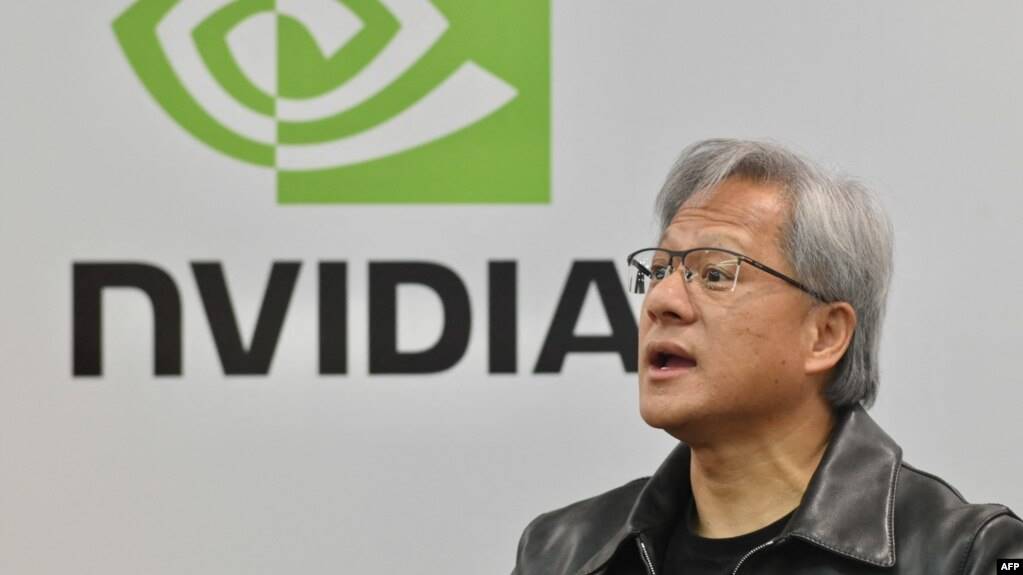

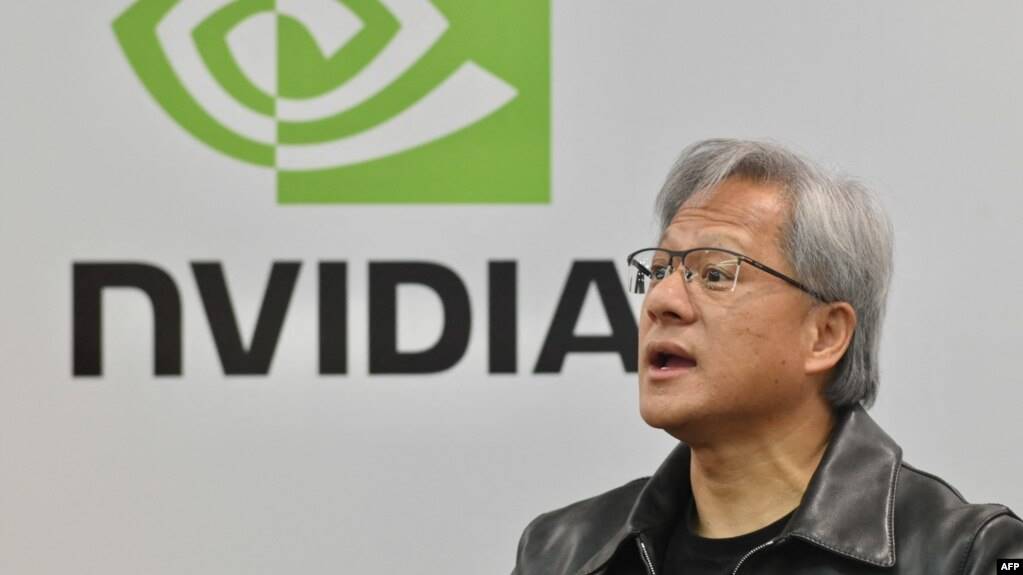

Nvidia internal meeting: Huang Renxun admits, "It's too hard—'doing well means an AI bubble,' and 'if expectations are slightly missed, the entire world could collapse'"

TechFlow Selected TechFlow Selected

Nvidia internal meeting: Huang Renxun admits, "It's too hard—'doing well means an AI bubble,' and 'if expectations are slightly missed, the entire world could collapse'"

Jensen Huang rarely admitted that Nvidia now faces an unsolvable dilemma: strong performance would be accused of fueling the AI bubble, while poor performance would be seen as evidence of the bubble bursting.

Original author: Wall Street Horizon, Bu Shuqing

As global markets debate whether an "AI bubble" exists, even the most successful player, Nvidia, is facing unprecedented scrutiny. As a core supplier of AI infrastructure, every move by Nvidia is seen as a barometer of the industry's overall health.

According to Business Insider on Friday, Nvidia CEO Jensen Huang admitted during an internal meeting on Thursday that despite delivering "incredible" results, the "market isn't appreciative." The chip giant's leader rarely acknowledged that Nvidia now faces an unsolvable dilemma: strong performance is accused of fueling the AI bubble, while weak performance is viewed as proof the bubble has burst.

Huang stated at the meeting that market expectations for Nvidia have risen so high that the company has entered a kind of "no-win situation." He bluntly said: "If we deliver a bad quarterly report—even slightly off or appearing a bit shaky—the whole world will collapse."

Trapped in a "No-Win Dilemma"

Based on a recording of the Thursday internal meeting obtained by Business Insider, Huang elaborated on Nvidia's current predicament. "If we deliver a bad quarterly report, that’s evidence the AI bubble exists. If we deliver a great quarterly report, then we’re accused of inflating the AI bubble," he said.

Huang pointed out that market expectations for Nvidia have become so elevated that no matter how the company performs, it cannot satisfy investors. He referred to online discussions about the company's massive economic impact, saying, "You should check out some of the memes on the internet. Have you seen any? We're basically propping up the entire planet—that’s not untrue."

He also cited posts claiming Nvidia’s performance is helping the U.S. avoid a recession, highlighting how the market now sees this chipmaker as a key indicator of macroeconomic health.

Nvidia's earnings released on Wednesday showed third-quarter revenue accelerating with 62% growth, and guidance for the current quarter exceeded expectations. At the time of the earnings release, Huang rejected growing narratives about an AI bubble. Yet market reactions have been volatile: shares rose on Wednesday (up over 6%) but fell sharply again on Thursday (plunging 7%). The company’s market value has erased around $500 billion within weeks.

Joking during the meeting, Huang referred to the "good old days" when the company’s market value reached $5 trillion." "No one in history has ever lost $500 billion in a few weeks," he said. "You have to be worth a lot to lose $500 billion in a few weeks."

This volatility in market value reflects weakening investor confidence in the AI investment boom—doubts about sustainability persist even in the face of strong financial results.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News