Pre-Market Trading Guide: How to Seize the Opportunity Before Token Listings?

TechFlow Selected TechFlow Selected

Pre-Market Trading Guide: How to Seize the Opportunity Before Token Listings?

Selling in the pre-market allows you to exit before the airdropped token is listed.

Author: 𝕋𝕖𝕞𝕞𝕪

Translation: TechFlow

I've studied all cryptocurrency pre-markets and how they operate.

Here are some key dos and don'ts of pre-market trading:

I really wish I had known this before placing my first order.

I sold 10,000 $dogs in the pre-market and ended up with 550,000.

Pre-markets are often underestimated, but a single mistake can cost you dearly. I've made those mistakes—so you don't have to.

This is your guide to doing pre-market trading the right way.

Pre-markets are platforms that allow you to trade tokens before they go live on spot markets.

Obviously, this opens up many opportunities, but only a few people fully take advantage of them.

In fact, the reason most people don't utilize pre-markets effectively is that they're more complex and riskier than spot markets.

But I'll walk you through everything you need to know about these markets.

Based on how they operate, pre-markets generally fall into two categories:

Futures-based pre-markets like @aevoxyz and OKX function similarly to futures contracts and typically settle in stablecoins like USDT before the token launches on spot markets.

Spot-backed pre-markets like @bitgetglobal and @WhalesMarket work more like escrow systems, holding buyers’ funds and sellers’ collateral.

Trades settle when the seller delivers the actual spot tokens. If the seller fails to deliver, their collateral is used to compensate the buyer.

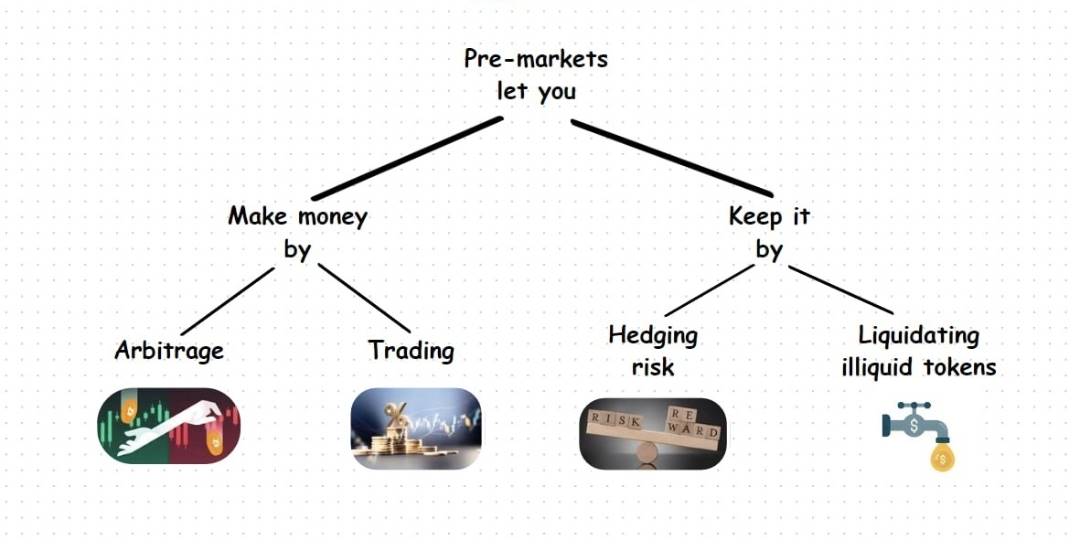

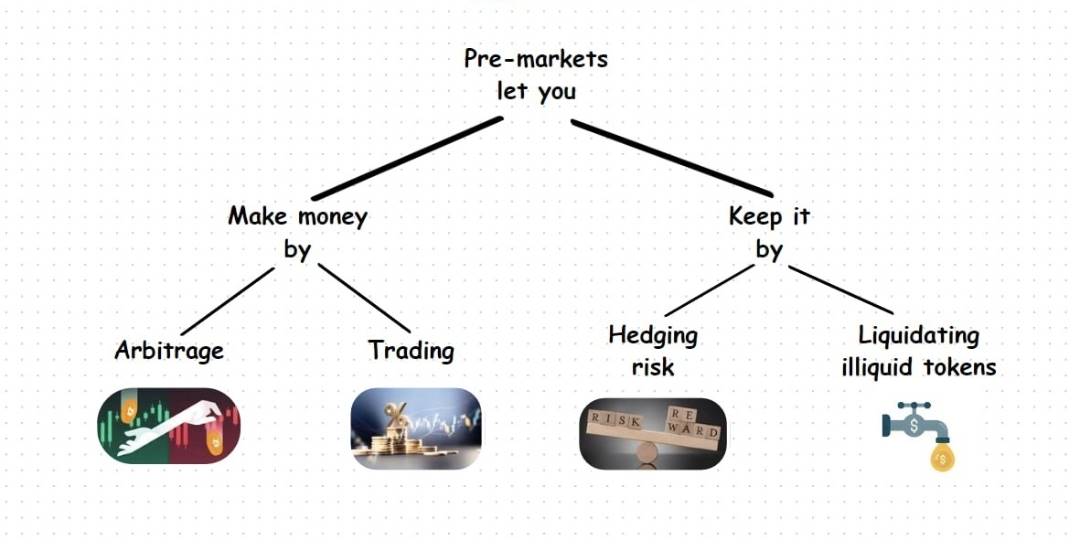

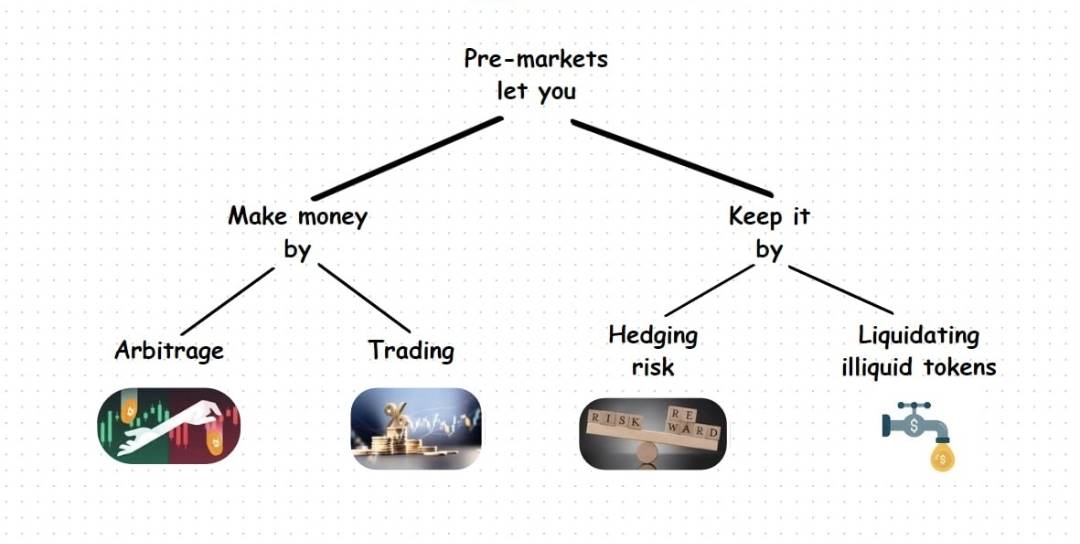

So what can you actually do on these markets?

Hedge illiquid airdrops.

We've seen airdropped tokens like $Eigen drop from $12 to $4 on Aevo, and $Order fall from $2 to $0.3. While most people wait for spot listings, some are already exiting their allocations at peak prices.

Selling in the pre-market allows you to exit your position before the airdrop token even hits the open market.

The goal here isn’t to predict price drops or speculate—it’s to exit your airdrop allocation at a price you’re satisfied with.

Arbitrage

Due to lower liquidity, prices across different pre-markets can vary significantly.

Depending on the size of the price discrepancy, you can sometimes find truly risk-free arbitrage trades—or at worst, break-even opportunities. But before getting too excited, there are several critical factors to consider when placing orders.

Mistakes here can be extremely costly—so proceed with caution!

1. Know exactly what you're trading!

On @WhalesMarket, points are traded separately from actual pre-market tokens, and there's a difference between the two.

While pre-market tokens correspond 1:1 with the actual spot token, points are calculated based on a ratio provided by the project.

If you don't clearly understand this ratio, do not trade points!

Additionally, when trading tokens whose tokenomics haven't been announced yet, pre-markets often assume a random total supply and later adjust the number of tradable tokens once official tokenomics are released (e.g., $Dogs). This is highly risky—I personally recommend avoiding such trades until tokenomics are officially confirmed!

2. TGE Date

Know the exact token generation event (TGE) date to avoid having your funds locked up longer than necessary.

If you're using a centralized exchange (CEX) pre-market, ensure the token will be listed on the TGE date itself—not delayed until later.

3. Settlement Time and Duration

Settlement times vary across platforms. For example, @bitgetglobal usually settles pre-market orders within 4 hours after listing.

On @WhalesMarket, settlement begins at TGE but lasts up to 24 hours.

4. Withdrawal Timing

This is especially important when conducting arbitrage via CEX pre-markets. Sometimes, a CEX may list a token but not enable withdrawals on the same day—for instance, $Dogs. Ideally, withdrawal capability should align with the settlement window, but this isn't always guaranteed.

As you can see, this is far more complex than regular spot trading, requiring careful consideration of multiple variables.

But when all these conditions align—and they occasionally do—it can yield substantial returns with almost no risk.

That's everything you need to know about pre-markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News