HTX Research Latest Report | Decoding the Pre-trading Ecosystem: How a Billion-dollar Market is Reshaping the Starting Line for Web3 Assets?

TechFlow Selected TechFlow Selected

HTX Research Latest Report | Decoding the Pre-trading Ecosystem: How a Billion-dollar Market is Reshaping the Starting Line for Web3 Assets?

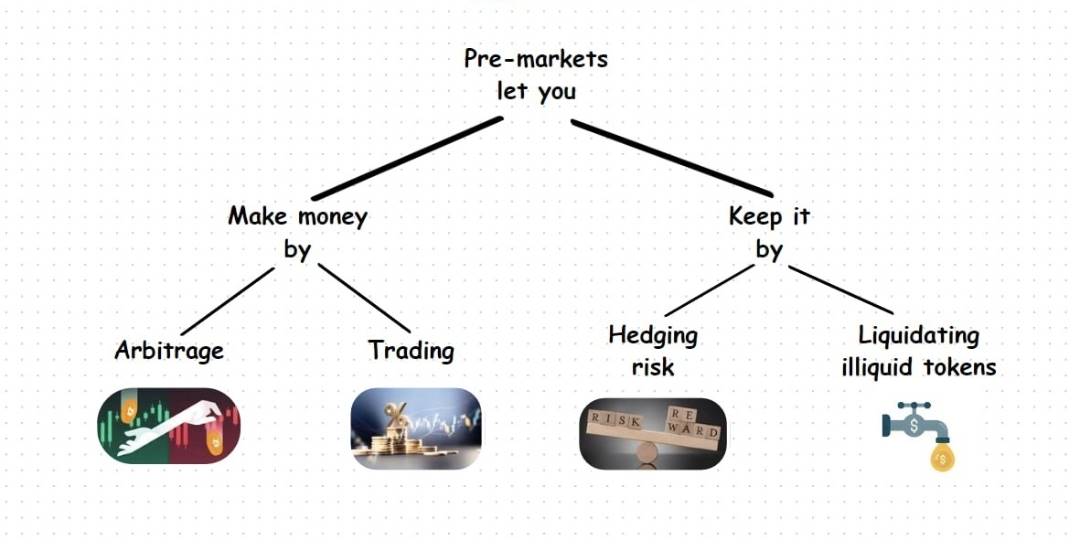

Against the backdrop of tightening financing conditions and prolonged token issuance cycles, pre-TGE trading activities are evolving from scattered attempts into a "1.5 market" that connects primary and secondary markets, gradually becoming an independent and significant market layer in the crypto industry.

Recently, HTX Research, the dedicated research division of HTX (formerly Huobi), released a new report titled "The Pre-Market Asset Trading Ecosystem: Mechanism Evolution, Market Structure, and Future Trends Behind Its Multi-Billion Scale", systematically analyzing the formation background, asset structure, typical models of the pre-market trading ecosystem in the crypto market, and its profound impact on project launches and exchange systems.

The report highlights an accelerating trend: amid tightening financing conditions and prolonged token issuance cycles, pre-TGE trading activities are evolving from isolated experiments into a "1.5-level market" bridging primary and secondary markets, gradually becoming a significant independent market layer within the crypto industry.

From the "Pre-Launch Vacuum Period" to the Pre-Market: A New Structure Between Primary and Secondary Markets

HTX Research指出 that the rise of the pre-market trading ecosystem is no accident. As primary market funding contracts and project launch timelines extend, projects increasingly rely on points systems, airdrop expectations, testnet access, and similar mechanisms to maintain community engagement. Users, in turn, continue investing time and capital before TGE. In this process, previously non-tradable "early contributions" and "future expectations" are gradually becoming assetized.

At the same time, lower barriers to token issuance and a surge in the number of projects have made attention a scarce resource. Trading mechanisms centered around attention, expectations, and future rights have naturally emerged, collectively forming an intermediate market once limited to VCs and internal exchange circles. This nascent 1.5-level market (Pre-Market) is no longer merely a speculative tool but a critical structure reshaping how projects launch and how early liquidity is established.

Three Asset Structures Underlying the Pre-Market Trading Ecosystem

Based on "methods of anchoring future value," HTX Research categorizes pre-market assets into three structural types:

The first revolves around future token value, with trading models including pre-market OTC, pre-market spot, and pre-market perpetual contracts. These assets are most directly linked to future spot prices and serve as the core mechanism for price discovery during the pre-market phase.

The second centers on points systems—user activity points and their financial derivatives—which have gradually evolved into standardized points OTC markets. Points carry user contribution and incentive expectations within airdrop economics and are incorporated into market pricing in advance through trading and yield-splitting mechanisms.

The third involves future redeemable rights, appearing as NFTs, eligibility certificates, or BuildKeys, transforming non-standard privileges like whitelists, Early Access, and token allocations into tradable assets.

Together, these three structures cover the full chain from "user contribution → market expectation → rights validation → final settlement," transforming the pre-market from isolated tools into a multi-layered forward-looking trading system.

HTX's Practical Exploration of Pre-Market Perpetual Contracts

As market demand grows and the ecosystem matures, pre-market trading is expanding beyond OTC and spot formats into derivatives. Pre-market perpetual contracts, as an innovative derivative design, allow users to engage in leveraged speculation on future spot prices before a token’s official listing, enabling earlier price discovery. Currently, pre-market perpetuals have become one of the most traded pre-market instruments.

In this domain, HTX launched pre-market perpetual trading for WLFI (World Liberty Financial) ahead of its official launch—a project under intense market scrutiny—providing users with tools to participate in price formation and manage risk prior to TGE. This initiative exemplifies the trend highlighted in the report: exchanges are extending their role beyond mere "listing venues" into the "pre-launch phase," with pre-market trading becoming a key component of exchange product offerings.

Market Scale Potential and Structural Challenges of the Pre-Market

The pre-market already demonstrates clear scale: top-tier projects often generate hundreds of millions in pre-market trading volume, with cumulative volumes for projects like WLFI and Monad exceeding one billion dollars, establishing the pre-market as a multi-billion-dollar ecosystem with further expansion potential.

However, the pre-market also reveals clear structural risks: inherently thin liquidity makes prices vulnerable to manipulation by large capital; settlement heavily depends on project teams, leading to persistent information asymmetry; and differing asset forms lack unified standards in rules, execution, and risk allocation. These issues mean the pre-market’s further growth depends on its ability to evolve from an "opportunistic market" into a more institutionalized and collaboratively governed structure.

Conclusion

HTX Research believes that pre-market trading is not a short-term fad, but a structural trend driven by shifts in financing environments, evolving user participation models, and the expansion of exchange product offerings. It is reshaping project launch pathways, exchange listing logic, and how users engage with early-stage markets.

In this evolution, pre-market trading is transitioning from a "gray zone before launch" into a critical foundational layer connecting primary and secondary markets. Its ultimate form may become a permanent, institutionalized core structure within the crypto market landscape.

About HTX Research

HTX Research is the dedicated research arm of HTX, conducting in-depth analysis across cryptocurrencies, blockchain technology, and emerging market trends. The team produces comprehensive reports and professional assessments, delivering data-driven insights and strategic foresight that shape industry discourse and support informed decision-making in the digital asset space. With rigorous methodology and cutting-edge data analytics, HTX Research remains at the forefront of innovation, driving thought leadership and deeper understanding of dynamic market developments. Visit us.

For inquiries, please contact research@htx-inc.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News