From NVIDIA to Binance, selling shovels is the strongest business model

TechFlow Selected TechFlow Selected

From NVIDIA to Binance, selling shovels is the strongest business model

As long as people keep digging, those selling shovels will never lose money.

By Liam, TechFlow

In 1849, the California Gold Rush began, drawing countless fortune-seekers to the American West.

German immigrant Levi Strauss had initially intended to join the gold rush, but he quickly spotted another opportunity: miners’ pants kept tearing—they urgently needed more durable workwear.

So he made a batch of canvas jeans and sold them directly to gold miners, giving birth to a clothing empire called "Levi's." Meanwhile, most of those who actually dug for gold ended up losing everything.

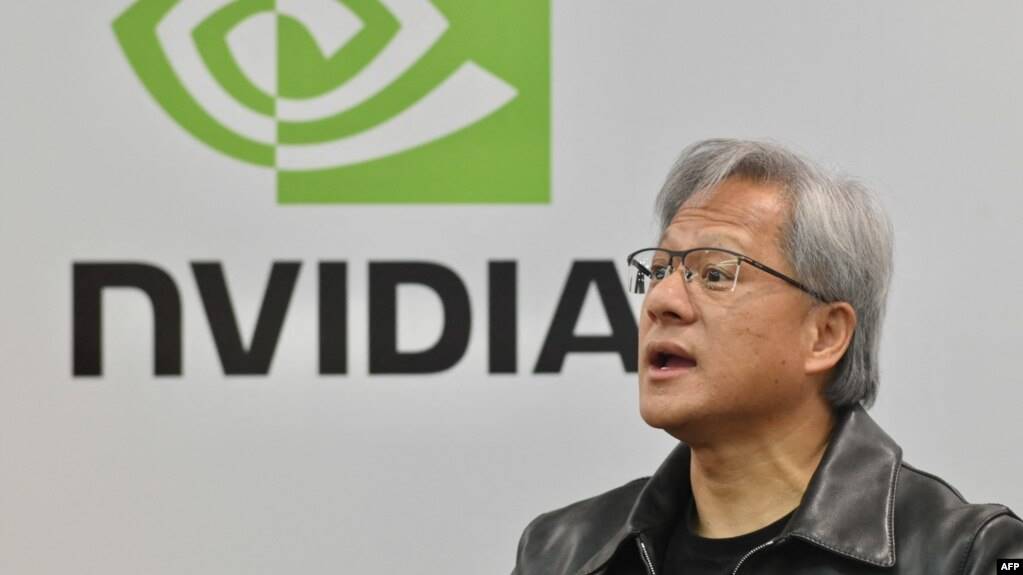

On November 20, 2025, NVIDIA once again delivered an "unbelievable" financial report.

Q3 revenue hit a record $57 billion, up 62% year-over-year; net profit surged 65% to $31.9 billion. Its latest GPUs remain scarce commodities—“you can’t buy them even if you have money”—and the entire AI industry is essentially working for it.

Meanwhile, across the cyber divide in the world of cryptocurrency, the same script is playing out.

From the 2017 ICO bull run, to DeFi Summer in 2020, to Bitcoin ETFs and the Meme wave of 2024, retail investors, projects, and VCs keep rotating roles—but exchanges like Binance remain permanently at the top of the food chain.

History rhymes.

From the California Gold Rush of 1849 to today’s crypto frenzy and AI boom, the biggest winners are rarely the “gold diggers” competing directly. Instead, they’re the ones selling the “shovels.” Selling shovels is the ultimate business model for riding through cycles and profiting from uncertainty.

AI Gold Rush, Enriching NVIDIA

In public perception, this AI wave is led by large models like ChatGPT—intelligent agents that write copy, create art, and code.

But from a business and profit standpoint, the essence of this AI wave isn't an “explosion of applications,” but rather an unprecedented revolution in computing power.

Just like the California Gold Rush in the 19th century, tech giants such as Meta, Google, and Alibaba are all modern-day prospectors locked in an AI gold rush.

Meta recently announced plans to spend as much as $72 billion on AI infrastructure this year, with even higher spending expected next year. CEO Mark Zuckerberg stated, he’d rather risk “missing out on hundreds of billions” than fall behind in superintelligence development.

Amazon, Google, Microsoft, OpenAI, and others are pouring record capital expenditures into AI.

The tech giants are going all-in, while Jensen Huang smiles—the Levi Strauss of the AI era.

Every company building large models must purchase GPUs at scale or rent GPU cloud services. Each model iteration consumes massive training and inference resources.

If your model underperforms or your application lacks a clear monetization path, you can always start over. But the GPUs bought and compute contracts signed? The money has already been spent.

In other words, while everyone is still figuring out whether “AI will change the world” or “AI apps can be sustainably profitable,” one thing is certain: to play the game, you must first pay a “ticket fee” to the providers of computing power.

NVIDIA sits precisely at the top of this computing power food chain.

It nearly monopolizes the high-performance training chip market. H100, H200, B100 have become the “golden shovels” every AI company fights for. By integrating software (CUDA), developer tools, and framework support beneath its GPUs, NVIDIA has built dual moats of technology and ecosystem.

It doesn’t need to bet on which large model will win. It only needs the entire industry to keep “gambling”: betting that AI will create some future, justify higher valuations, and larger budgets.

In traditional internet, Amazon’s AWS once played a similar role: whether a startup survives is one thing—but sorry, you still have to pay for your cloud resources upfront.

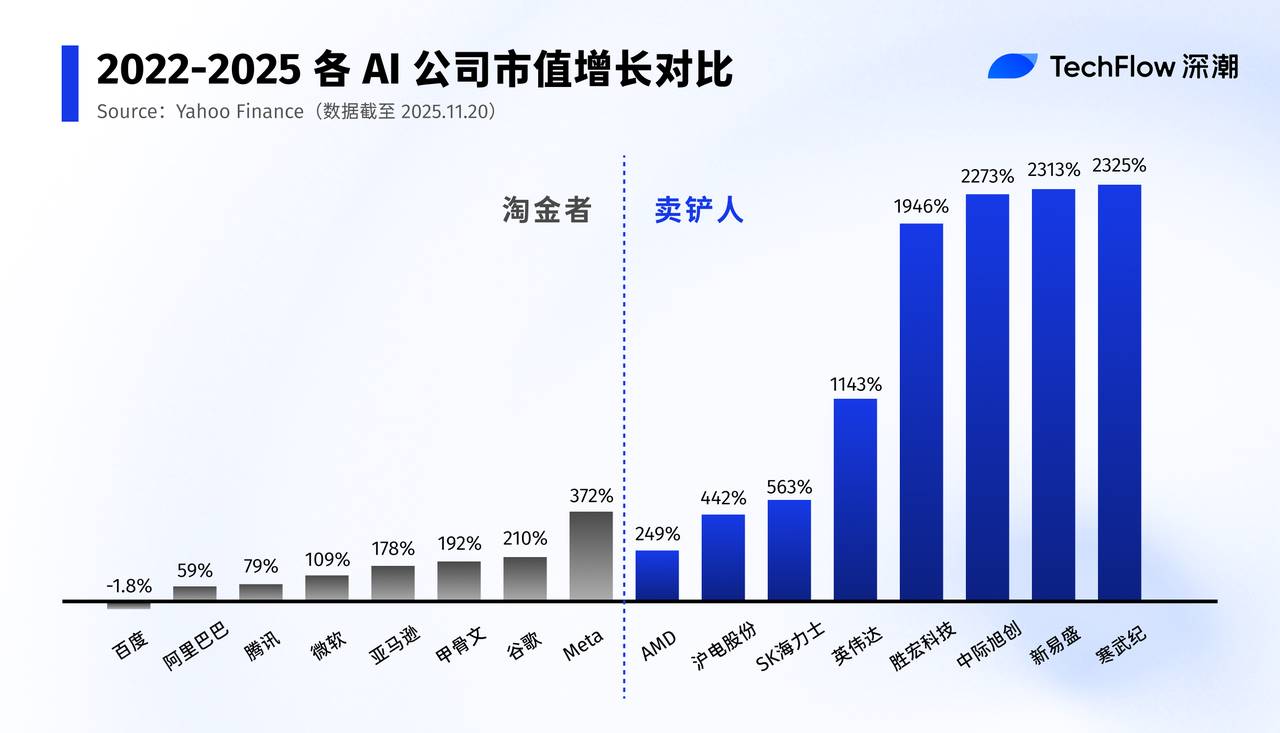

Of course, NVIDIA isn’t alone. Behind it lies an entire “shovel-selling supply chain,” all quietly laughing their way to riches amid the AI wave.

GPUs require high-speed interconnects and optical modules. Chinese A-share stocks like Newishine, Zhongji Xuzhuang, and TFCOM have become indispensable parts of the “shovel,” with their stock prices multiplying this year.

Data center upgrades demand racks, power systems, and cooling solutions—spawning new industrial opportunities from liquid cooling to power distribution and infrastructure. Storage, PCBs, connectors, packaging and testing—all component makers tied to “AI servers” are taking turns harvesting valuation and profit gains.

This is the terrifying power of the shovel-selling model:

Diggers may lose money, mining efforts may fail, but as long as people keep digging, shovel sellers never lose.

While large models are still struggling to figure out “how to make money,” the computing and hardware supply chain is already steadily counting profits.

Crypto’s Shovel Sellers

If NVIDIA is the shovel seller in AI, then who plays that role in crypto?

The answer is obvious to all: exchanges.

The industry keeps changing, but one thing remains constant—exchanges keep printing money.

2017 marked the first truly global bull market in crypto history.

Project token issuance had extremely low barriers—a whitepaper and a few slides could launch a fundraising campaign. Investors chased “10x, 100x tokens,” countless tokens launched and crashed, most projects froze or delisted within 1–2 years, their founding teams vanishing into history.

But listing a token costs fees, trading incurs transaction fees, and futures contracts charge based on position size.

Token prices can halve repeatedly, but as long as trading volume exists, exchanges thrive. The more frequent the trades, the greater the volatility—the more they earn.

In 2020, during the DeFi summer, Uniswap challenged traditional order books with its AMM model. Yield farming, lending, liquidity pools gave the impression that “maybe we no longer need centralized exchanges.”

But reality was subtle: vast amounts of funds moved from CEXs to on-chain farms, yet rushed back to CEXs during peaks and crashes for risk management, cashing out, and hedging.

Narratively, DeFi might be the future, but CEXs remain the go-to gateway for deposits, withdrawals, hedging, and perpetual contract trading.

By 2024–2025, Bitcoin ETFs, Solana’s ecosystem, and Meme 2.0 pushed crypto to new highs.

In this cycle, regardless of whether the narrative shifts to “institutional adoption” or “on-chain playgrounds,” one fact holds: massive leveraged capital continues flooding into centralized exchanges. Leverage, futures, options, perpetuals, structured products—these form the exchange’s “profit moat.”

Beyond that, CEXs are also merging with DEX features—trading on-chain assets via CEXs has become routine.

Prices rise and fall, projects rotate, regulations tighten, sectors shift—but as long as trading continues and volatility persists, exchanges remain the most stable “shovel sellers” in the game.

Beyond exchanges, there are many other “shovel sellers” in crypto:

For example, Bitmain and other miner manufacturers profit from selling miners rather than mining itself, staying profitable across multiple bull and bear markets.

Infura, Alchemy provide API services and benefit as blockchain applications grow;

Tether, Circle, as stablecoin issuers, earn the “digital dollar seigniorage” from interest spreads and asset allocation;

Pump.Fun and other asset issuance platforms continuously tax users by mass-producing meme assets.

...

In these positions, they don’t need to guess which chain will win or which meme will go viral. As long as speculation and liquidity exist, they keep printing money.

Why Is “Selling Shovels” the Ultimate Business Model?

The real business world is far harsher than imagined. Innovation is often a 90% failure rate game. To succeed requires not just personal effort, but alignment with historical momentum.

In any cyclical industry, outcomes typically look like this:

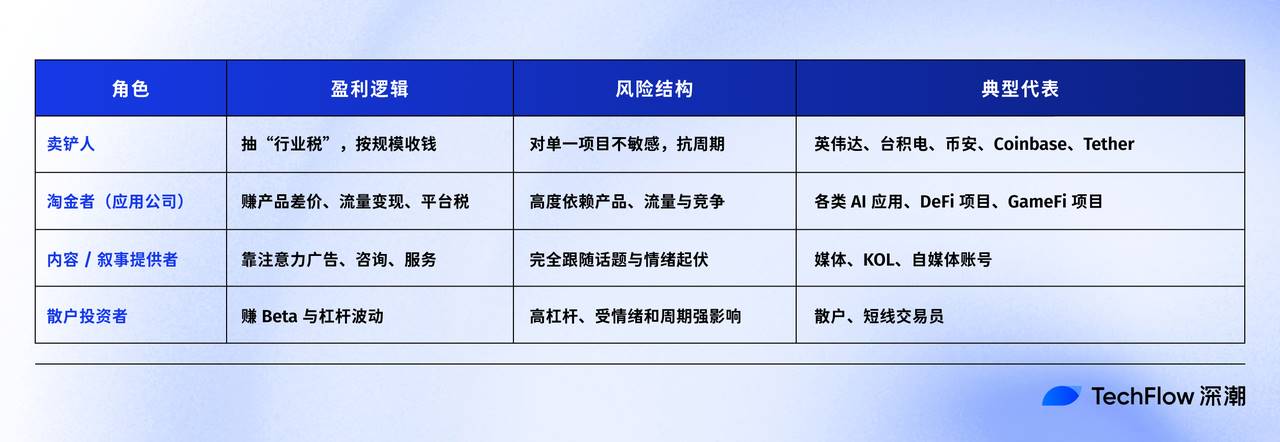

Building top-layer applications—digging for gold—chases Alpha (excess returns). You must bet right on direction, timing, and beat competitors. Win rates are extremely low, payouts extremely high. One wrong call and you lose everything.

Providing foundational infrastructure—the upstream shovel sellers—earns Beta. As long as the industry grows and participant numbers increase, they capture scale and network effects. Shovel sellers run a probability business, not a luck-based one.

NVIDIA doesn’t need to pick which AI model will “break through.” Binance doesn’t need to predict which narrative lasts longest.

All they need is one condition: “Everyone keeps playing the game.”

And once you're locked into NVIDIA’s CUDA ecosystem, migration costs become unimaginably high. Once your assets sit on a major exchange and you’re used to its depth and liquidity, switching to a smaller one becomes nearly impossible.

The endgame of shovel-selling tends toward monopoly. Once monopoly forms, pricing power fully rests with the shovel seller—just look at NVIDIA’s staggering 73% gross margin.

Put bluntly:

Shovel sellers collect an “industry existence tax.” Gold diggers chase “time-window premiums”—they must capture user mindshare within a narrow window or get discarded. Content creators or storytellers earn “attention volatility income,” which evaporates instantly when trends shift.

To put it even more plainly:

Selling shovels means betting that “this era will move down this path”;

Building applications means betting that “everyone will choose only me.”

The former is a macro thesis, the latter a brutal elimination contest. From a probabilistic standpoint, the odds of success for shovel sellers are an order of magnitude higher.

For retail investors or entrepreneurs, this offers a profound insight: If you can’t tell who the final winner will be, or which asset will multiply several times, then invest in those who deliver water, sell shovels, or even just jeans to all the miners.

One last data point: CTrip’s Q3 net profit reached 19.919 billion RMB, surpassing both Moutai (19.2 billion) and Xiaomi (11.3 billion).

Don’t just focus on who shines brightest in the story.

Ask who keeps collecting fees across all stories.

In times of frenzy, serving the frenzy while staying calm is the highest form of business wisdom.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News