The Great Reckoning: CZ’s Moral Compass Shatters; Binance Completes Its Dark Transformation

TechFlow Selected TechFlow Selected

The Great Reckoning: CZ’s Moral Compass Shatters; Binance Completes Its Dark Transformation

CZ’s transformation from an industry savior to a figure accused of “going dark” reflects the difficult choices facing crypto giants—balancing regulatory compliance, political maneuvering, and identity—ultimately leading him to abandon the U.S. market and re-embrace Chinese-speaking users.

The Atonement Path of Crypto Titans

Ark Invest lit the fuse.

Haseeb is once again posing as a great prophet; Xu Mingxing plays the role of Prometheus, combining traditional Chinese and Western medicine to jointly incinerate He Yi and CZ—Carthage must be destroyed, and so must Sodom and Gomorrah.

This religious-style presumption of guilt stems from a widespread psychological contradiction within the crypto industry.

Throughout cryptocurrency’s history, participants have operated on the fringes of established rules, navigating an ambiguous gray-to-black zone. Today, crypto titans seek legitimacy and redemption—but face two urgent questions:

- How can they evolve from rule arbitrageurs into rule adherents? For instance, if avoiding the “October 11” mass regulatory crackdown requires self-sacrifice, how should Binance weigh that cost?

- How can they seize authority over crypto rulemaking to secure tangible industry benefits? For example, Coinbase’s stance can sway the progress of clear legislative frameworks—where does that influence originate?

Binance faces an additional identity dilemma: SBF could simply plead for mercy and warp spacetime to become a Republican in 2022, but CZ and Binance’s Chinese heritage and background continually trap them in a loop of Western scrutiny and self-justification.

Rules Have a Price: Even the Crypto King Is Meat on the Chopping Block

The purpose of political science is not to create people, but to explore how to use people naturally.

Let me begin with an old story—the tale of a dragon-slayer who becomes the dragon.

In 1991, as the Soviet Union neared collapse, history seemed to culminate in neoliberal triumph. The U.S., earnestly attempting global governance through the UN system, secured UN authorization to lead a coalition of 35 nations against Saddam Hussein’s invasion of Kuwait. Within just 100 hours of ground operations, Saddam was defeated and Kuwaiti sovereignty restored.

At that time, the U.S. received genuine global acclaim.

Just two years later, however, the U.S. suffered the “Black Hawk Down” disaster in Mogadishu—the mission failed to capture warlords, and domestic backlash was fierce. From then on, America’s moral resolve began to fracture: if doing good yields no reward, perhaps doing evil carries no real penalty either.

Then came 9/11 in 2001—the final shattering of America’s moral compass—and the nation plunged into a quagmire of global counterterrorism warfare.

Zooming in from the macro to the micro, this story resonates powerfully with today’s crypto predicament: after narrowly winning its cold war against Wall Street and traditional banking—and securing dominance in tokenization and stablecoins—the industry now faces intense internal strategic rifts.

After Black Hawk Down, America turned dark; after doing good brought no reward, Binance tried saving the crypto industry—but ultimately chose to build its own walled garden.

Let’s rewind to 2022: at the height of FTX’s collapse, Binance commanded over 70% of centralized exchange (CEX) market share—but the entire industry hovered under a cloud of uncertainty.

Binance decided to step in and rescue the sector. That’s when it launched the $1 billion SAFU Fund—though not without ulterior motives: the fund was largely composed of Binance’s own BUSD and BNB tokens. Its recent fame came from responding to Yi Lihua’s call to swap holdings into BTC.

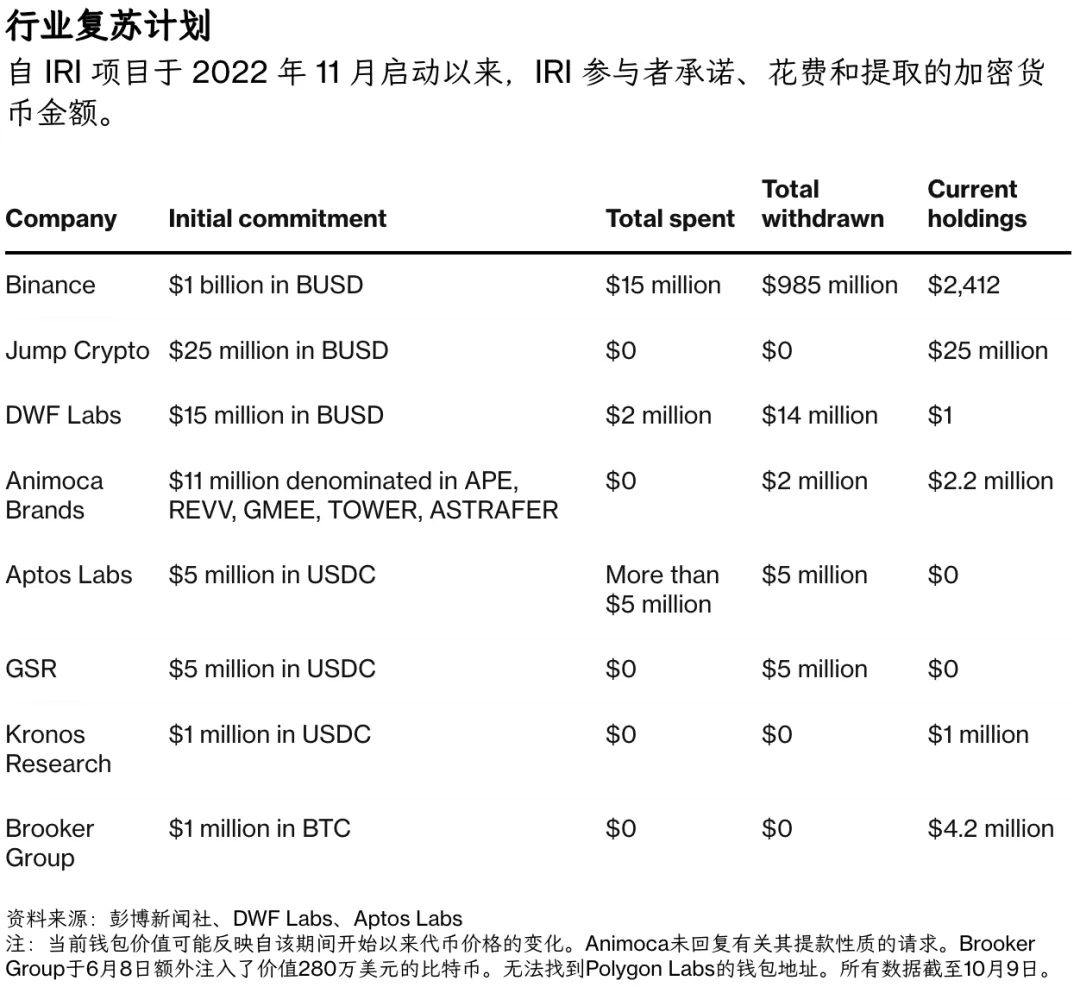

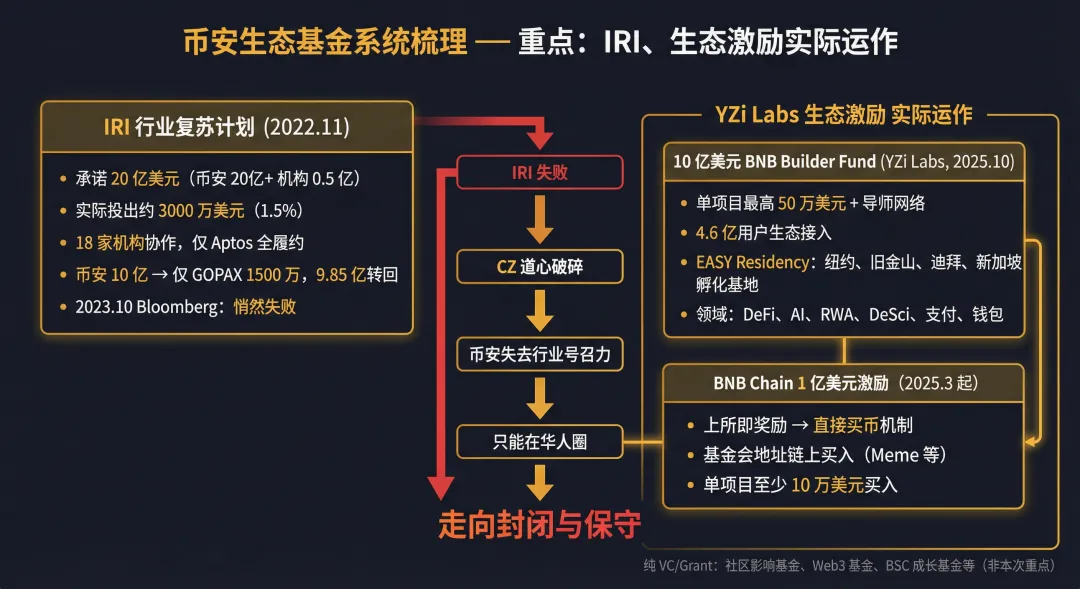

Unfortunately, that’s not the full story. Concurrently with SAFU, Binance also announced the Industry Recovery Initiative (IRI), a collaborative rescue effort with major projects and exchanges. Binance pledged at least $1 billion, aiming for a total fund size exceeding $2 billion.

Today, the IRI application form is inaccessible—perhaps the industry has already recovered.

Image caption: IRI funding breakdown

Source: @business

In fact, IRI had already ceased operations by 2023. Many promised contributors—including market makers Jump, GSR, and Kronos—never actually contributed. Why? Because Binance—the industry’s de facto leader—only spent $15 million, then withdrew the remaining $985 million.

Moreover, IRI’s operations were extremely opaque: you simply couldn’t tell which projects received funding—and which were left begging, doomed to die.

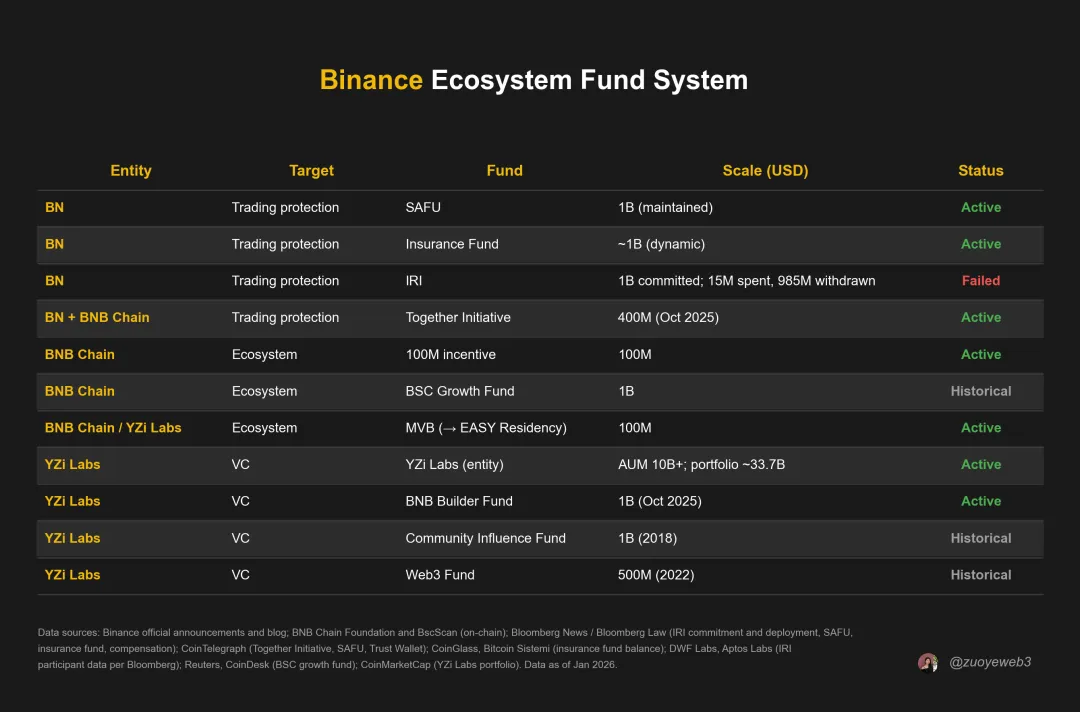

Dig deeper, and you’ll find Binance’s unfulfilled commitments extend far beyond IRI: there’s the $400 million “Same Boat Fund” launched post–October 11, and the $1 billion BSC Growth Fund established back in 2021—whose later expenditures included a mere $50,000 purchase of the meme coin “I’m Here, Dammit!”

Image caption: Binance ecosystem funds

Source: @zuoyeweb3

If you tally up all Binance-initiated programs, you’ll notice a curious fondness for the figure “$1 billion.” Much like Sun Yuchen’s perpetually unclaimed $100,000 reward, aside from the YZi Labs flagship fund, Binance’s publicly pledged funds exceed $5 billion—but less than $100 million has materialized.

It’s unequivocal: after IRI’s failure, Binance effectively embarked on a “diverting industry liquidity rather than generating it” dark path—actively promoting its main exchange against other CEXs, and championing BNB Chain over rival Layer-1s like Solana.

That’s precisely why Solana co-founder Anatoly said the industry needs an 18-month recovery period: Binance doesn’t care about crypto’s bull/bear cycles or broader health—only that BSC and its main exchange retain trading hegemony.

Binance cannot become the architect of rules—it can only reign as king over its own small fiefdom.

But Coinbase CEO Brian Armstrong sees things differently. In his view, one shouldn’t merely obey existing rules—instead, one must attempt to tame them. Its current tussle with banks over USDC yield is merely the tip of the iceberg; directly engaging in politics is the ultimate solution.

This doesn’t mean Coinbase will RPG-blast mayoral limousines. It employs a more sophisticated playbook—applying engineering rigor and commercial discipline to lobbying.

Traditional K Street lobbying relies on retired politicians’ networks—the so-called “revolving door” between government and business. To Silicon Valley, that’s embarrassingly low-grade. From Airbnb to Uber, disruptive innovators have long operated on the razor’s edge of compliance. Seen this way, crypto isn’t especially unusual.

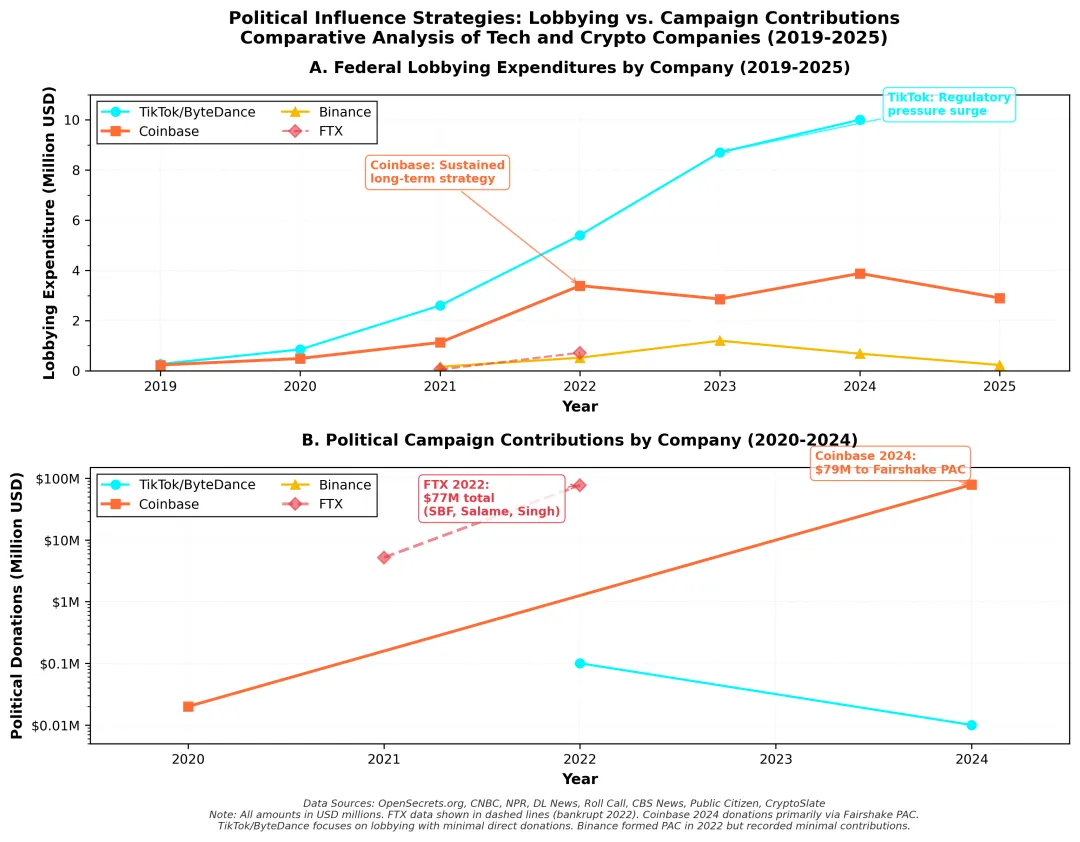

Image caption: Election and donation data

Source: @zuoyeweb3

Yet both FTX’s SBF and Binance’s CZ are outliers. SBF leaned excessively into the Democratic Party—even after rebranding himself as a Republican, TIME magazine reports he donated over $40 million to Democrats versus just $29 million to Republicans.

Meanwhile, Binance willingly paid a $4.2 billion fine to a Democratic administration and partnered with a Republican administration on a $2 billion USD1-to-MGX equity investment—but spent only $800,000 on lobbying and political engagement in 2025.

The top two players are both transparent—and foolish. Coinbase, despite lower trading volume, surged ahead: it hired Chris Lehane to assemble the most powerful lobbying team in crypto history—and teamed up with a16z to launch StandwithCrypto’s “Red-Black List,” scoring politicians directly. Crypto-friendly officials receive donations; unfriendly ones aren’t punished—but their opponents get funded instead.

At the core of U.S. politics lies elections; in China’s bureaucracy, it’s personnel selection. Coinbase’s early strategic positioning explains why Trump—who loves Bitcoin during election season—emerged as a crypto ally.

Failed U.S. Entry: A Small Piggy Bank Hides Inside a Big One

When the U.S. says you’re connected to the Chinese government, you’d better actually be connected.

Let me tell another story—the tale of dragons rolling in the mud.

As Trump prepared to enter the White House, Bezos instructed the Washington Post to remain neutral during the election; Microsoft hastily disbanded its DEI division; Zuckerberg reinstated Trump’s Instagram account; and Peter Thiel had already backed Trump as early as 2020, while Musk pledged allegiance in 2022.

Their outcomes varied: Thiel profited most, Musk second, and other billionaires remained relatively safe. Add in Koch Brothers and New York Mellon family wealth—the “old old money”—and you’ll observe an interesting pattern across Trump’s second term:

“Old old money” escaped purges; “old money” could hedge both sides; internet-era elites could oscillate freely; crypto nouveau riche needed to place bets carefully; and foreign outsiders were mere meat on the chopping block—Sun Yuchen got “cut” (FDUSD holders struggled to assert rights, blacklisted by WLFI), while CZ paid the most—but remained most unsettled.

Image caption: Binance’s self-abandonment path

Source: @zuoyeweb3

This unease has lingered in CZ’s mind—especially since his UAE passport neither guaranteed personal safety nor preserved corporate reputation via equity-for-token swaps.

- Oil-rich Gulf states like the UAE function as America’s oversized piggy bank; the U.S. doesn’t particularly respect their sovereignty, making such political shelter extremely limited in scope;

- The WLFI–MGX investment tie-up between the Trump family and the UAE is mutually binding—but the sole party surrendering real interests remains Binance and CZ alone—and even that submission proves fleeting.

MGX represents Abu Dhabi’s royal interests—which explains why Binance swiftly relocated from Dubai to Abu Dhabi after securing MGX investment. MGX invested $2 billion to purchase WLFI’s USD1 token, after which Binance itself received MGX funding.

According to the Washington Post, USD1’s technology was entirely developed by Binance—meaning Binance supplied capital, tech, and distribution infrastructure, while WLFI merely reaped rewards. MGX, at least, secured equity in Binance.

The going market rate for pardons during Trump’s second term? Lobbying firms charge $1 million minimum. Within just five months of taking office, Trump granted clemency to 1,600 people—CZ undoubtedly topped the list.

Yet this protection offers zero leverage against fellow Americans like Ark Invest’s Cathie Wood or Elon Musk. CZ invested $500 million in Musk’s Twitter acquisition—roughly 1% of Musk’s $43 billion total—fitting neatly into a minor shareholder role. But Musk’s vision for Twitter’s future barely features Binance.

All CZ could do was aggressively funnel Twitter traffic to Binance Square—but those drawn there won’t be Twitter’s crisis originators, and at least Xu Mingxing certainly won’t show up.

Every cause has its effect—nothing happens by accident.

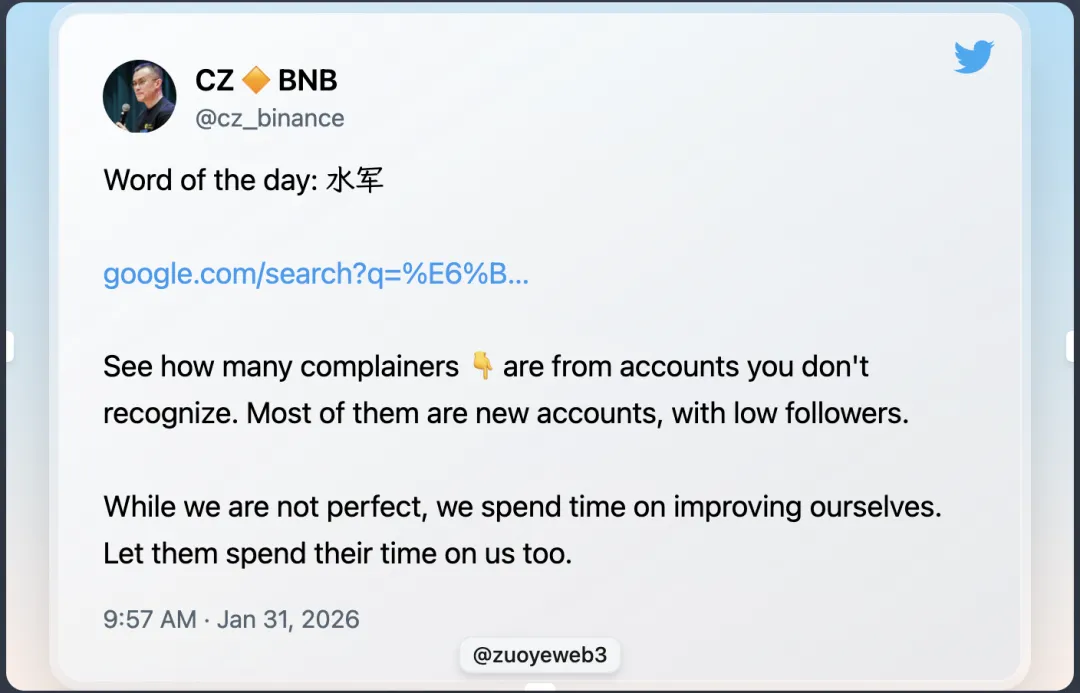

Image caption: Meaning of “water army”

Source: @cz_binance

After Binance and CZ’s failed U.S. entry, you’ll notice something surprising: CZ began tweeting in Chinese—and even started educating English-language crypto Twitter users on the meaning of “water army.” It seems CZ’s rapport with Chinese-speaking users has grown closer.

This isn’t illusion. Re-embracing the Chinese-speaking market has become Binance’s central theme—and the rationale is straightforward: don’t force your way into circles you can’t join.

CZ’s mindset mirrors that of reform-and-opening-era Chinese professionals: rules are sacred; Western civilization is revered; he dares not intervene in politics like Coinbase, nor pick sides like Musk. In short: he knows only how to solve problems—not how to set them.

Faced with U.S. pressure, he slides into the fallacy that “since I haven’t paid enough, I must pay more”—a misreading of Trump’s art of the deal. The right moment to bid arrives only after terms are fully negotiated.

Unable to engage in high-level博弈 with U.S. government and legislative institutions—and equally unable to win grassroots public support—

Looking left and right, CZ can only pin hopes on Chinese-speaking users—yet stubbornly clings to distancing himself from the Chinese government. The result? Neither the U.S. nor China intervenes on his behalf: he receives none of Meng Wanzhou’s personal protections, nor TikTok’s commercial advantages.

By contrast, TikTok today operates as three distinct entities: China’s Douyin, U.S.-based TT, and global TT. ByteDance retains 19.9% ownership of TT.US, while Oracle, MGX, and Silver Lake each hold 15%.

TT.US adopted the “Texas-in-the-Cloud” model: ByteDance keeps algorithmic IP and profits. After the deal closed, American public opinion swiftly shifted blame for increased censorship onto Oracle—delivering ByteDance the ideal outcome: partial profit retention plus public sympathy.

Oh—and no massive fines required.

Conclusion

British liberty is not French liberty; internet-era newcomers’ investments are not crypto billionaires’ speculation.

SBF’s clumsy plea for mercy evokes memories of summer 2022, when FTX briefly represented crypto’s last hope—while Coinbase’s Armstrong consistently lacked charismatic authority.

Yet compared to them, CZ exited the collusion of capital and power prematurely—or perhaps never entered it at all—eventually resigning himself, unwillingly, to the awkward narrative identity of a “Canadian-Chinese dual citizen holding a UAE passport,” championing the ill-fitting slogan of “securing space for Chinese users in crypto.”

But that has never been reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News