IOSG | TCG Deep Research: The $8 Billion On-Chain Investment Landscape from Gachas to Derivatives

TechFlow Selected TechFlow Selected

IOSG | TCG Deep Research: The $8 Billion On-Chain Investment Landscape from Gachas to Derivatives

TCG is a genuine asset class, not a short-term fad.

Author: Max Wang @IOSG

In the past few months of 2025, on-chain TCG (trading card game) scenarios have gained significant attention. Off-chain, especially since 2019, TCGs have seen rapid growth in popularity—yet few realize that TCGs have existed for over 50 years and now form a highly mature ecosystem comparable in scale to sneaker or watch markets. This article will introduce recent developments in the TCG space, early-stage startups in this field and their respective scales, aiming to provide readers with better insights into the evolution of on-chain card markets.

TL;DR

#TCG is a real asset class, not a short-term trend.

The global TCG market is valued at $8–10 billion, comparable to sneakers and smaller than watches, with a CAGR of around 8% and over 25 years of cultural depth (Pokémon, MTG, Yu-Gi-Oh).

#The on-chain TCG market structure is skewed, driven by gray markets.

Supply flows from publishers → distributors → big-box stores/traditional shops → gray markets → retail. True collectors rarely access MSRP; over 50% of volume/price discovery happens in gray markets, driving up break costs continuously.

#Card grading is a massive, centralized "pick and shovel" business.

-

~1.5 million submissions per month (~18 million annually), ~$40 each: an ~$720 million annual industry, with PSA holding ~77% market share.

-

~65% of grading volume is TCG, and slabbing cards represents the financialization layer that turns cards into tradable "assets".

#The sealed pack/product market dwarfs Gacha.

-

Pokémon alone: ~10 billion cards → ~1 billion packs/year, average pack price ~$15 → ~$15 billion in sealed pack sales, while the overall Gacha market is ~$800 billion. Gacha dominates headlines on CT; but for TCG, sealed products are the true economic core.

-

Targets hardcore fans/TCG collectors who are more committed and sticky than Gacha players.

#Hardcore fans/TCG collectors (rip.fun’s user base) are receptive to digital assets and possess strong spending power.

-

Spent $1.3 billion on digital Pokémon packs with no monetary value.

-

$3 billion GMV (users buy data packs from streamers who open them live—even with major trust issues, rip.fun solves this).

#Direct statements from top Gacha players (Collector Crypt, Beezie) indicate they don’t plan to enter the sealed product/live-break market.

#Opportunity: Build infrastructure, not just another “casino”.

We believe the largest growth potential lies in:

-

Access rails (fair on-chain allocation, fractional ownership, live-breaking at near-MSRP prices);

-

Liquidity rails (vaults, tokenization, MM/AMM layers for slabs/sealed);

-

Derivatives/credit (perps, indices, options, TCG-backed lending).

#On-chain TCG primarily consists of four verticals:

-

Gacha platforms (Courtyard, Collector Crypt, Phygitals): unofficial TCG packs built on secondary market slabs. The top three platforms have reached ~$750–820 million annual GMV, ~10% net margins, 80/20 split between gamblers and fans.

-

Digital vaulting/live-break platforms: seal and break official SKUs (packs, ETBs, boxes) via card management and grading, serving hardcore fans/collectors. Operationally heavy, but higher ARPU and stickiness.

-

Money markets: using tokenized slabs/sealed packs as collateral so collectors/shops can borrow instead of selling outright; PocketDex naturally fits as a "portfolio & risk management" frontend, seamlessly integrating with lending infrastructure.

-

Perp markets: synthetic exposure to TCG indices/sets; Trove is the leading example, offering Pokémon index and CS2 skins perps for hedging and speculation.

1. Background and Introduction

First, what is a TCG? TCG (Trading Card Games) are collectible card games where players compete by building and customizing their own decks. Players acquire new cards through randomized card packs or trading with others. However, beyond being competitive games, TCG cards also serve as collectibles due to their scarcity, similar to art.

Some popular TCG games include:

Pokémon TCG – 1996

Yu-Gi-Oh TCG – 1996

Magic: The Gathering – 1993

In terms of market size, TCG compares favorably with other popular collectibles, reaching scale on par with major categories.

Currently, most reports estimate the TCG market generates annual sales between $8–10 billion, with a projected CAGR of 7.8%.

2. TCG Market Structure and Landscape

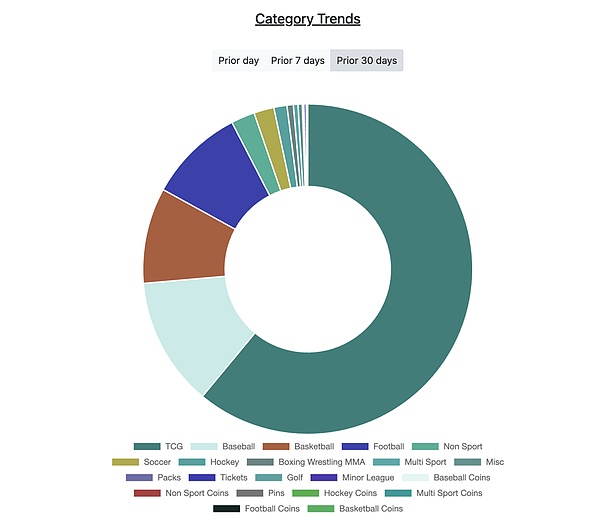

Today, the TCG market can be divided into off-chain TCG experiences and on-chain + digital TCG experiences, each with different participants. Clearly, the off-chain market is more mature, but the on-chain digital TCG environment is rapidly gaining traction. Regardless of perspective, every segment of the broader TCG market is hitting all-time highs.

Off-Chain

Bottom-up view:

-

TCG publishers/factories

-

Distributors

-

Shops

-

Official TCG retailers

-

Secondary market shops

-

Distributors/gray market

-

Retail

-

Grading companies

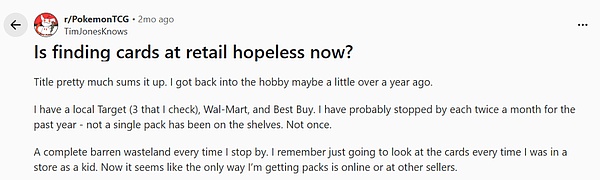

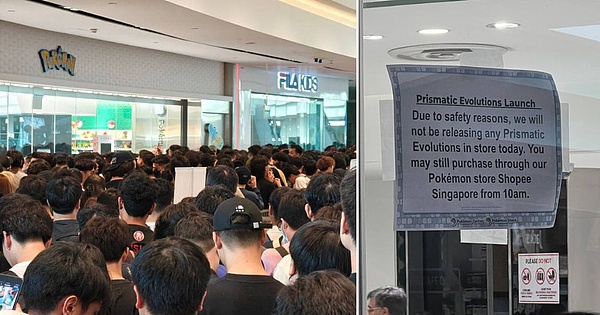

The current flow generally follows this path: TCG publishers/factories produce official sealed products, which are then delivered to distributors. Distributors allocate these to shops or official retailers like Walmart, Target, or small vendors. However, due to high demand and popularity, scalpers often bulk-buy these products and resell them at premium prices to genuine collectors/retailers.

Pokémon TCG sealed packs

Shop <> Distributor Relationship

Regarding the relationship between shops and distributors, new independent stores struggle to secure meaningful allocations because demand is extremely high. Most supply goes to large enterprises like Target/Walmart or long-established, well-connected stores, leaving only minimal quantities for smaller shops. As a result, many small shops source inventory from larger stores with better distributor access. For example:

-

Store A receives 5,000 packs/month from distributors

-

Store B receives 100 packs

-

Store A buys 5,000 packs at MSRP

-

Store B buys 2,500 packs from Store A at 15%+ above MSRP

-

Store B sells to scalpers/retailers at 50% above MSRP

Additionally, it's important to distinguish shop types. Large stores like Walmart/Target sell at MSRP. But there are examples like Store A and Store B—individual brands with distributor quotas that resell at 10%-50% markups. Generally, genuine retail collectors almost never get sealed products directly from Target/Walmart and must turn to smaller shops or entirely rely on gray channels.

Gray Market

The gray market itself accounts for 50% of the TCG market, with some arguing it exceeds primary market volumes. This segment includes scalpers, eBay sellers, Whatnot/live-breakers, Facebook/Discord sellers, and informal Telegram/Instagram networks operating between official stores and end collectors.

Gray market participants typically do not source directly from distributors but instead obtain inventory through:

-

Big-box retail restocks (Target/Walmart drops, store-hopping)

-

Allocation shops like Store A, reselling part of their allotment at markup

-

Liquidating collectors/shops needing quick cash and willing to accept discounts

Gray market actors then repackage and resell products in various ways:

-

Selling sealed boxes/ETBs/booster boxes at premium prices

-

Breaking down (selling partial packs instead of full boxes, often with implied high markups) on sites like Whatnot

-

Grading and flipping individual cards on eBay/TCGplayer, or consigning to large sellers

-

Gacha S-tier collectors

Since true retailers cannot reliably access MSRP products, the gray market becomes the de facto center of price discovery. While distributors and big-box stores nominally sell at MSRP, most economic surplus is captured by intermediaries through secondary market premiums extracted from retail collectors. This means effective prices for hot products are determined by gray market clearing prices, not official Pokémon MSRPs—leading to significant upward pricing pressure across the TCG industry.

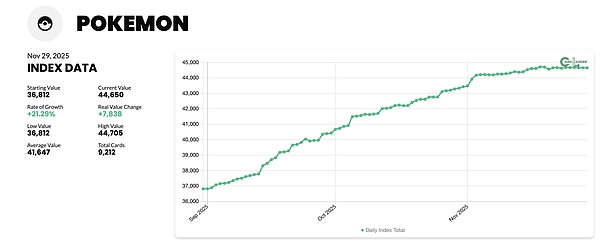

▲ Pokémon Market Index

Up 21.3% in 3 months, ~250% in 1.5 years

Grading

Grading companies sit atop the entire off-chain TCG industry. They rarely interact directly with sealed products or distributor allocations; instead, they receive raw singles from shops, break streamers, and collectors, converting them into standardized condition-rated slabs.

Main grading companies:

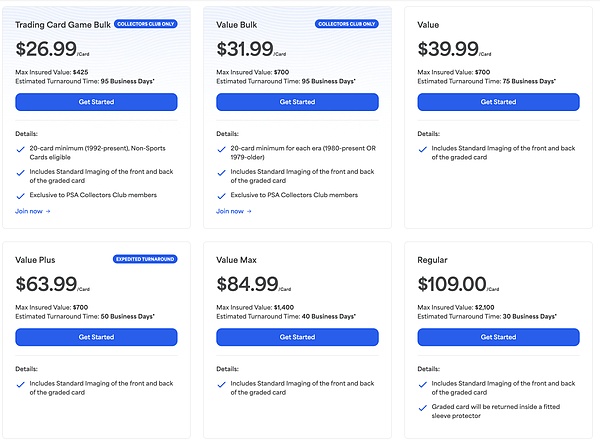

Average pricing per submission:

Cards are graded on a 1–10 scale, with 10 being pristine, significantly impacting value. For instance, an ungraded raw card worth $100 could be valued at $2,000 if graded PSA 10. Hence, most collectors and break streamers choose to grade high-value cards.

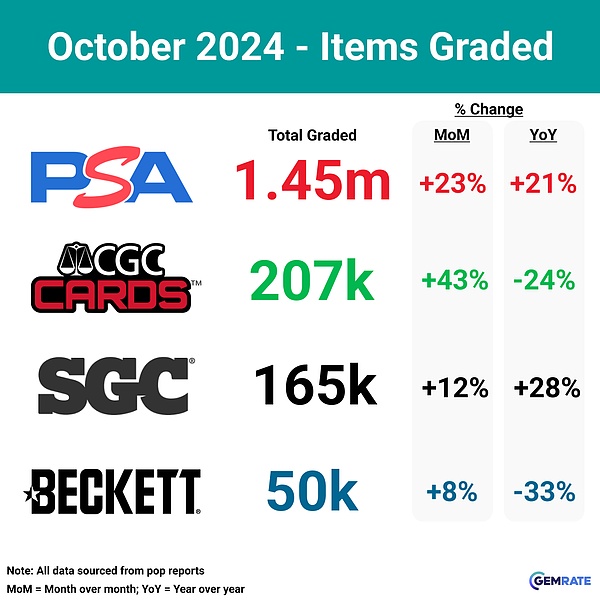

▲ Ungraded vs. Graded Cards (Slabs)

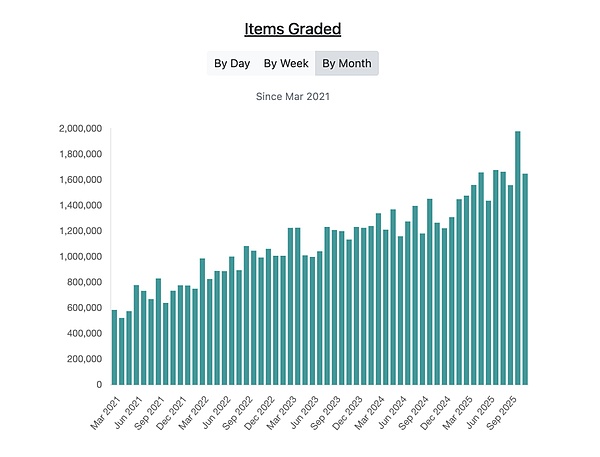

Here we see monthly submission volumes for the top five grading companies. Since 2021, average monthly submissions have grown steadily year-over-year, more than doubling from start to finish.

▲~1.5 million items/month

~18 million items/year without factoring in growth

~$40 per item

A $720 million annual industry dominated by four companies, with over 65% of grading volume coming from TCG alone.

Regarding market share breakdown, PSA clearly leads:

-

PSA: ~77.5%

-

CGC: ~11.1%

-

SGC: ~8.8%

-

Beckett: ~2.7%

3. On-Chain + Digital TCG

Now examining the landscape of on-chain + digital TCG, it can be segmented into the following areas:

-

Gacha platforms

-

Sealed pack / live-break & card management platforms

-

Money markets (lending markets)

-

Perpetual markets

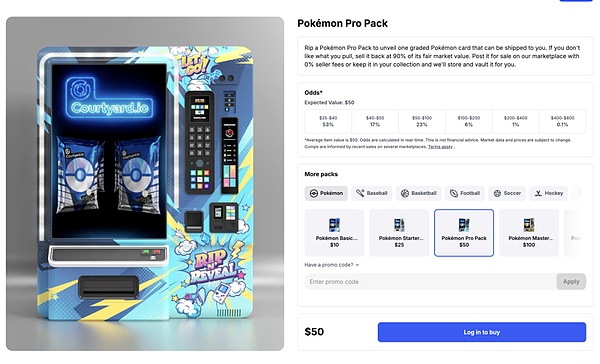

Gacha Platforms

Clearly, given the intrinsic link between Gacha platforms and cryptocurrency, Gacha has remained the focus of CT. So, what exactly is a Gacha machine?

Generally, Gacha machines are unofficial offerings curated by third parties (Courtyard, Beezie, etc.). Gacha platforms source cards from secondary/gray markets, build inventory, and curate unofficial packs.

However, the core of Gacha is random allocation at fixed prices. The term originates from Japanese crane games: insert a coin, turn the knob, and randomly receive a toy from a known pool. In TCG terms, you pull from a Gacha platform and receive a randomly selected graded card.

-

You pay a fixed amount (e.g., $3 per pull)

-

Draw one or more cards from a predetermined pool

-

Pools have varying rarity tiers and probabilities (common/rare/ultra-rare)

-

The entire economy revolves around chasing specific rare cards or repeated pulls

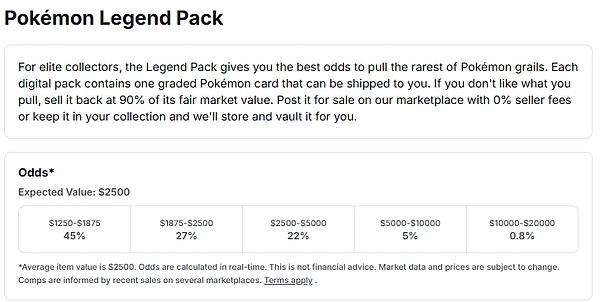

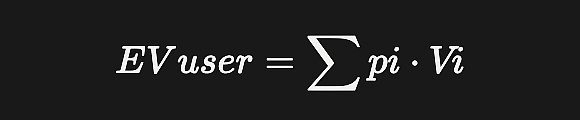

Thus, Gacha platforms price each pull based on EV mechanics:

Item i = 1 … n

Drop probability $Pi (summing to 1)

Fair market value $Vi (actual resale price after fees)

Price per pull / platform fee $P

Then, the expected value for one user pull is:

Therefore, the platform’s overall goal is:

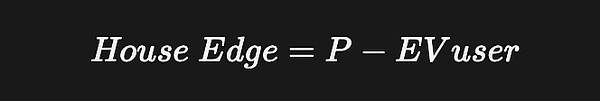

And house edge (platform profit margin):

This essentially represents the platform’s profit per Gacha pull.

-

Users chasing specific cards or trying to hit jackpot cards contribute most of the EV.

-

EV for common/rare cards is nearly zero.

-

Retail price per pack is set above the probability-weighted resale value of its internal cards.

Insights from Beezie / Collector Crypt:

"Most Gacha platforms have net profit margins of about 10% of total Gacha machine spend. This is because we usually buy cards in bulk from gray market stores at 90% of market price, then use that inventory in our Gacha machines."

About Flow

#Consumers

-

Players deposit USD/crypto

-

Select and purchase desired Gacha packs to open

-

Sell received cards back to platform at 90% market value or redeem physically

-

If redeemed, receive physical cards

#Platform

-

Purchase cards at discount from gray market dealers or markets

-

Curate Gacha packs and calculate pack pricing via EV

-

Buy back cards from consumers or ship them (if physical redemption)

-

Repeat

So, what matters most for Gacha platforms?

-

Stable access to below-market priced graded cards

-

Ability to create +EV Gacha machines that keep players engaged in continuous "gambling"

Overall, key players in this space include:

Courtyard.io

Users ~250k

Total platform spend (YTD): ~$536.5 million

Gross profit: ~$53.6 million (~$53.6M)

Collector Crypt ($CARDS)

Users: ~10k

Total platform spend (annual): ~$150 million

Gross profit: ~$21 million

Phygitals

Users: ~20k

Total platform spend (annual): ~$61 million

Gross profit: ~$6.1 million

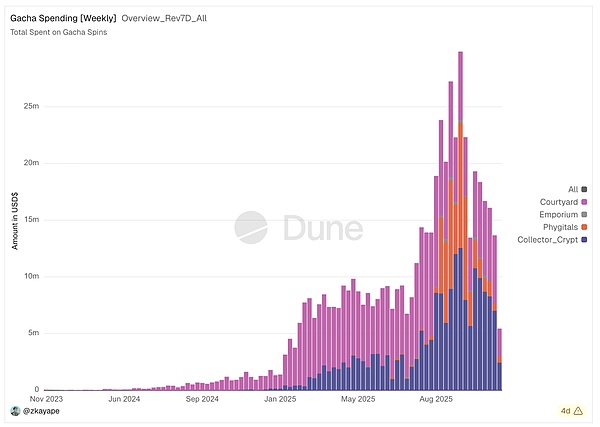

Thus, the combined Gacha industry spend of the top three reaches $747.5 million, already surpassing the graded card market—a sector integral to the industry for over a decade.

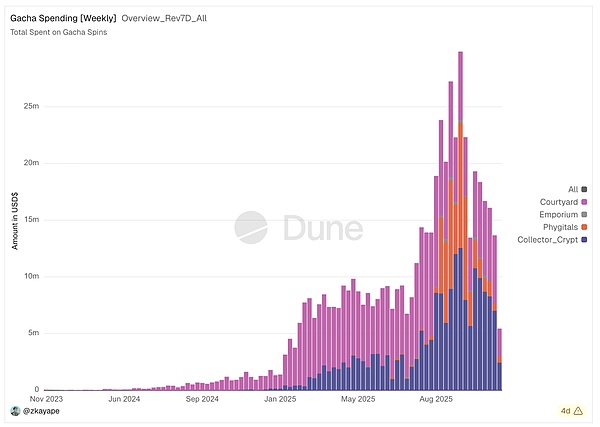

Overall, here is the transaction volume distribution and growth across the entire Gacha industry over the past year.

4. Sealed Pack / Live-Break and Card Management Platforms

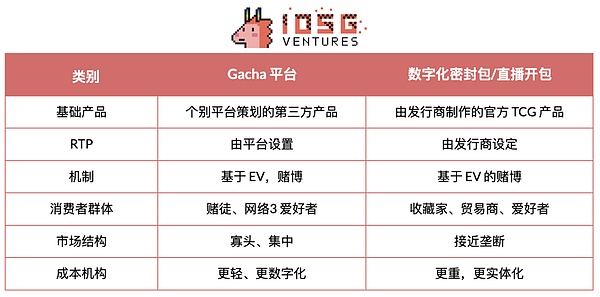

Recently, another emerging vertical in the on-chain TCG space is sealed pack/live-break and card management platforms. How do sealed pack/live-break platforms differ from Gacha?

Generally, Gacha machines are unofficial offerings curated by third parties, whereas sealed products are official items printed by publishers (Pokémon, MTG, etc.). They are typically limited in quantity, with standardized products in Pokémon such as:

Single Packs (10 cards per pack)

Booster Boxes (36 packs)

Elite Trainer Boxes

Tins

Boxes

Therefore, sealed pack/live-break platforms sell official TCG products rather than synthetic pools like Gacha. In principle, when you purchase a sealed pack or booster box, you're buying the factory-designed card mix and hit rate exposure created by Pokémon or MTG. The platform’s role is to procure and custody these sealed products, match them with buyers, and open them on-demand—not remixing underlying cards into customized "in-house designed" Gacha pools.

Moreover, why do sealed products/live-break formats better cater to superfans?

-

Sealed products are usually limited, tied to specific sets, and have defined production dates

-

Collectors and fans chase cards from specific series, hence prefer opening sealed products

-

Collectors/fans want to grade their own raw cards, requiring them to open sealed products to obtain raws

About Process

#Consumer

-

Player deposits USDC/crypto

-

Selects desired official sealed pack to open

-

Waits for platform to open pack and watches live-break stream

-

Sells received cards back to platform at 90% MP, redeems physically, or requests grading service

-

If redeemed, receives physical cards / waits for grading return

#Platform

-

Purchases official sealed products in bulk directly from distributors or shops with distributor allocations

-

List packs at set markups (10%-50%)

-

Physically opens packs, stores and manages cards

-

Buys back raw cards from consumers, ships to them if redeemed, or sends for grading

-

Repeat

So, what truly matters for sealed product/live-break platforms?

-

Stable relationships with distributors to access sealed products at MSRP, or a network of shops willing to allocate to them

-

Warehousing/infrastructure setup to manage the actual breaking process and prove authenticity

-

Offering sealed products at reasonable prices to attract consumer fans

Generally, operational overhead for these sealed pack/live-break platforms is much higher than Gacha. While Gacha platforms also need to manage and store cards, they don’t handle procurement of official packs (a major capability constraint), physically opening packs, scanning cards, or assisting customers with grading—all of which incur substantial operating costs from execution and warehousing.

In the words of Beezie and Collector Crypt:

Neither side is interested in entering the sealed pack/live-break market

-

Asked directly—they said no

Reasons:

-

Not familiar with this space;

-

Consider operations too burdensome, unsure how to build infrastructure;

-

No distributor relationships

They’re expanding further into Gacha product lines and shifting toward non-Pokémon TCGs rather than sealed pack/live-break routes. However, this also means players capable of effectively entering this space enjoy significant moats and can dominate the market easily.

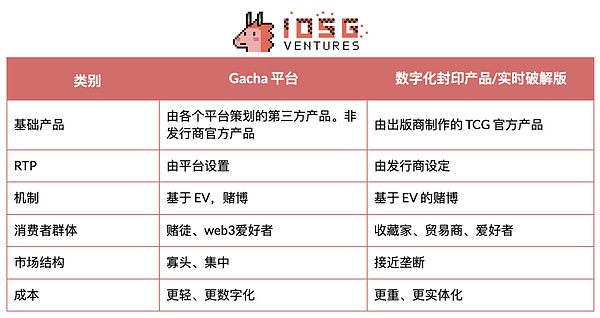

To summarize, key differentiating factors:

Insight from John @ Cardmint

One of the largest buyers and suppliers of graded slabs for Courtyard, Beezie, etc., transacting millions monthly (former Chainlink engineer)

-

On-chain TCG gambler / true fan split is 80/20

-

Yet despite fewer in number, fans are more retained and sticky than gamblers, with significant spending power

Consumer Preferences and Demand for Sealed Products

Consumer preferences between Gacha and sealed pack/live-break are also crucial. Gacha appeals more to gamblers/Web3 users who care only about the monetary value of graded cards, not the cards themselves, while sealed pack/live-break consumers are mostly hardcore fans of specific TCG series. Objectively, demand exists for Gacha—but the key question remains: is there demand for sealed packs/live-breaks? Do core TCG fans have the spending capacity/willingness to act as Gacha buyers?

Key data points:

Pokémon Pocket is an official Pokémon app, a casual digital version of Pokémon TCG. Players spend money opening digital packs, but the cards hold no monetary value nor physical redemption. It’s purely commemorative.

-

$1.3 billion revenue in first year

-

18 million packs opened

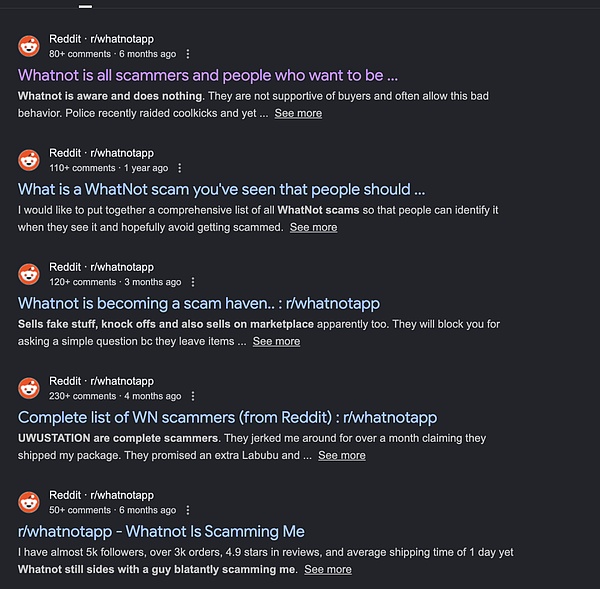

Additionally, Whatnot has generated billions in GMV. On Whatnot, Pokémon fans pay streamers to open packs live and mail them the cards.

-

$3 billion GMV in 2024

-

$6 billion GMV projected for 2025

Furthermore, Whatnot faces serious trust issues. Sellers frequently steal cards, weigh packs, or swap cards before shipping. Yet TCG fans still willingly spend large sums on sealed packs via their platform.

True core TCG players not only accept moving away from hands-on physical breaks to digital experiences but also demonstrate strong spending power and deep engagement. Take Pokémon Pocket: those packs have zero monetary value, yet core fans enthusiastically keep opening them.

Therefore, while on-chain live-breaking caters more to hardcore fans, these fans possess greater spending power and adaptability to digital experiences. Clearly, core TCG fans have strong demand for standard sealed pack products, whether digital or physical.

Market dynamics also show massive demand drivers.

Pokémon TCG cards sell out instantly at retail stores, with retailers (Walmart, Target, etc.) often limiting per-person purchases.

5. Market Size: Gacha vs. Sealed Products

The TCG market isn't limited to Pokémon, but on most Gacha platforms, Pokémon has become nearly the sole category available.

Sealed Products

-

Pokémon TCG printed 10 billion cards in 2024

-

Estimated ~50 million players/buyers

-

10 cards per pack → ~1.02 billion packs/year

-

~$15 per pack (mixed MSRP + gray market pricing)

Annual sealed pack sales ~$15 billion

Gacha

The top three dominate the industry, capturing ~90% market share.

Annual Gacha sales ~$747.5 million. Adjusting for other players (~+10%), Gacha becomes an ~$822.5 million industry.

The sealed pack product industry is far larger than the on-chain Gacha industry.

Money Markets

Money markets represent another area just beginning to be explored in on-chain TCG. Logically, once cards are properly digitized and vaulted, money markets become the next layer. The core idea is simple: transform slabs and sealed products into collateral so collectors and shops can borrow stablecoins during liquidity needs instead of selling collections outright.

In on-chain TCG money markets, tokenized TCG assets (representing slabs or sealed vault NFTs/ERC-1155) can be deposited into lending protocols, allowing users to borrow USDC or other liquid assets. This requires:

(i) Robust floor/index pricing

(ii) Conservative LTVs accounting for reprint risks and pop-report shocks

(iii) Sufficient secondary liquidity so liquidators can actually clear collateral.

This is precisely where PocketDex naturally fits within the ecosystem stack: products like PocketDex already serve as card databases + portfolio management tools, integrating card info, price data, and user collections in one interface. By connecting this view with on-chain custody and lending protocols, PocketDex can effectively become the discovery portal + risk management frontend for lending markets:

-

Users can view their tokenized collection, real-time valuation, and system-suggested borrowing limits;

-

One-click jump to lending protocol to open credit lines against specific sealed packs/series;

-

Repayment, health status, and liquidation warnings displayed directly within their daily "collector app".

For collectors, this acts like margin on their collection. For shops and brokers, it functions like inventory-backed warehouse lines, smoothing cash flow and scaling operations.

Derivatives Market

Perp markets extend this functionality further, enabling leveraged, purely synthetic long/short trading on TCG prices without touching physical cards. Traders can go long on an "EVSK Box Index Perp" instead of buying and storing an "Evolving Skies" box; traders can trade a "Charizard PSA-10 Index Perp" instead of building a large "Charizard" portfolio.

Trove is the clearest living example here: a decentralized perpetual futures exchange focused on collectibles, starting with Pokémon card indices and CS2 skins, offering up to ~5x leverage. Trove aggregates pricing data from major markets, builds on-chain indices (e.g., Pokémon card index, Charizard PSA-10 benchmark), and lets users go long or short on these indices via perps. Effectively, this:

-

Provides collectors and shops a way to hedge downside risk of physical/vault inventory (go short on Trove when long on cards);

-

Allows traders to express views on sets, eras, or the entire Pokémon market without handling grading, shipping, or storage;

-

Creates arbitrage loops between physical spot, tokenized spot (Courtyard/Collector’s Basement/Phygitals), and derivatives.

What truly matters here is index construction and data quality: if Trove (and similar platforms) can become the canonical pricing and hedging venue for TCGs, then perps can turn illiquid collectibles into tradable macro surfaces. Combined with money markets, this enables full-stack trading: Hold → Borrow → Hedge → Speculate entirely on-chain on TCG risk, with Trove sitting as the derivatives layer atop vaults, Gacha platforms, and sealed pack/live-break rails.

6. Arguments and Perspectives

Overall, it’s clear that off-chain TCG has massive demand drivers, and we’ve seen on-chain TCG momentum beginning to build. To most, crypto’s societal value lies in abstracting away frictions seen in traditional finance and creating new opportunities to expand fintech frontiers. In many ways, this same relationship exists between off-chain TCG <> on-chain TCG—the latter existing to reduce friction widely experienced by consumers and TCG fans, while providing more use cases, opportunities, and pathways for their hobby.

We can also infer this market is here to stay; the value lies in capturing it, and the opportunity is ripe. This isn’t just a new hobby/market—TCGs have been mainstream for 25 years since inception, and cards/collectibles have transformed into valuable assets, akin to art or NFTs.

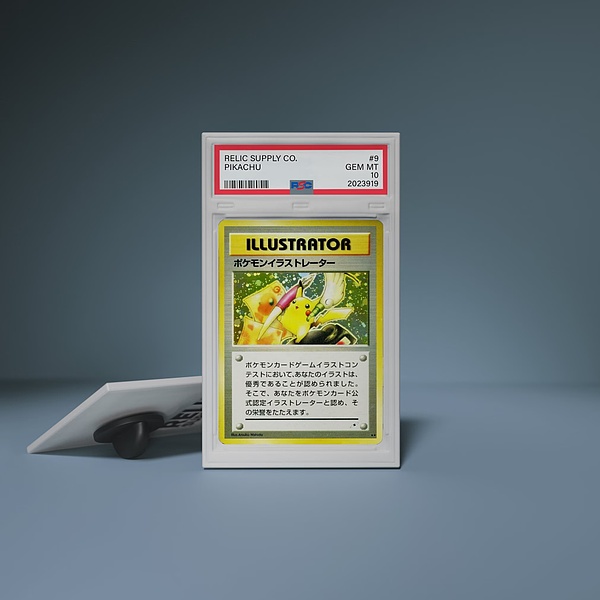

$3 million sale price

Magic: The Gathering, Black Lotus - PSA 10

$5.25 million sale price

Pokémon, Pikachu Illustrator - PSA 10

In summary, several interesting angles stand out:

Products Bridging Retail Supply <> Demand Gaps

Currently, retail supply severely under-matches demand: distributors allocate most supply to whales and well-connected shops, pushing true collectors into gray markets and forcing them to pay steep premiums. On-chain + digital TCG infrastructure can directly address this. Here, access means: providing retailers with credible, fair, near-MSRP access to sealed products or single cards.

Example product directions:

-

On-chain live-break platform where collectors/fans can directly purchase and open packs online at low fees, optionally redeeming physical cards.

-

Alleviates collector demand for packs;

-

Or avoids paying scalpers 2–3x markups

-

Fractional ownership of packs, allowing retail users to buy portions of sealed inventory (e.g., 1/36 of a box) at fair prices instead of overpaying for unaffordable full boxes.

-

Mass procurement from distributors/large shops, then repackaged into smaller, fairer fractional products for global retail rather than relationship-based distribution.

-

On-chain queues/raffles/whitelists for sealed card products, with wallet-level allocation caps and transparent odds.

These products may not change total Pokémon supply, but they fundamentally alter who can access Pokémon cards and at what effective price.

Platforms Enhancing Overall TCG Market Liquidity

Most off-chain TCG value sits in slow, high-friction forms: physical collections or sealed packs in vaults. Selling usually means listing on eBay, paying fees, and waiting weeks. On-chain card management and vaulting platforms transform this into instant, programmable liquidity.

Core mechanics: Physical vault → Tokenization → Insertion into DeFi-like rails.

-

Platforms enable slab vaulting and tokenization, allowing 24/7 trading and transfer without moving physical items.

-

Live-break solutions instantly push hits into users’ digital inventories, ready for listing, auction, or collateralization.

-

Vault yield platforms can act as MM across markets, taking two-sided positions on popular SKUs (chase cards, key slabs, flagship packs), narrowing spreads vs. eBay, enabling instant sales instead of “waiting 10 days for auction to end”.

This can:

-

Accelerate turnover for shops and collectors.

-

Enable global price discovery, not fragmented local pricing.

-

Allow TCG assets to integrate with other protocols (lending, AMM, indices)—impossible if everything remains in paper form.

Complementary Products Built on On-Chain TCG Markets Enabling Derivatives

Related to the above; once TCG assets are properly digitized (NFTs, vault tokens, price feeds), derivative and structured products can be built atop them, turning collectibles into proper financial primitives.

Examples:

-

Perps/Futures

-

Indices for top graded cards (e.g., Top 50 Pokémon slabs index)

-

Specific sealed products (e.g., evolving skies booster box perp)

-

Options or vault strategies letting users bet on volatility or upside of a set without holding specific cards

-

Money markets using packs/slabs as collateral, with risk managed via oracles and liquidators

-

Prediction markets around releases, reprint risks, or PSA population growth, letting traders hedge or speculate on meta-factors driving TCG prices

These complementary products don’t compete directly with Gacha or live-break platforms—they sit above them. Gacha and sealed/live-break platforms handle buying, selling, and inventory management, while derivatives and money markets handle risk transfer, leverage, and hedging. Together, they transform TCG from a niche collectible ecosystem into an increasingly formalized, multi-layered on-chain financial market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News