Apple or Google.

Once you adopt an enterprise sales model, it becomes nearly impossible to remove because you don’t want to change or take risks. From the Lindy Effect (the longer something has existed, the more likely it is to continue existing), Ethereum has stood the test of time and effectively meets financial market needs. Will Goldman Sachs or JPMorgan build on Solana? Unlikely. Ethereum may introduce a new narrative and outperform Bitcoin in the short term. Looking ahead five years, unless they completely mismanage it, its significance will only grow.

Bitcoin’s Lightning Network and payment concepts have limited impact on price appreciation—the core value of Bitcoin lies in its role as a store of value; the same will eventually happen with ETH.

9. On AI

AI is advancing rapidly, already outperforming 99% of analysts. After deep reflection, Pal believes AI’s rise raises profound questions about consciousness and humanity’s future role. He encourages active participation, deeper understanding, and proficient use of AI technologies.

Secondly, we don't know what this means for employment or how we'll create wealth moving forward, but I do know—what are humans best at? What can humans do that AI cannot? Be human.

I developed an AI Raoul that reads news daily—news written by AI—and built a chatbot trained on my voice, using data from all my X posts, YouTube content, and 100 books. Now, Real Vision users can interact with this chatbot. Pal predicts these two technologies will soon converge, profoundly impacting podcasts and media, resulting in highly personalized media experiences for everyone. Moreover, human memory and actions could ultimately become “fuel” for AI, achieving a form of immortality.

10. Market Attention and Selecting High-Quality Projects

This is a game of attention. Public focus on key tokens is fragmented, and narratives tend to be short-lived. Pal emphasizes that holding Bitcoin remains a wise choice. Additionally, buying Solana at cycle lows and purchasing SUI last year were also sound strategies.

Investors should focus on the top 10 or top 20 tokens, prioritizing projects that continuously increase network adoption, as these typically offer higher investment value. According to Metcalfe’s Law, project potential can be assessed through metrics like active user count, total transaction value, and user value.

Bitcoin has a vast user base and sovereign nations buying in—that’s why it holds more value. Ethereum boasts a large user community and diverse applications; despite added complexity from L2s, it remains significantly valuable. Investors should actively seek projects where both user numbers and application value are rising—for example, Solana during its cycle bottom saw growing developer communities, stable user counts, and Bonk further boosted confidence in Solana (note: the host mentioned Toly previously stating Mad Lads was Solana’s turning point); Sui is similar in this regard.

Highlights from Raoul Pal's Speech at Sui Basecamp in Dubai

1. Core Macro Factors: Liquidity and currency depreciation. Cryptocurrency and the economy follow a four-year cycle, driven fundamentally by debt refinancing cycles. Since global debt surged in 2008, economies have been sustained by rolling over old debt with new debt.

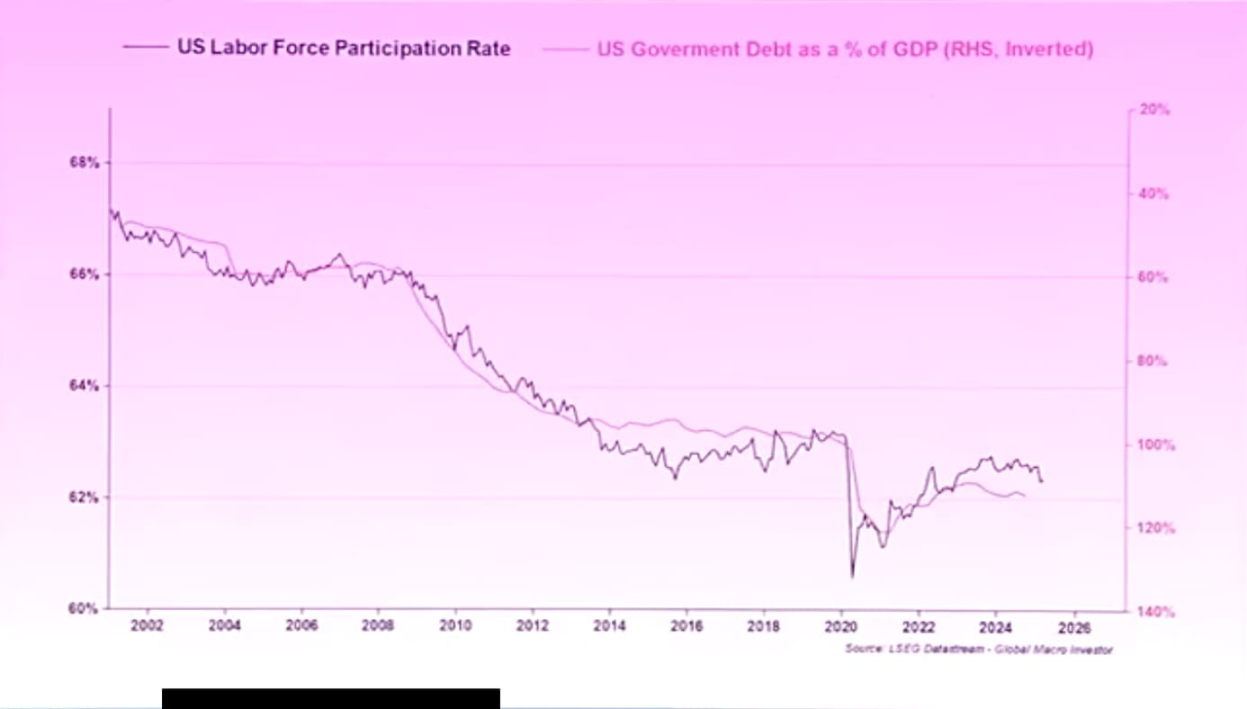

2. Aging Population and Economic Growth: An aging population slows economic growth, necessitating more debt to sustain GDP expansion. This trend is widespread globally, clearly visible through correlation charts between debt and GDP.

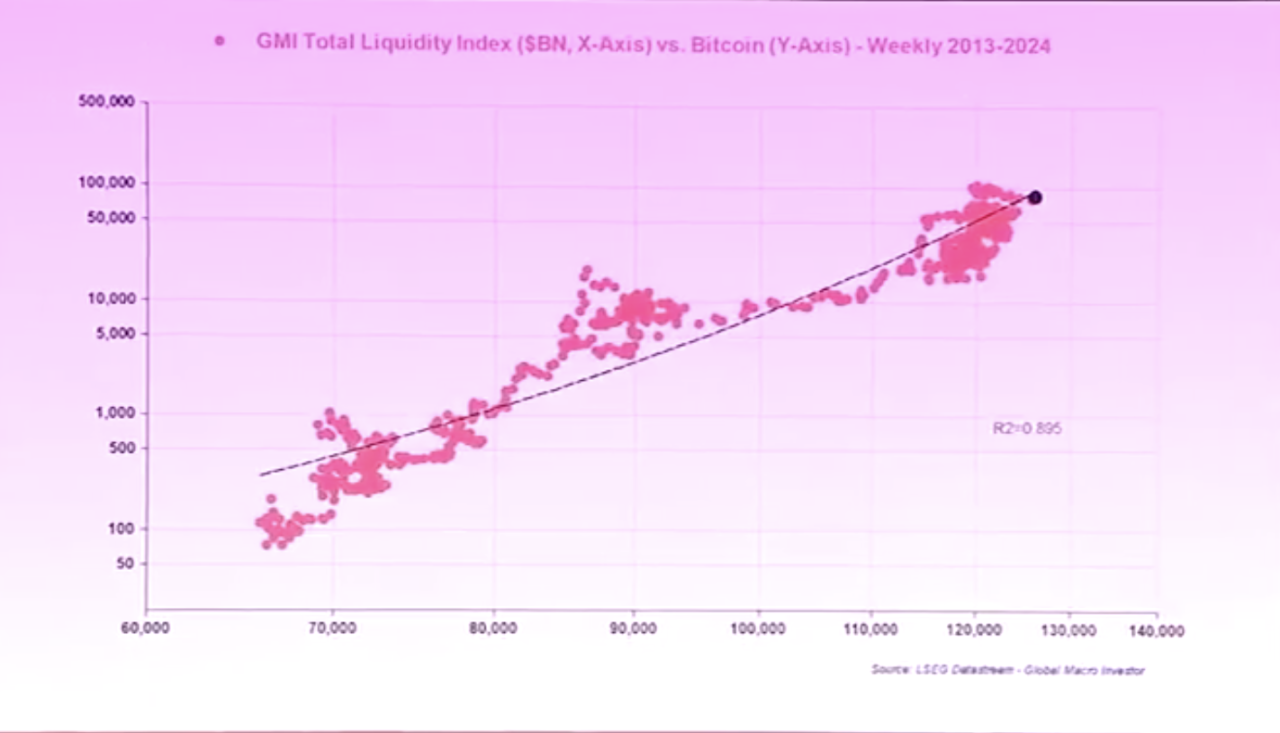

3. Liquidity Drives Everything: Fed net liquidity is the key indicator. From 2009 to 2014, liquidity was primarily provided through balance sheet expansion, later supplemented by tools like bank reserve adjustments. Today, total liquidity (including M2) is crucial—it explains Bitcoin’s movements with 90% correlation and Nasdaq’s with 97% correlation.

4. Currency Depreciation Mechanism: Currency depreciation acts as a global tax—8% implicit inflation tax annually plus 3% explicit inflation means you need 11% annual returns just to preserve wealth. This explains why younger generations flock to crypto: traditional assets (real estate, stocks, etc.) offer insufficient returns, forcing them to pursue high-risk assets for outsized gains.

5. Wealth Inequality and Crypto Opportunity: The wealthy hold scarce assets, while the poor rely on labor income (whose purchasing power declines yearly). Crypto disrupts this dynamic—enabling youth to break through via high-risk assets.

6. Crypto Asset Performance: Since 2012, annualized returns: 130% for Bitcoin (including three major corrections), 113% for Ethereum, 142% for Solana. Bitcoin has gained 2.75 million times cumulatively—an extremely rare feat in investing—making crypto assets increasingly act as a "super black hole" attracting capital.

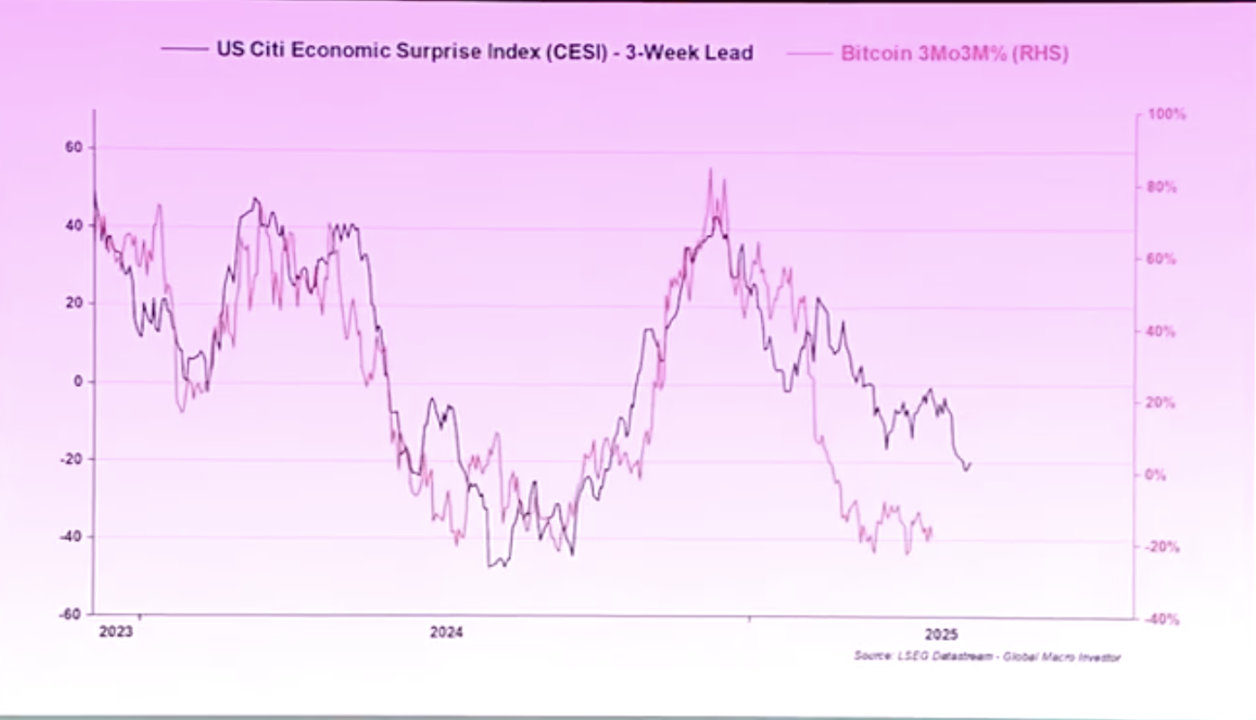

7. Sui Ecosystem Has Immense Potential: DEEP (DeepBook liquidity layer protocol) has performed exceptionally well recently. The SOL/SUI ratio shows SUI’s relative strength.

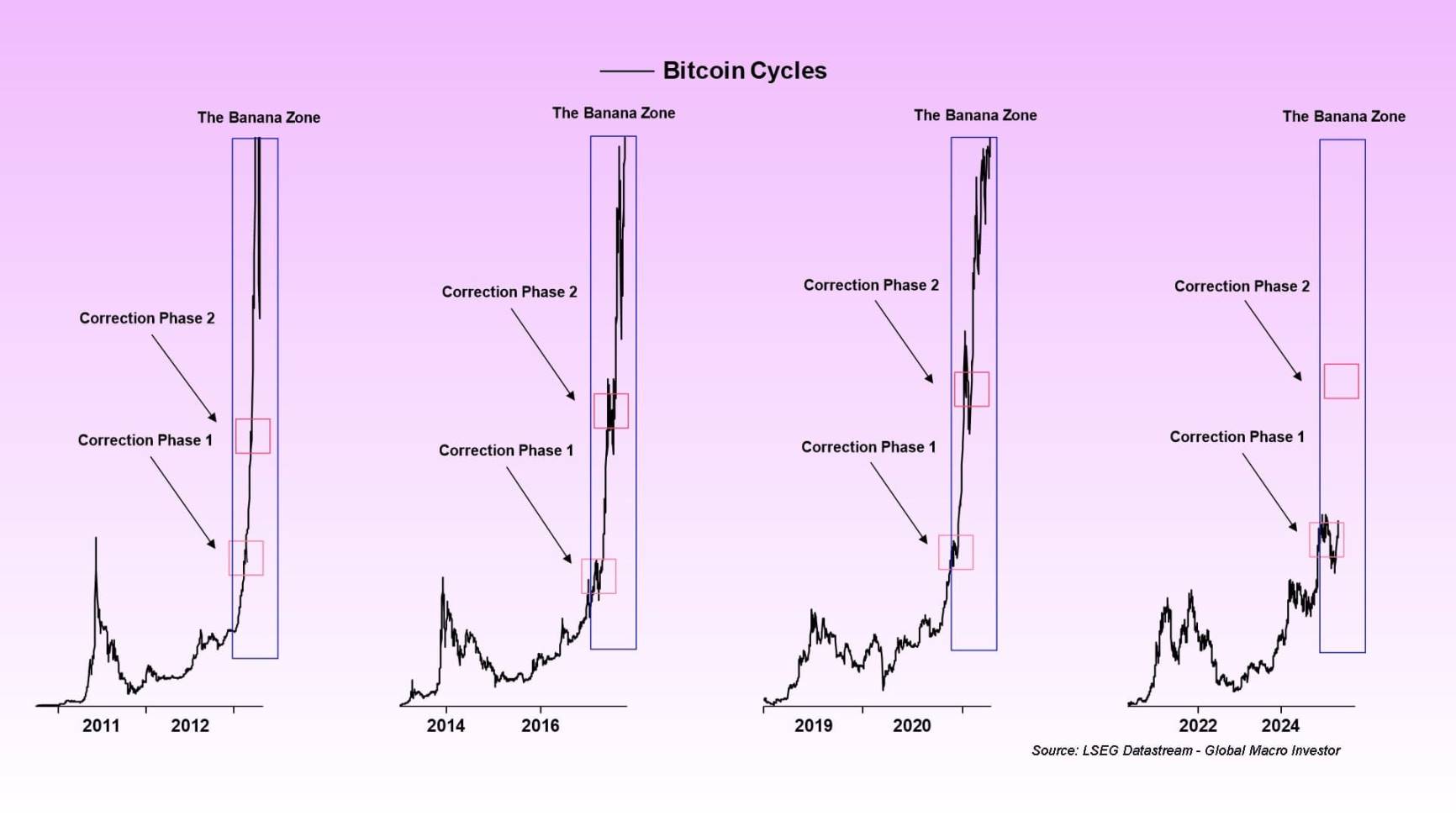

8. Current Market Misjudgment Analysis: People often interpret current market narratives (e.g., tariff fears) using liquidity conditions from three months ago, creating bias. In reality, tightening financial conditions in Q4 2024 (rising dollar rates, higher oil prices) produced a three-month lag effect. Economic surprise indices (U.S. vs. global) suggest current weakness is temporary. Looking back at the 2017 Trump tariff cycle, the dollar first rose then fell, followed by liquidity-driven asset price surges.

9. Global M2 and Asset Relationships: When global M2 hits record highs, asset prices should rise accordingly. Taking Bitcoin as an example, its price pattern typically involves breakout, retest, then accelerated growth in the "banana zone." Compared to the 2017 cycle—when Bitcoin rose 23x—the current market differs but is still expected to deliver substantial gains. The market is currently in the correction phase following the first breakout in the banana zone, about to enter the second phase, which usually brings altcoin rallies.

10. Business Cycle and Bitcoin Price Movement: The ISM Manufacturing Index is a key leading indicator. When it breaks above 50, it signals economic recovery, rising corporate earnings, and active reinvestment—all driving faster Bitcoin price increases. If the ISM index reaches 57, Bitcoin could hit $450,000. As the business cycle improves and household cash rises, risk appetite grows, making altcoins behave similarly to junk bonds and small-cap stocks.

Note: Raoul Pal is also a member of the Sui Foundation Board.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News