Interpreting Binance's Pre-Market as Another Declaration of War on High Market Capitalization

TechFlow Selected TechFlow Selected

Interpreting Binance's Pre-Market as Another Declaration of War on High Market Capitalization

The launch of Pre-Market is another bold move by Binance to challenge high market capitalization, aiming to enable community-driven pricing before listing, thereby eliminating project teams' control over price.

By: Riyue Xiaochu

Binance announced Pre-market, and at first glance I thought it was just the usual pre-trading market. But after carefully reading the rules, I realized I was wrong. Its purpose isn't simply to earn more trading fees—it's another bold move by Binance to combat inflated market caps.

It’s almost become common knowledge that any project listed on Binance instantly achieves a high market cap. After the TGE (Token Generation Event), retail investors get rekt, Binance gets blamed, while only the project team parties on yachts with models. Even worse, once the team has made their fortune, they often lose motivation and stop working altogether.

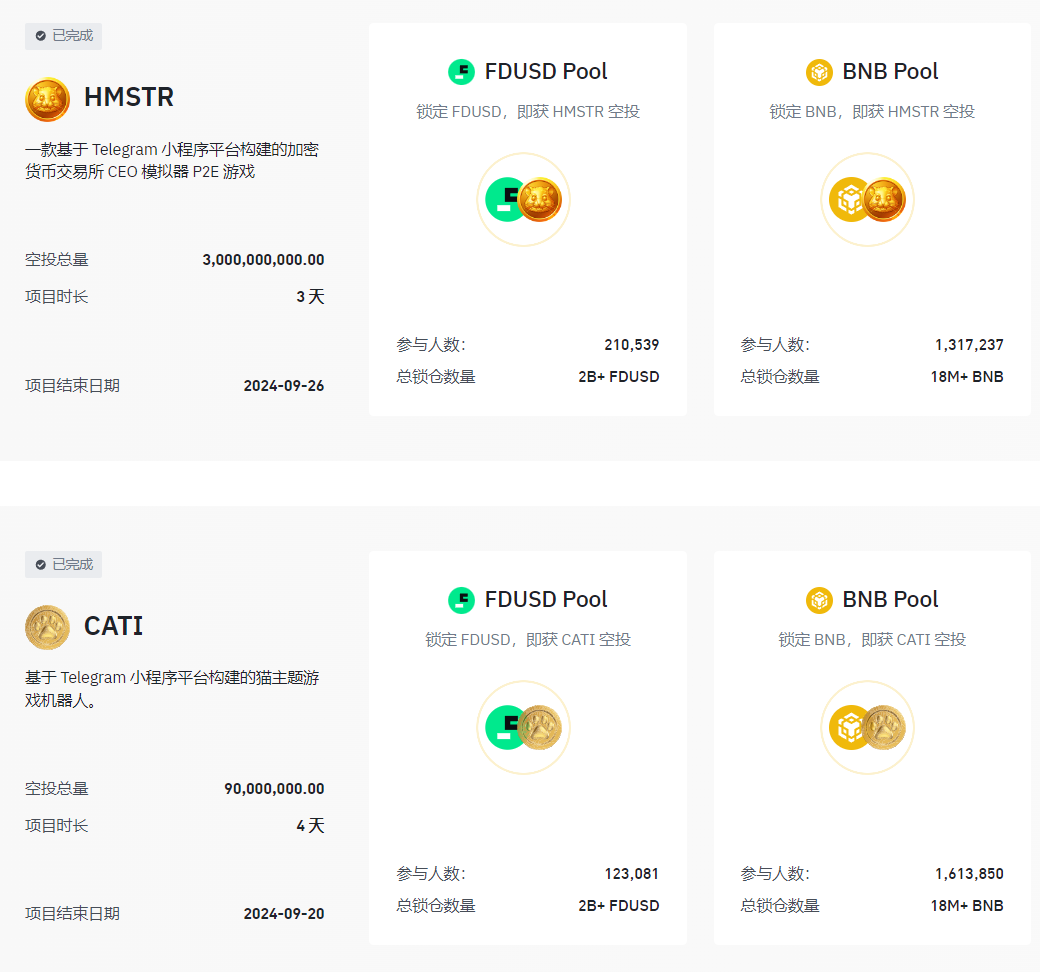

So how is Pre-market different? Why could it potentially break this pattern? The key lies in the fact that Pre-market trading involves only tokens from Launchpool distributions—meaning no allocations for the project team or market makers, and no insider dumps disguised as "airdrops." This allows the community to set the price fairly and prevents artificially inflated valuations.

Let’s first look at how project teams operate today. Before listing, they build up hype: an impressive and hardworking team, backing from top-tier VCs, a grand narrative, and engagement metrics boosted by yield farmers. Then they wait to be blessed by the "divine hand" of fortune. Once listing day arrives, everything changes. At launch, project teams hold immense control—they possess large token reserves, work with experienced market makers who have real-time data and deep understanding of trader psychology, and can even manipulate when airdropped tokens enter exchanges using tactics like server crashes. They are like omnipotent gods, wielding overwhelming advantages against retail investors—and on listing day, they cash out heavily.

If you follow my Twitter, you know I’ve repeatedly exposed how many project teams dump massive amounts of tokens on Binance at launch. The scale is staggering: if Launchpool accounts for 5% of total supply, teams themselves may sell another 5% or more. That means single dumping events start at $50 million, and for high-liquidity projects in bullish markets, can exceed $100 million. All of this stems from the fact that at launch, project teams collude with their market maker allies, leveraging capital, token holdings, and expertise to control pricing and list at sky-high valuations for maximum profit-taking.

With the introduction of Pre-market, this playbook will be disrupted. Unlike other exchanges where Pre-market is merely a simulated pre-listing trading mechanism without actual tokens, Binance’s Pre-market trades real Launchpool tokens. These tokens are held by users who participated in Launchpool campaigns—typically 1 to 2 million people based on past events. This wide distribution makes centralized manipulation extremely difficult. And psychologically speaking, since Launchpool tokens are free ("whether the pork chop rice is fancy or not"), participants tend not to be highly price-sensitive. As a result, initial market caps are less likely to be inflated.

In Pre-market, only Launchpool participants can trade—the project team and market makers are excluded. We used to believe we were all in this together: builders, dreamers, united toward a shared vision of the stars and the sea. But once listed on Binance, the project team turns into a total scumbag boyfriend, focused only on selling us tokens at the highest possible price before jetting off to yacht parties with his "nm" girlfriend. Meanwhile, we’re still here trying to build and believing in that grand vision. Now, with Pre-market, these bad actors can no longer manipulate prices through capital or token advantages. Here, trades reflect genuine community sentiment—fair and honest. Additionally, Binance imposes position limits to prevent whales or malicious actors from distorting prices. In short, Pre-market becomes a true community-driven pricing mechanism, not one dictated by the project team. Logically, since teams previously aimed for high-launch valuations to dump, removing their influence should naturally lead to lower market caps during Pre-market.

Once a Pre-market price forms, it plays a crucial guiding role—especially in shaping psychological expectations, creating what’s known as an "anchoring effect." In traditional launches, market makers can spike the price initially, offload part of their holdings, then let the price naturally decline due to airdrop unlocks and profit-taking. When the price eventually drops significantly, retail investors think: "Wow, down 50% already—must be cheap now! After all, this is a promising project endorsed by W God’s mom, and M God’s girlfriend’s baby project—time to buy, buy, buy, go all in!" But with Pre-market establishing a low baseline price, even if the team tries to pump again later, retail holders are more likely to take profits rather than blindly buy the dip.

Humans are fascinating creatures. When something drops from $100 to $80, you feel it's a bargain—"Double Eleven sale! A once-a-year opportunity!" But when it rises from $60 to $80, you suddenly think it's too expensive and decide to wait. And guess what? That’s just human nature.

To sum up, the launch of Pre-market represents another bold step by Binance against inflated market caps. It aims to enable community-based price discovery before listing, stripping project teams of their ability to manipulate prices. By leveraging behavioral psychology, it also influences the actual spot market price post-listing. This gives sincere retail participants early access—not just exposing them to exploitation at launch.

The real-world outcome remains to be seen. But Binance’s intentions are good, and I hope it delivers as expected. Currently, newly listed projects have such absurdly high valuations that there’s barely any liquidity left for secondary market traders. If this change works, quality projects can finally list with sustainable economics. My mouse has already worn out from constant clicking—two mice down, just because of this madness.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News